Smart oilfield Market Overview

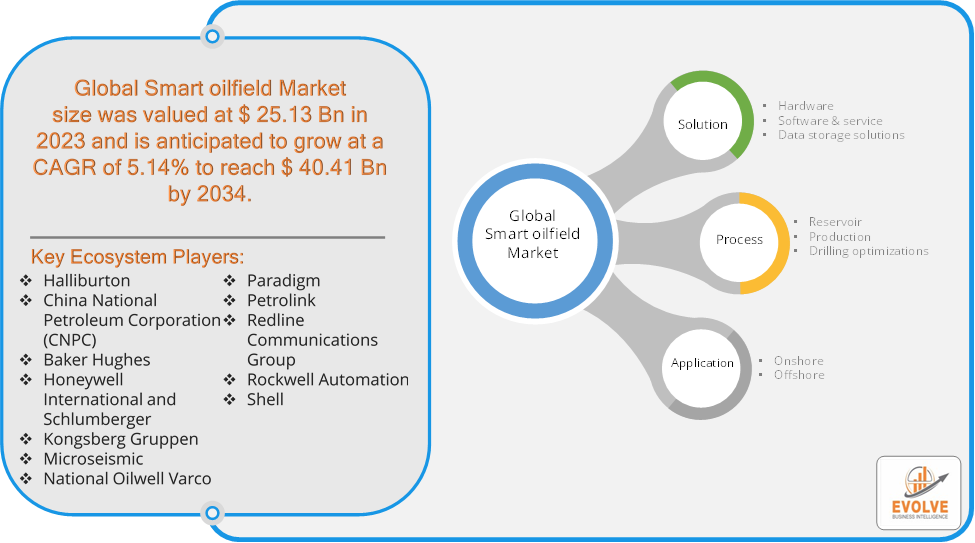

The Smart oilfield Market size accounted for USD 25.13 Billion in 2023 and is estimated to account for 26.89 Billion in 2024. The Market is expected to reach USD 40.41 Billion by 2034 growing at a compound annual growth rate (CAGR) of 5.14% from 2024 to 2034. A smart oilfield refers to an oilfield where advanced technologies, such as data analytics, sensors, automation, and real-time monitoring systems, are integrated to optimize oil and gas exploration, production, and management. The goal of a smart oilfield is to improve operational efficiency, enhance decision-making, and reduce costs and environmental impact.

This approach is sometimes referred to as digital oilfield or intelligent oilfield and is increasingly adopted to enhance productivity while managing the challenges of declining oil reserves and complex reservoirs.

Global Smart oilfield Market Synopsis

Smart oilfield Market Dynamics

Smart oilfield Market Dynamics

The major factors that have impacted the growth of Smart oilfield Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in Internet of Things (IoT), automation, big data analytics, artificial intelligence (AI), and cloud computing have enabled better real-time monitoring and decision-making, driving adoption of smart oilfield solutions. Smart oilfield technologies help reduce operational costs by improving asset management, predictive maintenance, and reducing downtime. This leads to better resource allocation and more efficient use of equipment and labor. Mature and aging oilfields require more advanced methods to maintain or enhance productivity. Smart oilfields use enhanced recovery techniques and data-driven decisions to maximize output from these fields.

Restraint:

- Perception of High Initial Investment Costs and Cybersecurity Concerns

Implementing smart oilfield technologies, such as IoT sensors, automation systems, and advanced data analytics platforms, requires significant upfront capital investment. Smaller companies or those in regions with limited financial resources may find it difficult to justify these costs. As oilfield operations become more reliant on digital technologies and connected systems, the risk of cyberattacks increases. The oil and gas industry is a critical infrastructure sector, and breaches could lead to operational disruptions, financial loss, or even environmental hazards.

Opportunity:

⮚ Increased Focus on Digital Transformation

As more oil and gas companies invest in digital solutions, there is a growing opportunity to develop and offer advanced smart oilfield technologies, including IoT sensors, AI-driven analytics, and cloud-based platforms. These technologies can optimize operations, improve decision-making, and reduce costs. The oil and gas industry is increasingly exploring the integration of renewable energy, such as solar and wind, into its operations. Smart oilfields can facilitate hybrid energy systems that combine traditional oil extraction with renewable sources, creating new opportunities for energy management solutions.

