Baby Pacifier Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

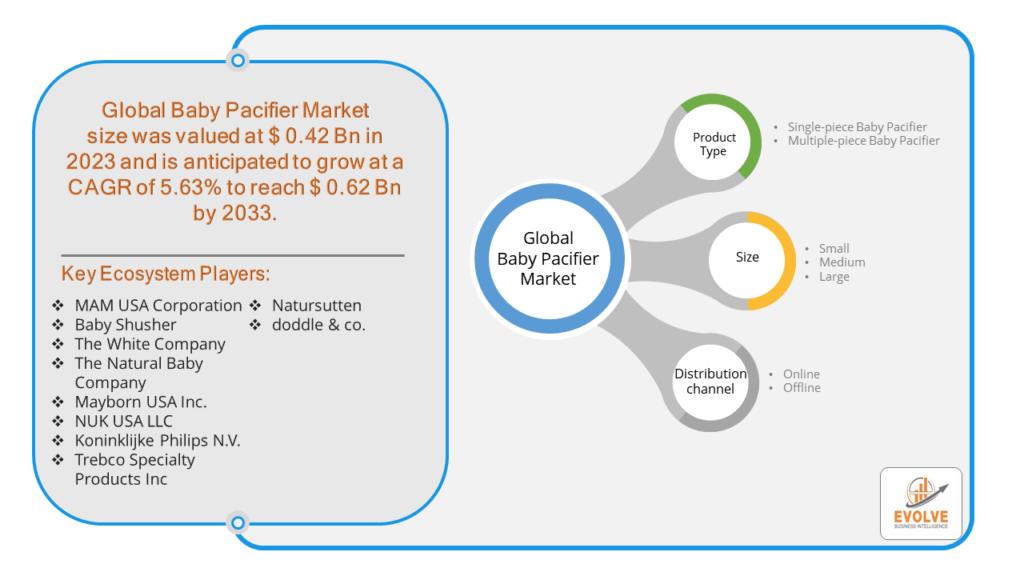

Baby Pacifier Market Research Report: Information By Product Type (Single-piece Baby Pacifier, Multiple-piece Baby Pacifier), By Size (Small, Medium, Large), By Distribution channel (Online, Offline), and by Region — Forecast till 2033

Page: 165

Baby Pacifier Market Overview

The Baby Pacifier Market Size is expected to reach USD 0.62 Billion by 2033. The Baby Pacifier industry size accounted for USD 0.42 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.63% from 2023 to 2033. A baby pacifier, also referred to as a soother or dummy, is a device designed for infants and young children to suck on for comfort and soothing. It typically consists of a rubber, plastic, or silicone nipple that is attached to a mouth shield and a handle. The pacifier serves to satisfy the natural sucking reflex, which helps to calm the infant and can assist in sleep. Pacifiers are commonly used to reduce crying and provide a sense of security for the baby. They are manufactured in various sizes and shapes to accommodate different ages and preferences and are subject to stringent safety standards to ensure they are free from harmful substances and are constructed to prevent choking hazards.

Global Baby Pacifier Market Synopsis

The COVID-19 pandemic profoundly transformed the baby pacifier market by shifting consumer behavior and reshaping supply chains. With more parents spending increased time at home due to lockdowns and remote work, there was a heightened focus on infant care and comfort, driving up demand for pacifiers. Concurrently, heightened concerns about hygiene and safety led to increased preference for high-quality, easy-to-clean, and sterilizable pacifiers. Supply chain disruptions prompted manufacturers to innovate and diversify their sourcing and production strategies to ensure consistent product availability. This period also saw a surge in online shopping for baby products, further influencing market dynamics.

Baby Pacifier Market Dynamics

The major factors that have impacted the growth of Baby Pacifier are as follows:

Drivers:

Ø Increasing Awareness of Infant Health and Hygiene

The growing awareness among parents about the importance of infant health and hygiene. With greater access to information through the internet, social media, and healthcare professionals, parents are more informed about the benefits of using pacifiers to soothe their babies and support their natural sucking reflex. This awareness leads to a preference for high-quality, safe, and hygienic pacifiers made from non-toxic materials like BPA-free silicone and rubber. Additionally, the demand for pacifiers that are easy to clean and sterilize has risen, as parents seek to ensure their infants’ health and safety. The market is also driven by innovations in pacifier designs that cater to specific needs, such as orthodontic pacifiers that support healthy dental development.

