Dental Digital Treatment Software Market Overview

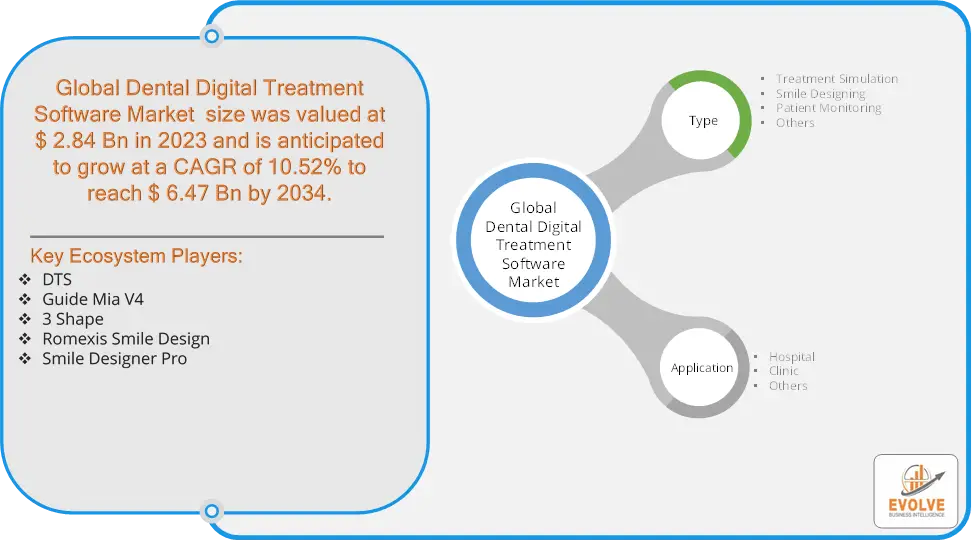

The Dental Digital Treatment Software Market size accounted for USD 2.84 Billion in 2023 and is estimated to account for 3.16 Billion in 2024. The Market is expected to reach USD 6.47 Billion by 2034 growing at a compound annual growth rate (CAGR) of 10.52% from 2024 to 2034. The Dental Digital Treatment Software Market refers to the sector focused on the development, sale, and usage of software solutions designed to enhance and streamline dental treatments and procedures through digital tools. This market includes software for diagnostics, treatment planning, patient management, and communication, often integrating 3D imaging, CAD/CAM (computer-aided design/computer-aided manufacturing), and other advanced technologies.

The market is driven by the increasing adoption of digital technologies in dentistry, demand for precision in dental procedures, and the growing number of dental clinics using digital tools to improve patient care and efficiency. Advances in AI, machine learning, and cloud-based platforms are also shaping the future of the Dental Digital Treatment Software Market.

Global Dental Digital Treatment Software Market Synopsis

Dental Digital Treatment Software Market Dynamics

Dental Digital Treatment Software Market Dynamics

The major factors that have impacted the growth of Dental Digital Treatment Software Market are as follows:

Drivers:

Ø Technological Advancements

The market is fueled by innovations in artificial intelligence (AI), 3D imaging, CAD/CAM, and cloud-based solutions. These advancements enable more precise, customized, and faster treatment processes, appealing to both patients and dentists. Patients increasingly expect personalized and efficient dental care. Digital treatment software enhances the patient experience by providing more accurate diagnostics, faster procedures, and improved communication between dentists and patients. Digital treatment software improves workflow efficiency by streamlining complex tasks such as diagnostics, planning, and communication. Its accuracy in creating treatment plans and restorations reduces errors and leads to better clinical outcomes.

Restraint:

- Perception of High Initial Costs and Data Security and Privacy Concerns

The implementation of dental digital treatment software often requires significant investment in hardware, software licenses, and training. For smaller dental practices, the high upfront costs can be a barrier to adoption, limiting market growth. Dental software stores sensitive patient information, making it a potential target for cyberattacks. Data breaches and privacy concerns can deter adoption, as practices must ensure compliance with regulations like HIPAA (Health Insurance Portability and Accountability Act) in the U.S. or GDPR (General Data Protection Regulation) in Europe.

Opportunity:

Ø Rising Demand for Tele-dentistry

The increasing use of telehealth solutions, including remote dental consultations and treatment planning, offers significant growth potential for dental digital treatment software. Software solutions that enable virtual care can expand access to dental services, particularly in rural or underserved areas. As 3D printing becomes more prevalent in dental procedures, there is an opportunity to develop software that integrates with 3D printers for the design and production of dental restorations, such as crowns, bridges, and aligners. Software that offers personalized treatment options based on individual patient data, dental history, and predictive analytics is gaining traction. This creates opportunities for software providers to develop advanced features that cater to patient-specific needs.

Dental Digital Treatment Software Market Segment Overview

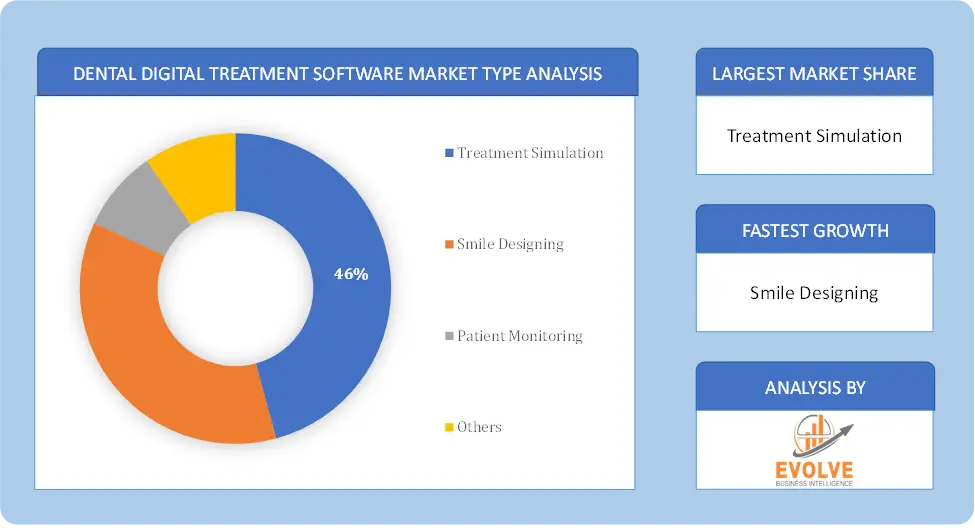

By Type

Based on Type, the market is segmented based on Treatment Simulation, Smile Designing, Patient Monitoring and Others. The Treatment Simulation segment dominant the market. Treatment simulation tools are increasingly used in remote consultations and tele dentistry, where patients can have their dental scans sent to dentists who can then create a treatment plan virtually. This is particularly beneficial for follow-ups and patients in remote areas.

Based on Type, the market is segmented based on Treatment Simulation, Smile Designing, Patient Monitoring and Others. The Treatment Simulation segment dominant the market. Treatment simulation tools are increasingly used in remote consultations and tele dentistry, where patients can have their dental scans sent to dentists who can then create a treatment plan virtually. This is particularly beneficial for follow-ups and patients in remote areas.

By Application

Based on Application, the market segment has been divided into Hospital, Clinic and Others. The Hospital segment dominant the market. Hospitals often provide a wide range of dental services, from routine check-ups to complex surgeries such as implants and orthodontic treatments. Dental digital treatment software is used to streamline and manage these procedures, ensuring a unified platform for diagnosis, treatment planning, patient records, and follow-up.

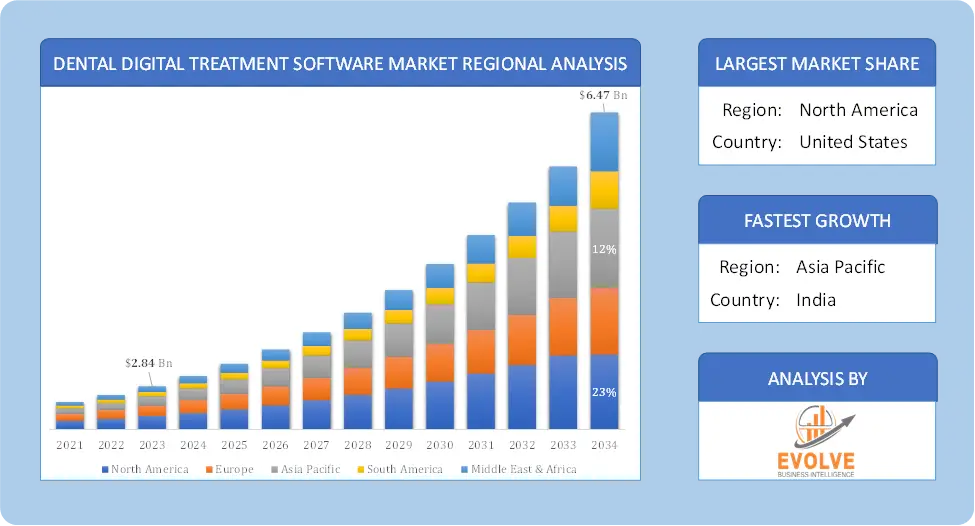

Dental Digital Treatment Software Market Regional Analysis

Based on region, the Dental Digital Treatment Software Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Dental Digital Treatment Software Market followed by the Asia-Pacific and Europe regions.

Dental Digital Treatment Software North America Market

Dental Digital Treatment Software North America Market

North America holds a dominant position in the Dental Digital Treatment Software Market. The U.S. is a major contributor to the growth of the dental digital treatment software market in North America. Technological innovations, such as AI-powered dental software and 3D imaging tools, are widely used in the U.S., especially for orthodontic treatments and dental implantology.

Dental Digital Treatment Software Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Dental Digital Treatment Software Market industry. China is one of the fastest-growing markets due to rising healthcare expenditure, an expanding middle-class population, and increased demand for dental aesthetics. Government initiatives to modernize healthcare and the rise of private dental clinics are also driving the market and In India, the adoption of digital dental solutions is still emerging, with increasing investments in urban areas. The rising number of dental clinics and awareness about oral health is contributing to market growth.

Competitive Landscape

The global Dental Digital Treatment Software Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- DTS

- Guide Mia V4

- 3 Shape

- Romexis Smile Design

- Smile Designer Pro

Scope of the Report

Global Dental Digital Treatment Software Market, by Type

- Treatment Simulation

- Smile Designing

- Patient Monitoring

- Others

Global Dental Digital Treatment Software Market, by Application

- Hospital

- Clinic

- Others

Global Dental Digital Treatment Software Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $6.47 Billion |

| CAGR | 10.52% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | DTS, Guide Mia V4, 3 Shape, Romexis Smile Design and Smile Designer Pro |

| Key Market Opportunities | • Rising Demand for Tele-dentistry • Growing Use of 3D Printing in Dentistry |

| Key Market Drivers | • Technological Advancements • Growing Focus on Patient-Centric Care |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Dental Digital Treatment Software Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Dental Digital Treatment Software Market historical market size for the year 2021, and forecast from 2023 to 2033

- Dental Digital Treatment Software Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Dental Digital Treatment Software Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.