Asset Performance Management Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

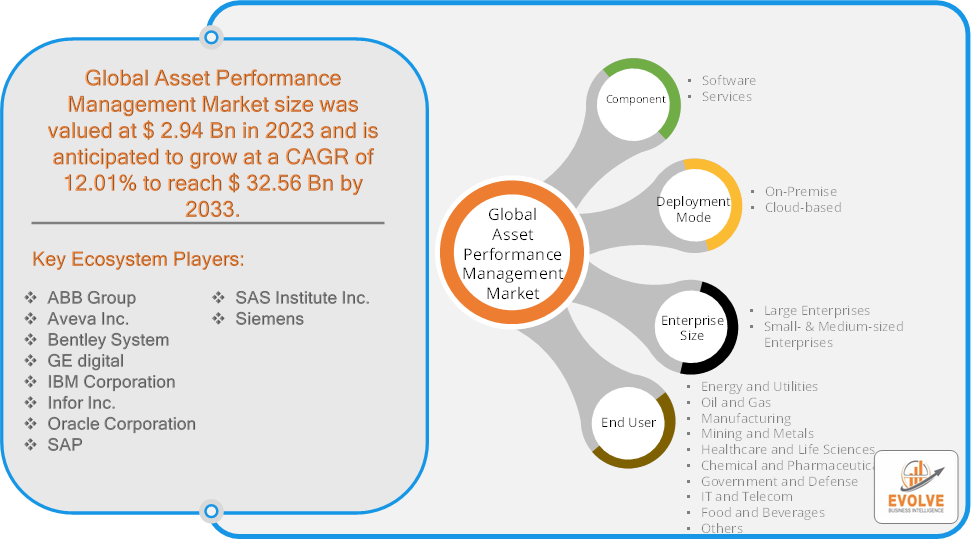

Asset Performance Management Market Research Report: Information By Component (Software, Services), By Deployment Mode (On-Premise, Cloud-based), By Enterprise Size (Large Enterprises, Small- & Medium-sized Enterprises), By End-User (Energy and Utilities, Oil and Gas, Manufacturing, Mining and Metals, Healthcare and Life Sciences, Chemical and Pharmaceuticals, Government and Defense, IT and Telecom, Food and Beverages, Others), and by Region — Forecast till 2033

Page: 165

Asset Performance Management Market Overview

The Asset Performance Management Market Size is expected to reach USD 32.56 Billion by 2033. The Asset Performance Management Market industry size accounted for USD 2.94 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 12.01% from 2023 to 2033. The Asset Performance Management (APM) market involves technologies and services focused on optimizing the performance, reliability, and lifespan of physical assets within various industries. Asset Performance Management (APM) is a strategic approach to managing physical assets by analyzing operational data to improve their efficiency and productivity, while minimizing operating costs.

The APM market serves industries such as manufacturing, oil and gas, utilities, transportation, and more, where maintaining the performance and reliability of critical assets is crucial for operational efficiency and cost management.

Global Asset Performance Management Market Synopsis

The COVID-19 pandemic had a notable impact on the Asset Performance Management (APM) market. The pandemic accelerated the adoption of remote monitoring and management solutions as businesses sought to maintain operations while minimizing physical presence. This led to a greater demand for APM systems that support remote access and management of assets. The pandemic acted as a catalyst for digital transformation across industries. Organizations accelerated their investments in digital technologies, including APM solutions, to improve operational efficiency and resilience. Many companies faced budget constraints due to the economic impact of COVID-19. This led to a focus on cost-effective APM solutions and a reassessment of investment priorities. Some organizations opted for cloud-based APM solutions to reduce capital expenditures. The pandemic highlighted the importance of asset reliability and resilience in maintaining business continuity. As a result, companies became more aware of the need for robust APM systems to manage and optimize their critical assets.

Asset Performance Management Market Dynamics

The major factors that have impacted the growth of Asset Performance Management Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in artificial intelligence (AI), machine learning, and data analytics enhance the capabilities of APM systems. These technologies enable more accurate predictions, better risk management, and optimized performance. The broader trend of digital transformation across industries is driving the adoption of advanced APM solutions. Companies are investing in digital technologies to improve operational processes and decision-making. As assets and systems become more complex, the need for sophisticated APM solutions to manage and optimize their performance increases.

Restraint:

- Perception of High Implementation Costs and Data Security

The initial investment required for APM solutions, including software, hardware, and integration costs, can be significant. This high cost can be a barrier for smaller organizations or those with limited budgets. The collection and analysis of sensitive asset data raise concerns about data security and privacy. Organizations must ensure that APM systems adhere to security standards and regulations to protect against data breaches and cyber threats.

Opportunity:

⮚ Advancements in Data Analytics and Visualization

Enhanced data analytics and visualization capabilities within APM systems can provide actionable insights and improve decision-making. Developing sophisticated analytics and visualization tools presents opportunities for innovation and differentiation in the market. The trend towards remote work and the need for remote asset management solutions, accelerated by the COVID-19 pandemic, continues to drive demand for APM systems that support remote monitoring and control. There is a growing emphasis on managing the entire lifecycle of assets, from acquisition to disposal. APM solutions that provide comprehensive lifecycle management capabilities are well-positioned to address this need.

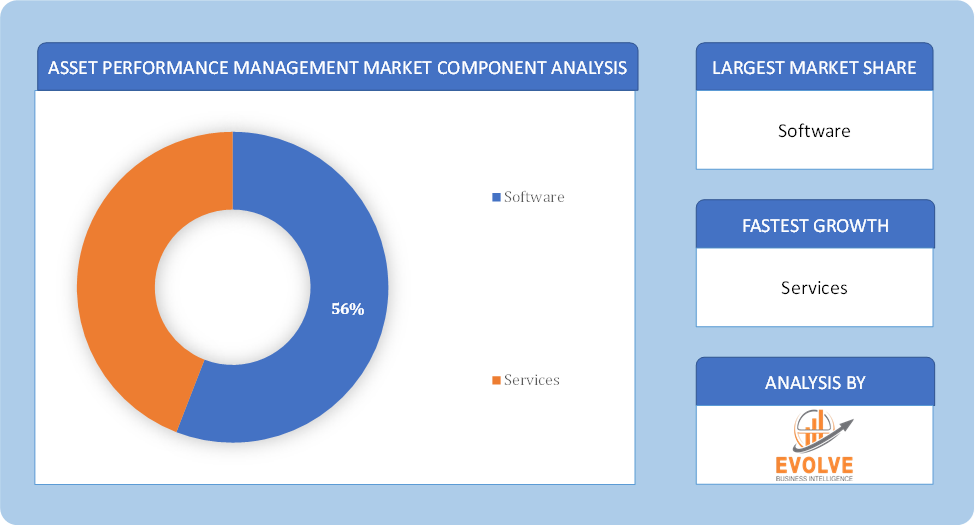

Asset Performance Management Market Segment Overview

Based on Component, the market is segmented based on Software and Services. The software segment dominant the market. The software segment consists of various tools and platforms for storing, managing, and analyzing valuable data collected from the vast and continuous operations of assets like machinery, pipelines, and structures in the manufacturing, healthcare, energy, and real estate industries. Most businesses have begun using asset performance management software to handle various issues relating to the maintenance of assets and to acquire real-time information regarding the impending collapse of assets.

By Deployment Mode

Based on Deployment Mode, the market segment has been divided into On-Premise and Cloud-based. The on-premise segment dominant the market. On-premise deployment allows asset performance monitoring software to be installed and run on a company’s systems rather than in a server farm or cloud. On-premise asset performance management system improves enterprises’ scalability, speed, reliability, and connectivity. On-premise asset performance management software is frequently used in government, aerospace, and defense, where data confidentiality is crucial.

By Enterprise Size

Based on Enterprise Size, the market segment has been divided into Large Enterprises and Small- & Medium-sized Enterprises. The large enterprises segment dominant the market. Heavy machinery’s vast data during operation is crucial for important businesses. Asset performance management software helps huge companies evaluate machinery’s condition and make wise decisions. Large companies’ investments in asset performance management will also boost the market.

By End User

Based on End User, the market segment has been divided into Energy and Utilities, Oil and Gas, Manufacturing, Mining and Metals, Healthcare and Life Sciences, Chemical and Pharmaceuticals, Government and Defense, IT and Telecom, Food and Beverages and Others. The energy & utility segment dominant the market. Energy and utility firms must handle power plants, turbines, machines, and distribution cables from numerous places. Industry 4.0 revolution digitalizes energy and utility carrying operations, positively affecting the company. High energy output and better labor productivity promote market growth. In the energy and utility industry, asset performance management software transforms manufacturing facilities into smart power plants.

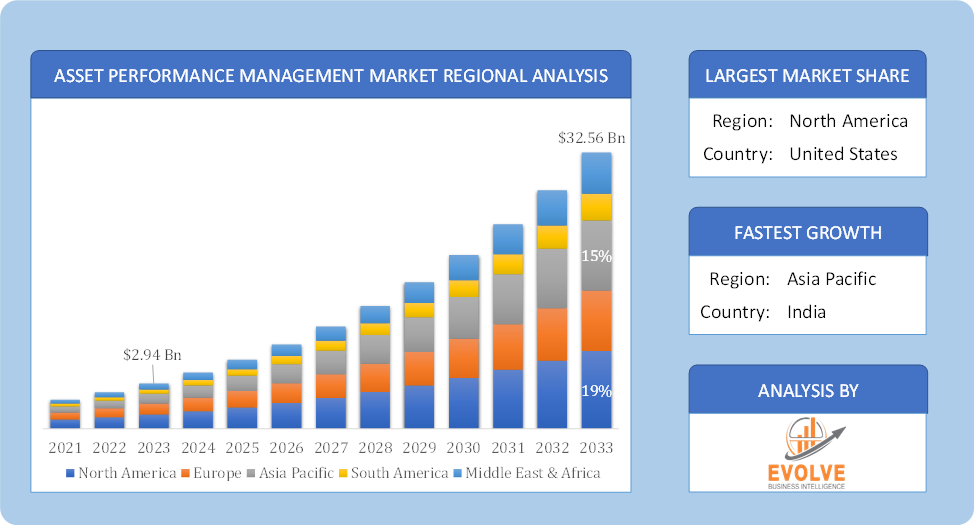

Global Asset Performance Management Market Regional Analysis

Based on region, the global Asset Performance Management Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Asset Performance Management Market followed by the Asia-Pacific and Europe regions.

Asset Performance Management North America Market

Asset Performance Management North America Market

North America holds a dominant position in the Asset Performance Management Market. North America, particularly the United States and Canada, has a mature APM market with strong adoption due to advanced industrial infrastructure and high technology integration. High investment in digital transformation, widespread adoption of IoT and AI technologies, and a focus on improving operational efficiency and reducing downtime and expansion in manufacturing, energy, and utilities sectors; increasing demand for advanced predictive maintenance and remote monitoring solutions.

Asset Performance Management Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Asset Performance Management Market industry. The Asia-Pacific region is experiencing rapid industrial growth and modernization, leading to a rising demand for APM solutions. Industrialization in countries like China and India, growing investments in infrastructure, and increasing focus on operational efficiency and predictive maintenance and expansion in manufacturing, utilities, and transportation sectors; rising adoption of IIoT and digital technologies in emerging markets.

Competitive Landscape

The global Asset Performance Management Market is highly competitive, with numerous players offering a wide range of software Solution. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- ABB Group

- Aveva Inc.

- Bentley System

- GE digital

- IBM Corporation

- Infor Inc.

- Oracle Corporation

- SAP

- SAS Institute Inc.

- Siemens

Key Development

Scope of the Report

Global Asset Performance Management Market, by Component

- Software

- Services

Global Asset Performance Management Market, by Deployment Mode

- On-Premise

- Cloud-based

Global Asset Performance Management Market, by Enterprise Size

- Large Enterprises

- Small- & Medium-sized Enterprises

Global Asset Performance Management Market, by End User

- Energy and Utilities

- Oil and Gas

- Manufacturing

- Mining and Metals

- Healthcare and Life Sciences

- Chemical and Pharmaceuticals

- Government and Defense

- IT and Telecom

- Food and Beverages

- Others

Global Asset Performance Management Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 32.56 Billion |

| CAGR (2023-2033) | 12.01% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Deployment Mode, Enterprise Size, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | ABB Group, Aveva Inc., Bentley System, GE digital, IBM Corporation, Infor Inc., Oracle Corporation, SAP, SAS Institute Inc. and Siemens. |

| Key Market Opportunities | · Advancements in Data Analytics and Visualization · Focus on Asset Lifecycle Management |

| Key Market Drivers | · Technological Advancements · Digital Transformation Initiatives |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Asset Performance Management Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Asset Performance Management Market historical market size for the year 2021, and forecast from 2023 to 2033

- Asset Performance Management Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Asset Performance Management Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Asset Performance Management Market is 2021- 2033

What is the growth rate of the global Asset Performance Management Market?

The global Asset Performance Management Market is growing at a CAGR of 12.01% over the next 10 years

Which region has the highest growth rate in the market of Frozen Food?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Asset Performance Management Market?

North America holds the largest share in 2022

Who are the key players in the global Asset Performance Management Market?

ABB Group, Aveva Inc., Bentley System, GE digital, IBM Corporation, Infor Inc., Oracle Corporation, SAP, SAS Institute Inc. and Siemens are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Component Segement – Market Opportunity Score 4.1.2. Deployment Mode Segment – Market Opportunity Score 4.1.3. Enterprise Size Segment – Market Opportunity Score 4.1.4. End User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Asset Performance Management Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Asset Performance Management Market, By Component 7.1. Introduction 7.1.1. Software 7.1.2. Services CHAPTER 8. Asset Performance Management Market, By Deployment Mode 8.1. Introduction 8.1.1. On-Premise 8.1.2. Cloud-based CHAPTER 9. Asset Performance Management Market, By Enterprise Size 9.1. Introduction 9.1.1. Large Enterprises 9.1.2. Small- & Medium-sized Enterprises CHAPTER 10. Asset Performance Management Market, By End User 10.1.Introduction 10.1.1. Energy and Utilities 10.1.2. Oil and Gas 10.1.3. Manufacturing 10.1.4. Mining and Metals 10.1.5. Healthcare and Life Sciences 10.1.6. Chemical and Pharmaceuticals 10.1.7. Government and Defense 10.1.8. IT and Telecom 10.1.9. Food and Beverages 10.1.10. Others CHAPTER 11. Asset Performance Management Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Deployment Mode, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Enterprise Size, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. ABB Group 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Aveva Inc. 13.3. Bentley System 13.4. GE digital 13.5. IBM Corporation 13.6. Infor Inc. 13.7. Oracle Corporation 13.8. SAP 13.9. SAS Institute Inc. 13.10. Siemens

Connect to Analyst

Research Methodology