Agricultural Micronutrients Market Overview

The Agricultural Micronutrients Market Size is expected to reach USD 15.96 Billion by 2033. The Agricultural Micronutrients Market industry size accounted for USD 1.97 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.76% from 2023 to 2033. The Agricultural Micronutrients Market refers to the segment of the agricultural industry that involves the production, distribution, and use of micronutrient-based products aimed at enhancing crop growth, yield, and overall plant health. Micronutrients are essential elements required by plants in small quantities for various physiological functions, including enzyme activation, photosynthesis, and nutrient uptake.

Factors driving the Agricultural Micronutrients Market include increasing awareness among farmers about the importance of balanced plant nutrition, rising demand for high-quality crops with improved nutritional content, and the need for sustainable agricultural practices to mitigate environmental degradation. The Agricultural Micronutrients Market encompasses a range of products such as micronutrient fertilizers, micronutrient-rich soil amendments, foliar sprays, and seed treatments. These products are applied to soils or directly onto plants to supplement micronutrient deficiencies and optimize crop growth and productivity.

Global Agricultural Micronutrients Market Synopsis

The COVID-19 pandemic had significant impacts on the Agricultural Micronutrients Market. During the early stages of the pandemic, lockdown measures and restrictions on movement disrupted global supply chains, including those for agricultural inputs. This disruption led to challenges in the availability and distribution of micronutrient products, affecting farmers’ ability to access essential inputs for crop production. Economic uncertainties resulting from the pandemic led to reduced purchasing power among farmers, particularly smallholders. As a result, there was a decrease in demand for agricultural inputs, including micronutrients. Many farmers opted to minimize expenses, leading to delayed or reduced purchases of micronutrient fertilizers and other related products. The pandemic prompted shifts in agricultural practices, with some farmers adjusting cropping patterns or reducing inputs to cope with economic challenges. This shift may have affected the demand for micronutrient products, as farmers may have prioritized essential inputs such as seeds and basic fertilizers over micronutrient supplements.

Agricultural Micronutrients Market Dynamics

The major factors that have impacted the growth of Agricultural Micronutrients Market are as follows:

Drivers:

Ø Intensive Farming Practices

Intensive farming practices, including monocropping and high-yield varieties, can lead to micronutrient depletion in soils over time. Farmers increasingly recognize the importance of micronutrients in maintaining soil fertility and optimizing crop yields, driving the demand for micronutrient-based solutions. There is growing awareness among farmers about the importance of balanced plant nutrition for maximizing crop yields and quality. Agricultural extension services, research institutions, and industry stakeholders play a crucial role in educating farmers about micronutrient deficiencies and the benefits of micronutrient supplementation. Advances in agricultural technologies, such as precision agriculture, remote sensing, and digital farming platforms, enable farmers to make data-driven decisions about nutrient management. These technologies facilitate the targeted application of micronutrients based on soil and crop requirements, optimizing nutrient use efficiency and crop productivity.

Restraint:

- Perception of High Cost

Micronutrient fertilizers and soil amendments are often more expensive than conventional fertilizers. The high cost of micronutrient products can be a barrier to adoption, particularly for smallholder farmers with limited financial resources. Economic constraints may limit the widespread use of micronutrient-based solutions, especially in low-income agricultural regions. Micronutrient management requires a nuanced understanding of soil characteristics, crop nutrient requirements, and environmental factors. Soil testing and nutrient analysis are essential for accurately diagnosing micronutrient deficiencies and determining appropriate fertilizer formulations. The complexity of nutrient management practices can pose challenges for farmers, particularly those with limited access to technical expertise and support services.

Opportunity:

⮚ Rising Demand for High-Value Crops

Increasing consumer demand for nutritious and high-quality food products, such as fruits, vegetables, and specialty crops, creates opportunities for micronutrient manufacturers. Micronutrients play a crucial role in enhancing crop quality, nutritional content, and market value, aligning with consumer preferences for healthy and sustainable food choices. The adoption of precision agriculture technologies, including soil and crop sensing, variable rate application, and GPS-guided equipment, offers opportunities for targeted micronutrient management. Precision agriculture enables farmers to optimize nutrient application based on spatial variability in soil properties and crop requirements, improving nutrient use efficiency and crop yields. Ongoing research and development efforts in micronutrient technology lead to innovations in product formulations, application methods, and delivery systems. Advanced micronutrient formulations, such as chelated and controlled-release products, offer improved nutrient availability, uptake efficiency, and crop response, providing competitive advantages for manufacturers and suppliers.

Agricultural Micronutrients Market Segment Overview

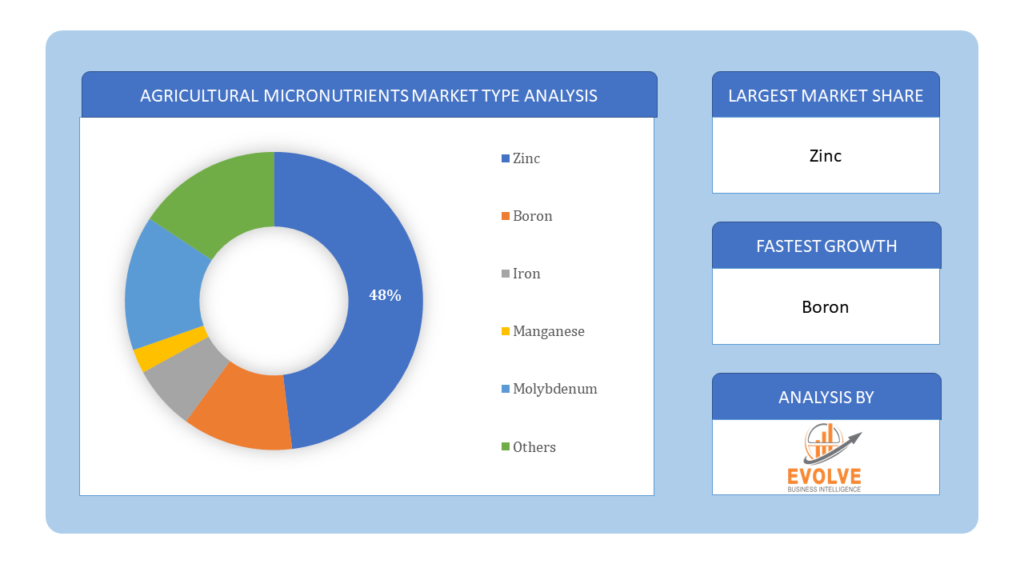

By Type

Based on Type, the market is segmented based on Zinc, Boron, Iron, Molybdenum, Copper and Manganese. The zinc segment held the largest market share and it was expected to continue to dominate the market. Zinc is the most commonly used micronutrient in agriculture due to its multiple benefits, including promoting plant growth and development, enhancing crop yields, and improving resistance to diseases and pests.

Based on Type, the market is segmented based on Zinc, Boron, Iron, Molybdenum, Copper and Manganese. The zinc segment held the largest market share and it was expected to continue to dominate the market. Zinc is the most commonly used micronutrient in agriculture due to its multiple benefits, including promoting plant growth and development, enhancing crop yields, and improving resistance to diseases and pests.

By Crop Type

Based on Crop Type, the market has been divided into Cereals & Grains, Oilseeds & Pulses and Fruits & Vegetables. The cereals & grains segment held the largest market share. Cereals & grains are the most extensively cultivated crops worldwide, and they are major sources of food for human consumption and animal feed. The increasing population and changing dietary habits are expected to drive the demand for cereals & grains, which in turn is expected to boost the demand for agricultural micronutrients market in this segment.

By Application

Based on Application, the market has been divided into Soil, Foliar and Fertigation. The soil application segment contributed the largest share of the market. A typical and popular method for applying micronutrients in agriculture is through the soil. This segment enables the uniform distribution of micronutrients to plants using the standard equipment for fertilizer application. Due to the aforementioned reasons, soil mode of application is frequently used in agriculture and is therefore the Agricultural Micronutrients Market industry is anticipated to grow in popularity over the following years.

By End Use

Based on End Use, the market has been divided into Chelated and Non-Chelated. Chelated segment anticipated to dominant the market. Chelated micronutrients are frequently employed in agriculture and are also partially promoted by fertiliser producers. They are organic molecules that contain inorganic nutrients.

Global Agricultural Micronutrients Market Regional Analysis

Based on region, the global Agricultural Micronutrients Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Agricultural Micronutrients Market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America holds a dominant position in the Agricultural Micronutrients Market. North America is a mature market for agricultural micronutrients, characterized by advanced farming practices, extensive use of fertilizers, and a strong emphasis on soil health and crop nutrition. The United States and Canada are major producers and consumers of micronutrient fertilizers, driven by large-scale commercial agriculture and high-value crop production. Growing demand for micronutrient-enriched specialty crops and organic farming practices further fuels market growth.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Agricultural Micronutrients Market industry. Asia-Pacific is the largest and fastest-growing market for agricultural micronutrients, fueled by rapid population growth, increasing food demand, and expanding agricultural intensification. Countries such as China, India, and Southeast Asian nations are major consumers of micronutrient fertilizers, driven by large-scale rice, wheat, and vegetable production. Rising awareness about soil health, nutrient deficiencies, and micronutrient-responsive crops stimulates market growth, especially in regions with acidic soils and widespread nutrient deficiencies.

Competitive Landscape

The global Agricultural Micronutrients Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- BASF SE

- AkzoNobel

- Nutrien Ltd.

- Nufarm

- Coromandel International Ltd.

- Helena Chemical Company

- Yara International ASA

- The Mosaic Company

- Haifa Group

- BMS Micronutrient NV

Key Development

In August 2021, BASF launched its new micronutrient product, Basagran Zinc. The product is a combination of the herbicide Basagran and zinc, which helps in the proper growth and development of crops.

In May 2020, Nutrien Ltd. acquired Agrible, Inc., a digital agriculture company that provides agronomic and environmental solutions to growers. This acquisition is expected to enhance Nutrien’s offerings in the agricultural micronutrients market.

Scope of the Report

Global Agricultural Micronutrients Market, by Type

- Zinc

- Boron

- Iron

- Molybdenum

- Copper

- Manganese

Global Agricultural Micronutrients Market, by Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

Global Agricultural Micronutrients Market, by Application

- Soil

- Foliar

- Fertigation

Global Agricultural Micronutrients Market, by End Use

- Chelated

- Non-Chelated

Global Agricultural Micronutrients Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $15.96 Billion |

| CAGR | 8.76% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Crop Type, Application, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF SE, AkzoNobel, Nutrien Ltd., Nufarm, Coromandel International Ltd., Helena Chemical Company, Yara International ASA, The Mosaic Company, Haifa Group and BMS Micronutrient NV |

| Key Market Opportunities | • Rising Demand for High-Value Crops • Innovations in Product Formulations and Delivery Systems |

| Key Market Drivers | • Intensive Farming Practices • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Agricultural Micronutrients Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Agricultural Micronutrients Market historical market size for the year 2021, and forecast from 2023 to 2033

- Agricultural Micronutrients Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Agricultural Micronutrients Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.