Restraint:

- Concerns About Dental Health and Overuse

A major restraint in the baby pacifier market is the concern among healthcare professionals and parents about the potential negative impact of prolonged pacifier use on dental health. Continuous and extended use of pacifiers can lead to dental issues such as misalignment of teeth, bite problems, and changes in the shape of the roof of the mouth. These concerns can deter parents from purchasing or using pacifiers beyond the infant stage. Additionally, some parents may worry about the dependency their children might develop on pacifiers, leading to difficulties in weaning them off. Pediatricians and dentists often recommend limited use of pacifiers, which can impact market growth as parents heed these professional guidelines.

Opportunity:

⮚ Growth in Online Retail and E-commerce

The rise of online retail and e-commerce presents a significant opportunity for the baby pacifier market. The COVID-19 pandemic accelerated the shift towards online shopping as parents sought convenient and safe ways to purchase baby products without leaving their homes. This trend is likely to continue, providing manufacturers and retailers with the chance to reach a broader customer base. Online platforms offer extensive product information, reviews, and comparisons, helping parents make informed decisions. E-commerce also allows for personalized shopping experiences and targeted marketing strategies, such as subscriptions for regular delivery of baby products. By leveraging online channels, companies can introduce innovative pacifier designs, offer exclusive deals, and engage directly with consumers, thereby driving market growth.

Baby Pacifier Segment Overview

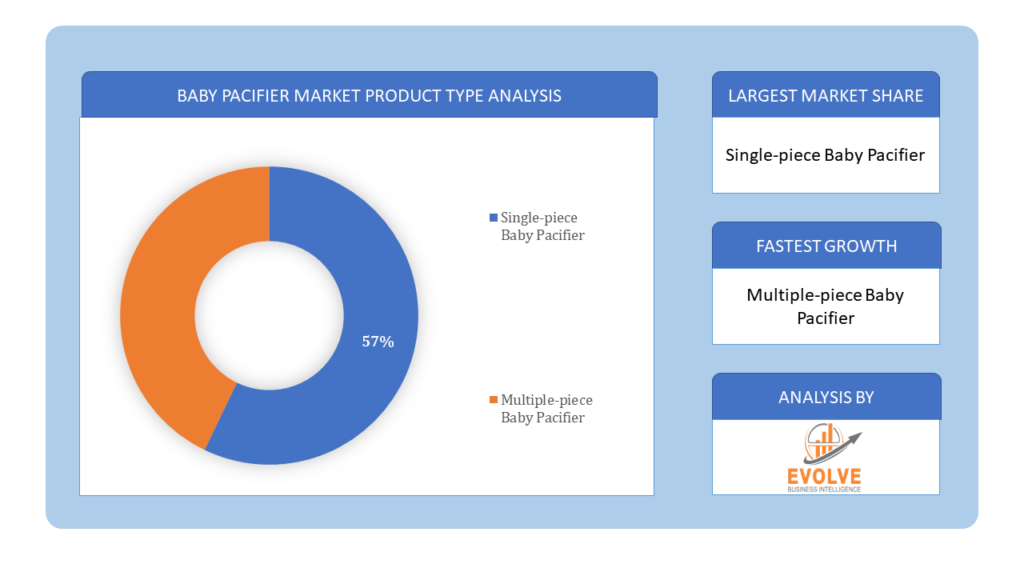

By Product Type

Based on Product Type, the market is segmented based on Single-piece Baby Pacifier and multiple-piece Baby Pacifier. The Single-piece Baby Pacifier segment is poised for notable expansion, driven by its superior safety design that minimizes choking hazards and ease of cleaning, appealing to health-conscious parents. Additionally, the rising demand for durable and hygienic baby products further boosts its market growth.

Based on Product Type, the market is segmented based on Single-piece Baby Pacifier and multiple-piece Baby Pacifier. The Single-piece Baby Pacifier segment is poised for notable expansion, driven by its superior safety design that minimizes choking hazards and ease of cleaning, appealing to health-conscious parents. Additionally, the rising demand for durable and hygienic baby products further boosts its market growth.

By Size

Based on Size, the market has been divided into Small, Medium, and Large. Small businesses are emerging as the predominant force in the Baby Pacifier market due to their agility in responding to evolving consumer preferences and their ability to offer niche and personalized products, catering to the diverse needs and preferences of modern parents. Additionally, their focus on innovation and sustainability aligns with the growing demand for eco-friendly and safe baby care solutions.

