Payroll Outsourcing Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

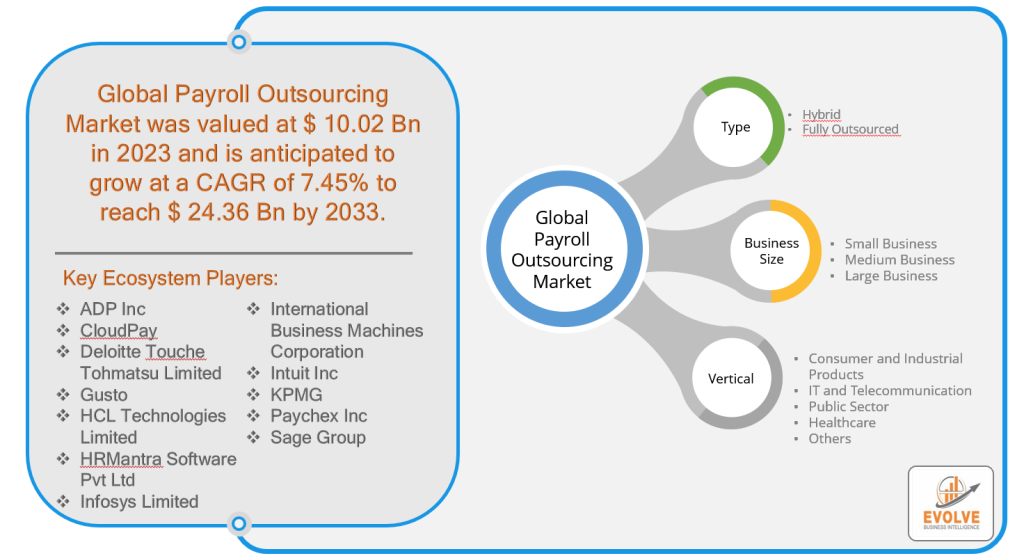

Payroll Outsourcing Market Research Report: By Type (Hybrid, Fully Outsourced), By Business Size (Small Business, Medium Business, Large Business), By Vertical (BFSI, Consumer and Industrial Products, IT and Telecommunication, Public Sector, Healthcare, Others), and by Region — Forecast till 2033

Payroll Outsourcing Market Size is expected to reach USD 24.36 Billion by 2033. The Payroll Outsourcing industry size accounted for USD 10.02 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.45% from 2023 to 2033. Payroll outsourcing refers to the practice of delegating the management and administration of payroll processes to external service providers. It involves the transfer of responsibilities for calculating, processing and distributing employee salaries, wages, bonuses, and other related payments to a specialized third-party organization. In this arrangement, the payroll outsourcing service provider assumes the responsibility of ensuring accurate and timely payroll processing, tax withholding, and compliance with relevant labor laws and regulations. They typically handle tasks such as salary calculations, deductions, statutory contributions, generating pay slips, preparing payroll reports, and disbursing payments to employees. Payroll outsourcing offers several benefits to organizations, including cost savings, increased accuracy and efficiency, reduced administrative burden, access to specialized expertise and technology, and enhanced compliance with legal and regulatory requirements. It allows businesses to focus on their core operations while entrusting payroll-related functions to experienced professionals, ensuring smooth and reliable payroll management.

Global Payroll Outsourcing Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant positive impact on the Payroll Outsourcing market. As businesses faced unprecedented challenges during the pandemic, such as remote work arrangements, changing government regulations, and economic uncertainties, the demand for outsourced payroll services surged. Organizations turned to payroll outsourcing providers to navigate complex payroll processes, ensure compliance with evolving regulations, and alleviate the administrative burden on their internal resources. The pandemic highlighted the value of outsourcing payroll functions as a reliable and efficient solution, enabling businesses to adapt quickly to changing circumstances, maintain accurate and timely payroll processing, and focus on core operations. This increased demand for payroll outsourcing services is expected to continue as companies recognize the benefits of outsourcing in streamlining payroll operations and mitigating risks in a rapidly changing business environment.

Global Payroll Outsourcing Market Dynamics

The major factors that have impacted the growth of Payroll Outsourcing are as follows:

Drivers:

The Potential for Cost Efficiency

By outsourcing payroll processes, organizations can reduce the expenses associated with hiring and training in-house payroll staff, investing in payroll software and infrastructure, and managing payroll-related compliance and regulatory requirements. Payroll outsourcing providers can leverage economies of scale, expertise, and technology to efficiently handle payroll tasks, resulting in cost savings for businesses.

Restraint:

- Data Security Concerns

A significant restraint in the Payroll Outsourcing market is the potential risk to data security and privacy. Payroll data contains sensitive employee information, including personal details, financial data, and tax information. Outsourcing this data to a third-party service provider raises concerns about data breaches, unauthorized access, and compliance with data protection regulations. Organizations must carefully assess the security measures and protocols of payroll outsourcing providers to ensure the protection and confidentiality of their employees’ data.

Opportunity:

Focus on Core Competencies

Payroll Outsourcing offers organizations the opportunity to focus on their core competencies and strategic priorities. By entrusting payroll processes to external experts, businesses can free up valuable time and resources that can be directed toward activities that drive growth and competitive advantage. It allows organizations to concentrate on core business functions, such as innovation, customer service, and market expansion, while leaving payroll administration in the hands of specialized providers who can ensure accuracy, compliance, and efficiency in payroll operations.

Payroll Outsourcing Market Segment Overview

By Type

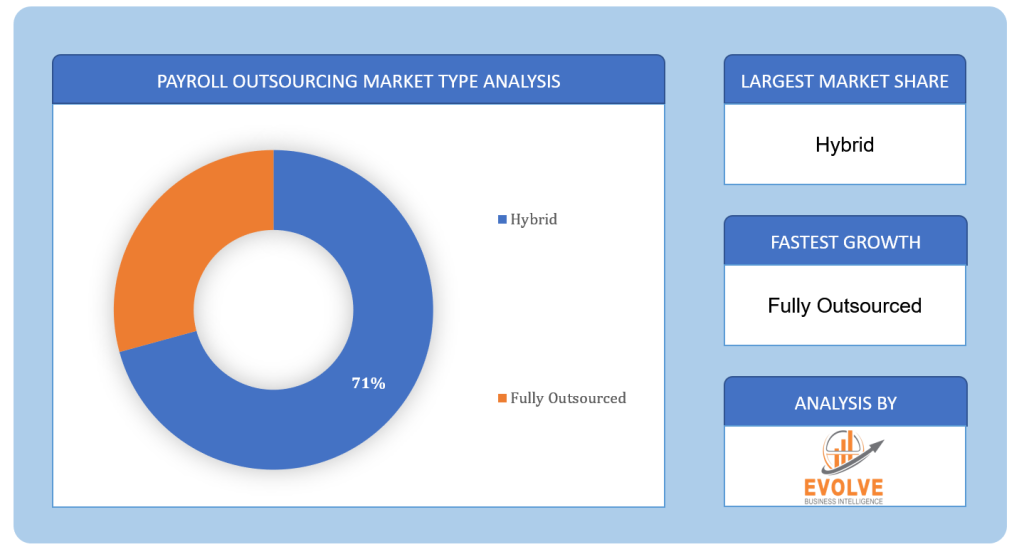

Based on the Type, the market is segmented based on Hybrid, Fully Outsourced. The largest market share is anticipated to go to the Hybrid segment. The increasing adoption of hybrid models, which combine outsourced payroll services with in-house capabilities, is driving the growth of this segment. Organizations are opting for hybrid approaches to strike a balance between outsourcing certain payroll functions to specialized providers while retaining control over critical aspects of payroll management.

Based on the Type, the market is segmented based on Hybrid, Fully Outsourced. The largest market share is anticipated to go to the Hybrid segment. The increasing adoption of hybrid models, which combine outsourced payroll services with in-house capabilities, is driving the growth of this segment. Organizations are opting for hybrid approaches to strike a balance between outsourcing certain payroll functions to specialized providers while retaining control over critical aspects of payroll management.

By Business Size

Based on Business Size, the market has been divided into Small Businesses, Medium Businesses, and Large Businesses. The Large Business segment is expected to hold the largest market share in the Market. This projection is driven by the complex payroll requirements of large enterprises, including extensive employee bases, multiple locations, diverse compensation structures, and intricate regulatory compliance. Large businesses often face resource constraints and operational challenges in managing their payroll processes in-house, leading them to opt for outsourcing to specialized providers.

By Vertical

Based on Vertical, the market has been divided into BFSI, Consumer and Industrial Products, IT and Telecommunication, Public Sector, Healthcare, and Others. The market is projected to see significant growth in the Consumer and Industrial Products segment. This projection is driven by several factors. Firstly, the consumer products industry encompasses a wide range of companies, including retail, e-commerce, and consumer goods manufacturers, which often have large workforces and complex payroll needs. Outsourcing payroll services allows these organizations to streamline their payroll processes, ensure compliance with labor regulations, and focus on their core business functions.

Global Payroll Outsourcing Market Regional Analysis

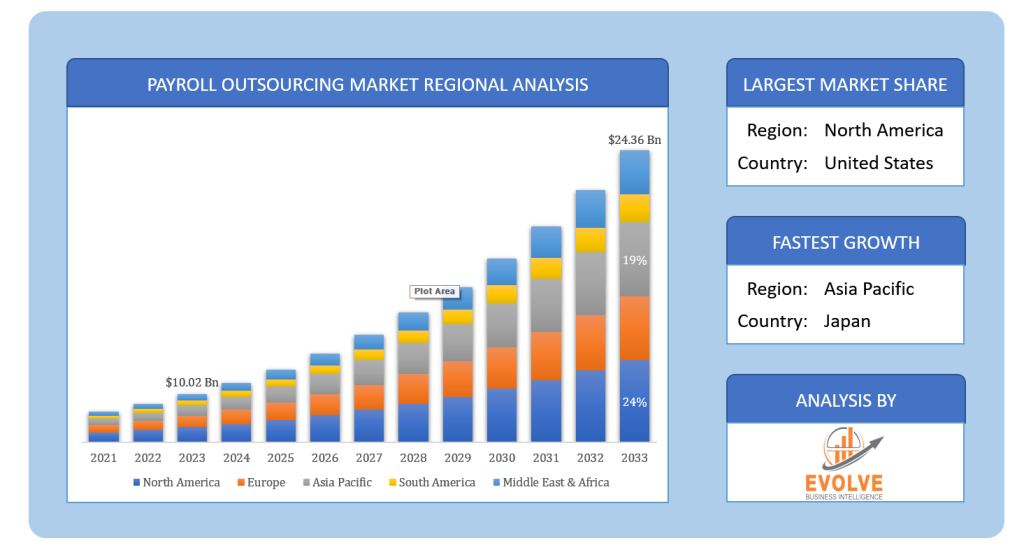

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Payroll Outsourcing, followed by those in Asia-Pacific and Europe.

North America Market

North America Market

North America has emerged as a leading region in terms of market share in the Payroll Outsourcing market. The region’s dominance can be attributed to several factors. Firstly, North America houses a large number of multinational corporations and businesses across various industries, driving the demand for payroll outsourcing services. Additionally, the complex and ever-changing payroll regulations and compliance requirements in the region create a need for specialized expertise, which outsourcing providers can offer. Furthermore, North America boasts a well-established outsourcing ecosystem, comprising experienced service providers with robust infrastructure and technology capabilities. This combination of factors positions North America as a frontrunner in the Payroll Outsourcing market, with a significant market share and a wide range of businesses opting for outsourced payroll services to enhance operational efficiency and compliance.

Asia Pacific Market

The Asia-Pacific region had been witnessing a growing CAGR in the Payroll Outsourcing industry. The region is home to a diverse range of economies, including emerging markets with rapid industrialization and globalization. As businesses in these countries expand, the complexity of their payroll processes increases, creating a demand for outsourced payroll services. Additionally, the Asia-Pacific region has a large and growing labor force, requiring efficient and scalable payroll management solutions. Furthermore, the region is witnessing digital transformation and increased adoption of cloud-based technologies, which facilitate the outsourcing of payroll functions.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as HCL, ADP inc, Gusto, and Infosys are some of the leading players in the global Payroll Outsourcing Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- ADP Inc

- CloudPay

- Deloitte Touche Tohmatsu Limited

- Gusto

- HCL Technologies Limited

- HRMantra Software Pvt Ltd

- Infosys Limited

- International Business Machines Corporation

- Intuit Inc

- KPMG

- Paychex Inc

- Sage Group

Key Development:

In 2021, ADP expanded its global payroll capabilities by acquiring a minority stake in Celergo, a leading provider of international payroll solutions. This acquisition aimed to strengthen ADP’s position in the global payroll outsourcing market.

In 2021, Paychex continued to focus on technological advancements by introducing new features and functionalities to its payroll outsourcing platform. This includes enhancements in mobile payroll solutions, time and attendance tracking, and employee self-service options.

Scope of the Report

Global Payroll Outsourcing Market, by Type

- Hybrid

- Fully Outsourced

Global Payroll Outsourcing Market, by Business Size

- Small Business

- Medium Business

- Large Business

Global Payroll Outsourcing Market, by Vertical

- BFSI

- Consumer and Industrial Products

- IT and Telecommunication

- Public Sector

- Healthcare

- Others

Global Payroll Outsourcing Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $24.36 Billion |

| CAGR | 7.45% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Business Size, Vertical |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | ADP Inc, CloudPay, Deloitte Touche Tohmatsu Limited, Gusto, HCL Technologies Limited, HRMantra Software Pvt Ltd, Infosys Limited, International Business Machines Corporation, Intuit Inc, KPMG, Paychex Inc, Sage Group |

| Key Market Opportunities | Streamlined and efficient payroll processes Compliance with changing regulations and requirements Scalability and flexibility in payroll operations |

| Key Market Drivers | Cost efficiency and potential for cost savings Focus on core competencies and strategic priorities Access to specialized expertise and technology |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Payroll Outsourcing Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Payroll Outsourcing market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Payroll Outsourcing market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Payroll Outsourcing Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Payroll Outsourcing market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Payroll Outsourcing market?

The global Payroll Outsourcing market is growing at a CAGR of ~45% over the next 10 years

Which region has the highest growth rate in the market of Payroll Outsourcing?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Payroll Outsourcing?

North America holds the largest share in 2022

Major Key Players in the Market of Payroll Outsourcing?

ADP Inc, CloudPay, Deloitte Touche Tohmatsu Limited, Gusto, HCL Technologies Limited, HRMantra Software Pvt Ltd, Infosys Limited, International Business Machines Corporation, Intuit Inc, KPMG, Paychex Inc, Sage Group are the major companies operating in the Payroll Outsourcing

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Business Size Segment – Market Opportunity Score 4.1.3. Vertical Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Payroll Outsourcing Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Payroll Outsourcing Market, By Type 7.1. Introduction 7.1.1. Hybrid 7.1.2. Fully Outsourced CHAPTER 8. Global Payroll Outsourcing Market, By Business Size 8.1. Introduction 8.1.1. Small Business 8.1.2. Medium Business 8.1.3. Large Business CHAPTER 9. Global Payroll Outsourcing Market, By Vertical 9.1. Introduction 9.1.1. BFSI 9.1.2. Consumer and Industrial Products 9.1.3. IT and Telecommunication 9.1.4. Public Sector 9.1.5. Healthcare 9.1.6. Other CHAPTER 10. Global Payroll Outsourcing Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Business Size, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. ADP Inc 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. CloudPay 13.3. Deloitte Touche Tohmatsu Limited 13.4. Gusto 13.5. HCL Technologies Limited 13.6. HRMantra Software Pvt Ltd 13.7. Infosys Limited 13.8. International Business Machines Corporation 13.9. Intuit Inc 13.10. KPMG

Connect to Analyst

Research Methodology