Silicone Elastomer Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

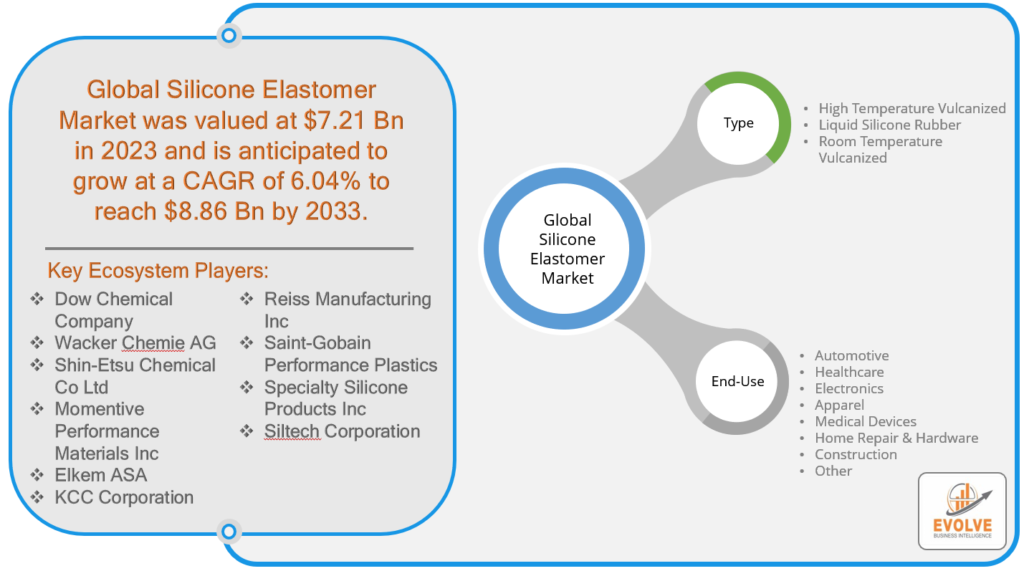

Silicone Elastomer Market Research Report: Information By Type (High-Temperature Vulcanized, Liquid Silicone Rubber, Room Temperature Vulcanized), By End-Use (Automotive, Healthcare, Electronics, Apparel, Medical Devices, Home Repair & Hardware, Construction, Other), and by Region — Forecast till 2033

Silicone Elastomer Market Overview

The Silicone Elastomer Market Size is expected to reach USD 8.86 Billion by 2033. The Silicone Elastomer industry size accounted for USD 7.21 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.04% from 2023 to 2033. Silicone elastomer refers to a class of synthetic elastomeric materials that are primarily composed of silicone polymers. It is a versatile material known for its unique combination of elastomeric properties, such as high elasticity, flexibility, and resilience, along with the exceptional temperature resistance and electrical insulation characteristics inherent to silicone-based materials. Silicone elastomers exhibit excellent durability, weather ability, and resistance to aging, making them suitable for a wide range of applications across various industries. These materials are formulated through the cross-linking of silicone polymers, resulting in a three-dimensional network structure that imparts elastomeric properties. Silicone elastomers find extensive use in diverse sectors, including automotive, healthcare, electronics, construction, and consumer goods, owing to their superior performance attributes and compatibility with stringent regulatory requirements.

Global Silicone Elastomer Market Synopsis

The COVID-19 pandemic had a profound and remarkable impact on the Silicone Elastomer market. The global crisis disrupted supply chains, halted manufacturing activities, and caused significant shifts in consumer behavior and market dynamics. The widespread lockdowns and travel restrictions imposed to curb the spread of the virus led to a decline in industrial and commercial activities, thereby reducing the demand for silicone elastomers across multiple sectors. Industries such as automotive, construction, and electronics experienced a slowdown, affecting the demand for silicone elastomers in applications like gaskets, seals, and electrical components. Additionally, the medical sector, which is a major consumer of silicone elastomers, witnessed a shift in priorities toward manufacturing essential medical supplies and equipment, impacting the demand for non-critical silicone elastomer products. However, the pandemic also highlighted the importance of silicone elastomers in critical applications like healthcare, where they were used in the production of personal protective equipment (PPE), medical devices, and vaccine storage solutions.

Silicone Elastomer Market Dynamics

The major factors that have impacted the growth of Silicone Elastomers are as follows:

Drivers:

Rising Demand in the Healthcare and Medical Industry

Silicone elastomers are widely used in medical devices and healthcare applications due to their biocompatibility, flexibility, and resistance to sterilization processes. The expanding healthcare sector, coupled with the growing aging population and increasing prevalence of chronic diseases, is driving the demand for silicone elastomers in medical applications such as implants, prosthetics, and wearable devices.

Restraint:

- Volatility in raw material prices

The prices of key raw materials utilized in the production of silicone elastomers, including silicone polymers and fillers, are subject to frequent fluctuations. These fluctuations can arise from various factors such as changes in supply and demand dynamics, geopolitical events, currency exchange rates, and shifts in global trade policies. The impact of fluctuating raw material prices is felt throughout the supply chain of silicone elastomer manufacturers. When the prices of silicone polymers and fillers increase, it directly raises the production costs of silicone elastomers. This can pose challenges for market players as they strive to maintain competitive pricing while ensuring profitability.

Opportunity:

Advancements in Silicone Elastomer Technologies

Ongoing research and development activities are driving technological advancements in silicone elastomers. These advancements aim to enhance the performance characteristics of silicone elastomers, such as improved heat resistance, mechanical properties, and processability. These developments open up new opportunities for the application of silicone elastomers in various industries.

Silicone Elastomer Segment Overview

By Type

Based on Type, the market is segmented based on High-Temperature Vulcanized, Liquid Silicone Rubber, Room Temperature Vulcanized. The Liquid Silicone Rubber (LSR) segment is expected to witness significant growth during the forecast period. LSR offers unique advantages such as excellent thermal stability, electrical insulation properties, and resistance to aging and chemicals, making it ideal for a wide range of applications. LSR is widely used in industries such as healthcare, automotive, electronics, and consumer goods due to its biocompatibility, transparency, and ease of processing.

Based on Type, the market is segmented based on High-Temperature Vulcanized, Liquid Silicone Rubber, Room Temperature Vulcanized. The Liquid Silicone Rubber (LSR) segment is expected to witness significant growth during the forecast period. LSR offers unique advantages such as excellent thermal stability, electrical insulation properties, and resistance to aging and chemicals, making it ideal for a wide range of applications. LSR is widely used in industries such as healthcare, automotive, electronics, and consumer goods due to its biocompatibility, transparency, and ease of processing.

By End-Use

Based on End-Use, the market has been divided into Automotive, Healthcare, Electronics, Apparel, Medical Devices, Home Repair & Hardware, Construction, and Others. Automotive dominates the Silicone Elastomer Market. Silicone elastomers offer exceptional temperature resistance, durability, and electrical insulation properties, making them highly suitable for automotive applications. They are used extensively in gaskets, seals, O-rings, and other components to provide reliable sealing, vibration damping, and protection against harsh environmental conditions. Additionally, silicone elastomers exhibit excellent resistance to fuel, oils, and automotive fluids, ensuring long-lasting performance. The automotive sector’s constant drive for lightweight, fuel efficiency and enhanced safety features further increases the demand for silicone elastomers.

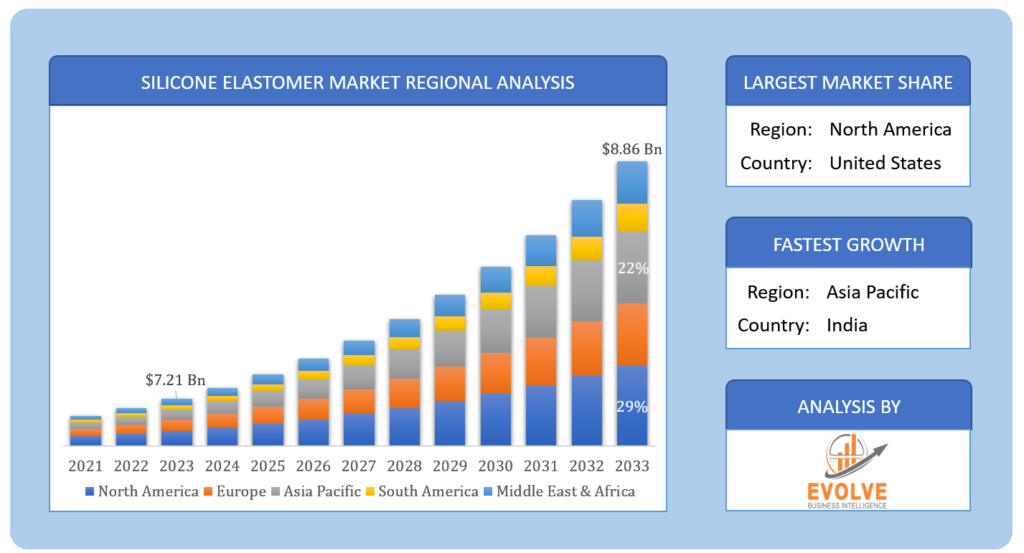

Global Silicone Elastomer Market Regional Analysis

Based on region, the global Silicone Elastomer market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Silicone Elastomer market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America has indeed maintained a dominant position in the Silicone Elastomer market. The region’s strong position can be attributed to several factors. First, North America is home to a robust industrial and manufacturing base, with key industries such as automotive, healthcare, electronics, and aerospace utilizing silicone elastomers in various applications. The region’s advanced infrastructure and technological advancements provide a conducive environment for the production and consumption of silicone elastomers. Additionally, North America has a well-established regulatory framework that ensures the quality and safety of silicone elastomer products, which instills confidence among end-users. Furthermore, the presence of major market players, research institutions, and investments in research and development activities contribute to the region’s leadership in silicone elastomers. As a result, North America continues to witness steady growth and innovation in the Silicone Elastomer market, reinforcing its dominant position in the industry.

