Price range: $ 1,390.00 through $ 5,520.00

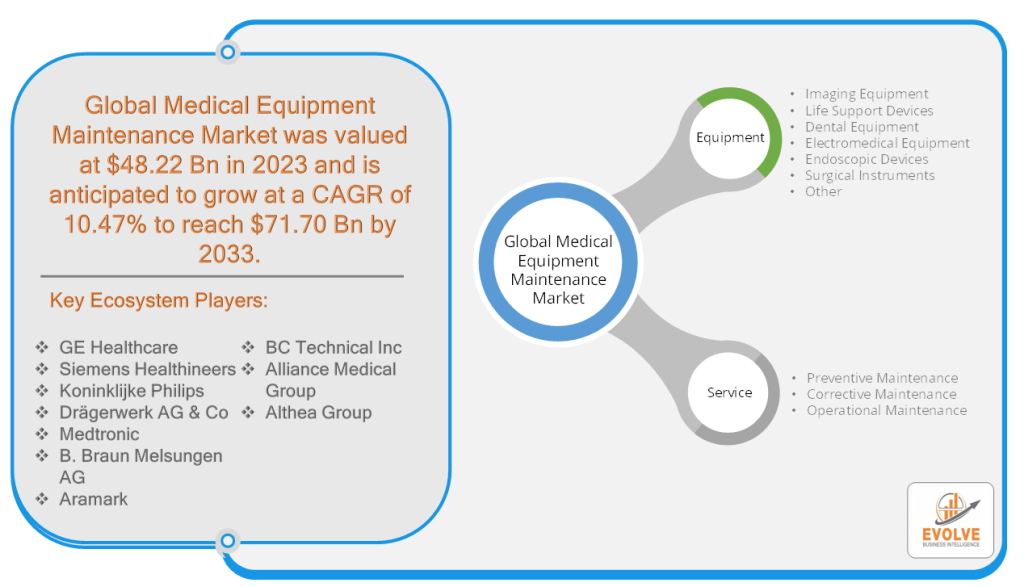

Medical Equipment Maintenance Market Research Report: Information By Equipment (Imaging Equipment, Life Support Devices, Dental Equipment, Electromedical Equipment, Endoscopic Devices, Surgical Instruments, Other), By Service (Preventive Maintenance, Corrective Maintenance, Operational Maintenance), and by Region — Forecast till 2033

Description

Medical Equipment Maintenance Market Overview

The Medical Equipment Maintenance Market Size is expected to reach USD 71.70 Billion by 2033. The Medical Equipment Maintenance industry size accounted for USD 48.22 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 10.47% from 2023 to 2033. Medical Equipment Maintenance refers to the systematic and strategic activities undertaken to ensure the optimal performance, safety, and reliability of medical equipment utilized within healthcare facilities. It encompasses a range of planned tasks, inspections, and corrective measures aimed at preventing equipment failures, identifying and rectifying malfunctions, and prolonging the operational lifespan of the equipment. The primary objectives of medical equipment maintenance are to minimize equipment downtime, maximize operational efficiency, comply with regulatory requirements, and support the uninterrupted delivery of high-quality healthcare services. These activities encompass preventive maintenance routines, such as routine inspections, calibration, and adjustments, as well as corrective maintenance interventions to address equipment malfunctions and faults. The effective management of medical equipment maintenance involves adherence to manufacturer guidelines, compliance with industry standards, documentation of maintenance activities, and the utilization of advanced technologies for condition monitoring, predictive maintenance, and asset management.

Global Medical Equipment Maintenance Market Synopsis

The Medical Equipment Maintenance market experienced a profound and transformative impact due to the COVID-19 pandemic. The global healthcare sector faced an unprecedented surge in demand for medical equipment, highlighting the critical need for reliable and well-maintained equipment. Healthcare providers, including hospitals and clinics, prioritized the preparedness and uninterrupted operation of vital equipment such as ventilators, respiratory monitors, and diagnostic machines. The pandemic emphasized the significance of prompt and agile maintenance services to address emerging requirements and equipment failures effectively. Furthermore, the widespread adoption of telehealth and remote monitoring technologies necessitated the maintenance of virtual care equipment and the integration of connectivity and cybersecurity measures. Consequently, the Medical Equipment Maintenance market witnessed substantial growth and innovation, with service providers offering specialized maintenance solutions and leveraging digital technologies for remote diagnostics, predictive maintenance, and asset management.

Medical Equipment Maintenance Market Dynamics

The major factors that have impacted the growth of Medical Equipment Maintenance are as follows:

Drivers:

Increasing Demand for Healthcare Services

The growing global population, aging demographics, and the prevalence of chronic diseases contribute to increasing demand for healthcare services. As more individuals require medical care, there is a corresponding need for well-maintained medical equipment to support diagnosis, treatment, and patient care. This includes equipment such as imaging machines, surgical instruments, patient monitors, and life support systems. The rising demand for healthcare services drives the importance of medical equipment maintenance to ensure that the equipment remains operational, reliable, and safe for use, ultimately supporting the delivery of quality healthcare to meet the needs of the population.

