Advanced Wound Care Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

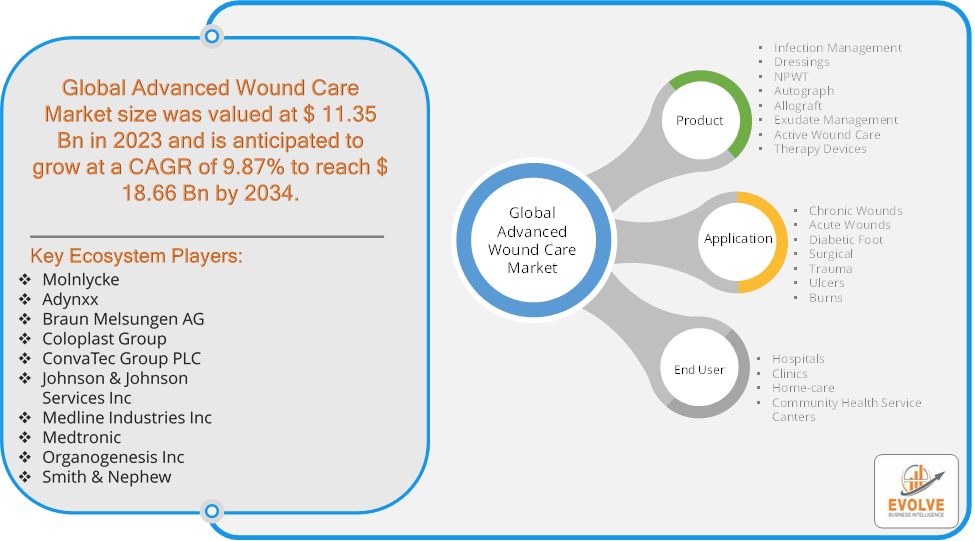

Advanced Wound Care Market Research Report: Information By Product (Infection Management, Dressings, NPWT, Autograph, Allograft, Exudate Management, Active Wound Care and Therapy Devices), by Application (Chronic Wounds, Acute Wounds, Diabetic Foot, Surgical, Trauma, Ulcers and Burns), by End User (Hospitals, Clinics, Home-care and Community Health Service Centers), and by Region — Forecast till 2034

Page: 161

Advanced Wound Care Market Overview

The Advanced Wound Care Market size accounted for USD 11.35 Billion in 2023 and is estimated to account for 14.36 Billion in 2024. The Market is expected to reach USD 18.66 Billion by 2034 growing at a compound annual growth rate (CAGR) of 9.87% from 2024 to 2034. The Advanced Wound Care Market refers to the industry focused on the development, manufacturing, and sales of products used in the treatment of complex or chronic wounds. These wounds are typically harder to heal and may require specialized care due to conditions such as diabetes, ulcers, or severe burns. The market encompasses a variety of innovative and specialized products aimed at promoting faster and more effective healing compared to traditional wound care methods.

The demand for advanced wound care products is driven by factors such as the increasing prevalence of chronic diseases (e.g., diabetes), a growing aging population, rising awareness of wound care management, and advancements in medical technology. The market primarily serves healthcare providers in hospitals, clinics, and home care settings.

Global Advanced Wound Care Market Synopsis

Advanced Wound Care Market Dynamics

Advanced Wound Care Market Dynamics

The major factors that have impacted the growth of Advanced Wound Care Market are as follows:

Drivers:

Ø Technological Advancements in Wound Care

Innovations such as negative pressure wound therapy (NPWT), bioengineered skin substitutes, and advanced wound dressings (hydrogels, alginates, and foams) improve the effectiveness of treatment, driving adoption. Increasing awareness about the importance of proper wound care and the benefits of advanced wound care products among healthcare providers, patients, and caregivers leads to higher utilization of these products. There is a growing preference for home-based care, especially among the elderly and patients with chronic conditions. Advanced wound care products that can be used in home settings, such as dressings and portable wound therapy devices, are seeing increased demand.

Restraint:

- Perception of High Cost of Advanced Wound Care Products and Complexities in Wound Diagnosis

Advanced wound care treatments, such as bioengineered skin substitutes, negative pressure wound therapy (NPWT), and specialized dressings, are often more expensive than traditional wound care products. This high cost can limit accessibility, especially in developing regions and for patients without adequate insurance coverage. Proper diagnosis and treatment of chronic and complex wounds can be challenging, requiring specialized knowledge. Inadequate assessment or inappropriate use of advanced wound care products can lead to suboptimal outcomes, reducing trust in these solutions among healthcare professionals.

Opportunity:

⮚ Rising Demand for Home Healthcare

The growing preference for home-based care, particularly among the elderly and individuals with chronic conditions, presents an opportunity for advanced wound care solutions designed for home use. Portable wound therapy devices, easy-to-apply dressings, and telemedicine for wound management could see increasing demand. The increasing adoption of telehealth services presents an opportunity for remote wound care monitoring and consultation. Digital wound care platforms that allow healthcare providers to track wound healing, manage treatments, and provide guidance remotely are gaining traction, especially in post-pandemic healthcare.

