Brazil Off-Price Retail Market Overview

The Brazil Off-Price Retail Market Size is expected to reach USD 602.14 Billion by 2033. The Brazil Off-Price Retail Market industry size accounted for USD 50.65 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 41.65% from 2023 to 2033. The Brazil Off-Price Retail Market refers to a segment of the retail industry in Brazil that focuses on selling branded and high-quality merchandise at discounted prices. This market typically includes products such as clothing, footwear, accessories, and sometimes home goods. These products are usually surplus stock, overstock, or out-of-season items from higher-end retailers and manufacturers.

The Brazilian off-price retail market refers to the segment of retail stores that sell brand-name apparel, footwear, and other household goods at discounted prices. These stores source their inventory from various channels, including excess stock from manufacturers and department stores, cancelled orders, and out-of-season items. In Brazil, similar formats may be operated by both local retailers and international companies that have entered the market.

Global Brazil Off-Price Retail Market Synopsis

The COVID-19 pandemic has significantly impacted the Brazil Off-Price Retail Market in various ways. With lockdowns and social distancing measures in place, many consumers turned to online shopping. Off-price retailers, traditionally reliant on physical stores, had to quickly adapt by enhancing their e-commerce capabilities. The pandemic caused disruptions in global supply chains, affecting the availability of products. This impacted inventory levels for off-price retailers, who rely on surplus stock from manufacturers and other retailers. Economic uncertainty and reduced disposable incomes drove consumers to seek out bargains, potentially benefiting off-price retailers. The demand for discounted goods may have increased as consumers became more price-sensitive. The pandemic accelerated changes in consumer behavior, including a preference for value and convenience. Off-price retailers had to adapt to these changes by offering a seamless online shopping experience and ensuring attractive price points.

Brazil Off-Price Retail Market Dynamics

The major factors that have impacted the growth of Brazil Off-Price Retail Market are as follows:

Drivers:

Ø Brand and Product Variety

Offering a wide variety of well-known and premium brands at discounted prices attracts a broad customer base. Consumers are drawn to the opportunity to purchase branded items at reduced prices. The shift towards e-commerce and digital platforms allows off-price retailers to reach a wider audience. Investment in online sales channels and technology enhances customer convenience and expands market reach. Trends such as increased price sensitivity, value-oriented shopping, and a preference for sustainability (buying overstock and returned goods reduces waste) drive consumers towards off-price retail options. Urbanization and a growing middle class in Brazil increase the potential customer base for off-price retailers. Young, urban consumers are particularly attracted to the value and variety offered by these stores.

Restraint:

- Perception of Competition

The off-price retail market is highly competitive, with numerous players vying for market share. Intense competition can lead to price wars, reducing profit margins. Additionally, traditional retailers and e-commerce giants expanding into the discount segment increase competition. Off-price retailers must effectively manage a constantly changing inventory of surplus and overstock products. Poor inventory management can lead to overstocking unwanted items or stockouts of popular products, negatively impacting sales and customer satisfaction. Maintaining a positive consumer perception is crucial. If consumers perceive off-price stores as selling low-quality or outdated merchandise, it can harm the retailer’s reputation and deter potential customers.

Opportunity:

⮚ E-Commerce Expansion and Omni-Channel Retailing

The growing trend of online shopping presents a significant opportunity for off-price retailers to expand their digital presence. Investing in robust e-commerce platforms and enhancing online shopping experiences can attract a wider customer base. Developing a seamless omni-channel strategy that integrates online and offline shopping experiences can enhance customer convenience. Offering services like click-and-collect, in-store returns for online purchases, and personalized marketing can boost sales and customer loyalty. Emphasizing sustainability and ethical practices can attract environmentally conscious consumers. Implementing sustainable sourcing, reducing waste, and promoting eco-friendly products can enhance brand reputation and appeal. Focusing on improving the in-store experience through attractive store layouts, excellent customer service, and engaging marketing can drive foot traffic and repeat business. Creating a pleasant shopping environment enhances customer satisfaction.