Smart oilfield Market Segment Overview

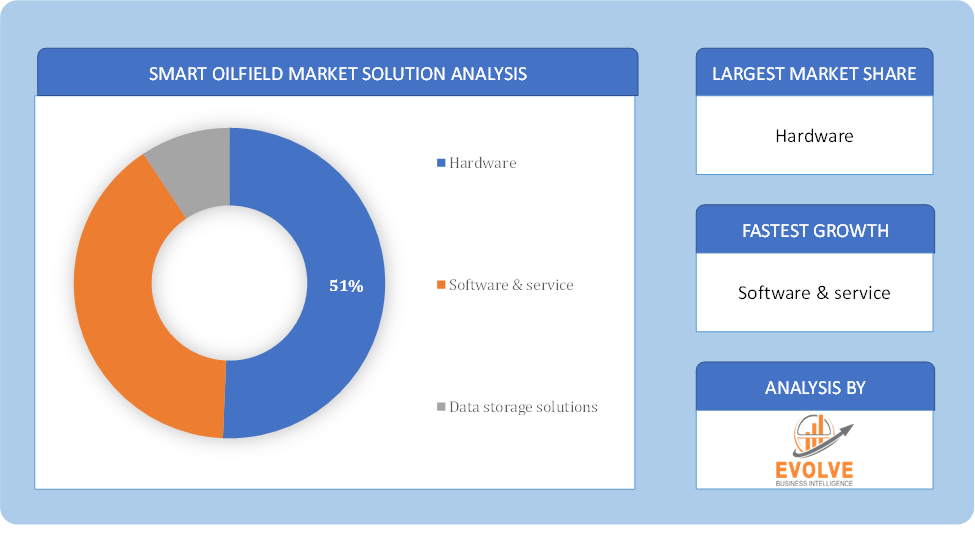

Based on Solution, the market is segmented based on hardware, software & service, and data storage solutions. The hardware segment dominant the market. This is attributed to the large capital investment by oilfield operators toward technology enhancement and process automation. This enables the companies to eliminate non-productive time, optimize production and control, and monitor oil & gas fields.

By Process

Based on Process, the market segment has been divided into reservoir, production, and drilling optimizations. The Production segment dominant the market.

By Application

Based on Application, the market segment has been divided into Onshore and Offshore. The Onshore segment dominant the market. The Onshore segment dominant the market. Onshore oilfields benefit from real-time data collection using IoT sensors, drones, and automated systems that monitor various aspects of production, including well performance, pressure levels, fluid flow, and equipment health. Data analytics systems analyze this data to provide actionable insights that help operators make faster, more informed decisions, improving production efficiency and reducing downtime.

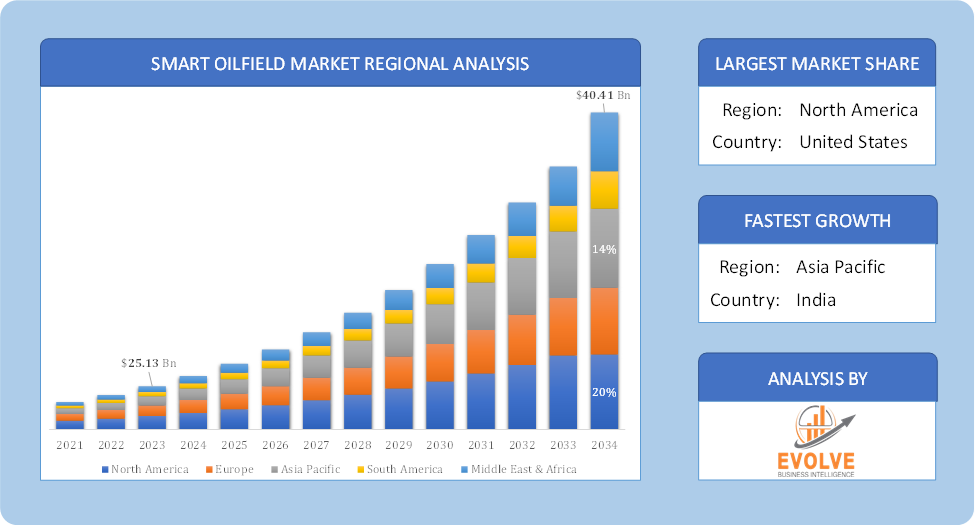

Global Smart oilfield Market Regional Analysis

Based on region, the global Smart oilfield Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Smart oilfield Market followed by the Asia-Pacific and Europe regions.

Global Smart oilfield North America Market

Global Smart oilfield North America Market

North America holds a dominant position in the Smart oilfield Market. North America, especially the U.S., is one of the largest adopters of smart oilfield technologies. The region’s advanced technological infrastructure, high oil production (particularly in shale formations), and significant investments in digital transformation drive the adoption of smart oilfield solutions and the U.S. leads in innovation, particularly in automation, AI, and data analytics. With mature fields in places like Texas and offshore platforms in the Gulf of Mexico, the need for enhanced oil recovery (EOR) and cost optimization presents substantial opportunities for smart technologies.

Global Smart oilfield Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Smart oilfield Market industry. APAC is one of the fastest-growing regions in terms of energy demand, driven by rapid industrialization and population growth in countries like China and India. These nations are increasingly adopting smart oilfield technologies to maximize production from mature fields and complex offshore fields.

Competitive Landscape

The global Smart oilfield Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Halliburton

- China National Petroleum Corporation (CNPC)

- Baker Hughes

- Honeywell International and Schlumberger

- Kongsberg Gruppen

- Microseismic, National Oilwell Varco

- Paradigm, Petrolink

- Redline Communications Group

- Rockwell Automation

- Shell

Scope of the Report

Global Smart oilfield Market, by Solution

- Hardware

- Software & service

- Data storage solutions.

Global Smart oilfield Market, by Process

- Reservoir

- Production

- Drilling optimizations

Global Smart oilfield Market, by Application

- Onshore

- Offshore

Global Smart oilfield Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 40.41 Billion |

| CAGR (2024-2034) | 5.14% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Solution, Process, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Halliburton, China National Petroleum Corporation (CNPC), Baker Hughes, Honeywell International and Schlumberger, Kongsberg Gruppen, Microseismic, National Oilwell Varco, Paradigm, Petrolink, Redline Communications Group, Rockwell Automation and Shell. |

| Key Market Opportunities | · Increased Focus on Digital Transformation

· Integration of Renewable Energy Sources |

| Key Market Drivers | · Technological Advancements

· Cost Optimization and Declining Oilfield Productivity |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Smart oilfield Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Smart oilfield Market historical market size for the year 2021, and forecast from 2023 to 2033

- Smart oilfield Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Smart oilfield Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.