- Please choose product options by visiting E-books Market Analysis and Global Forecast 2023-2033.

Global & US Merchant Cash Advance Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

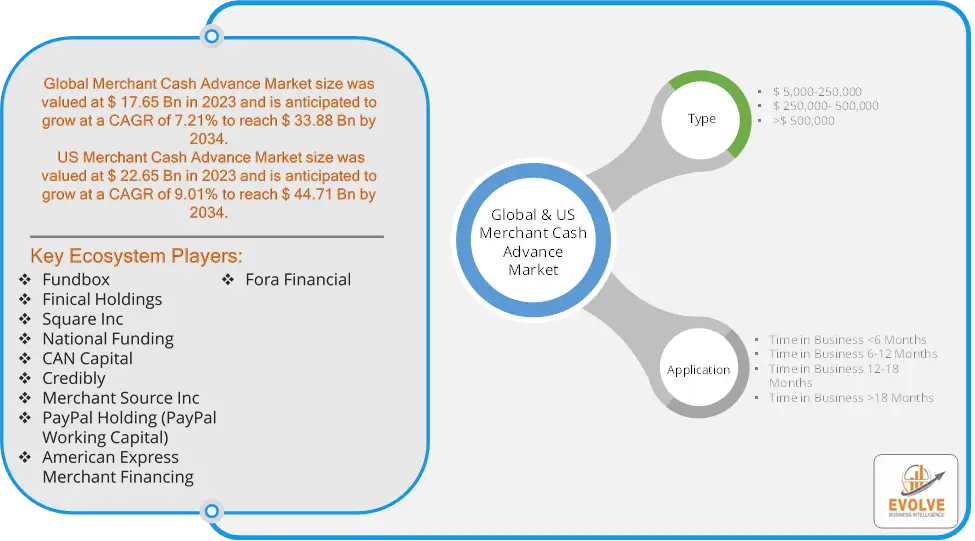

Global & US Merchant Cash Advance Market Research Report: Information By Type ($ 5,000-250,000, $ 250,000- 500,000, >$ 500,000), By Application (Time in Business <6 Months, Time in Business 6-12 Months, Time in Business 12-18 Months, Time in Business >18 Months), and by Region — Forecast till 2034

Page: 56

Global & US Merchant Cash Advance Market Overview

Global Merchant Cash Advance Market size was valued at $ 17.65 Bn in 2023 and is anticipated to grow at a CAGR of 7.21% to reach $ 33.88 Bn by 2034. US Merchant Cash Advance Market size was valued at $ 22.65 Bn in 2023 and is anticipated to grow at a CAGR of 9.01% to reach $ 44.71 Bn by 2034. The Global & US Merchant Cash Advance (MCA) Market refers to the financial services industry focused on providing short-term funding to small and medium-sized businesses (SMBs) in exchange for a portion of future sales. This alternative financing model is widely used by businesses that may not qualify for traditional loans or need quick capital.

The global and US MCA markets are expected to continue growing as businesses seek alternative financing options and technological advancements make these products more accessible.

Global & US Merchant Cash Advance Market Synopsis

Global & US Merchant Cash Advance Market Dynamics

Global & US Merchant Cash Advance Market Dynamics

The major factors that have impacted the growth of Global & US Merchant Cash Advance Market are as follows:

Drivers:

Ø Technological Advancements

Fintech innovations have streamlined the application and approval processes for MCAs. Online platforms allow for quicker assessments and disbursement of funds, attracting more businesses. The rise in e-commerce has increased the number of businesses requiring fast access to capital for inventory and operational expenses. MCAs cater to these needs effectively. As more businesses become aware of MCAs as a financing option, acceptance is growing. Educational initiatives by lenders and industry players have helped demystify the product.

Restraint:

- Perception of High Costs and Fees

MCAs typically come with higher fees and interest rates compared to traditional financing options. The overall cost of borrowing can be significant, making them less attractive to some businesses. The ease of obtaining an MCA may lead some businesses to overextend themselves financially. This can result in difficulties in managing cash flow and repaying the advance, increasing the risk of default.

Opportunity:

⮚ Customization of Financial Products

There is an opportunity to develop tailored MCA products that cater to specific industries or business needs. Customization can help providers differentiate their offerings and attract diverse clientele. Increasing awareness and understanding of MCAs can help mitigate negative perceptions. Educational campaigns highlighting the benefits and proper usage of MCAs can empower businesses to make informed decisions. As e-commerce continues to grow, integrating MCA solutions with online retail platforms can streamline funding for businesses. This can provide a seamless experience for businesses needing quick capital.

Global & US Merchant Cash Advance Market Segment Overview

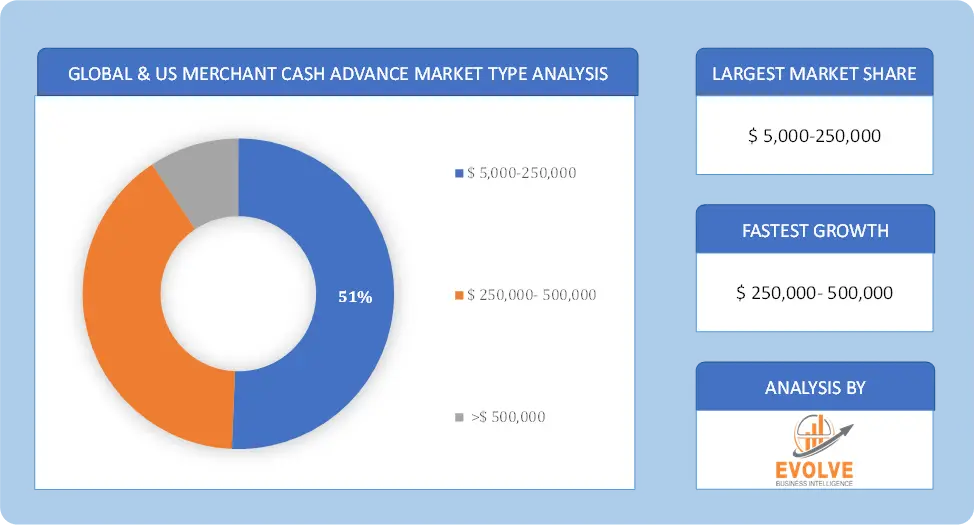

By Type

Based on Type, the market is segmented based on $ 5,000-250,000, $ 250,000- 500,000 and >$ 500,000. The $ 5,000-250,000 segment dominant the market. The growth of this segment is related to the fact that small businesses and startups rely heavily on such capital sources to finance their short-term business capital requirements. The $5,000 to $250,000 range caters to a diverse array of businesses, from startups needing initial capital to established SMBs looking for funds to expand operations, purchase inventory, or manage cash flow.

Based on Type, the market is segmented based on $ 5,000-250,000, $ 250,000- 500,000 and >$ 500,000. The $ 5,000-250,000 segment dominant the market. The growth of this segment is related to the fact that small businesses and startups rely heavily on such capital sources to finance their short-term business capital requirements. The $5,000 to $250,000 range caters to a diverse array of businesses, from startups needing initial capital to established SMBs looking for funds to expand operations, purchase inventory, or manage cash flow.

By Application

Based on Application, the market segment has been divided into Time in Business <6 Months, Time in Business 6-12 Months, Time in Business 12-18 Months and Time in Business >18 Months. The Time in Business <6 Months segment dominant the market. New businesses lack a credit history or established financial performance, making it difficult to secure traditional loans. MCA providers typically rely on future sales potential and cash flow rather than past credit performance and MCAs usually involve repayment based on a percentage of daily credit card sales, allowing businesses to adapt their repayment amounts according to their revenue, which is beneficial for new ventures experiencing fluctuating cash flow.