Brazil Off-Price Retail Market Segment Overview

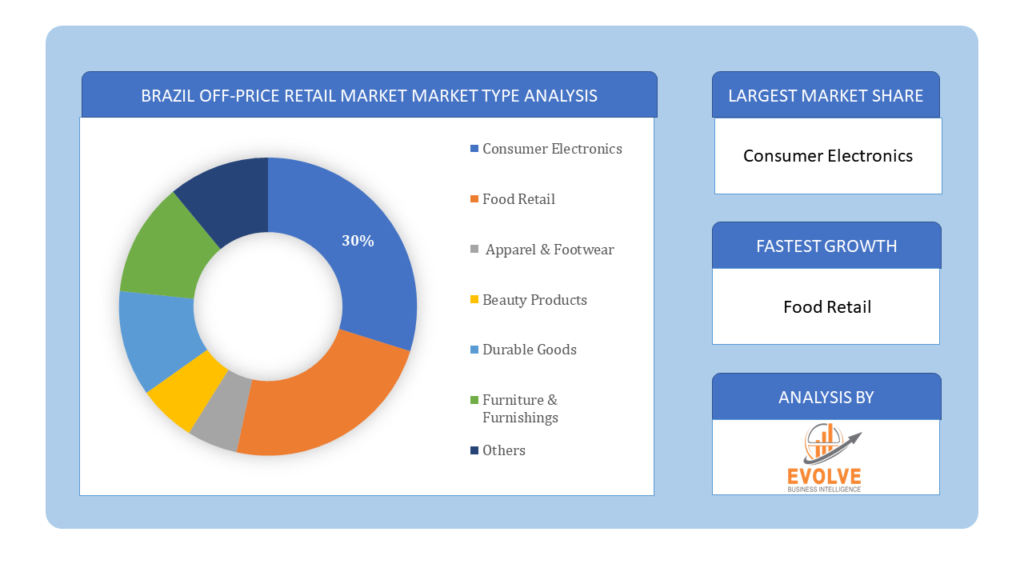

By Type

Based on Type, the market is segmented based on Consumer Electronics, Food Retail, Apparel & Footwear, Beauty Products, Durable Goods, Furniture & Furnishings and Others. The Beauty Products segment dominant the market. Brazilians seeking quality beauty products at affordable prices are a major driver. The beauty products segment in Brazil’s off-price retail market offers a unique shopping experience for budget-conscious consumers seeking deals on popular brands.

Based on Type, the market is segmented based on Consumer Electronics, Food Retail, Apparel & Footwear, Beauty Products, Durable Goods, Furniture & Furnishings and Others. The Beauty Products segment dominant the market. Brazilians seeking quality beauty products at affordable prices are a major driver. The beauty products segment in Brazil’s off-price retail market offers a unique shopping experience for budget-conscious consumers seeking deals on popular brands.

By Store Type

Based on Store Type, the market segment has been divided into the 3rd Party and Manufacturer. The Manufacturer segment dominant the market. Manufacturers may have surplus stock due to overproduction, cancelled orders, or out-of-season items. Off-price retailers offer a valuable channel to sell this excess inventory at a discounted price, recouping some costs and freeing up storage space.

By Application

Based on Application, the market segment has been divided into the Internet Sales and Store Sales. The Store Sales segment dominant the market. The store sales segment is expected to continue growing in Brazil due to the increasing popularity of value-conscious shopping. The rise of online marketplaces with off-price retail models might pose some competition to physical stores. However, the in-store experience of discovery and treasure hunting is likely to remain a significant advantage.

Competitive Landscape

The global Brazil Off-Price Retail Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- AMAZON.COM

- ALPARGATAS S.A

- MARISA

- CENTAURO

- PRIVALIA

- WESTWING

- QBAZAR

- RESTOQUE

- GRUPO DE MODA SOMA

- INBRANDS

Scope of the Report

Global Brazil Off-Price Retail Market, by Type

- Consumer Electronics

- Food Retail

- Apparel & Footwear

- Beauty Products

- Durable Goods

- Furniture & Furnishings

- Others

Global Brazil Off-Price Retail Market, by Store Type

- 3rd Party

- Manufacturer

Global Brazil Off-Price Retail Market, by Application

- Internet Sales

- Store Sales

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $602.14 Billion |

| CAGR | 41.65% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Store Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | AMAZON.COM, ALPARGATAS S.A, MARISA, CENTAURO, PRIVALIA, WESTWING, QBAZAR, RESTOQUE, GRUPO DE MODA SOMA and INBRANDS |

| Key Market Opportunities | • E-Commerce Expansion and Omni-Channel Retailing • Enhanced Customer Experience |

| Key Market Drivers | • Brand and Product Variety • Digital Transformation |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Brazil Off-Price Retail Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Brazil Off-Price Retail Market historical market size for the year 2021, and forecast from 2023 to 2033

- Brazil Off-Price Retail Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Brazil Off-Price Retail Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.