Robotic Drilling Equipment Market Overview

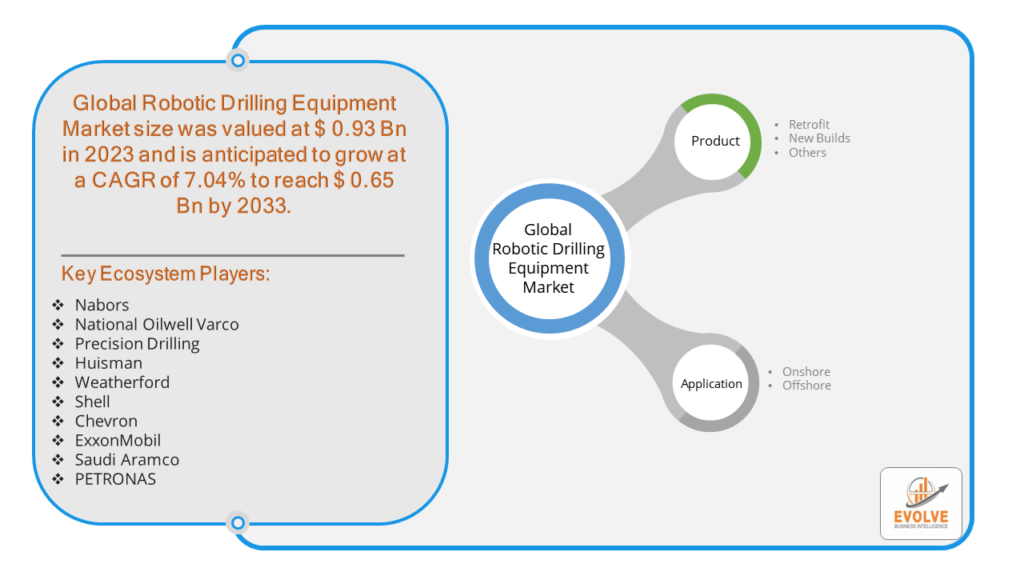

The Robotic Drilling Equipment Market Size is expected to reach USD 0.65 Billion by 2033. The Robotic Drilling Equipment industry size accounted for USD 0.93 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.04% from 2023 to 2033. The Robotic Drilling Equipment Market encompasses the development, manufacturing, and deployment of automated drilling systems used in oil and gas exploration. These systems utilize robotics and advanced technologies to enhance precision, safety, and efficiency in drilling operations. Key components include robotic drilling rigs, control systems, and software for automation and monitoring. The market is driven by the demand for reducing operational costs, minimizing human intervention, and improving drilling accuracy. Adoption of robotic drilling equipment is increasing due to advancements in technology, rising energy demands, and the need for safer, more efficient drilling practices.

Global Robotic Drilling Equipment Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the robotic drilling equipment market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Robotic Drilling Equipment Market Dynamics

The major factors that have impacted the growth of Robotic Drilling Equipment are as follows:

Drivers:

Ø Technological Advancements

Continuous innovations in robotics, AI, and sensor technologies are driving the market forward. These advancements enable real-time data collection, analysis, and decision-making, enhancing drilling accuracy and efficiency.

Restraint:

- High Initial Investment Costs

One of the primary barriers to the widespread adoption of robotic drilling equipment is the significant upfront investment required. The costs associated with acquiring, installing, and maintaining robotic systems can be prohibitive for many operators, particularly smaller companies or those with limited capital resources.

Opportunity:

⮚ Cost Efficiency and Operational Savings

Robotic drilling equipment offers significant opportunities for cost reduction and operational savings. Automation minimizes labor costs, enhances operational efficiency, and reduces downtime associated with human error, thereby improving overall project economics.

Robotic Drilling Equipment Segment Overview

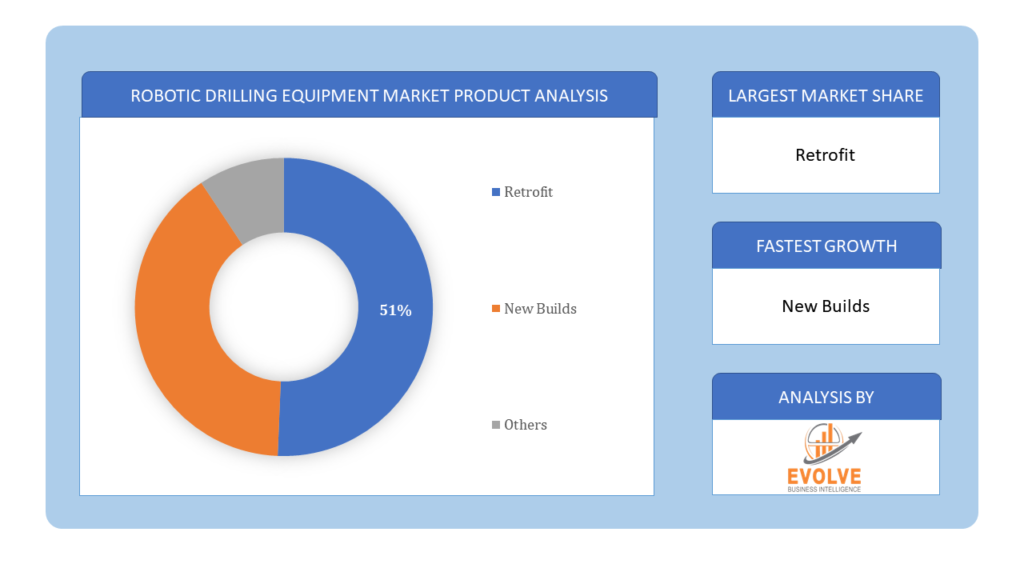

By Product

Based on Product, the market is segmented based on Retrofit, New Builds. the Retrofit segment currently dominates, as many existing drilling rigs are being upgraded with robotic technologies to enhance efficiency and safety, rather than solely focusing on new builds.

Based on Product, the market is segmented based on Retrofit, New Builds. the Retrofit segment currently dominates, as many existing drilling rigs are being upgraded with robotic technologies to enhance efficiency and safety, rather than solely focusing on new builds.

By Application

Based on Applications, the market has been divided into the Onshore, Offshore. the Onshore segment currently dominates, driven by the higher volume of onshore drilling activities globally compared to offshore operations.

Global Robotic Drilling Equipment Market Regional Analysis

Based on region, the global Robotic Drilling Equipment market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Robotic Drilling Equipment market followed by the Asia-Pacific and Europe regions.

Robotic Drilling Equipment North America Market

Robotic Drilling Equipment North America Market

North America holds a dominant position in the Robotic Drilling Equipment Market. In 2022, the North American robotic drilling market held a 45.80% market share. The Gulf of Mexico continues to be the primary location for offshore oil and gas production. Using robotic drilling technologies can improve these operations’ productivity and safety, which will appeal to local companies. In addition, the robotic drilling market in the United States had the most market share, while the robotic drilling market in Canada was expanding at the quickest rate on the North American continent.

Robotic Drilling Equipment Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Robotic Drilling Equipment industry. From 2023 to 2032, the robotic drilling market in Asia-Pacific is anticipated to develop at the quickest rate of compound annual growth. Large-scale infrastructure projects, including as high-rise buildings, tunnels, and bridges, are well-known in the region. Robotic drilling can expedite these projects and boost overall production. Furthermore, the robotic drilling market in China had the most market share, while the robotic drilling market in India had the quickest rate of growth in the Asia-Pacific area.

Competitive Landscape

The global Robotic Drilling Equipment market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Nabors

- National Oilwell Varco

- Precision Drilling

- Huisman

- Weatherford

- Shell

- Chevron

- ExxonMobil

- Saudi Aramco

- PETRONAS

Key Development

In September 2022, National Oilwell Varco (NOV) launched advanced robotic drilling systems aimed at improving drilling efficiency and reducing operational costs in the oil and gas industry.

Scope of the Report

Global Robotic Drilling Equipment Market, by Product

- Retrofit

- New Builds

- Others

Global Robotic Drilling Equipment Market, by Application

- Onshore

- Offshore

Global Robotic Drilling Equipment Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $0.65Billion |

| CAGR | 7.04% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Installation, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Nabors, National Oilwell Varco, Precision Drilling, Huisman, Weatherford, Shell, Chevron, ExxonMobil, Saudi Aramco, PETRONAS |

| Key Market Opportunities | • Safety in Oil Rigs. |

| Key Market Drivers | • Increased Exploration Activities In Deep Water |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Robotic Drilling Equipment market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Robotic Drilling Equipment market historical market size for the year 2021, and forecast from 2023 to 2033

- Robotic Drilling Equipment market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Robotic Drilling Equipment market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.