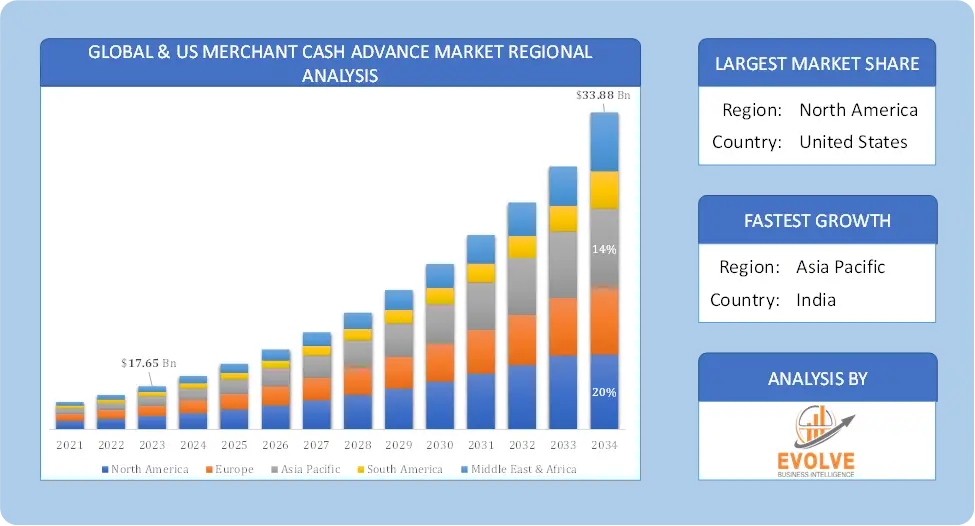

Global & US Merchant Cash Advance Market Regional Analysis

Based on region, the Global & US Merchant Cash Advance Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global & US Merchant Cash Advance Market followed by the Asia-Pacific and Europe regions.

Global & US Merchant Cash Advance North America Market

Global & US Merchant Cash Advance North America Market

North America holds a dominant position in the Global & US Merchant Cash Advance Market. The US and Canada dominate the global MCA market, accounting for a significant portion of the total market size. This is due to the high concentration of small and medium-sized businesses (SMBs) in these regions, which are the primary target for MCA providers. A high concentration of fintech companies offers diverse MCA products, streamlining the application and approval processes.

Global & US Merchant Cash Advance Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global & US Merchant Cash Advance Market industry. The Asia-Pacific region is experiencing rapid growth in the MCA market, particularly in countries like China, India, and Australia. This growth is fueled by the large number of SMBs and the increasing adoption of digital payment methods. The rise of digital payments and e-commerce in the region creates opportunities for integrating MCAs with online business models.

Competitive Landscape

The Global & US Merchant Cash Advance Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Fundbox

- Finical Holdings

- Square Inc

- National Funding

- CAN Capital

- Credibly

- Merchant Source Inc

- PayPal Holding (PayPal Working Capital)

- American Express Merchant Financing

- Fora Financial

Scope of the Report

Global & US Merchant Cash Advance Market, by Type

- $ 5,000-250,000

- $ 250,000- 500,000

- >$ 500,000

Global & US Merchant Cash Advance Market, by Application

- Time in Business <6 Months

- Time in Business 6-12 Months

- Time in Business 12-18 Months

- Time in Business >18 Months

Global & US Merchant Cash Advance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $44.71 Billion |

| CAGR | 9.01% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Fundbox, Finical Holdings, Square Inc, National Funding, CAN Capital, Credibly, Merchant Source Inc, PayPal Holding (PayPal Working Capital), American Express Merchant Financing and Fora Financial. |

| Key Market Opportunities | • Customization of Financial Products • Integration with E-commerce Platforms |

| Key Market Drivers | • Technological Advancements • Awareness and Acceptance of MCAs |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global & US Merchant Cash Advance Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global & US Merchant Cash Advance Market historical market size for the year 2021, and forecast from 2023 to 2033

- Global & US Merchant Cash Advance Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Global & US Merchant Cash Advance Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the Global & US Merchant Cash Advance Market is 2021- 2033

What is the growth rate of the Global & US Merchant Cash Advance Market?

The Global & US Merchant Cash Advance Market is growing at a CAGR of 9.01% over the next 10 years

Which region has the highest growth rate in the market of Global & US Merchant Cash Advance Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the Global & US Merchant Cash Advance Market?

North America holds the largest share in 2022

Who are the key players in the Global & US Merchant Cash Advance Market?

Fundbox, Finical Holdings, Square Inc, National Funding, CAN Capital, Credibly, Merchant Source Inc, PayPal Holding (PayPal Working Capital), American Express Merchant Financing and Fora Financial are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Market Insights and Trends 4.1. Value Chain Analysis 4.1.1. Lender/Supplier 4.1.2. System Integrator 4.1.3. End-Users/Merchants 4.2. Porter’s Five Forces Analysis 4.2.1. Bargaining Power of Buyers 4.2.2. Bargaining Power of Suppliers 4.2.3. Threat of New Entrant 4.2.4. Threat of Substitute 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on Merchant Cash Advance Market 4.3.1. Impact on Market Size 4.3.2. End-User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window CHAPTER 5. Market Dynamics 5.1. Introduction 5.2. Drivers 5.2.1. Merchant cash advances (MCA) help to raise the seasonal business 5.2.2. Retention of full ownership without equity sales 5.3. Restraints 5.3.1. Merchant cash advances (MCA) are not regulated and are more expensive than traditional loan 5.3.2. Merchant cash advance (MCA) limitations on business operations 5.4. Opportunity 5.4.1. Innovations and advances in technology CHAPTER 6. Global & U.S. Merchant Cash Advance Market, By Type 6.1. Introduction 6.2. Global & U.S. Merchant Cash Advance Market, By Type CHAPTER 7. Global & U.S. Merchant Cash Advance Market, By Application 7.1. Introduction 7.2. Global & U.S. Merchant Cash Advance Market Share, By Application CHAPTER 8. GLOBAL & U.S. MERCHANT CASH ADVANCE MARKET, By Region 8.1. Introduction 8.2. Global Merchant Cash Advance Market Size, By Country, 2020-2028 CHAPTER 9. Company Landscape 9.1. U.S. Merchant Cash Advance Market Share Analysis CHAPTER 10. Company Profiles 10.1. Fundbox 10.1.1. Business Overview 10.1.2. Product Portfolio 10.1.3. Recent Development and Strategies Adopted 10.2. Finical Holdings 10.2.1. Business Overview 10.2.2. Product Portfolio 10.2.3. Recent Development and Strategies Adopted 10.3. Square Inc. 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. National Funding 10.4.1. Business Overview 10.4.2. Product Portfolio 10.4.3. Recent Development and Strategies Adopted 10.5. CAN Capital 10.5.1. Business Overview 10.5.2. Product Portfolio 10.5.3. Recent Development and Strategies Adopted 10.6. Credibly 10.6.1. Business Overview 10.6.2. Product Portfolio 10.6.3. Recent Development and Strategies Adopted 10.7. Merchant Source Inc 10.7.1. Business Overview 10.7.2. Product Portfolio 10.7.3. Recent Development and Strategies Adopted 10.8. PayPal Holding (PayPal Working Capital) 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. American Express Merchant Financing 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Fora Financial 10.10.1. Business Overview 10.10.2. Product Portfolio 10.10.3. Recent Development and Strategies Adopted

Connect to Analyst

Research Methodology

Our Most Viewed Report and gain instant expertise

Corporate Training, Lifelong Learning and Credentialing Market Analysis and Forecast 2020-2028

E-Learning Market Analysis and Global Forecast 2023-2033

E-Learning Market Research Report: By Technology (Online E-Learning, Learning Management System (LMS), Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others), By Application (Academic, Corporate, Government), By Provider (Services, Content), and by Region — Forecast till 2033

Page: 144Global & Australia Vocational Training Market Analysis and Global Forecast 2024-2034

Global & Australia Vocational Training Market Research Report: Information By Type (Accredited, Non-Accredited), by Program Type (High School programs, Tech Prep Education, Postsecondary Vocational School, Apprenticeship Programs, On-the-job Training, Others), by RTO Types (Private RTOs, TAFE Institutes, Community RTOs, Schools, Enterprise RTOs, Universities), and by Region — Forecast till 2034

Page: 55Global Career & Education Counselling Market Analysis and Forecast 2020-2028

Global Commercial Aquarium Market Analysis and Global Forecast 2021-2034

Global Commercial Aquarium Market Research Report: Information By Type (Inland, Ocean, Comprehensive), By Application (Male, Female, Kids), and by Region — Forecast till 2034

Page: 93Hard-Surface Flooring Market Analysis and Global Forecast 2023-2033

Hard-Surface Flooring Market Research Report: Information by Type (Ceramic Flooring, Wood and Laminate Flooring, Vinyl Flooring, Other), By Application (Residential Buildings, Nonresidential Buildings, Transportation), and by Region — Forecast till 2033

PRESS RELEASE: https://evolvebi.com/hard-surface-flooring-market-is-estimated-to-record-a-cagr-of-around-5-12-during-the-forecast-period/Negative Pressure Wound Therapy (NPWT) Market Analysis and Global Forecast 2023-2033

Negative Pressure Wound Therapy (NPWT) Market Research Report: By Device Type (Conventional NPWT, and Single-use NPWT), By Indication (Diabetic Foot Ulcers, Pressure Ulcers, Burns & Trauma, and Others), By End User (Hospitals, Clinics, Homecare Settings, and Others), and Region — Forecast till 2033

Report Code: EB_LS_1271 | Page: 194 | Published Date: UpcomingPress Release: https://evolvebi.com/the-negative-pressure-wound-therapy-market-is-estimated-to-record-a-cagr-of-around-6-4-during-the-forecast-period/