Team Collaboration Software Market Overview

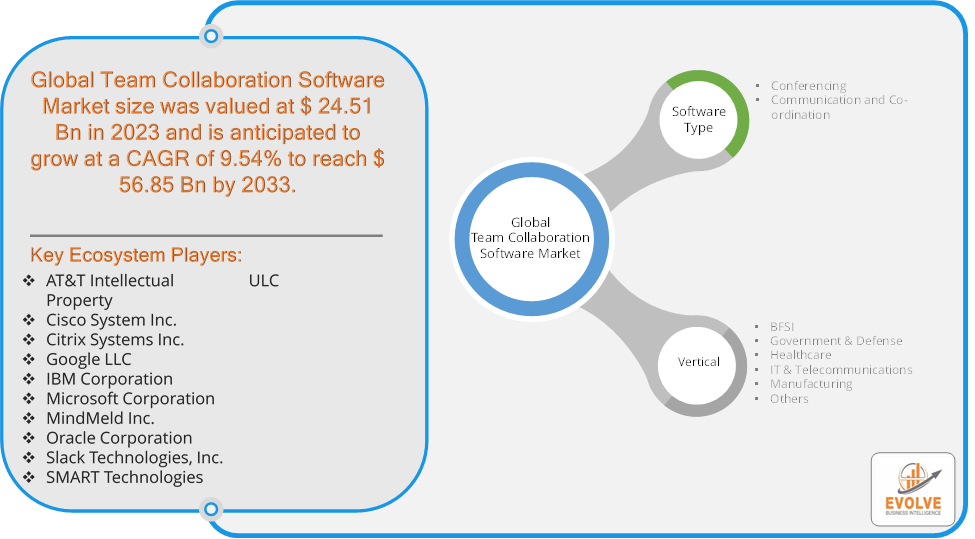

The Team Collaboration Software Market Size is expected to reach USD 56.85 Billion by 2033. The Team Collaboration Software Market industry size accounted for USD 24.51 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.54% from 2023 to 2033. The Team Collaboration Software Market refers to the industry focused on the development, distribution, and use of software solutions designed to facilitate communication, coordination, and collaboration among teams, whether they are working in the same location or remotely. These software solutions are essential for enhancing productivity and ensuring that team members can work together efficiently, even when they are geographically dispersed.

The Team Collaboration Software Market is expected to grow as businesses increasingly rely on digital tools to enhance team productivity and communication in a rapidly evolving work environment.

Global Team Collaboration Software Market Synopsis

The COVID-19 pandemic had a significant impact on the Team Collaboration Software Market. As lockdowns and social distancing measures were implemented globally, many organizations rapidly transitioned to remote work. This created an urgent need for effective team collaboration tools to maintain productivity and communication. With the increased use of collaboration tools, concerns about data security and privacy grew. This led to the introduction of more robust security measures, such as end-to-end encryption and secure access controls. The pandemic forced a broad range of industries, including education, healthcare, and government, to adopt team collaboration software. This widened the user base beyond traditional corporate environments. The pandemic normalized virtual meetings as a standard form of communication, reducing the reliance on in-person meetings and business travel. The surge in demand attracted new entrants into the market, leading to increased competition. Companies that previously offered different types of software pivoted to include collaboration features. The pandemic opened up opportunities for collaboration software providers to expand into new markets and demographics, particularly in regions and sectors that were previously underpenetrated.

Team Collaboration Software Market Dynamics

The major factors that have impacted the growth of Team Collaboration Software Market are as follows:

Drivers:

Ø Rise of Remote and Hybrid Work

The shift to remote work, accelerated by the COVID-19 pandemic, has made team collaboration software essential for maintaining productivity, communication, and collaboration among distributed teams. Many organizations have adopted hybrid work models, where employees work both remotely and on-site, driving ongoing demand for collaboration tools that facilitate seamless communication. The integration of artificial intelligence (AI) and automation in collaboration software is driving innovation, offering features like smart meeting scheduling, automated task assignments, and AI-driven insights. Advancements in internet infrastructure and 5G technology are enhancing the performance and reliability of collaboration tools, making them more accessible and efficient for users.

Restraint:

- Perception of High Implementation and Subscription Costs

While collaboration software can lead to long-term cost savings, the initial implementation and integration can be expensive, especially for small and medium-sized enterprises (SMEs). This can be a significant barrier to entry for organizations with limited budgets. Many collaboration tools operate on a subscription-based model, which can lead to ongoing costs. Organizations may experience subscription fatigue, especially if they are already paying for multiple software solutions, leading to reluctance in adopting additional tools.

Opportunity:

⮚ Enhancing Security and Compliance Features

As concerns about data security and privacy grow, particularly with the rise in remote work, there is a significant opportunity for vendors to differentiate themselves by offering enhanced security features. This includes end-to-end encryption, advanced authentication methods, and compliance with global and regional regulations like GDPR, HIPAA, and CCPA. The ongoing demand for workplace flexibility provides opportunities to innovate in areas like virtual offices, employee wellness tools, and seamless integration with remote work infrastructure.

Team Collaboration Software Market Segment Overview

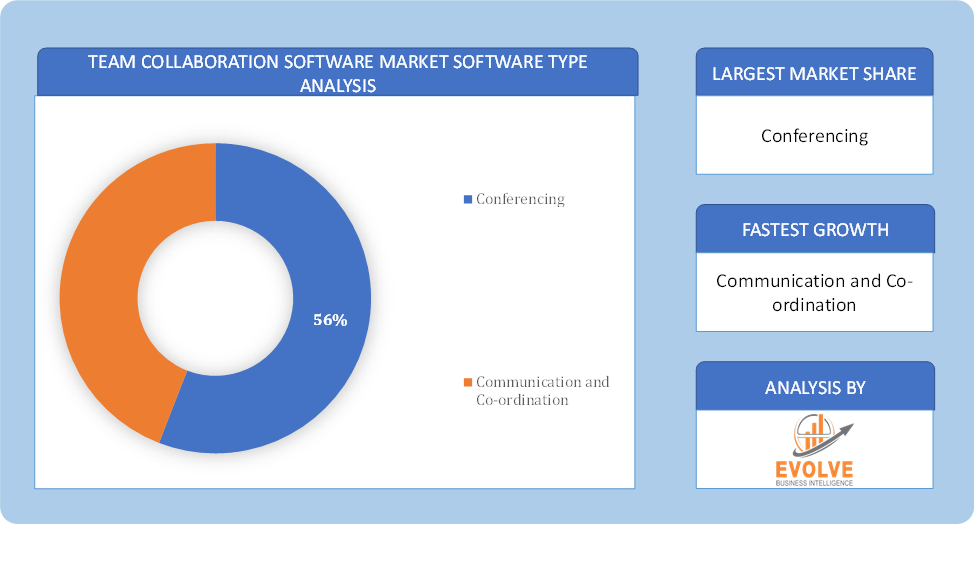

Based on Software Type, the market is segmented based on Conferencing, Communication and Co-ordination. The communication and co-ordination segment dominant the market. This is attributed to the essential role of communication and co-ordination tools in facilitating seamless interaction and collaboration among team members, regardless of their location. They include tools like instant messaging, email integration, shared calendars, and collaboration platforms for maintaining continuous and effective communication within organizations.

By Industry Vertical

Based on Industry Vertical, the market segment has been divided into BFSI, Government & Defense, Healthcare, IT & Telecommunications, Manufacturing and Others. The IT and telecommunications segment dominant the market. This is driven by the industry’s inherent need for efficient and effective communication tools to manage complex projects and coordinate among distributed teams. Moreover, the growing need for robust collaboration software as technology companies operate on a global scale with employees and stakeholders spread across different geographies is creating a positive outlook for the market.

Global Team Collaboration Software Market Regional Analysis

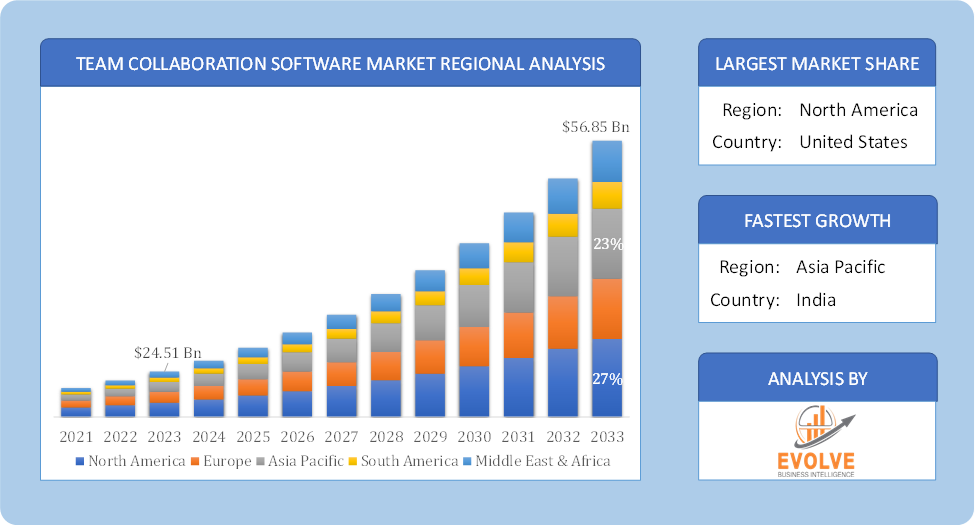

Based on region, the global Team Collaboration Software Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Team Collaboration Software Market followed by the Asia-Pacific and Europe regions.

Team Collaboration Software North America Market

Team Collaboration Software North America Market

North America holds a dominant position in the Team Collaboration Software Market. North America, particularly the United States, is one of the largest and most mature markets for team collaboration software. The region’s early adoption of digital technologies, advanced IT infrastructure, and widespread remote work practices drive market growth and the presence of major technology companies, strong emphasis on innovation, and the adoption of hybrid work models are significant drivers. Additionally, the COVID-19 pandemic further accelerated the use of collaboration tools across various industries.

Team Collaboration Software Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Team Collaboration Software Market industry. Asia-Pacific is one of the fastest-growing regions in the team collaboration software market, driven by the rapid digitalization of businesses, increasing internet penetration, and the growing adoption of remote work practices. The region comprises diverse markets, from technologically advanced countries like Japan, South Korea, and Singapore, to emerging economies like India and Indonesia, where there is substantial growth potential.

Competitive Landscape

The global Team Collaboration Software Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- AT&T Intellectual Property

- Cisco System Inc.

- Citrix Systems Inc.

- Google LLC

- IBM Corporation

- Microsoft Corporation

- MindMeld Inc.

- Oracle Corporation

- Slack Technologies, Inc.

- SMART Technologies ULC

Key Development

In March 2024, Adobe and Microsoft announced plans to bring Adobe Experience Cloud workflows and insights to Microsoft Copilot for Microsoft 365. This will help marketers overcome application and data silos and more efficiently manage everyday workflows. These new integrated capabilities will bring relevant marketing insights and workflows from Adobe Experience Cloud applications and Microsoft Dynamics 365 to Microsoft Copilot, assisting marketers as they work in tools such as Outlook, Microsoft Teams, and Word to develop creative briefs, create content, manage content approvals, deliver experiences, and more.

Scope of the Report

Global Team Collaboration Software Market, by Software Type

- Conferencing

- Communication and Co-ordination.

Global Team Collaboration Software Market, by Industry Vertical

- BFSI

- Government & Defense

- Healthcare

- IT & Telecommunications

- Manufacturing

- Others

Global Team Collaboration Software Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 56.85 Billion |

| CAGR (2023-2033) | 9.54% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Software Type, Industry Vertical |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | AT&T Intellectual Property, Cisco System Inc., Citrix Systems Inc., Google LLC, IBM Corporation, Microsoft Corporation, MindMeld Inc., Oracle Corporation, Slack Technologies, Inc. and SMART Technologies ULC |

| Key Market Opportunities | · Enhancing Security and Compliance Features |

| Key Market Drivers | · Rise of Remote and Hybrid Work

· Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Team Collaboration Software Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Team Collaboration Software Market historical market size for the year 2021, and forecast from 2023 to 2033

- Team Collaboration Software Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Team Collaboration Software Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the global Team Collaboration Software Market?

The global Team Collaboration Software Market is growing at a CAGR of 9.54% over the next 10 years

Which region has the highest growth rate in the market of Team Collaboration Software Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Team Collaboration Software Market?

North America holds the largest share in 2022

Who are the key players in the global Team Collaboration Software Market?

AT&T Intellectual Property, Cisco System Inc., Citrix Systems Inc., Google LLC, IBM Corporation, Microsoft Corporation, MindMeld Inc., Oracle Corporation, Slack Technologies, Inc. and SMART Technologies ULC. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.