Advanced Wound Care Market Segment Overview

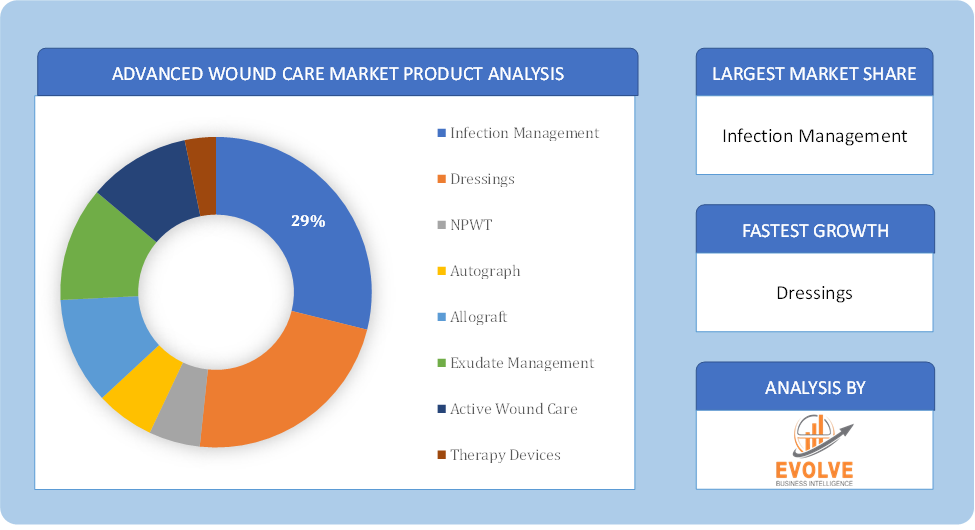

Based on Product, the market is segmented based on Infection Management, Dressings, NPWT, Autograph, Allograft, Exudate Management, Active Wound Care and Therapy Devices. The Dressings segment dominant the market. The rising prevalence of conditions such as diabetes, obesity, and an aging population contributes to a higher incidence of chronic wounds, driving demand for advanced dressings. The rising trend of home healthcare, especially for elderly patients, increases the demand for easy-to-use and effective dressing options.

By Application

Based on Application, the market segment has been divided into Chronic Wounds, Acute Wounds, Diabetic Foot, Surgical, Trauma, Ulcers and Burns. Acute Wounds segment dominant the market. This segment’s strength is largely due to the high volume of surgical procedures and trauma cases that require immediate wound care solutions. Products in this category are designed to minimize infection risk and promote rapid healing.

By End User

Based on End User, the market segment has been divided into Hospitals, Clinics, Home-care and Community Health Service Centers. Hospitals segment dominant market. This sector’s leadership is driven by the comprehensive care they provide, coupled with advanced technologies and specialized staff. Hospitals are often the first point of care for acute and severe chronic wounds, necessitating a wide array of advanced wound care products.

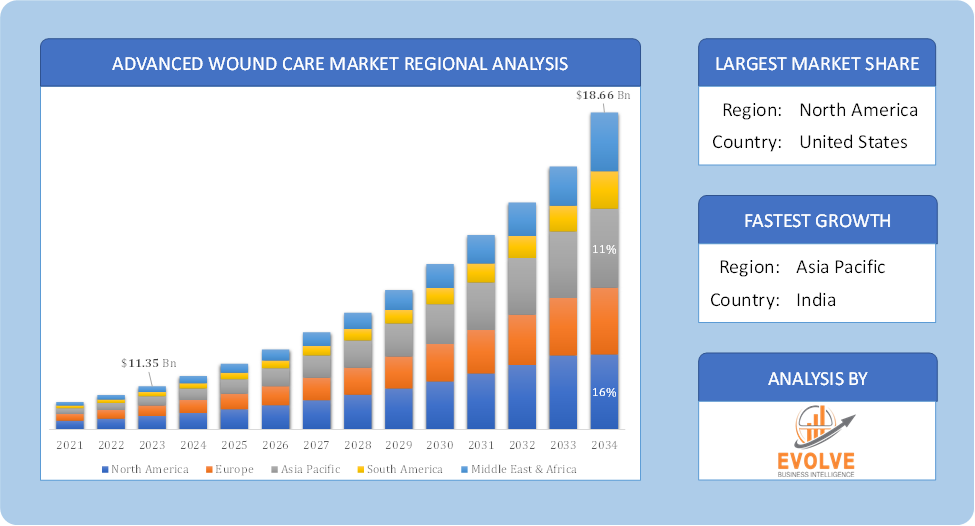

Global Advanced Wound Care Market Regional Analysis

Based on region, the global Advanced Wound Care Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Advanced Wound Care Market followed by the Asia-Pacific and Europe regions.

