Terpene Resins Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

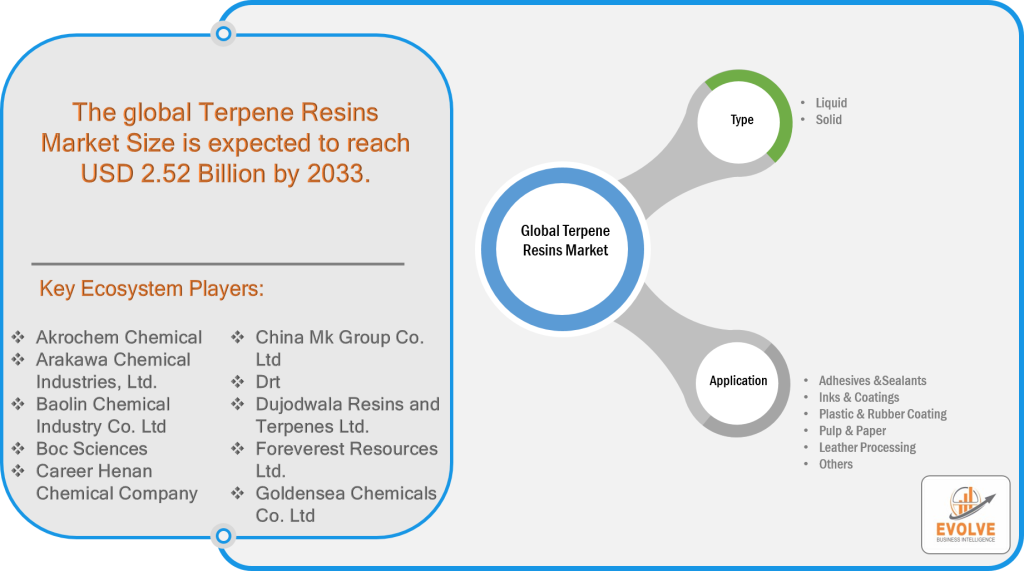

Terpene Resins Market Research Report: Information By Type (Liquid, Solid) By Application (Adhesives &Sealants, Inks & Coatings, Plastic & Rubber Coating, Pulp & Paper, Leather Processing, and Others), and By Region — Forecast till 2033

The global Terpene Resins Market Size is expected to reach USD 2.52 Billion by 2033. The global Terpene Resinsindustry size accounted for USD 1.19 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.74% from 2023 to 2033. The Terpene Resins Market has witnessed significant growth in recent years, driven by the diverse applications and versatile properties of terpene resins. Terpene resins are natural or synthetic compounds derived from plant sources, characterized by their distinct aromatic properties. They find applications in various industries such as adhesives and sealants, inks and coatings, plastic and rubber coatings, pulp and paper, leather processing, and more. With their exceptional adhesive, tackifying, and film-forming properties, terpene resins have become indispensable in numerous industrial processes.

Global Terpene Resins Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on various industries, including the terpene resins market. The restrictions on manufacturing activities, disrupted supply chains, and reduced demand due to economic uncertainties resulted in a temporary slowdown. However, as the world adapts to the post-pandemic scenario, the terpene resins market is expected to regain momentum. The gradual recovery of end-use industries, the increasing emphasis on sustainable materials, and the growing demand for bio-based products are factors that are likely to drive the market’s growth in the coming years.

Terpene Resins Market Dynamics

The major factors that have impacted the growth of Terpene Resins are as follows:

Drivers:

Growing Demand for Bio-based and Sustainable Materials

One of the key driving factors for the terpene resins market is the growing demand for bio-based and sustainable materials. As environmental concerns rise and regulatory frameworks become more stringent, industries are increasingly shifting towards greener alternatives. Terpene resins, being derived from renewable plant sources, offer a sustainable solution for various applications. They are considered environmentally friendly, biodegradable, and non-toxic, making them an attractive choice for industries seeking to reduce their ecological footprint. The bio-based revolution is reshaping the terpene resins market as manufacturers and consumers alike prioritize sustainable materials.

Restraint:

- Volatility in Raw Material Prices

Despite the numerous advantages of terpene resins, one of the restraining factors for market growth is the volatility in raw material prices. Terpene resins are derived from plant sources, and fluctuations in factors such as weather conditions, crop yields, and supply-demand dynamics can significantly impact the availability and cost of raw materials. The uncertainty in raw material prices can create challenges for manufacturers, affecting their production costs and profit margins. However, strategic sourcing, supply chain optimization, and the development of alternative raw material sources can help mitigate the impact of price volatility on the terpene resins market.

Opportunity:

Increasing Applications in Innovative Industries

An opportunity factor that holds immense potential for the terpene resins market is the increasing applications in innovative industries. Terpene resins are finding new uses and expanding their presence in industries beyond traditional applications. For example, in the automotive industry, terpene resins are being utilized in coatings and adhesives, offering improved performance and sustainability. In the packaging industry, they are being explored as bio-based alternatives to petroleum-based materials. The versatility of terpene resins opens up opportunities for innovation and collaboration, allowing manufacturers to cater to evolving market demands and develop new solutions for diverse industries.

Terpene Resins Segment Overview

By Type

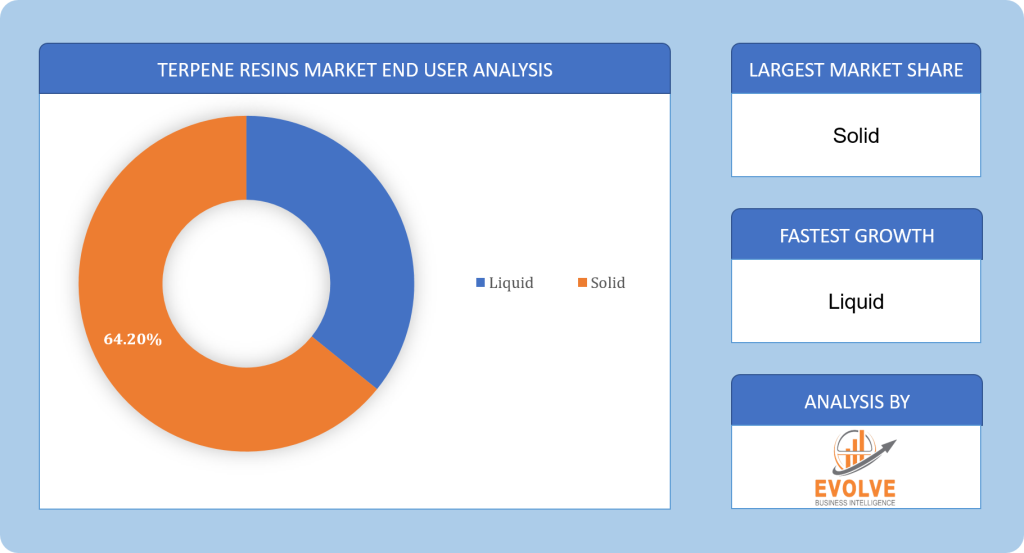

Based on the Type, the market is segmented based on Liquid, Solid. Liquid terpene resins hold the largest share in the market, owing to their versatility and wide range of applications. Liquid terpene resins are extensively used in industries such as adhesives and sealants, inks and coatings, and plastic and rubber coatings. Their excellent tackifying properties, good compatibility with other materials, and low viscosity make them suitable for various formulations. These resins enhance adhesion, improve coating properties, and provide excellent film-forming characteristics, making them highly desirable in industries that require strong bonding and surface protection.

By Application

Based on Application, the market has been divided into Adhesives &Sealants, Inks & Coatings. the adhesives and sealants segment holds the largest share in the terpene resins market. The demand for terpene resins in adhesives and sealants is driven by their ability to improve bonding strength, enhance tackiness, and provide heat resistance, making them suitable for a wide range of applications in industries such as construction, automotive, and packaging. As the need for advanced adhesive solutions continues to grow across various industry.

Based on Application, the market has been divided into Adhesives &Sealants, Inks & Coatings. the adhesives and sealants segment holds the largest share in the terpene resins market. The demand for terpene resins in adhesives and sealants is driven by their ability to improve bonding strength, enhance tackiness, and provide heat resistance, making them suitable for a wide range of applications in industries such as construction, automotive, and packaging. As the need for advanced adhesive solutions continues to grow across various industry.

Global Terpene Resins Market Regional Analysis

Based on region, the global Terpene Resins market has been divided into North America, Europe, Asia-Pacific, South America and Middle East & Africa. North America is projected to dominate the use of the market followed by the Europe and Asia-Pacific regions.

North America Market

North America Market

North America has emerged as a prominent region in the terpene resins market, driven by the presence of a well-established manufacturing base and a robust demand from various industries. The United States, in particular, has witnessed substantial growth due to the expanding construction sector, automotive manufacturing, and packaging industry. The increasing emphasis on sustainable materials and stringent regulations on VOC emissions have further fueled the demand for terpene resins in the region. The North American market benefits from technological advancements, extensive research and development activities, and collaborations between manufacturers and end-use industries.

Asia Pacific Market

Asia Pacific is another key region in the terpene resins market, fueled by rapid industrialization, infrastructure development, and growing consumer markets. Countries such as China, India, Japan, and South Korea are witnessing significant growth in industries such as automotive, construction, packaging, and textiles. The expanding manufacturing activities, rising disposable incomes, and urbanization are driving the demand for terpene resins in the region. Additionally, the increasing focus on environmental regulations and sustainable practices has led to the adoption of bio-based materials, including terpene resins. The Asia Pacific market presents immense growth opportunities due to its large population, favorable government initiatives, and the presence of key manufacturers.

Competitive Landscape

The global Terpene Resins market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Akrochem Chemical

- Arakawa Chemical Industries, Ltd.

- Baolin Chemical Industry Co. Ltd

- Boc Sciences

- Career Henan Chemical Company

- China Mk Group Co. Ltd

- Drt

- Dujodwala Resins and Terpenes Ltd.

- Foreverest Resources Ltd.

- Goldensea Chemicals Co. Ltd

Key Development:

March 2022: Yasuhara announced they signed an arrangement with Leaf Resources to purchase Terpene Resins for the next five years. The agreement is anticipated to strengthen Yasuhara’s Terpene Resins business.

Scope of the Report

Global Terpene Resins Market, by Type

- Liquid

- Solid

Global Terpene Resins Market, by Application

- Adhesives &Sealants

- Inks & Coatings

- Plastic & Rubber Coating

- Pulp & Paper

- Leather Processing

- Others

Global Terpene Resins Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $2.52 Billion |

| CAGR | 7.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Akrochem Chemical, Arakawa Chemical Industries, Ltd., Baolin Chemical Industry Co. Ltd, Boc Sciences, Career Henan Chemical Company, China Mk Group Co. Ltd, Drt, Dujodwala Resins and Terpenes Ltd., Foreverest Resources Ltd., and Goldensea Chemicals Co. Ltd. |

| Key Market Opportunities | Increasing Applications in Innovative Industries |

| Key Market Drivers | Growing Demand for Bio-based and Sustainable Materials |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Terpene Resins market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Terpene Resins market historical market size for the year 2021, and forecast from 2023 to 2033

- Terpene Resins market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, Commercial Use strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Terpene Resins market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Commercial Use health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Terpene Resins market is 2021- 2033

What is the growth rate of the global Terpene Resins market?

The global Terpene Resins market is growing at a CAGR of 7.9% over the next 10 years

Which region has the highest growth rate in the market of Terpene Resins?

North America is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Terpene Resins market?

Asia Pacific holds the largest share in 2022

Who are the key players in the global Terpene Resins market?

Akrochem Chemical, Arakawa Chemical Industries, Ltd., Baolin Chemical Industry Co. Ltd, Boc Sciences, Career Henan Chemical Company, China Mk Group Co. Ltd, Drt, Dujodwala Resins and Terpenes Ltd., Foreverest Resources Ltd., and Goldensea Chemicals Co. Ltd the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Terpene Resins Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7.Demand Supply Gap Analysis of the Terpene Resins Market 4.8.Import Analysis of the Terpene Resins Market 4.9.Export Analysis of the Terpene Resins Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Terpene Resins Market, By Type 6.1. Introduction 6.2. Liquid 6.3. Solid Chapter 7. Global Terpene Resins Market, By Application 7.1. Introduction 7.2. Adhesives &Sealants 7.3. Inks & Coatings Chapter 8. Global Terpene Resins Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Type, 2023-2033 8.2.5. Market Size and Forecast, By Application, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Application, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Application, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Type, 2023-2033 8.3.5. Market Size and Forecast, By Application, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Application, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Application, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Application, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Application, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Application, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Type, 2023-2033 8.4.5. Market Size and Forecast, By Application, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Application, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Application, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Application, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Application, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Application, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Type, 2023-2033 8.5.4. Market Size and Forecast, By Application, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Akrochem Chemical 10.1.1. Business Overview 10.1.2. Commercial Use Analysis 10.1.2.1. Commercial Use – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Arakawa Chemical Industries, Ltd. 10.2.1. Business Overview 10.2.2. Commercial Use Analysis 10.2.2.1. Commercial Use – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Baolin Chemical Industry Co. Ltd 10.3.1. Business Overview 10.3.2. Commercial Use Analysis 10.3.2.1. Commercial Use – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Boc Sciences 10.4.1. Business Overview 10.4.2. Commercial Use Analysis 10.4.2.1. Commercial Use – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Career Henan Chemical Company 10.5.1. Business Overview 10.5.2. Commercial Use Analysis 10.5.2.1. Commercial Use – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. China Mk Group Co. Ltd 10.6.1. Business Overview 10.6.2. Commercial Use Analysis 10.6.2.1. Commercial Use – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Drt 10.7.1. Business Overview 10.7.2. Commercial Use Analysis 10.7.2.1. Commercial Use – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Dujodwala Resins and Terpenes Ltd. 10.8.1. Business Overview 10.8.2. Molson Coors Beverage Company 10.8.2.1. Commercial Use – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Foreverest Resources Ltd. 10.9.1. Business Overview 10.9.2. Commercial Use Analysis 10.9.2.1. Commercial Use – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Goldensea Chemicals Co. Ltd 10.10.1. Business Overview 10.10.2. Commercial Use Analysis 10.10.2.1. Commercial Use – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology