Aquaculture Products Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

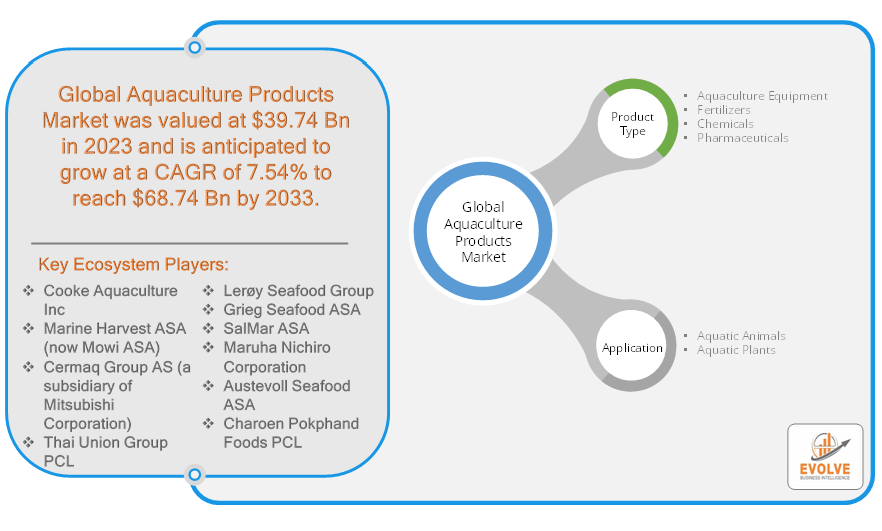

Aquaculture Products Market Research Report: Information Product Type (Aquaculture Equipment, Fertilizers, Chemicals, Pharmaceuticals), By Application (Aquatic Animals, Aquatic Plants), and by Region — Forecast till 2033

Aquaculture Products Market Overview

The Aquaculture Products Market Size is expected to reach USD 68.74 Billion by 2033. The Aquaculture Products industry size accounted for USD 39.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.54% from 2023 to 2033. Aquaculture products refer to goods and resources derived from the cultivation and rearing of aquatic organisms in controlled aquatic environments. Aquaculture, also known as fish farming or aquafarming, involves the cultivation of fish, shellfish, and aquatic plants for commercial purposes. Aquaculture products encompass a wide range of living organisms, including fish (such as salmon, tilapia, and catfish), mollusks (such as oysters, mussels, and clams), crustaceans (such as shrimp and prawns), and aquatic plants (such as seaweed and algae). These products are cultivated and managed in artificial ponds, tanks, or other designated aquatic systems, where environmental conditions and feed are carefully controlled to optimize growth, health, and productivity. Aquaculture products serve as a sustainable and efficient means to meet the increasing global demand for seafood, provide food security, support economic development, and reduce pressure on wild fish stocks and natural ecosystems.

Global Aquaculture Products Market Synopsis

The Aquaculture Products market underwent significant disruptions and challenges due to the COVID-19 pandemic. The global restrictions on travel, trade, and logistics severely affected the aquaculture industry, leading to supply chain disruptions, reduced demand, and financial setbacks. The closure of restaurants, hotels, and other food service establishments, which are major buyers of aquaculture products, resulted in a decline in demand and oversupply in some regions. Moreover, restrictions on transportation and the closure of borders hindered the export and import of aquaculture products, causing logistical difficulties and financial losses for producers. Additionally, the health and safety protocols implemented to prevent the spread of the virus added operational complexities and increased production costs for aquaculture businesses. However, as the situation gradually improves and consumer confidence returns, the Aquaculture Products market is expected to rebound, driven by the growing demand for sustainable and locally produced seafood and the gradual recovery of the food service sector.

Aquaculture Products Market Dynamics

The major factors that have impacted the growth of Aquaculture Products are as follows:

Drivers:

Growing Demand for Sustainable Seafood

The increasing awareness and demand for sustainable and responsibly sourced seafood products is a key driver for the Aquaculture Products market. Consumers are becoming more conscious of the environmental impact of traditional fishing methods and the importance of maintaining healthy fish stocks. Aquaculture offers a sustainable solution by providing controlled and monitored environments for fish and other aquatic organisms, reducing pressure on wild fish populations. The demand for sustainably sourced aquaculture products is expected to continue to grow as consumers prioritize environmentally friendly food choices.

Restraint:

- Environmental Concerns and Ecological Impact

Aquaculture operations can have ecological impacts on the surrounding environment, including water pollution, habitat destruction, and the potential for the introduction of non-native species. The discharge of effluents, excessive use of antibiotics or chemicals, and escape of farmed fish into the wild are some of the environmental concerns associated with aquaculture. These concerns can lead to regulatory challenges, public scrutiny, and negative perceptions of the industry, which may restrain its growth. Addressing these environmental issues and implementing sustainable practices are crucial for the long-term viability and acceptance of the Aquaculture Products market.