Asia-Pacific Market

The Asia-Pacific region has emerged as a rapidly growing market for the Silicone Elastomer industry. Several factors have contributed to the region’s significant growth in this sector. First and foremost, the region has witnessed rapid industrialization, urbanization, and economic growth, leading to increased demand across various end-use industries such as automotive, electronics, healthcare, and construction, all of which heavily rely on silicone elastomers. The expanding middle-class population, improving living standards, and infrastructure development have further fueled the demand for silicone elastomers in the region. Moreover, countries like China and India have become manufacturing hubs, attracting investments and establishing a strong manufacturing base, thereby driving the consumption of silicone elastomers. Additionally, the region benefits from a large consumer base, which has fueled the demand for consumer goods and electronics, where silicone elastomers find wide applications.

Competitive Landscape

The Global Silicone Elastomer market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Dow Chemical Company

- Wacker Chemie AG

- Shin-Etsu Chemical Co Ltd

- Momentive Performance Materials Inc

- Elkem ASA

- KCC Corporation

- Reiss Manufacturing Inc

- Saint-Gobain Performance Plastics

- Specialty Silicone Products Inc

- Siltech Corporation

Key Development

In October 2022, Elkem ASA unveiled its latest dedicated establishment situated on Timberland Court. Covering an area of 18,000 square feet, this state-of-the-art facility will manufacture top-quality medical silicone materials with exceptional purity to cater to the demands of the MedTech and Pharma sectors.

Scope of the Report

Global Silicone Elastomer Market, by Type

- High Temperature Vulcanized

- Liquid Silicone Rubber

- Room Temperature Vulcanized

Global Silicone Elastomer Market, by Application

- Automotive

- Healthcare

- Electronics

- Apparel

- Medical Devices

- Home Repair & Hardware

- Construction

- Other

Global Silicone Elastomer Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

• Increasing Focus on Sustainable and Eco-Friendly Materials

• Advancements in Silicone Elastomer Technologies• Increasing demand for data-driven decision-making

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.86 Billion |

| CAGR | 6.04% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, End-Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Dow Chemical Company, Wacker Chemie AG, Shin-Etsu Chemical Co Ltd, Momentive Performance Materials Inc, Elkem ASA, KCC Corporation, Reiss Manufacturing Inc, Saint-Gobain Performance Plastics, Specialty Silicone Products Inc, Siltech Corporation |

| Key Market Opportunities | |

| Key Market Drivers |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Silicone Elastomer market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Silicone Elastomer market historical market size for the year 2021, and forecast from 2023 to 2033

- Silicone Elastomer market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Silicone Elastomer market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

The study period of the global Silicone Elastomer market is 2021- 2033

The Global Silicone Elastomer market is growing at a CAGR of 6.04% over the next 10 years

Asia Pacific is expected to register the highest CAGR during 2023-2033

North America holds the largest share in 2022

Dow Chemical Company, Wacker Chemie AG, Shin-Etsu Chemical Co Ltd, Momentive Performance Materials Inc, Elkem ASA, KCC Corporation, Reiss Manufacturing Inc, Saint-Gobain Performance Plastics, Specialty Silicone Products Inc, Siltech Corporation are the major companies operating in the market.

Yes, we offer 16 hours of analyst support to solve the queries

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Material Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Silicone Elastomer Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Silicone Elastomer Market 4.8. Import Analysis of the Silicone Elastomer Market 4.9. Export Analysis of the Silicone Elastomer Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Silicone Elastomer Market, By Type 6.1. Introduction 6.2. High-Temperature Vulcanized 6.3. Liquid Silicone Rubber 6.4. Room Temperature Vulcanized Chapter 7. Global Silicone Elastomer Market, By End-Use 7.1. Introduction 7.2. Automotive 7.3. Healthcare 7.4. Electronics 7.5. Apparel 7.6. Medical Devices 7.7. Home Repair & Hardware 7.8. Construction 7.9. Other Chapter 8. Global Silicone Elastomer Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Type, 2023-2033 8.2.5. Market Size and Forecast, By End-Use, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End-Use, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End-Use, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Type, 2023-2033 8.3.5. Market Size and Forecast, By End-Use, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End-Use, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End-Use, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End-Use, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End-Use, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End-Use, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Type, 2023-2033 8.12.28. Market Size and Forecast, By End-Use, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End-Use, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End-Use, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End-Use, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End-Use, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End-Use, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Type, 2023-2033 8.5.4. Market Size and Forecast, By End-Use, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Dow Chemical Company 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Wacker Chemie AG 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Shin-Etsu Chemical Co Ltd 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Momentive Performance Materials Inc 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Elkem ASA 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. KCC Corporation 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Reiss Manufacturing Inc 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Saint-Gobain Performance Plastics 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Specialty Silicone Products Inc 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Siltech Corporation 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology