Pharmaceutical Quality Control Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

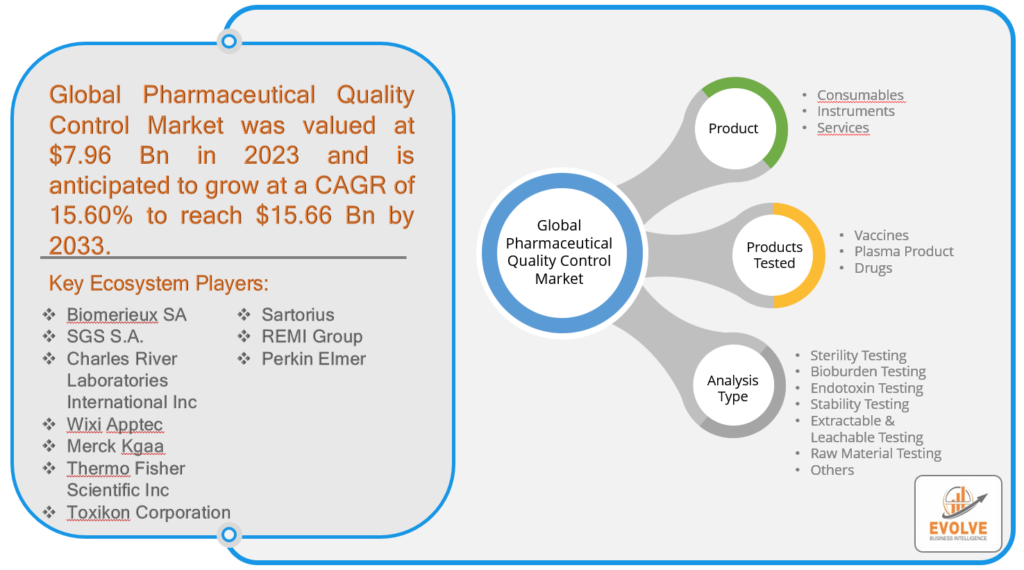

Pharmaceutical Quality Control Market Research Report: By Product (Consumables, Instruments, Services), By Products Tested (Vaccines, Plasma Products, Drugs), By Analysis Type (Sterility Testing, Bioburden Testing, Endotoxin Testing, Stability Testing, Extract able & Leachable Testing, Raw Material Testing, Others), and Region — Forecast till 2033

PRESS RELEASE:https://evolvebi.com/the-global-pharmaceutical-quality-control-market-is-estimated-to-record-a-cagr-of-around-15-60-during-the-forecast-period/

Pharmaceutical Quality Control Market Overview

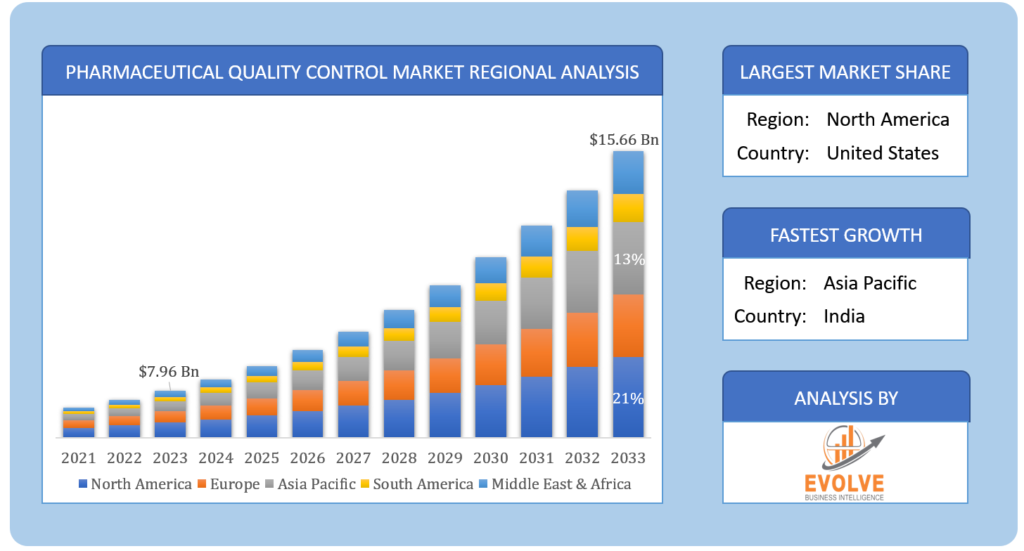

Pharmaceutical Quality Control Market Size is expected to reach USD 15.66 Billion by 2033. ThePharmaceutical Quality Controlindustry size accounted for USD 7.96 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 15.60% from 2023 to 2033.Pharmaceutical Quality Control is a process of verifying that pharmaceutical products conform to the specified quality standards in terms of safety, efficacy, and purity. This involves a comprehensive series of tests, inspections, and evaluations at different stages of the manufacturing process to detect any deviations from the expected quality parameters. The QC activities commence with the testing of raw materials and continue throughout the manufacturing process, including in-process and finished product testing, and stability testing to ascertain the product’s long-term stability. The tests performed during QC may comprise physical, chemical, and microbiological analyses, in addition to the evaluation of product performance and packaging. The primary objective of pharmaceutical QC is to ensure that the products are consistent in terms of quality, potency, and purity, and comply with regulatory requirements and customer expectations. This is a crucial element of pharmaceutical manufacturing that serves to prevent defects, maintain product quality, and guarantee patient safety.

COVID-19 Impact and Post-COVID Scenario

COVID-19 Impact and Post-COVID Scenario

The COVID-19 pandemic has certainly had a significant impact on the pharmaceutical industry, including the pharmaceutical quality control market. The pandemic has led to a surge in demand for pharmaceutical products, including vaccines, therapeutics, and diagnostics, which has increased the need for stringent quality control measures. With the urgent need for COVID-19 treatments and vaccines, regulatory agencies such as the FDA and EMA have expedited the approval process, but have also placed a heightened emphasis on ensuring that these products are safe and effective. As a result, pharmaceutical companies have had to invest more heavily in quality control measures to ensure that their products meet the required standards. Moreover, the pandemic has highlighted the importance of global supply chain resilience and the need for robust quality control measures to ensure the safety and efficacy of pharmaceutical products. This has led to an increased focus on quality control across the entire pharmaceutical industry, including both small and large-scale manufacturers.

Global Pharmaceutical Quality Control Market Growth Factors

- Increasing focus on personalized medicine

The increasing prevalence of chronic diseases is one of the major drivers of the market. Chronic diseases, such as cancer, cardiovascular diseases, diabetes, and respiratory diseases, are significant public health challenges worldwide. According to the World Health Organization (WHO), chronic diseases are responsible for approximately 71% of all deaths globally. The rising incidence of chronic diseases has led to an increased demand for pharmaceutical products, including drugs and biologics. These products require rigorous quality control measures to ensure that they are safe and effective for patient use. Pharmaceutical quality control plays a critical role in ensuring that these products meet the required quality standards and are suitable for use in the treatment of chronic diseases. Additionally, as the demand for pharmaceutical products for chronic diseases increases, so does the need for consistent and reliable quality control measures. This is particularly important for the production of generic drugs, which are often used to treat chronic diseases. Generic drugs must meet the same quality standards as their branded counterparts, and pharmaceutical quality control helps to ensure that these standards are met.

Global Pharmaceutical Quality Control Market Restraining Factors

- High cost of quality control

Implementing and maintaining quality control measures can be costly, particularly for small and mid-sized pharmaceutical companies. These costs can include expenses for specialized equipment, trained personnel, and compliance with regulatory requirements. The high cost of quality control can also impact drug pricing. Pharmaceutical companies may pass on the cost of quality control to consumers, resulting in higher drug prices. This may make pharmaceutical products less accessible to some patient populations, particularly those in developing countries or with limited access to healthcare. Moreover, the cost of quality control may also impact research and development (R&D) efforts. Pharmaceutical companies may be hesitant to invest in R&D for new drugs or biologics if the cost of quality control is too high, particularly for smaller companies with limited financial resources.

Global Pharmaceutical Quality Control Market Opportunity Analysis

advancements in technology are creating significant opportunities for the pharmaceutical quality control market. Automation, artificial intelligence, real-time monitoring, advanced analytics, and digitalization are transforming the pharmaceutical industry, and companies that can leverage these technologies to improve the accuracy, efficiency, and cost-effectiveness of quality control measures will be well-positioned to succeed in the market.

Global Pharmaceutical Quality Control Market Segment Analysis

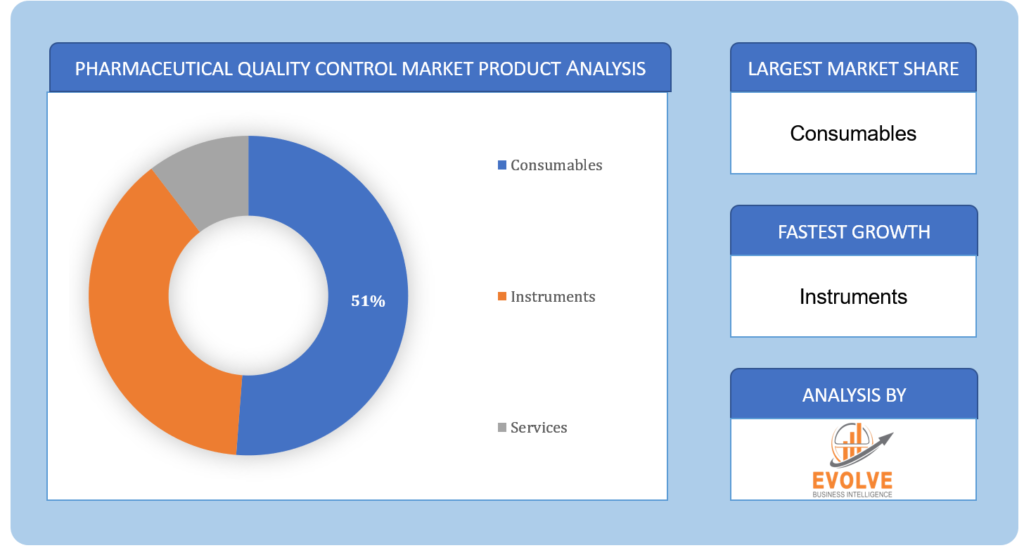

The Consumables segment is expected to hold the largest market share in 2023

Based on the Product, the market is segmented based on Consumables, Instruments, and Services. The largest market share is anticipated to go to the Consumablessegment.Driven by elements including rising demand for analytical testing services and an increase in the quantity of product and medicine launches.

TheVaccinessegment is expected to hold the largest market share in 2023

Based on Products Tested, the market has been divided intoVaccines, Plasma Products, and Drugs.The Vaccinessegment is expected to hold the largest market share in the Market, due to increasing demand for preventive healthcare, government initiatives for vaccination programs, and the ongoing COVID-19 pandemic. The development and manufacturing of vaccines require stringent quality control measures to ensure their safety, efficacy, and potency.

The Sterility Testing segment is expected to hold the largest market share in 2023

Based on Analysis Type, the market has been divided into Sterility Testing, Bioburden Testing, Endotoxin Testing, Stability Testing, Extractable & Leachable Testing, Raw Material Testing, and Others.The market is projected to see significant growth in the sterility testing segment due to factors such as the rising demand for biologics and biosimilars, the expansion of the pharmaceutical and biotechnology industries, and the rise in hospital-acquired infections.

Global Pharmaceutical Quality Control Market, Segmental Chart

Pharmaceutical Quality Control Market Regional Analysis

Pharmaceutical Quality Control Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, theMiddle East & Africa, and Latin America. The area of Europe is anticipated to dominate the market for the usage of Pharmaceutical Quality Control, followed by those in Asia-Pacific and North America.

Regional Coverage:

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- Thailand

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

Europe Market

The Europe region is the leading market for Pharmaceutical Quality Control. Europe is home to several leading pharmaceutical companies, such as Roche, Novartis, and Sanofi, and has a robust regulatory framework for drug development and manufacturing. The European Medicines Agency (EMA) is the regulatory body responsible for approving and monitoring medicinal products in the European Union (EU) and plays a critical role in ensuring the quality, safety, and efficacy of medicines in the EU.

Asia Pacific Market

The pharmaceutical business in the Asia Pacific area has seen enormous growth as a result of several reasons, including a sizable population, rising demand for high-quality healthcare, and expanding pharmaceutical sector investments. There are numerous developing nations in the area, such as China, India, and Japan, who have made large investments in their healthcare industries.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Merck Kgaa, Thermo Fisher Scientific Inc, Toxikon Corporation, and Sartorius are some of the leading players in the global Pharmaceutical Quality ControlIndustry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Biomerieux SA

- SGS S.A.

- Charles River Laboratories International Inc

- Wixi Apptec

- Merck Kgaa

- Thermo Fisher Scientific Inc

- Toxikon Corporation

- Sartorius

- REMI Group

- Perkin Elmer

Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

On February2022, Merck announced the launch of a new quality control platform for Pharmaceutical Manufacturing.

On October 2021, Merck announced a collaboration with Vineti to Strengthen its Quality Control Capabilities.

Report Scope:

Global Pharmaceutical Quality Control Market, by Product

- Consumables

- Instruments

- Services

Global Pharmaceutical Quality Control Market, by Products Tested

- Vaccines

- Plasma Product

- Drugs

Global Pharmaceutical Quality Control Market, by Analysis Type

- Sterility Testing

- Bioburden Testing

- Endotoxin Testing

- Stability Testing

- Extractable & Leachable Testing

- Raw Material Testing

- Others

Pharmaceutical Quality Control Market Synopsis:

| PARAMETER | VALUE |

Market Size | · 2023: USD 9.8 Billion· 2033: USD 15.66 Billion |

Growth Rate | · First 5 Years CAGR (2023–2028): XX%· Last 5 Years CAGR (2028–2033): XX%· 10 Years CAGR (2023–2033): 15.60% |

Key Market Drivers | · Increasing focus on personalized medicine· Increasing focus on patient safety |

Key Market Restraints | · High cost of quality control |

Market Opportunities | · Advancements in technology· Increasing regulatory focus on quality control |

Key Market Players | · Biomerieux SA· SGS S.A.· Charles River Laboratories International Inc· Wixi Apptec· Merck Kgaa· Thermo Fisher Scientific Inc· Toxikon Corporation· Sartorius· REMI Group· Perkin Elmer |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Pharmaceutical Quality ControlIndustry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Pharmaceutical Quality Control market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Pharmaceutical Quality Control market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Pharmaceutical Quality Control Market

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Hydrogen Fuel Cell Market Analysis and Global Forecast 2023-2035

Hydrogen Fuel Cell Market Research Report: Information by Type (Proton Exchange Membrane Fuel cells, Phosphoric Acid Fuel Cells, Solid Oxide Fuel Cells, Molten Carbonate Fuel Cells, Others), By Application (Stationary, Transportation, Portable), By End-Use (Fuel Cell Vehicles, Utilities, Defense), and by Region — Forecast till 2033

Page: 116

HoReCa Market Analysis and Global Forecast 2023-2035

HoReCa Market Research Report: Information By Service Type (Hotels, Restaurants, Cafés, Pubs), By Category (Single Outlet, HoReCa Chain), and by Region — Forecast till 2035

Page: 116

Medical Nitrile Gloves Market Analysis and Global Forecast 2023-2033

Medical Nitrile Gloves Market Research Report: Information By Type (Powdered gloves, Non-powdered gloves), By Usage (Disposable, Reusable), By Application (Medical & Healthcare, Food Industry, Cleaning Industry, Others), By End Use (Ambulatory Surgery Centers, Diagnostic Centers, Rehabilitation Centers), and by Region — Forecast till 2033

Page: 116

Bidets Market Analysis and US Forecast 2023-2033

US Bidets Market By Type (Ceramic Bidets, Over the Rim Bidets, Handheld Bidets, Others), By Category (Electronics, Manual), By Distribution Channel (Store-Based, Non-Store-Based), By End Use (Residential, Commercial) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2021 to 2028

Report Code: EB_LS_1279 | Page: 59 | Published Date: April 2022

Semiconductor Rectifiers Market Analysis and Global Forecast 2023-2033

Semiconductor Rectifiers Market Research Report: Information By Type (Half Wave, Full Wave), By Industry Vertical (Communication, Consumer Electronics, Automotive, Manufacturing), and by Region — Forecast till 2033

Page: 165

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Pharmaceutical Quality Control (PQC) market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Pharmaceutical Quality Control market?

The global Pharmaceutical Quality Control market is growing at a CAGR of ~60% over the next 10 years

Which region has the highest growth rate in the market of Pharmaceutical Quality Control?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Pharmaceutical Quality Control?

Europe holds the largest share in 2022

Major Key Players in the Market of Pharmaceutical Quality Control?

Biomerieux, SGS S.A., Charles River Laboratories International Inc, Wixi Apptec, Merck Kgaa, Thermo Fisher Scientific Inc, Toxikon Corporation, Sartorius, REMI Group, Perkin Elmer are the major companies operating in the Pharmaceutical Quality Control

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Product Segement – Market Opportunity Score

4.1.2. Products Tested Segment – Market Opportunity Score

4.1.3. Analysis Type Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Pharmaceutical Quality Control Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. MArket Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Global Pharmaceutical Quality Control Market, By Product

7.1. Introduction

7.1.1. Consumables

7.1.2. Instruments

7.1.3. Services

CHAPTER 8. Global Pharmaceutical Quality Control Market, By Products Tested

8.1. Introduction

8.1.1. Vaccines

8.1.2. Plasma Product

8.1.3. Drugs

CHAPTER 9. Global Pharmaceutical Quality Control Market, By Analysis Type

9.1. Introduction

9.1.1. Sterility Testing

9.1.2. Bioburden Testing

9.1.3. Endotoxin Testing

9.1.4. Stability Testing

9.1.5. Extractable & Leachable Testing

9.1.6. Raw Material Testing

9.1.7. Others

CHAPTER 10. Global Pharmaceutical Quality Control Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.2.2. North America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.2.3. North America: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.2.4. North America: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.2.5.2. US: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.2.5.3. US: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.2.6.3. Canada: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.3.2. Europe: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.3.3. Europe: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.3.4. Europe: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.3.6.3. Germany: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.3.7.2. France: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.3.7.3. France: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.3.8.3. Italy: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.3.9.3. Spain: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.3.11.3. Russia: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.5.2. China: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.5.3. China: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.6.3. Japan: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.7.2. India: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.7.3. India: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.12.3. Australia: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.5.2. South America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.5.3. South America: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.5.4. South America: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.6.6.3. UAE: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Products Tested, 2023 – 2033 ($ Million)

10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Analysis Type, 2023 – 2033 ($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Biomerieux SA

13.1.1. Business Overview

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. SGS S.A.

13.3. Charles River Laboratories International Inc

13.4. Wixi Apptec

13.5. Merck Kgaa

13.6. Thermo Fisher Scientific Inc

13.7. Toxikon Corporation

13.8. Sartorius

13.9. REMI Group

13.10. Perkin Elmer

Connect to Analyst

Research Methodology