Companion Diagnostics for Oncology Market Overview

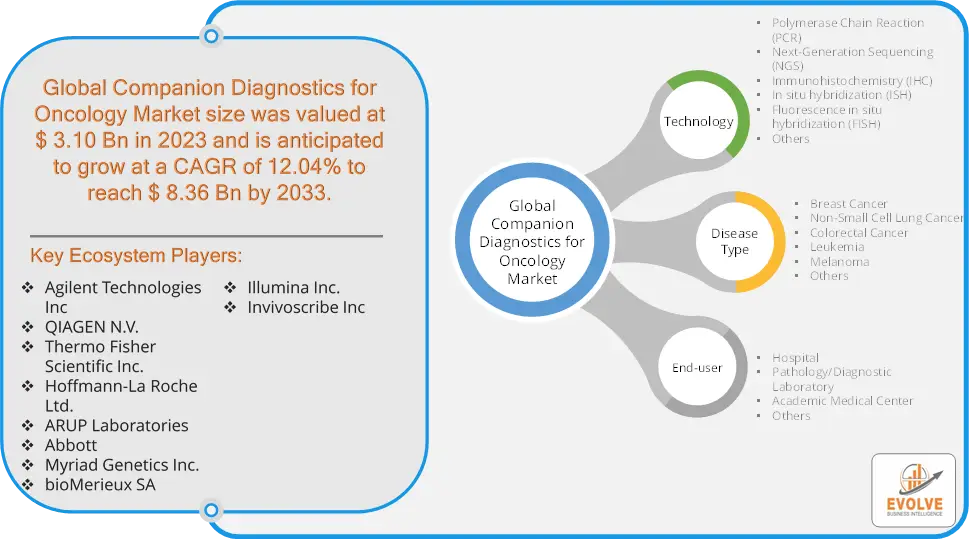

The Companion Diagnostics for Oncology Market Size is expected to reach USD 8.36 Billion by 2033. The Companion Diagnostics for Oncology Market industry size accounted for USD 3.10 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 12.04% from 2023 to 2033. The Companion Diagnostics for Oncology Market refers to the segment of the healthcare industry focused on developing and providing diagnostic tests that are specifically designed to assist in making treatment decisions for cancer patients. Companion diagnostics are tests used to identify patients who are most likely to benefit from a particular therapeutic product or who are at increased risk for serious side effects as a result of a specific treatment. These diagnostics are crucial in the era of personalized medicine, particularly in oncology, where they help tailor treatments to individual patient profiles based on their genetic makeup.

The Companion Diagnostics for Oncology Market is expected to grow significantly as the emphasis on personalized medicine and targeted therapies continues to rise, making cancer treatment more effective and reducing adverse effects.

Global Companion Diagnostics for Oncology Market Synopsis

The COVID-19 pandemic had a significant impact on the Companion Diagnostics for Oncology Market. During the height of the pandemic, many healthcare facilities postponed non-essential medical procedures, including diagnostic tests, to focus resources on COVID-19 patients. This led to delays in cancer diagnoses and treatments, impacting the use of companion diagnostics. The pandemic underscored the importance of personalized medicine and precision diagnostics, leading to increased awareness and adoption of companion diagnostics in oncology as healthcare systems adapt to more tailored treatment approaches. The shift towards telemedicine and remote monitoring accelerated the adoption of digital health solutions, potentially integrating companion diagnostics with digital platforms for better patient management and monitoring. The pandemic highlighted the need for resilient healthcare systems and supply chains. Companies in the companion diagnostics market are likely to invest in building more robust supply chains and diversifying manufacturing capabilities. The pandemic’s impact on healthcare has led to increased investment in diagnostics, including companion diagnostics, as investors recognize the value of early and precise diagnosis in improving patient outcomes.

Companion Diagnostics for Oncology Market Dynamics

The major factors that have impacted the growth of Companion Diagnostics for Oncology Market are as follows:

Drivers:

Ø Technological Innovations

Advancements in technologies such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and immunohistochemistry (IHC) have enhanced the accuracy and efficiency of companion diagnostics, making them more appealing to healthcare providers. The shift towards personalized medicine, where treatments are tailored to individual patient profiles, is a major driver. Companion diagnostics enable healthcare providers to select therapies based on specific genetic, proteomic, and metabolic profiles of patients. The growing number of targeted cancer therapies approved by regulatory bodies necessitates the use of companion diagnostics to identify suitable patient populations, driving demand for these diagnostics.

Restraint:

- Perception of High Development Costs and Reimbursement Issues

The development of companion diagnostics requires significant investment in research and development. The costs associated with clinical trials, validation studies, and regulatory approvals can be substantial, making it challenging for smaller companies to enter the market. Securing reimbursement for companion diagnostics from insurance companies and government health programs can be difficult. The lack of standardized reimbursement policies can limit the adoption of these diagnostics by healthcare providers.

Opportunity

⮚ Growing demand for Expansion of Personalized Medicine

As the healthcare industry increasingly shifts toward personalized medicine, there is a growing demand for companion diagnostics that can tailor treatments to individual patients based on their genetic and molecular profiles. This shift opens up opportunities for developing new diagnostics that align with personalized treatment plans. Increased investment from government agencies, private investors, and pharmaceutical companies in oncology research supports the development of companion diagnostics. This funding can drive innovation and expand the range of available diagnostics. Increasing awareness among healthcare providers and patients about the benefits of companion diagnostics creates opportunities for greater adoption. Educational initiatives can further drive the acceptance and use of these diagnostics.

Companion Diagnostics for Oncology Market Segment Overview

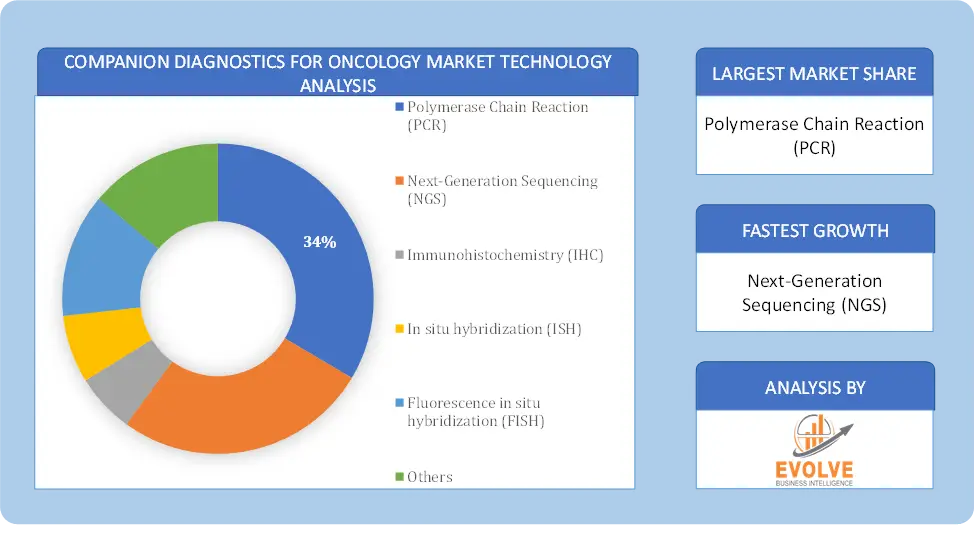

By Technology

Based on Technology, the market is segmented based on Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Immunohistochemistry (IHC), In situ hybridization (ISH), Fluorescence in situ hybridization (FISH) and Others. The immunohistochemistry segment dominant the market. Its primary role is to provide critical information about a patient’s tumor tissue. IHC detects specific biomarkers within the tissue, aiding in the categorization of cancer subtypes and treatment decisions. It is instrumental in classifying tumors into distinct subtypes, such as hormone receptor-positive or HER2-positive breast cancer, guiding therapy choices. IHC reveals predictive markers, indicating the likelihood of a patient’s response to certain treatments. It also identifies prognostic markers, offering insights into disease progression and patient survival.

Based on Technology, the market is segmented based on Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Immunohistochemistry (IHC), In situ hybridization (ISH), Fluorescence in situ hybridization (FISH) and Others. The immunohistochemistry segment dominant the market. Its primary role is to provide critical information about a patient’s tumor tissue. IHC detects specific biomarkers within the tissue, aiding in the categorization of cancer subtypes and treatment decisions. It is instrumental in classifying tumors into distinct subtypes, such as hormone receptor-positive or HER2-positive breast cancer, guiding therapy choices. IHC reveals predictive markers, indicating the likelihood of a patient’s response to certain treatments. It also identifies prognostic markers, offering insights into disease progression and patient survival.

By Disease Type

Based on Disease Type, the market segment has been divided into Breast Cancer, Non-Small Cell Lung Cancer, Colorectal Cancer, Leukemia, Melanoma and Others. The breast cancer segment dominant the market. Companion diagnostics for breast cancer have revolutionized oncology by facilitating precise and personalized care. These tests identify specific genetic and molecular characteristics within breast cancer cells, categorizing them into subtypes such as HER2-positive or hormone receptor-positive. This information guides treatment selection, enabling oncologists to administer targeted therapies with higher efficacy and fewer side effects. By aligning treatments with established guidelines, these diagnostics enhance patient outcomes and safety, marking a significant advancement in breast cancer management.

By End User

Based on End User, the market segment has been divided into Hospital, Pathology/Diagnostic Laboratory, Academic Medical Center and Others. The hospitals segment dominant the market. Hospitals employ oncology companion diagnostics to improve cancer care in numerous ways. These diagnostics play a central role in patient stratification, ensuring treatments are tailored to an individual’s genetic or molecular profile, thus enhancing treatment efficacy. They guide the selection of targeted therapies, reducing the use of ineffective treatments and minimizing side effects. Hospitals also rely on companion diagnostics for monitoring patient responses during treatment and for identifying suitable candidates for clinical trials.

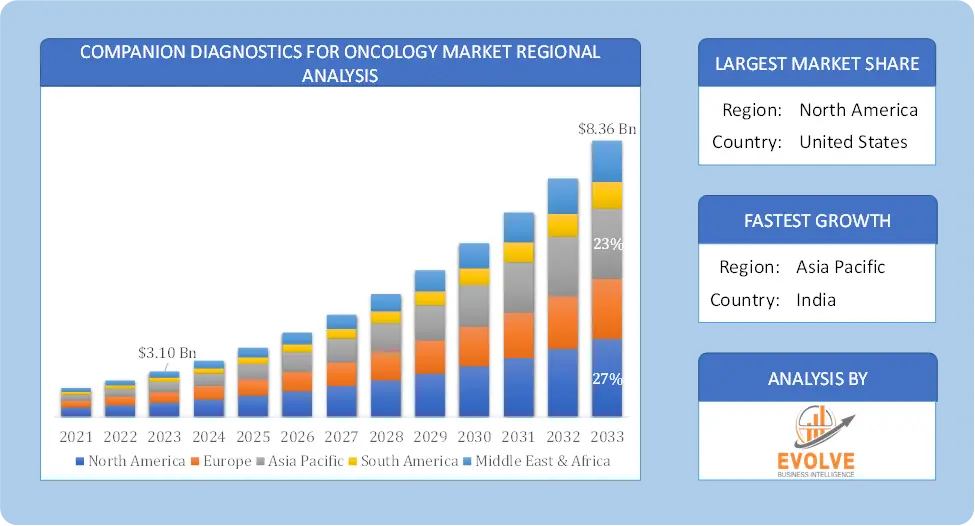

Global Companion Diagnostics for Oncology Market Regional Analysis

Based on region, the global Companion Diagnostics for Oncology Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Companion Diagnostics for Oncology Market followed by the Asia-Pacific and Europe regions.

Companion Diagnostics for Oncology North America Market

Companion Diagnostics for Oncology North America Market

North America holds a dominant position in the Companion Diagnostics for Oncology Market. North America, particularly the United States, is a leading region in the Companion Diagnostics for Oncology Market. The region’s leadership is attributed to advanced healthcare infrastructure, a strong focus on research and development, and significant investment in precision medicine. The U.S. Food and Drug Administration (FDA) has established clear regulatory pathways for the approval of companion diagnostics, facilitating faster market entry and adoption and the high prevalence of cancer in North America drives demand for innovative diagnostic solutions that can improve treatment outcomes.

Companion Diagnostics for Oncology Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Companion Diagnostics for Oncology Market industry. The Asia-Pacific region is experiencing rapid growth in the Companion Diagnostics for Oncology Market due to increasing healthcare expenditures, rising cancer incidence, and expanding access to advanced medical technologies. Countries such as China and India present significant opportunities for market expansion, driven by improving healthcare infrastructure and government initiatives supporting cancer diagnostics and local companies and research institutions in Asia-Pacific are actively involved in developing innovative companion diagnostics tailored to regional needs.

Competitive Landscape

The global Companion Diagnostics for Oncology Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Agilent Technologies Inc

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- Hoffmann-La Roche Ltd.

- ARUP Laboratories

- Abbott

- Myriad Genetics Inc.

- bioMerieux SA

- Illumina Inc.

- Invivoscribe Inc.

Key Development

In November 2022, Roche revealed the approval of the VENTANA FOLR1 (FOLR1-2.1) RxDx Assay by the US Food and Drug Administration (FDA). This marks a significant milestone as it is the inaugural immunohistochemistry (IHC) companion diagnostic test designed to assist in the identification of eligible epithelial ovarian cancer (EOC) patients who can benefit from targeted ELAHERE treatment.

In July 2021, Labcorp introduced the therascreen KRAS PCR Mutation Analysis, a companion diagnostic designed to identify individuals with non-small cell lung cancer (NSCLC) who qualify for treatment with LUMAKRAS (sotorasib), a therapeutic solution developed by Amgen.

Scope of the Report

Global Companion Diagnostics for Oncology Market, by Technology

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Immunohistochemistry (IHC)

- In situ hybridization (ISH)

- Fluorescence in situ hybridization (FISH)

- Others

Global Companion Diagnostics for Oncology Market, by Disease Type

- Breast Cancer

- Non-Small Cell Lung Cancer

- Colorectal Cancer

- Leukemia

- Melanoma

- Others

Global Companion Diagnostics for Oncology Market, by End User

- Hospital

- Pathology/Diagnostic Laboratory

- Academic Medical Center

- Others

Global Companion Diagnostics for Oncology Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.36 Billion |

| CAGR | 12.04% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Disease Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Agilent Technologies Inc, QIAGEN N.V., Thermo Fisher Scientific Inc., Hoffmann-La Roche Ltd., ARUP Laboratories, Abbott, Myriad Genetics Inc., bioMerieux SA, Illumina Inc. and Invivoscribe Inc. |

| Key Market Opportunities | • The growing demand for Expansion of Personalized Medicine • Growing Investment in Oncology Research |

| Key Market Drivers | • Technological Innovation • Advancements in Precision Medicine |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Companion Diagnostics for Oncology Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Companion Diagnostics for Oncology Market historical market size for the year 2021, and forecast from 2023 to 2033

- Companion Diagnostics for Oncology Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Companion Diagnostics for Oncology Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.