By Distribution channel

Based on the Distribution channel, the market has been divided into Online and offline. The dominance of the online channel in the Baby Pacifier market is evident due to its convenience, offering parents a wide selection of products, easy comparison, and the ability to shop from the comfort of their homes. Additionally, the COVID-19 pandemic accelerated the shift toward online shopping, further solidifying its prominence in the market.

Global Baby Pacifier Market Regional Analysis

Based on region, the global Baby Pacifier market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Baby Pacifier market followed by the Asia-Pacific and Europe regions.

Baby Pacifier North America Market

North America has consistently maintained a dominant position in the Baby Pacifier market due to its high consumer awareness, robust healthcare infrastructure, and strong emphasis on infant care and safety standards. Additionally, the region’s affluent population and disposable income levels contribute to the demand for premium and innovative baby pacifier products, further solidifying its leading position in the global market.

Baby Pacifier Asia-Pacific Market

The Asia-Pacific region has rapidly emerged as a growing market for the Baby Pacifier industry, driven by factors such as increasing birth rates, rising disposable incomes, and growing awareness of infant health and wellness. With a burgeoning middle class and urbanization, there is a rising demand for high-quality baby care products, including pacifiers, in countries like China, India, and Southeast Asia. Moreover, the influence of Western lifestyles and increasing adoption of modern parenting practices further propel the growth of the Baby Pacifier market in the Asia-Pacific region.

Competitive Landscape

The Global Baby Pacifier market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- MAM USA Corporation

- Baby Shusher

- The White Company

- The Natural Baby Company

- Mayborn USA Inc.

- NUK USA LLC

- Koninklijke Philips N.V.

- Trebco Specialty Products Inc

- Natursutten

- doddle & co.

Scope of the Report

Global Baby Pacifier Market, by Product Type

- Single-piece Baby Pacifier

- Multiple-piece Baby Pacifier

Global Baby Pacifier Market, by Size

- Small

- Medium

- Large

Global Baby Pacifier Market, by Distribution Channel

- Online

- Offline

Global Baby Pacifier Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $0.62 Billion |

| CAGR | 5.63% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Size, Distribution channel |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | MAM USA Corporation, Baby Shusher, The White Company, The Natural Baby Company, Mayborn USA Inc., NUK USA LLC, Koninklijke Philips N.V., Trebco Specialty Products Inc., Natursutten, doddle & co. |

| Key Market Opportunities | • Technological Advancements |

| Key Market Drivers | • Growing Awareness of Infant Health and Well-being |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Baby Pacifier market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Baby Pacifier market historical market size for the year 2021, and forecast from 2023 to 2033

- Baby Pacifier market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Baby Pacifier market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Baby Pacifier Market?

The study period for the Baby Pacifier Market spans from 2023 to 2033.

What is the growth rate of the Baby Pacifier Market?

The Baby Pacifier Market is expected to grow at a CAGR of 5.63% from 2023 to 2033.

Which region has the highest growth rate in the Baby Pacifier Market?

The Asia-Pacific region has the highest growth rate in the Baby Pacifier Market.

Which region has the largest share of the Baby Pacifier Market?

North America holds the largest share of the Baby Pacifier Market.

Who are the key players in the Baby Pacifier Market?

Key players in the Baby Pacifier Market include MAM USA Corporation, Baby Shusher, The White Company, Mayborn USA Inc., and Koninklijke Philips N.V.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Product Type Segement – Market Opportunity Score 4.1.2. Size Segment – Market Opportunity Score 4.1.3. Distribution channel Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Baby Pacifier Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Baby Pacifier Market, By Product Type 7.1. Introduction 7.1.1. Single-piece Baby Pacifier 7.1.2. Multiple-piece Baby Pacifier CHAPTER 8. Global Baby Pacifier Market, By Size 8.1. Introduction 8.1.1. Small 8.1.2. Medium 8.1.3. Large CHAPTER 9. Global Baby Pacifier Market, By Distribution channel 9.1. Introduction 9.1.1. Online 9.1.2. Offline CHAPTER 10. Global Baby Pacifier Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Size, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Distribution channel, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. MAM USA Corporation 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Baby Shusher 13.3. The White Company 13.4. The Natural Baby Company 13.5. Mayborn USA Inc. 13.6. NUK USA LLC 13.7. Koninklijke Philips N.V. 13.8. Trebco Specialty Products Inc 13.9. Natursutten 13.10. doddle & co.

Connect to Analyst

Research Methodology