Opportunity:

Technological Advancements and Innovation

The Aquaculture Products market presents opportunities for technological advancements and innovation to address challenges and enhance production efficiency. Advances in aquaculture technology, such as recirculating aquaculture systems (RAS), automated feeding systems, and genetic improvement programs, can improve productivity, reduce environmental impacts, and enhance fish health and welfare. Furthermore, innovation in feed formulations, including alternative protein sources and optimized nutrition, can contribute to sustainable and efficient aquaculture practices. Embracing technological advancements and innovation can open up new opportunities for growth and address some of the constraints faced by the Aquaculture Products market.

Aquaculture Products Segment Overview

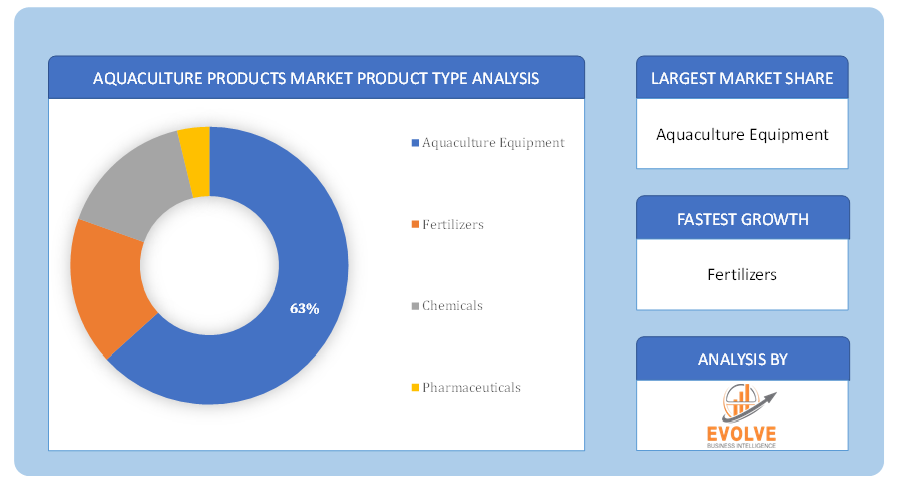

By Product Type

Based on Product type, the market is segmented based on Aquaculture Equipment, Fertilizers, Chemicals, and Pharmaceuticals. The Aquaculture Equipment segment is expected to witness significant growth during the forecast period. This growth can be attributed to several factors. Firstly, the increasing demand for aquaculture products, driven by factors such as population growth, rising incomes, and the need for sustainable food sources, is creating a need for efficient and technologically advanced equipment in aquaculture operations. Aquaculture equipment plays a vital role in ensuring optimal conditions for the cultivation and rearing of aquatic organisms, including fish, shellfish, and aquatic plants.

By Application

Based on Application, the market has been divided into Aquatic Animals, Aquatic Plants. Aquatic animals indeed dominate the Aquaculture Products market. The cultivation and production of aquatic animals, including fish, crustaceans, mollusks, and other species, form a significant portion of the aquaculture industry. These aquatic animals are bred, raised, and harvested in controlled aquatic environments for various purposes, including food production, ornamental trade, and research. The production of fish, such as salmon, tilapia, trout, and catfish, constitutes a substantial portion of the aquaculture market.

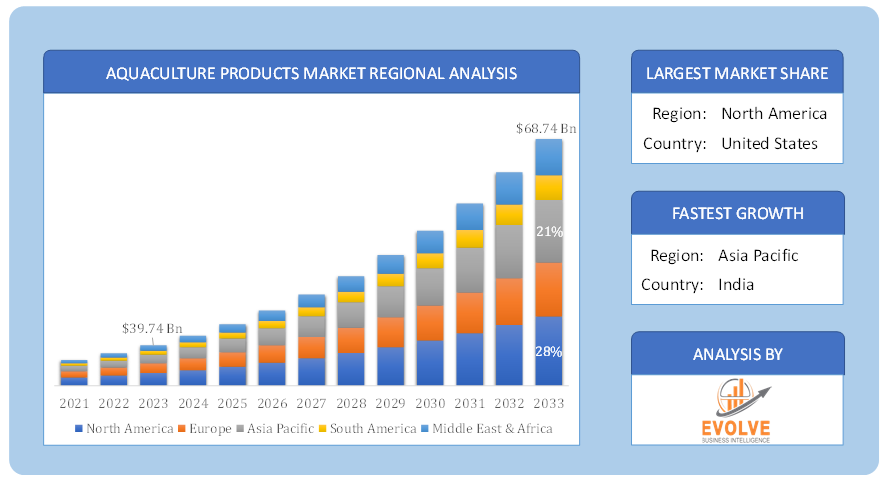

Global Aquaculture Products Market Regional Analysis

Based on region, the global Aquaculture Products market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Aquaculture Products market followed by the Asia-Pacific and Europe regions.

North America Market

North America, specifically the U.S. and Canada, holds a dominant position in the Aquaculture Products market. Several factors contribute to North America’s dominance in this market. The region benefits from a well-developed aquaculture infrastructure, advanced technologies, and extensive research and development initiatives. North America has a diverse aquaculture industry that cultivates various species of fish, shellfish, and other aquatic organisms. The region’s stringent regulatory standards and commitment to sustainable aquaculture practices have led to the production of high-quality, responsibly sourced aquaculture products. Additionally, North America’s strong consumer demand for locally produced and sustainable seafood, along with the presence of well-established distribution networks, drives the market growth. The region’s favorable economic conditions, supportive government policies, and increasing investments in aquaculture further contribute to its dominant position in the Aquaculture Products market.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Aquaculture Products market. The region has a rich tradition of aquaculture, with countries such as China, India, and Indonesia having a long history of aquaculture practices. This historical expertise, combined with favorable geographical conditions and abundant water resources, provides a solid foundation for the growth of aquaculture in the Asia-Pacific region. The increasing population and rising disposable incomes in many Asian countries have led to a growing demand for seafood, driving the expansion of the Aquaculture Products market. Additionally, the region’s strong focus on food security, along with the need to reduce dependence on wild fish stocks, has further boosted the development of aquaculture. The Asia-Pacific region has witnessed significant investments in modern aquaculture techniques, advanced technologies, and research and development activities to enhance productivity, sustainability, and product quality. As a result, the region is experiencing rapid growth in aquaculture production and is expected to continue expanding its market share in the global Aquaculture Products market.

Competitive Landscape

The global Aquaculture Products market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Cooke Aquaculture Inc

- Marine Harvest ASA (now Mowi ASA)

- Cermaq Group AS (a subsidiary of Mitsubishi Corporation)

- Thai Union Group PCL

- Cargill

- Grieg Seafood ASA

- SalMar ASA

- Maruha Nichiro Corporation

- Austevoll Seafood ASA

- Charoen Pokphand Foods

Key Development:

In 2021, Cargill announced the expansion of its aquafeed production capacity in Ecuador. The company invested in a new state-of-the-art feed mill to meet the increasing demand for high-quality aquafeed in the region.

In 2021, Cooke Aquaculture continued its expansion in the United States by acquiring several aquaculture farms and facilities. These acquisitions aimed to strengthen Cooke’s position in the North American market and increase its production capacity for various aquaculture products, including salmon and trout.

Scope of the Report

Global Aquaculture Products Market, by Product Type

- Aquaculture Equipment

- Fertilizers

- Chemicals

- Pharmaceuticals

Global Aquaculture Products Market, by Application

- Aquatic Animals

- Aquatic Plants

Global Aquaculture Products Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $68.74 Billion |

| CAGR | 7.54% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Cooke Aquaculture Inc, Marine Harvest ASA (now Mowi ASA), Cermaq Group AS (a subsidiary of Mitsubishi Corporation), Thai Union Group PCL, Cargill, Grieg Seafood ASA, SalMar ASA, Maruha Nichiro Corporation, Austevoll Seafood ASA, Charoen Pokphand Foods |

| Key Market Opportunities | • Expansion of aquaculture production to meet the rising demand for seafood. • Adoption of sustainable aquaculture practices and responsible sourcing. • Development of new and improved aquaculture technologies and equipment. |

| Key Market Drivers | • Increasing global demand for seafood and the need for sustainable food sources. • Technological advancements and innovation in aquaculture practices and equipment. • Growing consumer demand for sustainably sourced and locally produced seafood. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Aquaculture Products market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Aquaculture Products market historical market size for the year 2021, and forecast from 2023 to 2033

- Aquaculture Products market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Aquaculture Products market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Aquaculture Products market is 2021- 2033

What is the growth rate of the global Aquaculture Products market?

The global Aquaculture Products market is growing at a CAGR of 7.54% over the next 10 years

Which region has the highest growth rate in the market of Aquaculture Products?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Aquaculture Products market?

North America holds the largest share in 2022

Who are the key players in the global Aquaculture Products market?

Cooke Aquaculture Inc, Marine Harvest ASA (now Mowi ASA), Cermaq Group AS (a subsidiary of Mitsubishi Corporation), Thai Union Group PCL, Cargill, Grieg Seafood ASA, SalMar ASA, Maruha Nichiro Corporation, Austevoll Seafood ASA, Charoen Pokphand Foods are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Aquaculture Products Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Aquaculture Products Market 4.8. Import Analysis of the Aquaculture Products Market 4.9. Export Analysis of the Aquaculture Products Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Aquaculture Products Market, By Product Type 6.1. Introduction 6.2. Aquaculture Equipment 6.3. Fertilizers 6.4. Chemicals 6.5. Pharmaceuticals Chapter 7. Global Aquaculture Products Market, By Application 7.1. Introduction 7.2. Aquatic Animals 7.3. Aquatic Plants Chapter 8. Global Aquaculture Products Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product, 2023-2033 8.2.5. Market Size and Forecast, By Application, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Application, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Application, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By Application, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Application, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Application, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Application, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Application, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Application, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By Application, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Application, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Application, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Application, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Application, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Application, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By Application, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Cooke Aquaculture Inc 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Marine Harvest ASA (now Mowi ASA) 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Cermaq Group AS (a subsidiary of Mitsubishi Corporation) 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Thai Union Group 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Cargill 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Grieg Seafood ASA 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. SalMar ASA 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Maruha Nichiro Corporation 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Austevoll Seafood ASA 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Charoen Pokphand Foods 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology