Pharmaceutical Manufacturing Market Analysis and Global Forecast 2024-2035

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

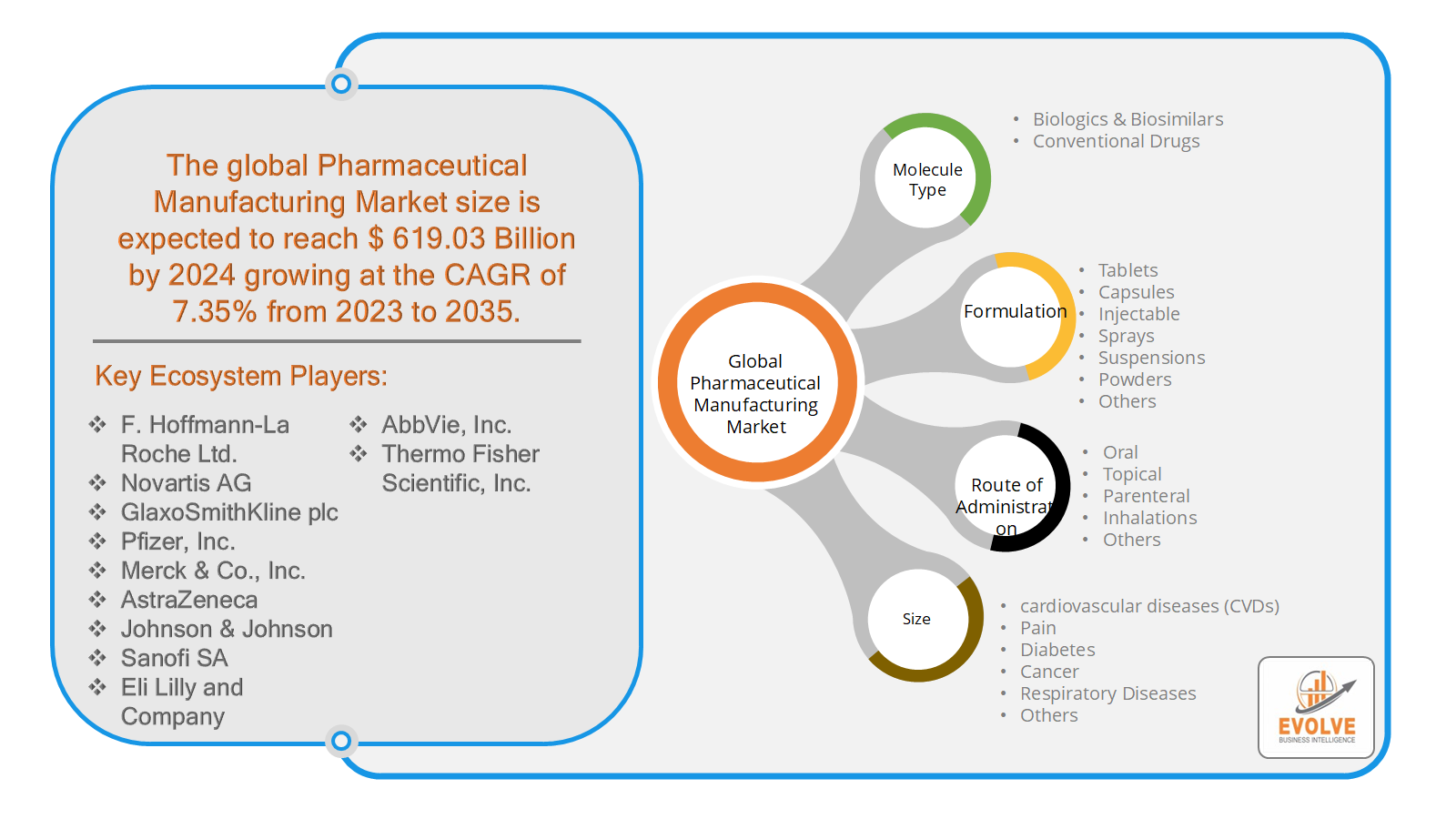

Pharmaceutical Manufacturing Market Research Report: Information By Molecule Type (Biologics & Biosimilars, Conventional Drugs), By Formulation (Tablets, Capsules, Injectable, Sprays, Suspensions, Powders, Others), By Route Of Administration (Oral, Topical, Parenteral, Inhalations, Others), By Therapy Area (cardiovascular diseases (CVDs), Pain, Diabetes, Cancer, Respiratory Diseases, Others), and by Region — Forecast till 2034

Page: 165

Pharmaceutical Manufacturing Market Overview

The Pharmaceutical Manufacturing Market size accounted for USD 562.35 Billion in 2023 and is estimated to account for 619.03 Billion in 2024. The Market is expected to reach USD 1379.59 Billion by 2035 growing at a compound annual growth rate (CAGR) of 31.75% from 2024 to 2035. The Pharmaceutical Manufacturing Market refers to the industry involved in the production of medications, including prescription and over-the-counter drugs, through chemical synthesis, fermentation, or biotechnological processes. This market plays a critical role in global healthcare by supplying drugs needed to prevent, treat, or manage various health conditions.

The pharmaceutical manufacturing market is a dynamic and expanding industry driven by increasing healthcare needs, technological advancements, and a growing focus on innovative treatments. The market presents numerous opportunities for growth across various segments and regions, with a continuous evolution in manufacturing processes and therapeutic focus.

Global Pharmaceutical Manufacturing Market Synopsis

Pharmaceutical Manufacturing Market Dynamics

Pharmaceutical Manufacturing Market Dynamics

The major factors that have impacted the growth of Pharmaceutical Manufacturing Market are as follows:

Drivers:

- Rising Prevalence of Chronic Diseases and Aging Global Population

Increasing rates of conditions such as cancer, diabetes, cardiovascular diseases, and autoimmune disorders are driving demand for both generic and innovative pharmaceuticals. Older adults typically require more medications due to age-related health issues, leading to a surge in pharmaceutical consumption and manufacturing needs. Implementation of AI, IoT, continuous manufacturing, and automation improves production efficiency, reduces cost, and enhances product quality. Pharmaceutical companies are increasingly outsourcing manufacturing to Contract Development and Manufacturing Organizations (CDMOs) to reduce costs and time-to-market.

Restraint:

- High Capital Investment

Establishing pharmaceutical manufacturing facilities, especially for biologics, requires significant upfront investment in infrastructure, equipment, and skilled labor. Events like pandemics, geopolitical conflicts, and raw material shortages can severely affect drug production and distribution. The industry requires highly skilled professionals in areas like bioprocessing, GMP compliance, and quality assurance—positions that are often hard to fill and government cost-control measures, especially in public healthcare systems, and pressure from insurance providers reduce profit margins for manufacturers.

Opportunity:

⮚ Adoption of Advanced Manufacturing Technologies

Technologies such as continuous manufacturing, 3D printing, AI-driven automation, and single-use systems are transforming drug production—improving efficiency and scalability. The pandemic highlighted the importance of vaccine manufacturing. Ongoing efforts in pandemic preparedness and rising awareness of preventive care are creating long-term demand. The integration of IoT, AI, and data analytics into manufacturing operations (known as Pharma 4.0) offers opportunities for real-time monitoring, predictive maintenance, and improved compliance.

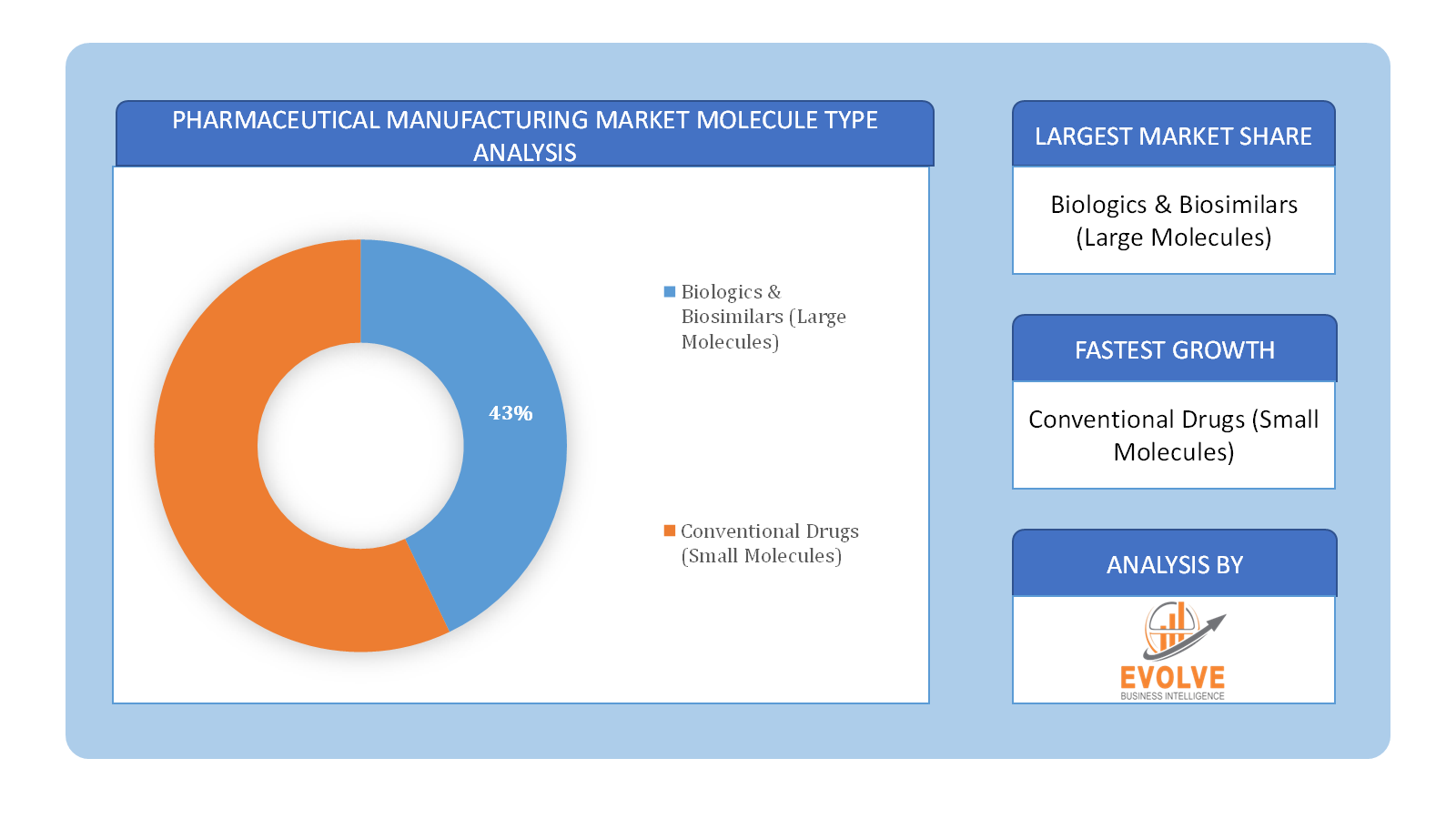

Pharmaceutical Manufacturing Market Segment Overview

Based on Molecule Type, the market is segmented based on Biologics & Biosimilars and Conventional Drugs. The Conventional Drugs segment dominant the market. The Conventional Drugs segment in pharmaceutical manufacturing refers to small-molecule medications that are chemically synthesized and widely used for treating a broad range of diseases. These drugs include tablets, capsules, injectables, and topical formulations, covering therapeutic areas such as cardiovascular diseases, infections, pain management, and neurological disorders.

By Formulation

Based on Formulation, the market segment has been divided into Tablets, Capsules, Injectable, Sprays, Suspensions, Powders, Others. The Tablets segment dominant the market. The Tablets segment refers to a solid dosage form in which active pharmaceutical ingredients (APIs) and excipients are compressed into a defined shape, typically for oral administration. Tablets are one of the most common and widely used drug formulations due to their stability, precise dosing, ease of storage, and patient convenience. They can be manufactured in various types, including immediate-release, extended-release, chewable, sublingual, and effervescent tablets, depending on the intended drug delivery mechanism.

By Route Of Administration

Based on Route Of Administration, the market segment has been divided into Oral, Topical, Parenteral, Inhalations, Others. The Oral segment dominant the market. The oral route of administration refers to the process of delivering medication through the mouth. This is the most common and convenient method of drug delivery, where the drug is formulated in forms such as tablets, capsules, liquids, suspensions, or powders that are ingested by the patient. Once consumed, the drug is absorbed through the gastrointestinal (GI) tract and enters the bloodstream to exert its therapeutic effect. Oral medications are typically preferred for their ease of use, non-invasive nature, and ability to be self-administered by patients.

By Therapy Area

Based on Therapy Area, the market segment has been divided into cardiovascular diseases (CVDs), Pain, Diabetes, Cancer, Respiratory Diseases, Others. The Respiratory Diseases segment dominant the market. Respiratory Diseases as a therapy area involves the development of medications to treat conditions affecting the lungs and airways, such as asthma, chronic obstructive pulmonary disease (COPD), chronic bronchitis, emphysema, and pulmonary infections. Medications in this category include bronchodilators, anti-inflammatory drugs, steroids, leukotriene modifiers, and antibiotics for infections. Inhalers (metered-dose inhalers (MDIs), dry powder inhalers (DPIs)), and nebulizers are commonly used for the direct delivery of drugs to the lungs, providing quick relief for conditions like asthma.

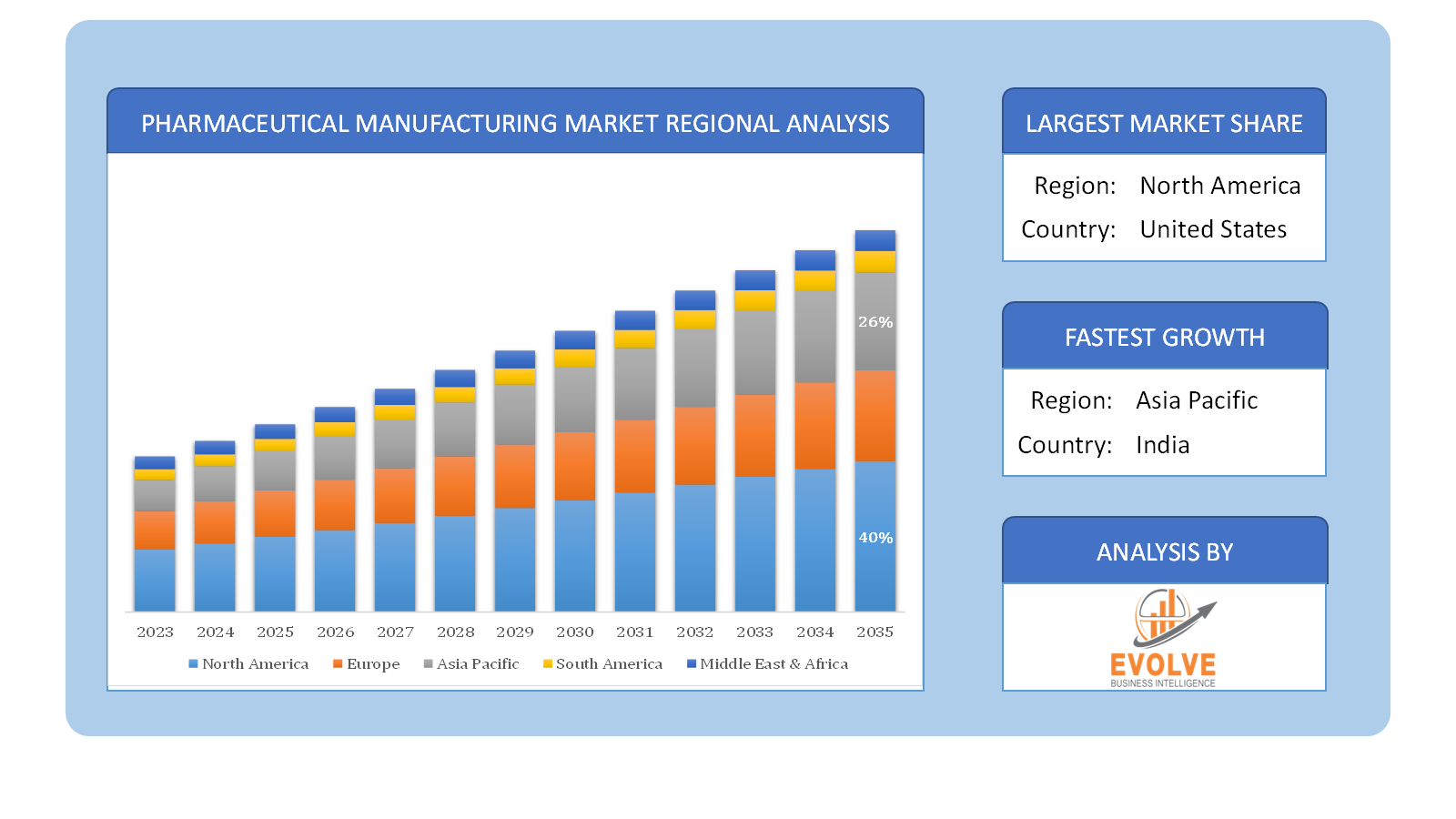

Global Pharmaceutical Manufacturing Market Regional Analysis

Based on region, the global Pharmaceutical Manufacturing Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Pharmaceutical Manufacturing Market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America is a key region in the Pharmaceutical Manufacturing Market. The pharmaceutical manufacturing market in North America is a highly advanced and competitive sector, driven by strong R&D investments, a well-established regulatory framework, and the presence of major global pharmaceutical companies. The United States dominates the regional market, accounting for the largest share due to its extensive biotech and pharmaceutical ecosystem, supported by the FDA’s stringent approval processes. Canada also contributes significantly, benefiting from favorable government policies and growing investments in drug production.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Pharmaceutical Manufacturing Market industry. The pharmaceutical manufacturing market in the Asia-Pacific region is experiencing rapid growth, driven by increasing healthcare demand, government support, and expanding production capabilities. Countries such as China, India, and Japan are key players, with China and India emerging as global pharmaceutical manufacturing hubs due to their cost-effective production, skilled workforce, and strong generic drug industries. Japan, on the other hand, focuses on high-quality drug innovation and advanced biopharmaceuticals.

Competitive Landscape

The global Pharmaceutical Manufacturing Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Hoffmann-La Roche Ltd.

- Novartis AG

- GlaxoSmithKline plc

- Pfizer Inc.

- Merck & Co. Inc.

- AstraZeneca

- Johnson & Johnson

- Sanofi SA

- Eli Lilly and Company

- Thermo Fisher Scientific Inc.

Scope of the Report

Global Pharmaceutical Manufacturing Market, by Molecule Type

- Biologics & Biosimilars

- Conventional Drugs

Global Pharmaceutical Manufacturing Market, by Formulation

- Tablets

- Capsules

- Injectable

- Sprays

- Suspensions

- Powders

- Others

Global Pharmaceutical Manufacturing Market, by Route Of Administration

- Oral

- Topical

- Parenteral

- Inhalations

- Others

Global Pharmaceutical Manufacturing Market, by Therapy Area

- cardiovascular diseases (CVDs)

- Pain

- Diabetes

- Cancer

- Respiratory Diseases

- Others

Global Pharmaceutical Manufacturing Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2035: USD 1379.59 Billion |

| CAGR (2024-2034) | 7.35% |

| Base year | 2022 |

| Forecast Period | 2024-2035 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Re-port Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Molecule Type, Formulation, Route Of Administration, Therapy Area |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | BASF SE, Akzo Nobel N.V., Axalta Coating Systems, Jotun, PPG Industries Inc, The Sherwin-Williams Company, Nippon Paint Holdings Co. Ltd., Hempel A/S, RPM International Inc., Diamond Paints and Kansai Paints. |

| Key Market Opportunities | · Adoption of Advanced Manufacturing Technologies · Growth in Preventive Healthcare and Vaccines |

| Key Market Drivers | · Rising Prevalence of Chronic Diseases and Aging Global Population · Advancements in Technology |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Pharmaceutical Manufacturing Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Pharmaceutical Manufacturing Market historical market size for the year 2021, and forecast from 2023 to 2033

- Pharmaceutical Manufacturing Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Pharmaceutical Manufacturing Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Pharmaceutical Manufacturing Market is 2021- 2033

What is the growth rate of the global Pharmaceutical Manufacturing Market?

The global Pharmaceutical Manufacturing Market is growing at a CAGR of 7.35% over the next 10 years

Which region has the highest growth rate in the market of Pharmaceutical Manufacturing Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Pharmaceutical Manufacturing Market?

North America holds the largest share in 2022

Who are the key players in the global Pharmaceutical Manufacturing Market?

BASF SE, Akzo Nobel N.V., Axalta Coating Systems, Jotun, PPG Industries Inc, The Sherwin-Williams Company, Nippon Paint Holdings Co. Ltd., Hempel A/S, RPM International Inc., Diamond Paints and Kansai Paints. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Molecule Type Segement – Market Opportunity Score

4.1.2. Formulation Segment – Market Opportunity Score

4.1.3. Route Of Administration Segment – Market Opportunity Score

4.1.4. Therapy Area Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Pharmaceutical Manufacturing Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. MArket Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Pharmaceutical Manufacturing Market, By Molecule Type

7.1. Introduction

7.1.1. Biologics & Biosimilars,

7.1.2. Conventional Drugs

CHAPTER 8. Pharmaceutical Manufacturing Market, By Formulation

8.1. Introduction

8.1.1. Tablets

8.1.2. Capsules

8.1.3. Injectable

8.1.4. Sprays

8.1.5. Suspensions

8.1.6. Powders

8.1.7. Others

CHAPTER 9. Pharmaceutical Manufacturing Market, By Route Of Administration

9.1. Introduction

9.1.1. Oral

9.1.2. Topical

9.1.3. Parenteral

9.1.4. Inhalations

9.1.5. Others

CHAPTER 10. Pharmaceutical Manufacturing Market, By Therapy Area

10.1.Introduction

10.1.1 cardiovascular diseases (CVDs)

10.1.2. Pain

10.1.3. Diabetes

10.1.4. Cancer

10.1.5. Respiratory Diseases

10.1.6. Others

CHAPTER 11. Pharmaceutical Manufacturing Market, By Region

11.1. Introduction

11.2. NORTH AMERICA

11.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.2.2. North America: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.2.3. North America: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.2.4. North America: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.2.5. North America: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.2.6. US

11.2.6.1. US: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.2.6.2. US: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.2.6.3. US: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.2.6.4. US: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.2.7. CANADA

11.2.7.1. Canada: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.2.7.2. Canada: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.2.7.3. Canada: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.2.7.4. Canada: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.2.8. MEXICO

11.2.8.1. Mexico: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.2.8.2. Mexico: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.2.8.3. Mexico: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.2.8.4. Mexico: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.3. Europe

11.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.3.2. Europe: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.3.3. Europe: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.3.4. Europe: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.3.5. Europe: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.3.6. U.K.

11.3.6.1. U.K.: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.3.6.2. U.K.: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.3.6.3. U.K.: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.3.6.4. U.K.: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.3.7. GERMANY

11.3.7.1. Germany: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.3.7.2. Germany: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.3.7.3. Germany: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.3.7.4. Germany: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.3.8. FRANCE

11.3.8.1. France: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.3.8.2. France: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.3.8.3. France: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.3.8.4. France: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.3.9. ITALY

11.3.9.1. Italy: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.3.9.2. Italy: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.3.9.3. Italy: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.3.9.4. Italy: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.3.10. SPAIN

11.3.10.1. Spain: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.3.10.2. Spain: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.3.10.3. Spain: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.3.10.4. Spain: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.3.11. BENELUX

11.3.11.1. BeNeLux: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.3.11.2. BeNeLux: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.3.11.3. BeNeLux: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.3.11.4. BeNeLux: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.3.12. RUSSIA

11.3.12.1. Russia: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.3.12.2. Russia: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.3.12.3. Russia: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.3.12.4. Russia: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.3.13. REST OF EUROPE

11.3.13.1. Rest of Europe: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.3.13.2. Rest of Europe: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.3.13.3. Rest of Europe: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.3.13.4. Rest of Europe: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4. Asia Pacific

11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.4.2. Asia Pacific: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.3. Asia Pacific: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.4. Asia Pacific: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.5. Asia Pacific: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4.6. CHINA

11.4.6.1. China: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.6.2. China: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.6.3. China: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.6.4. China: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4.7. JAPAN

11.4.7.1. Japan: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.7.2. Japan: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.7.3. Japan: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.7.4. Japan: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4.8. INDIA

11.4.8.1. India: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.8.2. India: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.8.3. India: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.8.4. India: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4.9. SOUTH KOREA

11.4.9.1. South Korea: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.9.2. South Korea: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.9.3. South Korea: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.9.4. South Korea: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4.10. THAILAND

11.4.10.1. Thailand: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.10.2. Thailand: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.10.3. Thailand: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.10.4. Thailand: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4.11. INDONESIA

11.4.11.1. Indonesia: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.11.2. Indonesia: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.11.3. Indonesia: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.11.4. Indonesia: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4.12. MALAYSIA

11.4.12.1. Malaysia: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.12.2. Malaysia: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.12.3. Malaysia: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.12.4. Malaysia: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4.13. AUSTRALIA

11.4.13.1. Australia: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.13.2. Australia: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.13.3. Australia: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.13.4. Australia: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.4.14. REST FO ASIA PACIFIC

11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.5. South America

11.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.5.2. South America: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.5.3. South America: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.5.4. South America: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.5.5. South America: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.5.6. BRAZIL

11.5.6.1. Brazil: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.5.6.2. Brazil: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.5.6.3. Brazil: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.5.6.4. Brazil: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.5.7. ARGENTINA

11.5.7.1. Argentina: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.5.7.2. Argentina: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.5.7.3. Argentina: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.5.7.4. Argentina: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.5.8. REST OF SOUTH AMERICA

11.5.8.1. Rest of South America: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.5.8.2. Rest of South America: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.5.8.3. Rest of South America: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.5.8.4. Rest of South America: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.6. Middle East & Africa

11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034 ($ Million)

11.6.2. Middle East & Africa: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.6.3. Middle East & Africa: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.6.4. Middle East & Africa: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.6.5. Middle East & Africa: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.6.6. SAUDI ARABIA

11.6.6.1. Saudi Arabia: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.6.6.2. Saudi Arabia: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.6.6.3. Saudi Arabia: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.6.6.4. Saudi Arabia: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.6.7. UAE

11.6.7.1. UAE: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.6.7.2. UAE: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.6.7.3. UAE: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.6.7.4. UAE: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.6.8. EGYPT

11.6.8.1. Egypt: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.6.8.2. Egypt: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.6.8.3. Egypt: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.6.8.4. Egypt: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.6.9. SOUTH AFRICA

11.6.9.1. South Africa: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.6.9.2. South Africa: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.6.9.3. South Africa: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.6.9.4. South Africa: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

11.6.10. REST OF MIDDLE EAST & AFRICA

11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Molecule Type, 2024 – 2034 ($ Million)

11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Formulation, 2024 – 2034 ($ Million)

11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Route Of Administration, 2024 – 2034 ($ Million)

11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Therapy Area, 2024 – 2034 ($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2024

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. F. Hoffmann-La Roche Ltd.

13.1.1. Business Overview

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million

13.1.2.2. Geographic Revenue Mix, 2020 (% Share)

13.1.3. Molecule Type Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Novartis AG

13.3. GlaxoSmithKline plc

13.4. Pfizer Inc.

13.5. Merck & Co. Inc.

13.6. AstraZeneca

13.7. Johnson & Johnson

13.8. Sanofi SA

13.9. Eli Lilly and Company

13.10. Thermo Fisher Scientific Inc.

Connect to Analyst

Research Methodology