Podiatry Service Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

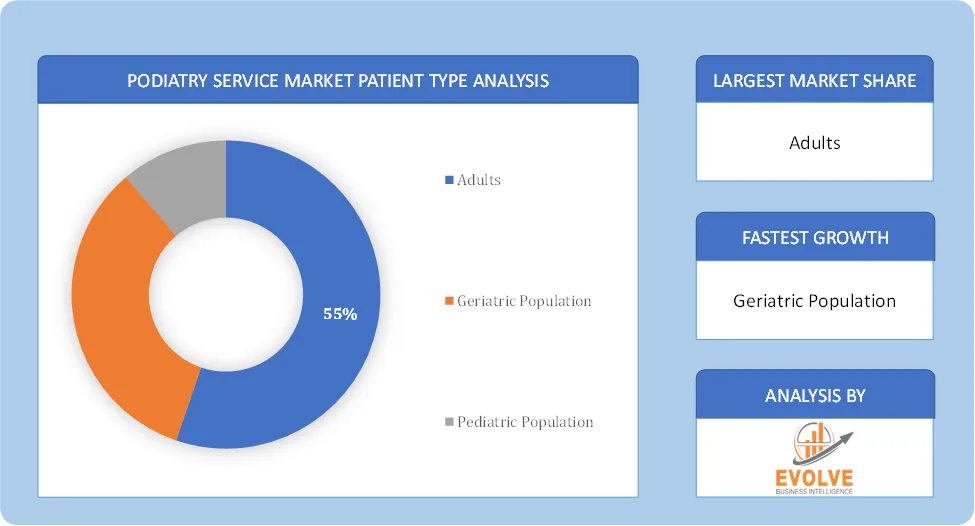

Podiatry Service Market Research Report: Information By Patient Type (Adults, Geriatric Population, Pediatric Population), By Procedure Type (Foot Surgery, Ankle Surgery, Routine Podiatric Procedures), By End-Use (Hospitals, Podiatry Clinics), and by Region — Forecast till 2034

Page: 165

Podiatry Service Market Overview

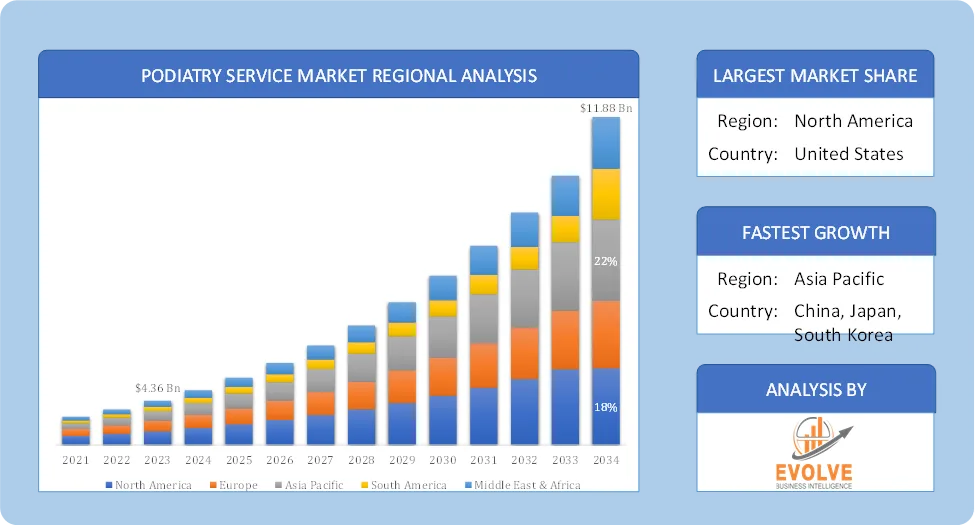

The Podiatry Service Market size accounted for USD 4.36 Billion in 2023 and is estimated to account for 6.85 Billion in 2024. The Market is expected to reach USD 11.88 Billion by 2034 growing at a compound annual growth rate (CAGR) of 2.87% from 2024 to 2034. The global podiatry services market is experiencing steady growth, driven primarily by the increasing prevalence of diabetes and related complications that necessitate specialized foot care. Older adults are more susceptible to various foot and ankle problems like osteoarthritis, bursitis, and heel spurs, leading to a higher demand for podiatry services.

The podiatry service market is a growing and dynamic sector driven by increasing health awareness, an aging population, the rising incidence of chronic diseases, and technological advancements. This presents numerous opportunities for healthcare providers and businesses in this domain to cater to the increasing demand for specialized foot and ankle care.

Global Podiatry Service Market Synopsis

Podiatry Service Market Dynamics

Podiatry Service Market Dynamics

The major factors that have impacted the growth of Podiatry Service Market are as follows:

Drivers:

Ø Rising Prevalence of Foot and Ankle Disorders

Conditions such as plantar fasciitis, heel spurs, bunions, hammertoes, and ingrown toenails are becoming increasingly common due to various lifestyle and health-related factors. The increasing incidence of foot and ankle problems directly translates to a higher demand for podiatric consultations, diagnoses, and treatments. This is a major driver due to the high risk of diabetic foot ulcers, neuropathy, and poor circulation, which necessitate regular podiatric care and management to prevent severe outcomes like amputations. The increasing global prevalence of diabetes directly fuels the demand for specialized diabetic foot care services.

Restraint:

- Limited Awareness and Understanding of Podiatry

In many regions, there is a lack of public awareness about the scope of podiatry and the importance of foot health. Many individuals may not realize that podiatrists can treat a wide range of conditions beyond basic foot care. This lack of understanding can lead to delayed treatment or individuals seeking help from general practitioners or other specialists when a podiatrist would be more appropriate and low awareness can particularly hinder market penetration in developing economies and rural areas. Podiatry is a specialized field requiring extensive training, and the number of graduates may not be sufficient to meet the increasing demand.

Opportunity:

⮚ Expanding Diabetic Foot Care Services

The escalating global prevalence of diabetes is a major driver for podiatry services. Diabetic foot complications are a leading cause of hospitalization and amputation. Focusing on comprehensive diabetic foot care programs, including regular screenings, patient education on self-care, advanced wound care, and the use of innovative technologies to prevent and manage complications. Collaborating with endocrinologists and primary care physicians can also enhance patient referrals. As public awareness about the importance of foot health grows, there’s an increasing demand for preventative care services and promoting routine foot check-ups, educating the public on proper foot hygiene and footwear choices, and offering preventative treatments for common conditions like corns and calluses. Workplace wellness programs focusing on foot health can also be a target.

Podiatry Service Market Segment Overview

Based on Patient Type, the market is segmented based on Adults, Geriatric Population, Pediatric Population. The Geriatric Population segment dominant the market due to the rising prevalence of foot and ankle problems in older adults. This growth is primarily attributed to the increasing incidence of diabetes, arthritis, and obesity among the elderly population, which are major risk factors for foot and ankle disorders.

By Procedure Type

Based on Procedure Type, the market segment has been divided into Foot Surgery, Ankle Surgery, Routine Podiatric Procedures. The Foot Surgery segment dominant the market. Poor footwear choices and prolonged standing in work environments contribute to these deformities. Surgeons increasingly rely on custom implants and bio-absorbable materials and increase in sports-related foot injuries (stress fractures, ligament tears) is fueling demand for corrective foot surgeries.

By End Use

Based on End Use, the market segment has been divided into Hospitals, Podiatry Clinics. The Hospitals segment dominant the market. This dominance is attributed to the increasing number of patients seeking podiatry services in hospitals due to the availability of advanced treatment facilities and specialized podiatrists and also install a larger hospital-based system coupled with an increase in the employment of physicians of these services.

Global Podiatry Service Market Regional Analysis

Based on region, the global Podiatry Service Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Podiatry Service Market followed by the Asia-Pacific and Europe regions.

North America Podiatry Service Market

North America Podiatry Service Market

North America holds a dominant position in the Podiatry Service Market. It’s driven by a high prevalence of chronic conditions like diabetes and arthritis, advanced healthcare infrastructure, high awareness about foot health, and significant healthcare expenditure. The US is expected to lead the global market in terms of revenue. Large geriatric population susceptible to foot and ankle disorders and presence of numerous podiatry clinics and a strong network of healthcare professionals. Increasing adoption of advanced podiatric treatments and technologies.

Asia-Pacific Podiatry Service Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Podiatry Service Market industry. Due to the increasing prevalence of diabetes, rising healthcare awareness, and improving healthcare infrastructure, particularly in countries like India and China. India is also highlighted as a fast-growing market. Growing middle-class population with increased disposable income for healthcare services and significant investments in healthcare facilities and modern medical infrastructure.

Competitive Landscape

The global Podiatry Service Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Beijing Puhua International Hospital

- Foot and Ankle Specialists of the Mid-Atlantic (FASMA)

- Foot Center of New York

- Burjeel Hospital for Advances Surgery

- Fortis Healthcare

- Kaiser Permanente

- Massachusetts General Hospital

- Max Healthcare

- Medicine Middle East

- Schoen Clinic.

Scope of the Report

Global Podiatry Service Market, by Patient Type

- Adults

- Geriatric Population

- Pediatric Population

Global Podiatry Service Market, by Procedure Type

- Foot Surgery

- Ankle Surgery

- Routine Podiatric Procedures

Global Podiatry Service Market, by End Use

- Hospitals

- Podiatry Clinics

Global Podiatry Service Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 11.88 Billion |

| CAGR (2024-2034) | 2.87% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Patient Type, Procedure Type, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Beijing Puhua International Hospital, Foot and Ankle Specialists of the Mid-Atlantic (FASMA), Foot Center of New York, Burjeel Hospital for Advances Surgery, Fortis Healthcare, Kaiser Permanente, Massachusetts General Hospital, Max Healthcare, Medicine Middle East and Schoen Clinic. |

| Key Market Opportunities | · Expanding Diabetic Foot Care Services · Increasing Awareness and Acceptance of Preventative Foot Care |

| Key Market Drivers | · Rising Prevalence of Foot and Ankle Disorders · Growing Prevalence of Chronic Diseases |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Podiatry Service Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Podiatry Service Market historical market size for the year 2021, and forecast from 2023 to 2033

- Podiatry Service Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Podiatry Service Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Podiatry Service Market is 2021- 2033

What is the growth rate of the global Podiatry Service Market?

The global Podiatry Service Market is growing at a CAGR of 2.87% over the next 10 years

Which region has the highest growth rate in the market of Podiatry Service Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Podiatry Service Market?

North America holds the largest share in 2022

Who are the key players in the global Podiatry Service Market?

Beijing Puhua International Hospital, Foot and Ankle Specialists of the Mid-Atlantic (FASMA), Foot Center of New York, Burjeel Hospital for Advances Surgery, Fortis Healthcare, Kaiser Permanente, Massachusetts General Hospital, Max Healthcare, Medicine Middle East and Schoen Clinic. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Patient Type Segement – Market Opportunity Score

4.1.2. Procedure Type Segment – Market Opportunity Score

4.1.3. End Use Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Podiatry Service Market Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. Market Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Podiatry Service Market Market, By Patient Type

7.1. Introduction

7.1.1. Adults

7.1.2 Geriatric Population

7.1.3. Pediatric Population

CHAPTER 8 Podiatry Service Market Market, By Procedure Type

8.1. Introduction

8.1.1. Foot Surgery

8.1.2. Ankle Surgery

8.1.3. Routine Podiatric Procedures

CHAPTER 9. Podiatry Service Market Market, By End Use

9.1. Introduction

9.1.1. Hospitals

9.1.2. Podiatry Clinics

CHAPTER 10. Podiatry Service Market Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.2.2. North America: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.2.3. North America: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.2.4. North America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.2.5.2. US: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.2.5.3. US: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.2.6.3. Canada: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.3.2. Europe: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.3.3. Europe: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.3.4. Europe: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.3.6.3. Germany: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.3.7.2. France: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.3.7.3. France: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.3.8.3. Italy: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.3.9.3. Spain: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.3.11.3. Russia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.5.2. China: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.5.3. China: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.6.3. Japan: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.7.2. India: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.7.3. India: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.12.3. Australia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.5.2. South America: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.5.3. South America: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.5.4. South America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.6.6.3. UAE: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Patient Type, 2024 – 2034($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Procedure Type, 2024 – 2034($ Million)

10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023-

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Beijing Puhua International Hospital

13.1.1. Hanon Systems

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Foot and Ankle Specialists of the Mid-Atlantic (FASMA)

13.3. Foot Center of New York

13.4. Burjeel Hospital for Advances Surgery

13.5. Fortis Healthcare

13.6. Kaiser Permanente

13.7. Massachusetts General Hospital

13.8. Max Healthcare

13.9 Medicine Middle East

13.10 Schoen Clinic

Connect to Analyst

Research Methodology