Global Advanced Wound Care North America Market

Global Advanced Wound Care North America Market

North America holds a dominant position in the Advanced Wound Care Market. North America, particularly the United States, dominates the advanced wound care market due to well-established healthcare infrastructure, high healthcare spending, and widespread adoption of advanced wound care technologies and the increasing elderly population, high prevalence of chronic conditions like diabetes and obesity, and rising surgical procedures drive demand for advanced wound care solutions.

Global Advanced Wound Care Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Advanced Wound Care Market industry. The Asia-Pacific region is witnessing the fastest growth in the advanced wound care market, driven by rising healthcare expenditures, improving healthcare infrastructure, and increasing awareness about wound care management. Countries like China and India have a high prevalence of diabetes, leading to an increase in diabetic foot ulcers and other chronic wounds that require advanced care and the cost of advanced wound care products may be a limiting factor in some areas, but economic growth and government investments in healthcare are boosting market penetration.

Competitive Landscape

The global Advanced Wound Care Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Molnlycke

- Adynxx

- Braun Melsungen AG

- Coloplast Group

- ConvaTec Group PLC

- Johnson & Johnson Services Inc

- Medline Industries Inc

- Medtronic

- Organogenesis Inc

- Smith & Nephew

Key Development

In February 2023, The FDA gives approval to a new alginate-based wound dressing. Designed for trauma wounds, this dressing is tailored to halt bleeding and foster healing, presenting a significant improvement in trauma care.

Scope of the Report

Global Advanced Wound Care Market, by Product

- Infection Management

- Dressings

- NPWT

- Autograph

- Allograft

- Exudate Management

- Active Wound Care

- Therapy Devices

Global Advanced Wound Care Market, by Application

- Chronic Wounds

- Acute Wounds

- Diabetic Foot

- Surgical

- Trauma

- Ulcers

- Burns

Global Advanced Wound Care Market, by End User

- Hospitals

- Clinics

- Home-care

- Community Health Service Canters

Global Advanced Wound Care Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- Fran

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 18.66 Billion |

| CAGR (2024-2034) | 9.87% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, Application, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Molnlycke, Adynxx, Braun Melsungen AG, Coloplast Group, ConvaTec Group PLC, Johnson & Johnson Services Inc, Medline Industries Inc, Medtronic, Organogenesis Inc and Smith & Nephew. |

| Key Market Opportunities | · Rising Demand for Home Healthcare · Expansion of Telehealth and Digital Wound Care Solutions |

| Key Market Drivers | · Technological Advancements in Wound Care · Growing Awareness of Wound Care Management |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Advanced Wound Care Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Advanced Wound Care Market historical market size for the year 2021, and forecast from 2023 to 2033

- Advanced Wound Care Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Advanced Wound Care Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Advanced Wound Care Market is 2021- 2033

What is the growth rate of the global Advanced Wound Care Market?

The global Advanced Wound Care Market is growing at a CAGR of 9.87% over the next 10 years

Which region has the highest growth rate in the market of Advanced Wound Care Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Advanced Wound Care Market?

North America holds the largest share in 2022

Who are the key players in the global Advanced Wound Care Market?

Molnlycke, Adynxx, Braun Melsungen AG, Coloplast Group, ConvaTec Group PLC, Johnson & Johnson Services, Inc, Medline Industries, Inc, Medtronic, Organogenesis Inc and Smith+Nephew are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Product Segement – Market Opportunity Score 4.1.2. End User Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Advanced Wound Care Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Advanced Wound Care Market, By Product 7.1. Introduction 7.1.1. Infection Management 7.1.2. Dressings 7.1.3. NPWT 7.1.4. Autograph 7.1.5. Allograft 7.1.6. Exudate Management 7.1.7. Active Wound Care 7.1.8. Therapy Devices CHAPTER 8 Advanced Wound Care Market, By Application 8.1. Introduction 8.1.1. Chronic Wounds 8.1.2. Acute Wounds 8.1.3. Diabetic Foot 8.1.4. Surgical 8.1.5. Trauma 8.1.6. Ulcers 8.1.7. Burns CHAPTER 9. Advanced Wound Care Market, By End User 9.1. Introduction 9.1.1. Hospitals 9.1.2 Clinics 9.1.3 Home-care 9.1.4. Community Health Service Canters CHAPTER 10. Advanced Wound Care Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.2.2. North America: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.2.3. North America: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.2.4. North America: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.2.5.2. US: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.2.5.3. US: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.3.2. Europe: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.3.3. Europe: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.4. Europe: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.3.7.2. France: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.7.3. France: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.5.2. China: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.5.3. China: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.7.2. India: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.7.3. India: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.5.2. South America: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.5.3. South America: Market Size and Forecast, By System, 2024 – 2034($ Million) 10.5.4. South America: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2024 – 2034($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By Application, 2024 – 2034($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Molnlycke 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Adynxx 13.3. Braun Melsungen AG 13.4. Coloplast Group 13.5. ConvaTec Group PLC 13.6. Johnson & Johnson Services Inc 13.7. Medline Industries Inc 13.8. Medtronic 13.9 Organogenesis Inc 13.10 Smith+Nephew.

Connect to Analyst

Research Methodology