Restraint:

- Budgetary Constraints

Healthcare organizations, especially those in resource-limited settings, often face financial constraints that impact their ability to invest in medical equipment maintenance. Limited budgets may lead to prioritization of immediate healthcare needs over preventive maintenance or delay in necessary repairs and replacements. The lack of adequate financial resources can result in deferred or inadequate maintenance activities, potentially compromising the performance, reliability, and safety of medical equipment. This restraint highlights the challenge of balancing budgetary limitations with the essential maintenance requirements for healthcare equipment, which can affect the overall quality of healthcare services provided.

Opportunity:

Technological Advancements

Rapid advancements in technology, such as the Internet of Things (IoT), artificial intelligence (AI), and predictive analytics, are revolutionizing the medical equipment maintenance landscape. These technologies offer promising opportunities to enhance maintenance practices and improve equipment performance. IoT-enabled devices can provide real-time data on equipment usage, performance, and potential issues, enabling remote monitoring and proactive maintenance interventions. AI and predictive analytics algorithms can analyze data patterns to predict equipment failures or malfunctions, allowing for preventive maintenance and minimizing unplanned downtime. Furthermore, advanced asset management systems utilizing technology can optimize equipment lifecycle, streamline maintenance workflows, and facilitate inventory management.

Medical Equipment Maintenance Segment Overview

By Equipment

Based on Equipment, the market is segmented based on Imaging Equipment, Life Support Devices, Dental Equipment, Electromedical Equipment, Endoscopic Devices, Surgical Instruments, Other. The Imaging Equipment segment is expected to witness significant growth during the forecast period. The increasing prevalence of chronic diseases and the growing demand for diagnostic imaging procedures drive the demand for imaging equipment, such as X-ray machines, MRI scanners, CT scanners, and ultrasound systems. As healthcare facilities strive to meet the rising demand, ensuring the optimal performance and availability of imaging equipment becomes crucial, leading to an increased need for maintenance services.

Based on Equipment, the market is segmented based on Imaging Equipment, Life Support Devices, Dental Equipment, Electromedical Equipment, Endoscopic Devices, Surgical Instruments, Other. The Imaging Equipment segment is expected to witness significant growth during the forecast period. The increasing prevalence of chronic diseases and the growing demand for diagnostic imaging procedures drive the demand for imaging equipment, such as X-ray machines, MRI scanners, CT scanners, and ultrasound systems. As healthcare facilities strive to meet the rising demand, ensuring the optimal performance and availability of imaging equipment becomes crucial, leading to an increased need for maintenance services.

By Service

Based on Service, the market has been divided into Preventive Maintenance, Corrective Maintenance, and Operational Maintenance. Preventive Maintenance dominates the Medical Equipment Maintenance Market. Preventive maintenance involves scheduled inspections, routine servicing, calibration, and proactive replacements of components to prevent equipment failures and ensure optimal performance. It aims to identify and address potential issues before they escalate into critical failures, reducing downtime and improving equipment reliability.

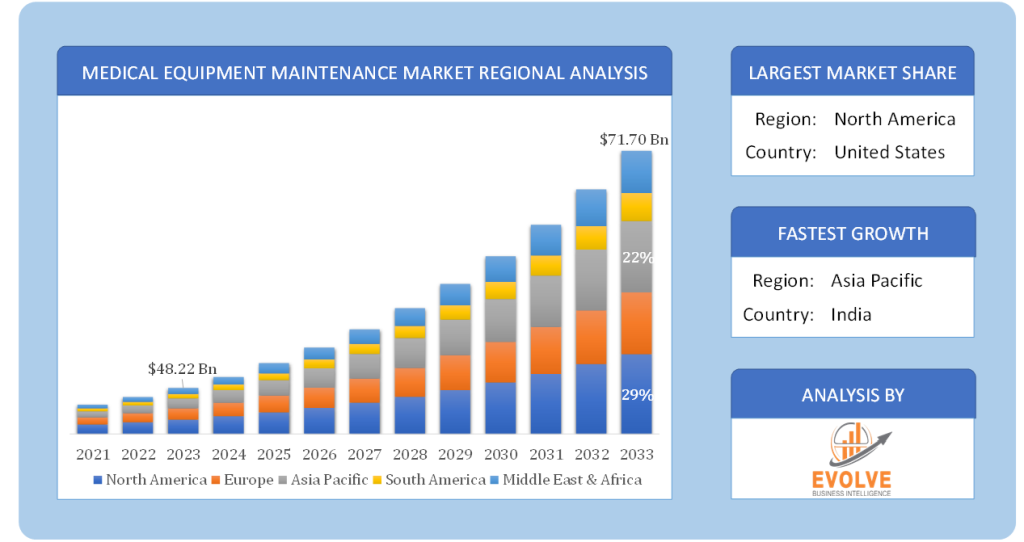

Global Medical Equipment Maintenance Market Regional Analysis

Based on region, the global Medical Equipment Maintenance market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Medical Equipment Maintenance market followed by the Asia-Pacific and Europe regions.

North America Market

North America has consistently maintained a dominant position in the Medical Equipment Maintenance market. The region’s strong healthcare infrastructure, high healthcare expenditure, stringent regulatory standards, and technological advancements have contributed to its leadership in this market. With advanced medical technologies and equipment being widely utilized in North American healthcare facilities, the need for reliable and well-maintained equipment is paramount. Healthcare providers in the region prioritize maintenance practices to ensure optimal equipment performance, patient safety, and the efficient delivery of high-quality healthcare services. While other regions are also witnessing growth in the Medical Equipment Maintenance market, North America’s continued dominance underscores its established position and ongoing commitment to maintaining a robust and efficient healthcare system.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as a rapidly growing market for the Medical Equipment Maintenance industry. This can be attributed to several factors. Firstly, the region’s expanding population, rising healthcare expenditure, and increasing access to healthcare services have led to a growing demand for medical equipment maintenance. As healthcare facilities in Asia-Pacific invest in advanced medical equipment, the need to ensure their proper functioning and longevity through maintenance services becomes crucial. Secondly, the rapid economic growth in countries like China, India, and Southeast Asian nations has resulted in the development of robust healthcare infrastructure, leading to an increased focus on medical equipment maintenance to support the delivery of quality healthcare. Additionally, technological advancements, increasing adoption of digital healthcare solutions, and a shift towards preventive maintenance practices in the region have further fueled the growth of the Medical Equipment Maintenance market in Asia-Pacific.

Competitive Landscape

The Global Medical Equipment Maintenance market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips

- Drägerwerk AG & Co

- Medtronic

- Braun Melsungen AG

- Aramark

- BC Technical Inc

- Alliance Medical Group

- Althea Group

Key Development

In July 2022, B. Braun introduced a Technical Service Center aimed at delivering high-quality medical equipment repair and maintenance services to bolster the public health system in Thailand. The center focuses on providing reliable and efficient support for the upkeep and repair of medical equipment, ensuring its optimal performance and extending its lifespan. This initiative by B. Braun aims to enhance the overall quality of healthcare services in Thailand by offering specialized maintenance solutions and expertise in line with industry standards and best practices.

Scope of the Report

Global Medical Equipment Maintenance Market, by Equipment

- Imaging Equipment

- Life Support Devices

- Dental Equipment

- Electromedical Equipment

- Endoscopic Devices

- Surgical Instruments

- Other

Global Medical Equipment Maintenance Market, by Service

- Preventive Maintenance

- Corrective Maintenance

- Operational Maintenance

Global Medical Equipment Maintenance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $71.70 Billion |

| CAGR | 10.47% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Equipment, Service |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | GE Healthcare, Siemens Healthineers, Koninklijke Philips, Drägerwerk AG & Co, Medtronic, B. Braun Melsungen AG, Aramark, BC Technical Inc, Alliance Medical Group, Althea Group |

| Key Market Opportunities | • Technological Advancements |

| Key Market Drivers | • Increasing Demand for Healthcare Services |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Medical Equipment Maintenance market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Medical Equipment Maintenance market historical market size for the year 2021, and forecast from 2023 to 2033

- Medical Equipment Maintenance market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Medical Equipment Maintenance market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

“]The study period of the global Medical Equipment Maintenance market is 2021- 2033

[/woodmart_accordion_item][woodmart_accordion_item title=”What is the growth rate of the global Medical Equipment Maintenance market?

“]The Global Medical Equipment Maintenance market is growing at a CAGR of 10.47% over the next 10 years[/woodmart_accordion_item][woodmart_accordion_item title=”Which region has the highest growth rate in the market of Medical Equipment Maintenance?

“]Asia Pacific is expected to register the highest CAGR during 2023-2033[/woodmart_accordion_item][woodmart_accordion_item title=”Which region has the largest share of the global Medical Equipment Maintenance market?

“]North America holds the largest share in 2022[/woodmart_accordion_item][woodmart_accordion_item title=”Who are the key players in the global Medical Equipment Maintenance market?

“]GE Healthcare, Siemens Healthineers, Koninklijke Philips, Drägerwerk AG & Co, Medtronic, B. Braun Melsungen AG, Aramark, BC Technical Inc, Alliance Medical Group, Althea Group are the major companies operating in the market.[/woodmart_accordion_item][woodmart_accordion_item title=”Do you offer Post Sale Support?

“]Yes, we offer 16 hours of analyst support to solve the queries[/woodmart_accordion_item][woodmart_accordion_item title=”Do you sell particular sections of a report?

“]Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.[/woodmart_accordion_item][/woodmart_accordion]

Additional information

| Packages | Single User License, Enterprise License, Data Pack Excel |

|---|

Table of Content

[html_block id="10662"]