Home Decor Market Overview

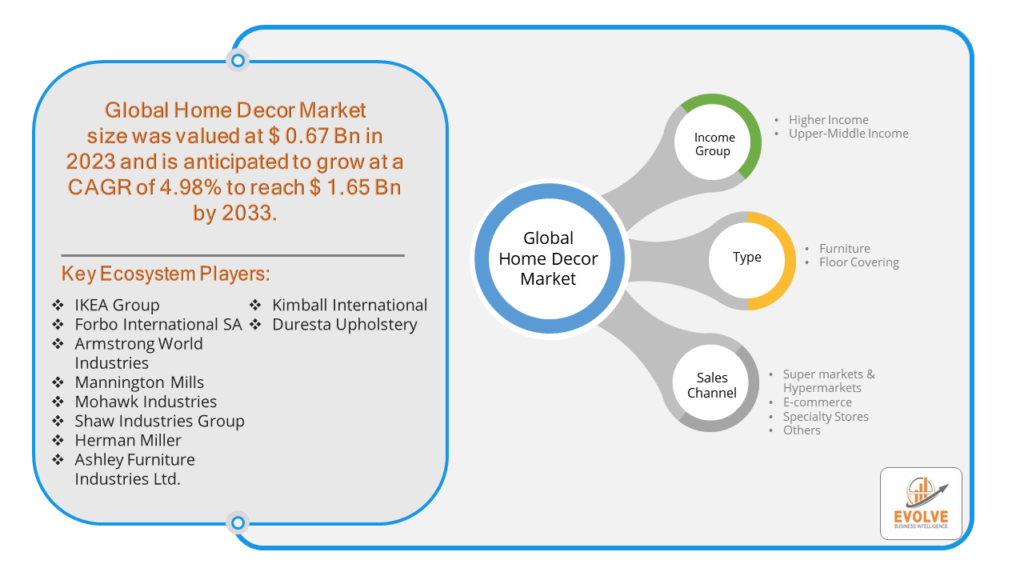

The Home Decor Market Size is expected to reach USD 1.65 Billion by 2033. The Home Decor Market industry size accounted for USD 0.67 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.98% from 2023 to 2033. The Home Decor Market refers to the industry encompassing the production, distribution, and sale of products used to enhance the aesthetic appeal and functionality of residential spaces. Key factors influencing the home decor market include changing consumer preferences, trends in interior design, economic conditions, and innovations in materials and manufacturing techniques. The market is also affected by seasonal trends, housing market conditions, and consumer spending habits.

The home decor market is a dynamic and ever-changing industry. New trends are constantly emerging, and consumers are increasingly looking for products that are both stylish and functional. The future of the home decor market is expected to be driven by a number of factors, including the growing popularity of online shopping, the increasing importance of home design, and the rising demand for sustainable and eco-friendly products.

Global Home Decor Market Synopsis

The COVID-19 pandemic had a significant impact on the Home Decor Market. The pandemic caused delays in the production and distribution of home decor products due to factory shutdowns, transportation issues, and restrictions on movement. This led to shortages of certain items and increased costs. With more people spending time at home, there was a surge in home improvement and decoration activities. Consumers invested in making their living spaces more comfortable and aesthetically pleasing. The closure of physical stores accelerated the shift to online shopping. E-commerce platforms saw significant growth, and many businesses enhanced their online presence and digital marketing efforts. The rise of remote work led to increased demand for home office furniture and accessories, as people sought to create functional and comfortable workspaces at home. There was a growing interest in home decor products that promote health and wellness, such as ergonomic furniture, air purifiers, and items made from sustainable materials.

Home Decor Market Dynamics

The major factors that have impacted the growth of Home Decor Market are as follows:

Drivers:

Ø Technological Advancements

Increases in disposable income allow consumers to spend more on home improvement and decor. The rise of online shopping platforms makes it easier for consumers to access a wide variety of home decor products. Increasing adoption of smart home technologies drives demand for smart decor items, such as connected lighting and home automation systems. Increasing awareness of environmental issues drives demand for sustainable, eco-friendly, and ethically sourced home decor products. Growing focus on health and wellness promotes demand for ergonomic furniture, air purifiers, and decor items made from non-toxic materials. Advances in materials, such as the development of durable, lightweight, and eco-friendly materials, drive product innovation. Innovative designs that combine aesthetics with functionality attract consumers looking for unique and practical decor solutions.

Restraint:

- Perception of Competition from Low-Cost Alternatives:

The availability of low-cost alternatives and mass-produced decor items from discount stores can limit the growth of premium home decor brands. High competition in the market can lead to saturation, making it difficult for new entrants to establish themselves and for existing brands to maintain market share. The fast pace of changing trends in interior design can lead to shorter product life cycles and increased pressure on manufacturers and retailers to constantly update their offerings. The vast array of options available can lead to consumer indecision, delaying purchase decisions.

Opportunity:

⮚ Growing demand for E-Commerce Expansion and Eco-Friendly Products

Increasing consumer preference for online shopping provides opportunities for retailers to expand their digital presence and reach a broader audience. Brands can leverage DTC models to build stronger relationships with customers, offer personalized experiences, and improve profit margins. Growing awareness of environmental issues and demand for sustainable products provide opportunities to develop and market eco-friendly home decor items. Using recycled and upcycled materials in product design can attract environmentally conscious consumers and reduce manufacturing costs. Increasing awareness of health and wellness drives demand for ergonomic furniture that promotes better posture and comfort. Products that improve indoor air quality and use natural, non-toxic materials appeal to health-conscious consumers.

Home Decor Market Segment Overview

By Income Group

Based on Income Group, the market is segmented based on Higher Income and Upper-Middle Income. The Upper-Middle Income segment is dominant the market. Upper-middle income consumers are increasingly interested in sustainable and eco-friendly products. They are willing to invest in items that are ethically sourced and environmentally friendly.

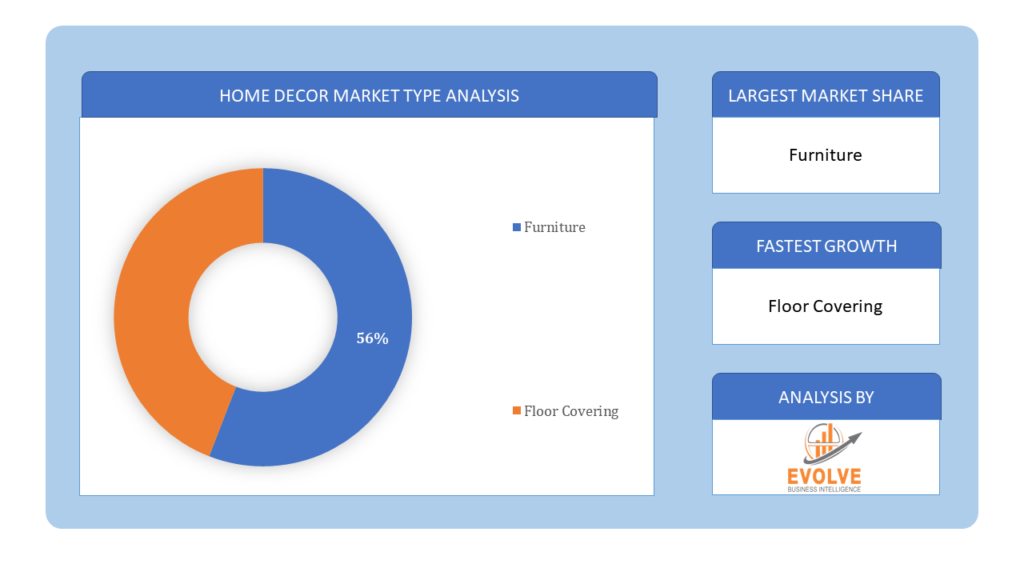

By Type

Based on Type, the market segment has been divided into the Furniture and Floor Covering. The furniture segment dominated the Market, due to its ability to combine form and function; furniture is frequently the most noticeable component of home décor. Furniture such as couches, tables, chairs, and beds all have a purpose in addition to adding to a room’s overall design. Traditional to modern furniture styles are available, with various materials like glass, metal, wood, and more.

Based on Type, the market segment has been divided into the Furniture and Floor Covering. The furniture segment dominated the Market, due to its ability to combine form and function; furniture is frequently the most noticeable component of home décor. Furniture such as couches, tables, chairs, and beds all have a purpose in addition to adding to a room’s overall design. Traditional to modern furniture styles are available, with various materials like glass, metal, wood, and more.

By Sales Channel

Based on Sales Channel, the market segment has been divided into the Super markets & Hypermarkets, E-commerce, Specialty Stores and Others. The specialty stores category generated the most income. Only home furniture and accessories are sold in speciality home-décor stores. They provide a large selection of goods, from wall art to furniture, frequently chosen to match particular themes or fashions. These shops often offer professional advice and sometimes even custom-made solutions to satisfy customers seeking luxurious or distinctive goods.

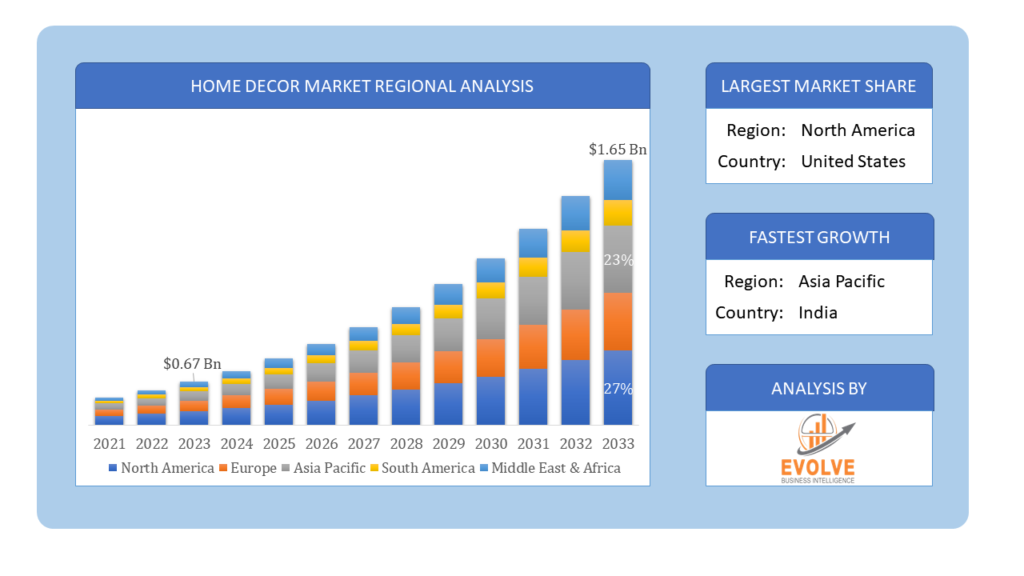

Global Home Decor Market Regional Analysis

Based on region, the global Home Decor Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Home Decor Market followed by the Asia-Pacific and Europe regions.

Home Decor North America Market

Home Decor North America Market

North America holds a dominant position in the Home Decor Market. High demand for both contemporary and traditional decor styles. Strong preference for DIY home improvement and renovation projects. Consumers in North America value quality and are willing to invest in durable and aesthetically pleasing home decor items. Increased focus on sustainable and eco-friendly products. Growth in e-commerce and smart home technologies.

Home Decor Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Home Decor Market industry. Rapid urbanization and growing middle-class populations drive demand. Preferences vary widely, from traditional to ultra-modern styles. Consumers are increasingly adopting Western decor styles while maintaining traditional elements. There is a growing appetite for luxury and high-end home decor items. Expansion of e-commerce platforms. Increasing demand for smart home products and multifunctional furniture.

Competitive Landscape

The global Home Decor Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- IKEA Group

- Forbo International SA

- Armstrong World Industries

- Mannington Mills

- Mohawk Industries

- Shaw Industries Group

- Herman Miller

- Ashley Furniture Industries Ltd.

- Kimball International

- Duresta Upholstery

Key Development

In August 2020, Ashley Furniture declared its intention to augment its operational capacities at its Verona and Saltillo. At both facilities, the expansions will generate 130 new positions. Investments totalling $13 million will be made by Ashley in its Verona facility, including the acquisition of new machinery and the construction of a structure.

Scope of the Report

Global Home Decor Market, by Income Group

- Higher Income

- Upper-Middle Income

Global Home Decor Market, by Type

- Furniture

- Floor Covering

Global Home Decor Market, by Sales Channel

- Super markets & Hypermarkets

- E-commerce

- Specialty Stores

- Others

Global Home Decor Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $1.65 Billion |

| CAGR | 4.98% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Income Group, Type, Sales Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | IKEA Group, Forbo International SA, Armstrong World Industries, Mannington Mills, Mohawk Industries, Shaw Industries Group, Herman Miller, Ashley Furniture Industries Ltd., Kimball International and Duresta Upholstery |

| Key Market Opportunities | • Growing demand for E-Commerce Expansion and Eco-Friendly Products • Health and Wellness Focus |

| Key Market Drivers | • Technological Advancements • Sustainability and Health Trends |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Home Decor Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Home Decor Market historical market size for the year 2021, and forecast from 2023 to 2033

- Home Decor Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Home Decor Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.