Contact and Intraocular Lenses Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

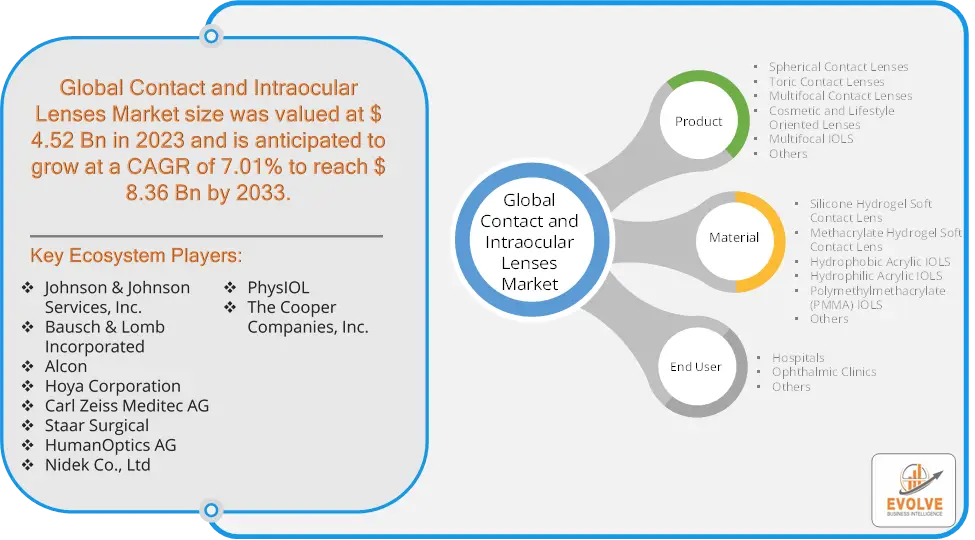

Contact and Intraocular Lenses Market Research Report: Information By Product Type (Spherical Contact Lenses, Toric Contact Lenses, Multifocal Contact Lenses, Cosmetic and Lifestyle Oriented Lenses, Multifocal IOLS, Others), By Material (Silicone Hydrogel Soft Contact Lens, Methacrylate Hydrogel Soft Contact Lens, Hydrophobic Acrylic IOLS, Hydrophilic Acrylic IOLS, Polymethylmethacrylate (PMMA) IOLS, Others), By End-User (Hospitals, Ophthalmic Clinics, Others), and by Region — Forecast till 2033

Page: 108

Contact and Intraocular Lenses Market Overview

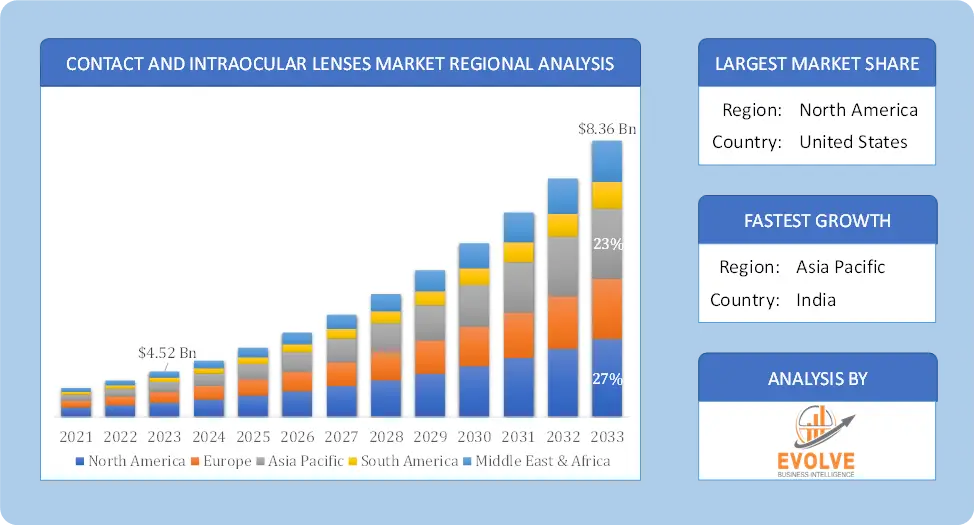

The Contact and Intraocular Lenses Market Size is expected to reach USD 8.36 Billion by 2033. The Contact and Intraocular Lenses Market industry size accounted for USD 4.52 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.01% from 2023 to 2033. The contact lenses market encompasses a range of corrective lenses designed to be placed directly on the eye’s surface to improve vision. These lenses are typically made from soft, flexible materials or rigid gas-permeable materials. They are used to correct various refractive errors, including nearsightedness, farsightedness, astigmatism, and presbyopia.

The market is driven by technological advancements, increasing eye health awareness, and a growing demand for minimally invasive vision correction solutions.

Global Contact and Intraocular Lenses Market Synopsis

The COVID-19 pandemic had a significant impact on the Contact and Intraocular Lenses Market. The pandemic caused disruptions in the supply chain, affecting the production and distribution of contact and intraocular lenses. Restrictions on transportation and manufacturing slowed down the availability of these products. With more people working from home and social distancing, the use of contact lenses decreased as people shifted to wearing glasses for convenience and comfort. As healthcare facilities adapted to the new normal with safety protocols, elective procedures like cataract surgeries resumed, leading to a recovery in the demand for intraocular lenses. The pandemic heightened awareness of health and hygiene, prompting some consumers to prioritize regular eye check-ups and consider vision correction options, including contact and intraocular lenses. With heightened hygiene awareness, there was a shift towards daily disposable contact lenses, as they are considered more hygienic compared to reusable lenses. Continued emphasis on hygiene and safety may lead to sustained demand for products perceived as safer and more convenient.

Contact and Intraocular Lenses Market Dynamics

The major factors that have impacted the growth of Contact and Intraocular Lenses Market are as follows:

Drivers:

Ø Advancements in Lens Technology

Developments in lens materials, such as silicone hydrogel, enhance oxygen permeability and comfort, encouraging more users to opt for contact lenses. The availability of multifocal and toric lenses, which offer solutions for presbyopia and astigmatism, expands the market by catering to diverse vision correction needs. Lenses with blue light filtering capabilities cater to digital device users, addressing concerns about digital eye strain. Growing awareness of the importance of regular eye examinations contributes to early diagnosis and treatment of vision issues, supporting lens market growth. Post-pandemic emphasis on hygiene and safety continues to influence consumer preferences for safer and more convenient lens options, such as daily disposables.

Restraint:

- Perception of High Cost of Advanced Lenses and Economic Factors

Advanced lens technologies, such as multifocal and toric lenses, often come with a higher price tag, making them less accessible to cost-sensitive consumers. Many vision insurance plans do not fully cover the cost of contact and intraocular lenses, especially for premium options, which can deter potential buyers. Economic uncertainties and downturns can lead to reduced consumer spending on non-essential healthcare products, impacting lens sales. Price-sensitive consumers in emerging markets may prioritize basic vision correction solutions over advanced, higher-cost options.

Opportunity:

⮚ Advancements in Surgical Techniques

Innovations in surgical techniques, such as femtosecond laser-assisted cataract surgery, can enhance the efficacy and safety of intraocular lens implantation, driving demand. Offering customizable intraocular lenses that cater to individual patient needs can create opportunities in the premium segment of the market. Expanding the range of daily disposable lenses, which are perceived as more hygienic, can meet increasing consumer demand for convenience and safety. Developing environmentally friendly and biodegradable contact lenses can address environmental concerns and appeal to eco-conscious consumers.

Contact and Intraocular Lenses Market Segment Overview

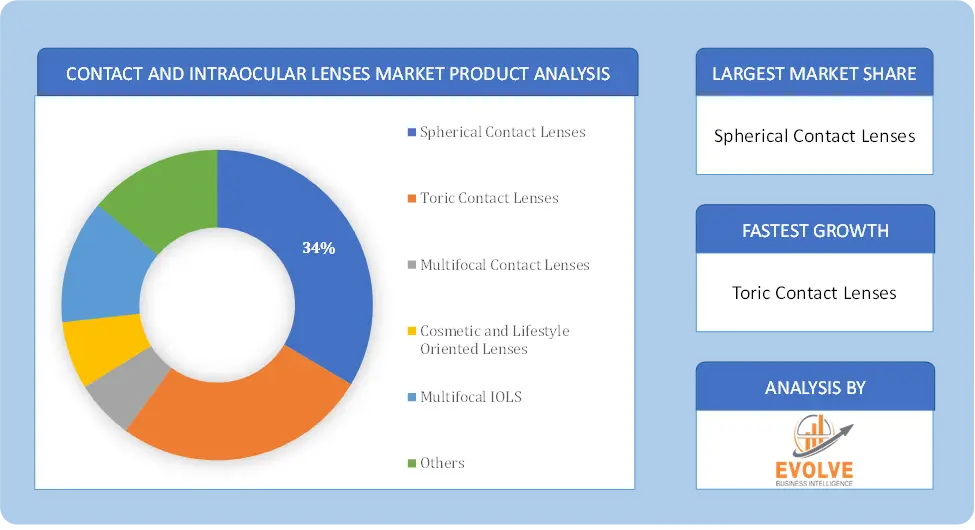

By Product Type

Based on Product Type, the market is segmented based on Spherical Contact Lenses, Toric Contact Lenses, Multifocal Contact Lenses, Cosmetic and Lifestyle Oriented Lenses, Multifocal IOLS and Others. The toric intraocular lens segment dominant the market. Astigmatism causes myopia, hypermetropia, or both in patients. Toric intraocular lenses are made particularly for such people. Furthermore, toric IOLs are meant to minimize the necessity for incision implants, which were previously necessary during astigmatism surgical operations, enhancing their popularity among people.

Based on Product Type, the market is segmented based on Spherical Contact Lenses, Toric Contact Lenses, Multifocal Contact Lenses, Cosmetic and Lifestyle Oriented Lenses, Multifocal IOLS and Others. The toric intraocular lens segment dominant the market. Astigmatism causes myopia, hypermetropia, or both in patients. Toric intraocular lenses are made particularly for such people. Furthermore, toric IOLs are meant to minimize the necessity for incision implants, which were previously necessary during astigmatism surgical operations, enhancing their popularity among people.

By Material

Based on Material, the market segment has been divided into Silicone Hydrogel Soft Contact Lens, Methacrylate Hydrogel Soft Contact Lens, Hydrophobic Acrylic IOLS, Hydrophilic Acrylic IOLS, Polymethylmethacrylate (PMMA) IOLS and Others. Because of its high refractive index, low water content, and preference, the hydrophobic segment dominant the market. The products made of foldable material are easier to insert and can be used more frequently in cataract surgery. IntechOpen published a research article that stated that hydrophobic acrylic products were the most popular intraocular lenses.

By End User

Based on End User, the market segment has been divided into Hospitals, Ophthalmic Clinics and Others. The hospital segment was the dominant segment in the market. This is due to the large number of vision and cataract surgeries performed in hospitals. Individual ophthalmic clinics are increasing in developing countries. These clinics do not have any affiliation with hospitals. The competition between service providers will increase due to the rise in eye care professionals and clinics.

Global Contact and Intraocular Lenses Market Regional Analysis

Based on region, the global Contact and Intraocular Lenses Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Contact and Intraocular Lenses Market followed by the Asia-Pacific and Europe regions.

Contact and Intraocular Lenses North America Market

Contact and Intraocular Lenses North America Market

North America holds a dominant position in the Contact and Intraocular Lenses Market. The U.S. and Canada are major players in this region, with a well-established healthcare system and high adoption rates of advanced vision correction solutions. High prevalence of vision disorders, advanced healthcare infrastructure, and a strong focus on innovation and technology drive market growth and increased demand for multifocal and toric lenses, growth in the use of smart lenses, and a rising focus on eye health awareness.

Contact and Intraocular Lenses Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Contact and Intraocular Lenses Market industry. China, India, Japan, and South Korea are significant markets in this region, with diverse needs and rapid growth in healthcare infrastructure. Large and growing population base, rising disposable incomes, and increasing awareness of eye health drive market expansion and expansion of e-commerce channels, increasing demand for affordable and disposable lenses, and a growing middle class with higher spending power.

Competitive Landscape

The global Contact and Intraocular Lenses Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Johnson & Johnson Services, Inc.

- Bausch & Lomb Incorporated

- Alcon

- Hoya Corporation

- Carl Zeiss Meditec AG

- Staar Surgical

- HumanOptics AG

- Nidek Co., Ltd

- PhysIOL

- The Cooper Companies, Inc.

Key Development

In December 2023, HOYA CORPORATION made strides by announcing a collaborative effort with the Indian Institute of Technology Delhi. This partnership aims to develop novel materials and technologies for intraocular lenses (IOLs), showcasing a commitment to advancing eye care solutions.

In November 2023, Johnson & Johnson Vision Care, Inc. introduced the Tecnis Symfony IOL, a cutting-edge presbyopia-correcting intraocular lens (IOL) featuring “NaturalVue” technology. This innovation aims to enhance image quality and minimize halos for an improved visual experience.

Scope of the Report

Global Contact and Intraocular Lenses Market, by Product

- Spherical Contact Lenses

- Toric Contact Lenses

- Multifocal Contact Lenses

- Cosmetic and Lifestyle Oriented Lenses

- Multifocal IOLS

- Others

Global Contact and Intraocular Lenses Market, by Material

- Silicone Hydrogel Soft Contact Lens

- Methacrylate Hydrogel Soft Contact Lens

- Hydrophobic Acrylic IOLS

- Hydrophilic Acrylic IOLS

- Polymethylmethacrylate (PMMA) IOLS

- Others

Global Contact and Intraocular Lenses Market, by End User

- Hospitals

- Ophthalmic Clinics

- Others

Global Contact and Intraocular Lenses Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.36 Billion |

| CAGR | 7.01% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Material, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Johnson & Johnson Services Inc., Bausch & Lomb Incorporated, Alcon, Hoya Corporation, Carl Zeiss Meditec AG, Staar Surgical, HumanOptics AG, Nidek Co. Ltd, PhysIOL and The Cooper Companies Inc. |

| Key Market Opportunities | • Advancements in Surgical Techniques • Innovation in Disposable and Sustainable Products |

| Key Market Drivers | • Advancements in Lens Technology • Increasing Focus on Eye Health |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Contact and Intraocular Lenses Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Contact and Intraocular Lenses Market historical market size for the year 2021, and forecast from 2023 to 2033

- Contact and Intraocular Lenses Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Contact and Intraocular Lenses Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Contact and Intraocular Lenses Market is 2021- 2033

What is the growth rate of the global Contact and Intraocular Lenses Market?

The global Contact and Intraocular Lenses Market is growing at a CAGR of 7.01% over the next 10 years

Which region has the highest growth rate in the market of Contact and Intraocular Lenses Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Contact and Intraocular Lenses Market?

North America holds the largest share in 2022

Who are the key players in the global Contact and Intraocular Lenses Market?

Johnson & Johnson Services Inc., Bausch & Lomb Incorporated, Alcon, Hoya Corporation, Carl Zeiss Meditec AG, Staar Surgical, HumanOptics AG, Nidek Co. Ltd, PhysIOL and The Cooper Companies Inc are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope of The Study 2.1. Market Definition 2.2. Scope of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat of New Entrants 4.2.2. Bargaining Power of Buyers 4.2.3. Bargaining Power of Suppliers 4.2.4. Threat of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Contact and Intraocular Lenses Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Contact and Intraocular Lenses Market, By Product Type 6.1. Introduction 6.2. Spherical Contact Lenses 6.3. Toric Contact Lenses 6.3. Multifocal Contact Lenses 6.4. Cosmetic and Lifestyle Oriented Lenses 6.5. Multifocal IOLS 6.6. Others Chapter 7. Global Contact and Intraocular Lenses Market, By Material 7.1. Introduction 7.2. Silicone Hydrogel Soft Contact Lens 7.3. Methacrylate Hydrogel Soft Contact Lens 7.4. Hydrophobic Acrylic IOLS 7.5. Hydrophilic Acrylic IOLS 7.6. Polymethylmethacrylate (PMMA) IOLS 7.7. Others Chapter 8. Global Contact and Intraocular Lenses Market, By End-User 8.1. Introduction 8.2. Hospitals 8.3. Ophthalmic Clinics 8.4. Others Chapter 9. Global Contact and Intraocular Lenses Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.5. Market Size and Forecast, By Material, 2020 – 2028 9.2.6. Market Size and Forecast, By End-User, 2020 – 2028 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Material, 2020 – 2028 9.2.7.5. Market Size and Forecast, By End-User, 2020 - 2028 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.8.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.8.5. Market Size and Forecast, By Material, 2020 – 2028 9.2.8.6. Market Size and Forecast, By End-User, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.5. Market Size and Forecast, By Material, 2020 – 2028 9.3.6. Market Size and Forecast, By End-User, 2020 – 2028 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Material, 2020 – 2028 9.3.7.5. Market Size and Forecast, By End-User, 2020 - 2028 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Material, 2020 – 2028 9.3.8.5. Market Size and Forecast, By End-User, 2020 - 2028 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Material, 2020 – 2028 9.3.9.5. Market Size and Forecast, By End-User, 2020 - 2028 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Material, 2020 – 2028 9.3.10.5. Market Size and Forecast, By End-User, 2020 - 2028 9.3.11. Rest of Europe 9.3.11.1. Introduction 9.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.11.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.11.4. Market Size and Forecast, By Material, 2020 – 2028 9.3.11.5. Market Size and Forecast, By End-User, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.5. Market Size and Forecast, By Material, 2020 – 2028 9.4.7. Market Size and Forecast, By End-User, 2020 - 2028 9.4.8. China 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Material, 2020 – 2028 9.4.8.5. Market Size and Forecast, By End-User, 2020 - 2028 9.4.9. India 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Material, 2020 – 2028 9.4.9.5. Market Size and Forecast, By End-User, 2020 - 2028 9.4.10. Japan 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Material, 2020 – 2028 9.4.10.5. Market Size and Forecast, By End-User, 2020 - 2028 9.4.11. South Korea 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.11.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.11.4. Market Size and Forecast, By Material, 2020 – 2028 9.4.11.5. Market Size and Forecast, By End-User, 2020 - 2028 9.4.12. Rest of Asia-Pacific 9.4.11.1. Introduction 9.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.12.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.12.4. Market Size and Forecast, By Material, 2020 – 2028 9.4.12.5. Market Size and Forecast, By End-User, 2020 - 2028 9.5. Rest of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.4. Market Size and Forecast, By Material, 2020 – 2028 9.5.5. Market Size and Forecast, By End-User, 2020 - 2028 9.5.6. Market Size and Forecast, By Region, 2020 - 2028 9.5.7. South America 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Material, 2020 – 2028 9.5.7.5. Market Size and Forecast, By End-User, 2020 - 2028 9.5.8. Middle East & Africa 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.8.4. Market Size and Forecast, By Material, 2020 – 2028 9.5.8.5. Market Size and Forecast, By End-User, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning 2020 Chapter 11. Company Profiles 11.1. Johnson & Johnson Services, Inc. 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. Bausch & Lomb Incorporated 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Alcon 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Hoya Corporation 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. Carl Zeiss Meditec AG 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Staar Surgical 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. HumanOptics AG 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Nidek Co., Ltd 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. PhysIOL 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. The Cooper Companies, Inc. 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology