Fintech Lending Market Analysis and Global Forecast 2021-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

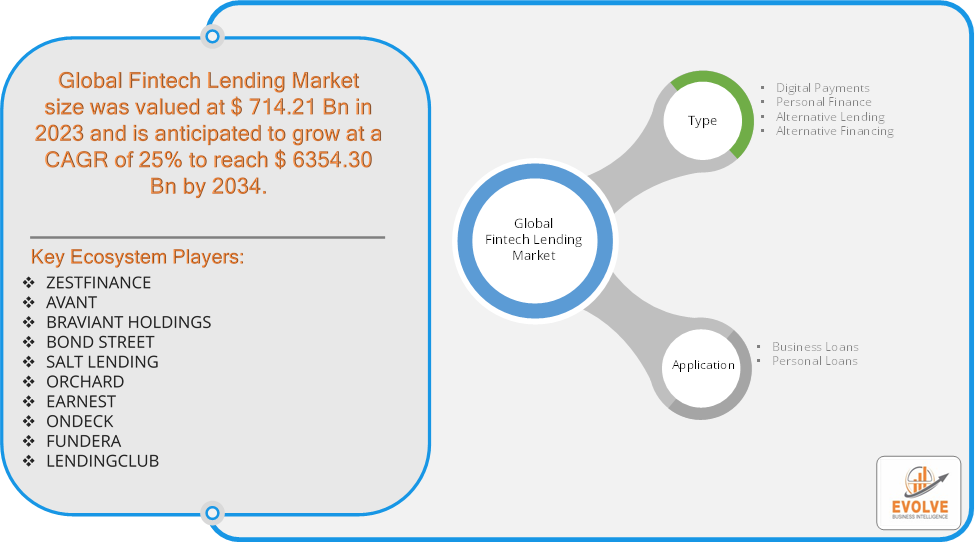

Fintech Lending Market Research Report: Information By Type (Digital Payments, Personal Finance, Alternative Lending, Alternative Financing), By Application (Business Loans, Personal Loans), and by Region — Forecast till 2034

Page: 122

Fintech Lending Market Overview

The Fintech Lending Market size accounted for USD 714.21 Billion in 2023 and is estimated to account for 910.74 Billion in 2024. The Market is expected to reach USD 6354.30 Billion by 2034 growing at a compound annual growth rate (CAGR) of 25% from 2024 to 2034. The Fintech Lending Market refers to the use of technology and innovative platforms to provide loans to consumers and businesses, bypassing traditional financial institutions like banks. This market leverages artificial intelligence (AI), machine learning (ML), and big data analytics to assess creditworthiness, streamline the lending process, and offer faster approvals. Fintech lenders typically operate via online platforms, offering products such as personal loans, business loans, and peer-to-peer lending. The market is characterized by increased accessibility, lower operational costs, and flexible borrowing terms, often attracting underserved or unbanked populations. Growth is driven by digitalization, changing consumer preferences, and regulatory advancements in financial services.

Global Fintech Lending Market Synopsis

Fintech Lending Market Dynamics

Fintech Lending Market Dynamics

The major factors that have impacted the growth of Fintech Lending are as follows:

Drivers:

Ø Digital Transformation and Technological Advancements

The widespread adoption of digital technologies like artificial intelligence (AI), machine learning (ML), big data, and blockchain is revolutionizing the lending process. These technologies enable fintech companies to streamline loan applications, automate credit assessments, and provide faster approvals. For example, AI and ML algorithms can analyze vast amounts of non-traditional data such as social media behavior, payment histories, and spending patterns, allowing fintech lenders to assess creditworthiness more accurately than traditional banks.

Restraint:

- High Default Rates and Credit Risk

As fintech lenders expand their reach to underserved or unbanked populations, they often face higher credit risk. Many of these borrowers have little to no formal credit history, making it difficult to assess their ability to repay loans. While fintech platforms use alternative data sources and advanced algorithms for credit scoring, these methods are not foolproof. The reliance on non-traditional data can lead to inaccurate risk assessments, resulting in higher default rates.

Opportunity:

⮚ AI and Big Data for Enhanced Credit Scoring

The use of artificial intelligence (AI) and big data analytics continues to be a game-changer for the fintech lending market. These technologies allow fintech lenders to process vast amounts of data, including non-traditional data sources such as social media activity, online behavior, and spending patterns, to assess the creditworthiness of borrowers who may lack formal credit histories. AI-driven credit scoring models can reduce bias, improve accuracy, and enable lenders to offer loans to a wider pool of borrowers, including those previously deemed high risk by traditional banks.

Fintech Lending Segment Overview

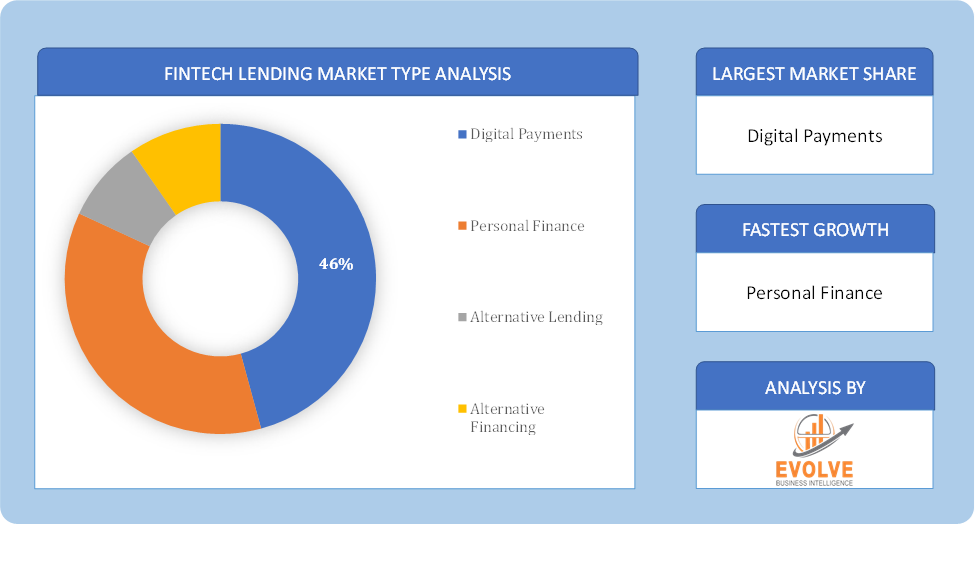

Based on Type, the market is segmented based on Digital Payments, Personal Finance, Alternative Lending, Alternative Financing. the Alternative Lending segment dominates, as it encompasses innovative lending models like peer-to-peer (P2P) lending and online lending platforms, which have gained widespread adoption due to their flexibility, speed, and accessibility compared to traditional financing methods.

By Application

Based on Applications, the market has been divided into the Business Loans, Personal Loans. the Personal Loans segment typically dominates, driven by rising consumer demand for quick and easy access to credit, streamlined approval processes, and growing adoption of digital lending platforms.

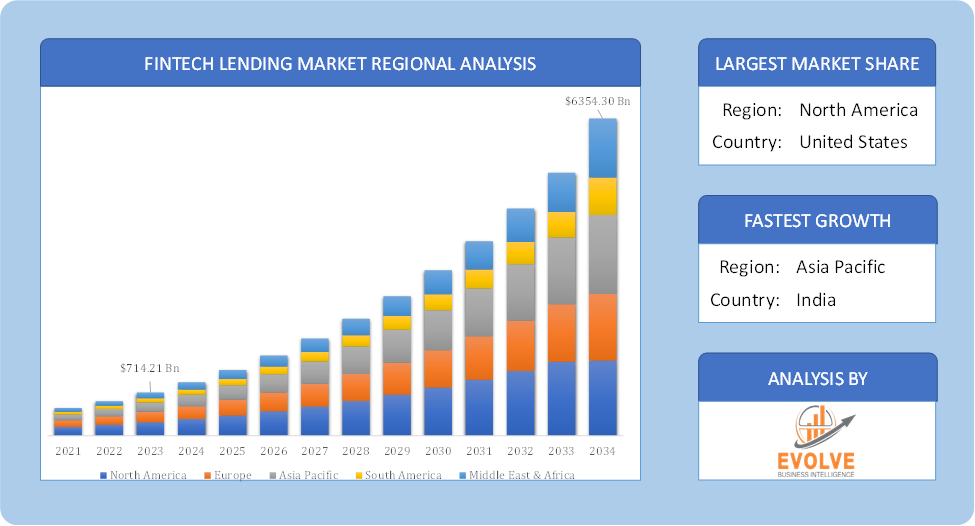

Global Fintech Lending Market Regional Analysis

Based on region, the global Fintech Lending market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Fintech Lending market followed by the Asia-Pacific and Europe regions.

Fintech Lending North America Market

Fintech Lending North America Market

North America holds a dominant position in the Fintech Lending Market. In North America, the Fintech Lending Market is experiencing significant growth, driven by advanced technological infrastructure, high internet penetration, and widespread adoption of digital financial services. The U.S. leads the region, with increasing demand for alternative lending models like peer-to-peer and online loans. Regulatory support and innovation further boost the market’s expansion in both personal and business loan segments.

Fintech Lending Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Fintech Lending industry. In the Asia Pacific, the Fintech Lending Market is rapidly growing due to the region’s large unbanked population, increasing smartphone and internet usage, and supportive government policies promoting financial inclusion. Countries like China and India are leading the market, with significant demand for alternative lending models, including peer-to-peer and digital lending platforms, especially in underserved rural areas.

Competitive Landscape

The global Fintech Lending market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Type launches, and strategic alliances.

Prominent Players:

- ZESTFINANCE

- AVANT

- BRAVIANT HOLDINGS

- BOND STREET

- SALT LENDING

- ORCHARD

- EARNEST

- ONDECK

- FUNDERA

- LENDINGCLUB

Key Development

In September 2022, ORCHARD, a major player in the fintech lending space, focused on expanding its digital lending platform and enhancing its technology infrastructure to streamline loan origination and risk assessment processes, aiming to offer more efficient and scalable lending solutions.

Scope of the Report

Global Fintech Lending Market, by Type

- Digital Payments

- Personal Finance

- Alternative Lending

- Alternative Financing

Global Fintech Lending Market, by Application

- Business Loans

- Personal Loans

Global Fintech Lending Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 6354.30 Billion |

| CAGR (2021-2034) | 25% |

| Base year | 2023 |

| Forecast Period | 2021-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa. |

| Key Vendors | ZESTFINANCE, AVANT, BRAVIANT HOLDINGS, BOND STREET, SALT LENDING, ORCHARD, EARNEST, ONDECK, FUNDERA, LENDINGCLUB |

| Key Market Opportunities | · Developing economies |

| Key Market Drivers | · Financial bodies implementing advanced technologies to provide integrated & value-added services to customers and increasing number of collaborations between national regulators & financial institutions |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Fintech Lending market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Fintech Lending market historical market size for the year 2022, and forecast from 2021 to 2034

- Fintech Lending market share analysis at each Type level

- Competitor analysis with detailed insight into its Type segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Type launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Fintech Lending market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Type offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Fintech Lending market is 2021- 2034

What is the growth rate of the global Fintech Lending market?

The global Fintech Lending market is growing at a CAGR of 25% over the next 10 years

Which region has the highest growth rate in the market of Fintech Lending?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region has the largest share of the global Fintech Lending market?

North America holds the largest share in 2023

Who are the key players in the global Fintech Lending market?

ZESTFINANCE, AVANT, BRAVIANT HOLDINGS, BOND STREET, SALT LENDING, ORCHARD, EARNEST, ONDECK, FUNDERA, and LENDINGCLUB are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Applications Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Fintech Lending Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Fintech Lending Market 4.8. Import Analysis of the Fintech Lending Market 4.9. Export Analysis of the Fintech Lending Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Fintech Lending Market, By Type 6.1. Introduction 6.2. Digital Payments 6.3. Personal Finance 6.4. Alternative Lending 6.5. Alternative Financing Chapter 7. Global Fintech Lending Market, By Application 7.1. Introduction 7.2. Business Loans 7.3. Personal Loans Chapter 8. Global Fintech Lending Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2021-2034 8.2.4. Market Size and Forecast, By Type, 2021-2034 8.2.5. Market Size and Forecast, By Application, 2021-2034 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Type, 2021-2034 8.2.6.4. Market Size and Forecast, By Application, 2021-2034 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Type, 2021-2034 8.2.7.5. Market Size and Forecast, By Application, 2021-2034 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2021-2034 8.3.4. Market Size and Forecast, By Type, 2021-2034 8.3.5. Market Size and Forecast, By Application, 2021-2034 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Type, 2021-2034 8.3.6.4. Market Size and Forecast, By Application, 2021-2034 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Type, 2021-2034 8.3.7.4. Market Size and Forecast, By Application, 2021-2034 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Type, 2021-2034 8.3.8.4. Market Size and Forecast, By Application, 2021-2034 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Type, 2021-2034 8.3.9.4. Market Size and Forecast, By Application, 2021-2034 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Type, 2021-2034 8.3.11.4. Market Size and Forecast, By Application, 2021-2034 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2021-2034 8.4.4. Market Size and Forecast, By Type, 2021-2034 8.12.28. Market Size and Forecast, By Application, 2021-2034 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Type, 2021-2034 8.4.6.4. Market Size and Forecast, By Application, 2021-2034 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Type, 2021-2034 8.4.7.4. Market Size and Forecast, By Application, 2021-2034 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Type, 2021-2034 8.4.8.4. Market Size and Forecast, By Application, 2021-2034 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Type, 2021-2034 8.4.9.4. Market Size and Forecast, By Application, 2021-2034 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Type, 2021-2034 8.4.10.4. Market Size and Forecast, By Application, 2021-2034 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Type, 2021-2034 8.5.4. Market Size and Forecast, By Application, 2021-2034 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. ZESTFINANCE 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Type Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. AVANT 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Type Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. BRAVIANT HOLDINGS 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Type Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. BOND STREET 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Type Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. SALT LENDING 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Type Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. ORCHARD 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Type Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. EARNEST 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Type Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 ONDECK 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Type Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 FUNDERA 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Type Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. LENDINGCLUB 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Type Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology