Non-Destructive Testing Equipment Market Overview

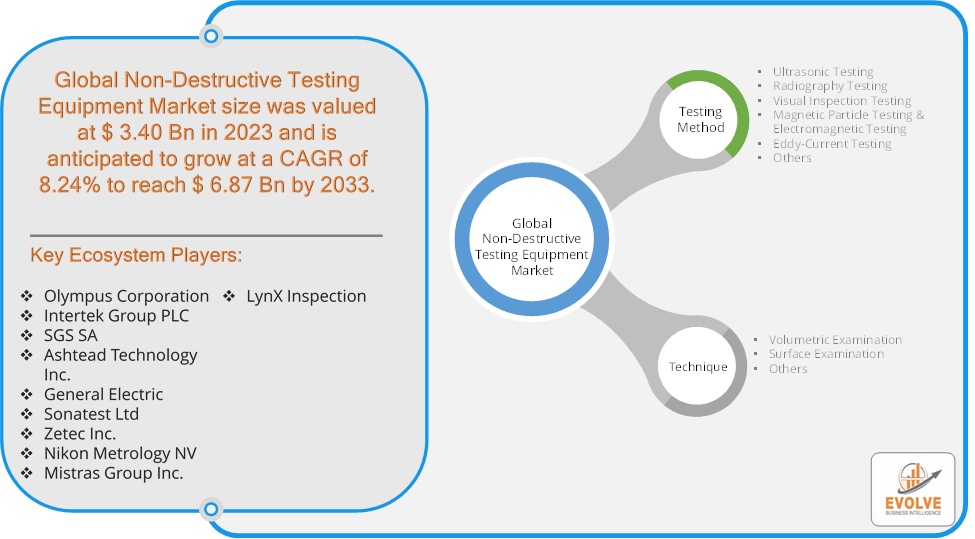

The Non-Destructive Testing Equipment Market Size is expected to reach USD 6.87 Billion by 2033. The Non-Destructive Testing Equipment Market industry size accounted for USD 3.40 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.24% from 2023 to 2033. The Non-Destructive Testing (NDT) Equipment Market refers to the global industry focused on the development, production, and distribution of equipment and technologies used for non-destructive testing. Non-destructive testing is a method of evaluating the properties of materials, components, or systems without causing damage to the object being inspected. It is crucial for ensuring the safety, reliability, and integrity of products in various industries, including aerospace, automotive, construction, oil and gas, power generation, and manufacturing.

The NDT Equipment Market is expected to grow due to the increasing need for ensuring the safety and reliability of critical components in various industries, along with advancements in testing technologies that offer more accurate and faster inspection methods.

Global Non-Destructive Testing Equipment Market Synopsis

The COVID-19 pandemic significantly impacted the Non-Destructive Testing (NDT) Equipment Market. The pandemic caused widespread disruptions in global supply chains due to lockdowns, restrictions, and reduced manufacturing activities. This led to delays in the production and delivery of NDT equipment, affecting market growth. Many companies postponed non-essential testing and inspection activities due to budget constraints, workforce reductions, and health and safety concerns. This further reduced the demand for NDT services and equipment during the peak of the pandemic. The pandemic led to workforce shortages due to illness, travel restrictions, and the need for social distancing. This made it difficult to carry out NDT inspections, especially in industries requiring on-site testing. The pandemic accelerated the adoption of advanced NDT technologies such as remote testing, automation, and digitalization. Companies invested in these technologies to reduce the need for on-site inspections and minimize human contact, which also drove innovation in the NDT market. The pandemic highlighted the importance of safety and compliance, leading to stricter regulations and standards in various industries. This is expected to drive sustained demand for NDT equipment in the long term.

Non-Destructive Testing Equipment Market Dynamics

The major factors that have impacted the growth of Non-Destructive Testing Equipment Market are as follows:

Drivers:

Ø Technological Advancements

Advancements in digital technologies, such as digital radiography, ultrasonic phased array, and automated inspection systems, have improved the accuracy, speed, and efficiency of NDT processes. These innovations are driving the adoption of NDT equipment across industries. The development of remote and real-time monitoring systems enables continuous inspection without disrupting operations. This is particularly valuable in industries like oil and gas and power generation, where downtime can be costly. The increasing emphasis on quality assurance in manufacturing processes, particularly in sectors like automotive, aerospace, and electronics, drives the demand for NDT equipment. Manufacturers are focused on reducing defects and improving product reliability through rigorous testing.

Restraint:

- Perception of High Initial Costs and Time-Consuming Processes

Advanced NDT equipment, such as digital radiography systems, ultrasonic phased array devices, and automated inspection systems, can be expensive. The high initial investment required for purchasing and setting up this equipment can be a barrier for small and medium-sized enterprises (SMEs) or industries with tight budgets. Regular maintenance, calibration, and upgrades of NDT equipment add to the overall cost, making it a significant financial commitment for companies. Certain NDT methods, especially those involving detailed analysis like radiographic testing or complex ultrasonic testing, can be time-consuming. The need for thorough inspection may cause delays in production processes or maintenance schedules, making NDT less attractive for industries where time efficiency is critical.

Opportunity:

⮚ Increased Focus on Sustainability and Green Energy

The growing focus on renewable energy sources, such as wind, solar, and hydroelectric power, presents new opportunities for NDT equipment. These industries require regular inspection and maintenance of turbines, solar panels, and other infrastructure to ensure optimal performance and longevity. As industries prioritize sustainability, there is an increasing need for NDT techniques that minimize material waste and energy consumption. NDT equipment that supports sustainable practices can gain a competitive edge in the market.

Non-Destructive Testing Equipment Market Segment Overview

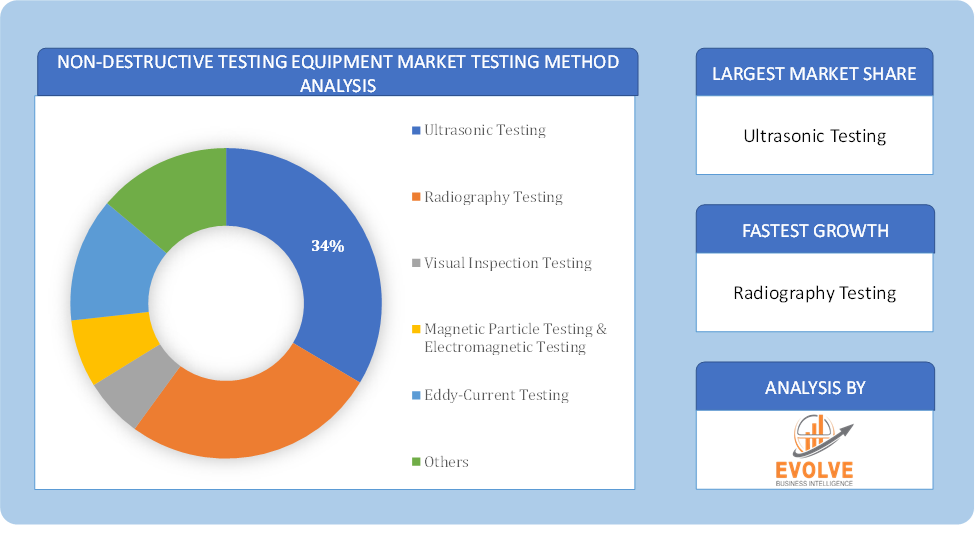

By Testing Method

Based on Testing Method, the market is segmented based on Ultrasonic Testing, Radiography Testing, Visual Inspection Testing, Magnetic Particle Testing & Electromagnetic Testing, Eddy-Current Testing and Others. The ultrasonic segment dominant the market. The ultrasonic testing equipment usually works on the acoustic principle for fault checking. This non-destructive inspection equipment sends sound waves through ultrasound conducting materials in an approximate frequency which ranges between 500 kHz and 50 MHz. The transit time of ultrasound from the equipment is used to find out the position and size of the damage or fault on the material being tested.

By Technique

Based on Technique, the market segment has been divided into Volumetric Examination, Surface Examination and Others. The Volumetric Examination segment dominant the market.

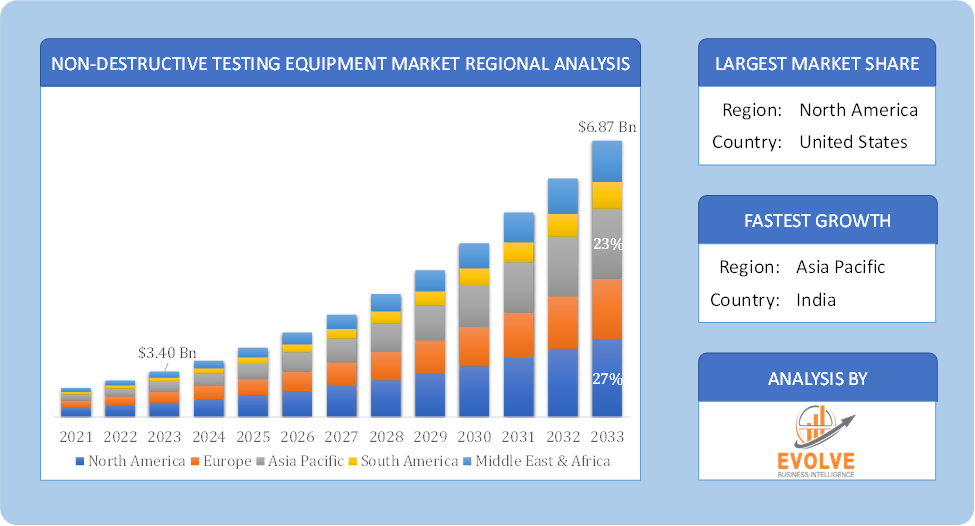

Global Non-Destructive Testing Equipment Market Regional Analysis

Based on region, the global Non-Destructive Testing Equipment Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Non-Destructive Testing Equipment Market followed by the Asia-Pacific and Europe regions.

Non-Destructive Testing Equipment North America Market

Non-Destructive Testing Equipment North America Market

North America holds a dominant position in the Non-Destructive Testing Equipment Market. North America is one of the leading regions in the NDT Equipment Market, driven by the presence of key industries such as aerospace, defense, oil and gas, and automotive. The region’s strict safety regulations and standards, coupled with a high focus on quality assurance, contribute to significant demand for advanced NDT equipment. The U.S. is a global leader in the aerospace and defense sectors, where NDT is critical for ensuring the safety and reliability of components and systems and North America is at the forefront of adopting advanced NDT technologies, including digital radiography, ultrasonic phased array, and AI-powered inspection systems.

Non-Destructive Testing Equipment Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Non-Destructive Testing Equipment Market industry. The Asia-Pacific region is experiencing rapid growth in the NDT Equipment Market, driven by industrialization, infrastructure development, and expanding manufacturing sectors. Countries like China, India, Japan, and South Korea are key contributors to this growth. Rapid industrialization and urbanization in countries like China and India are driving demand for NDT equipment across various sectors, including construction, manufacturing, and energy and he growing aerospace and automotive industries in Japan and South Korea are significant users of NDT equipment, particularly as these countries focus on high-quality manufacturing standards.

Competitive Landscape

The global Non-Destructive Testing Equipment Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Olympus Corporation

- Intertek Group PLC

- SGS SA

- Ashtead Technology Inc.

- General Electric

- Sonatest Ltd

- Zetec Inc.

- Nikon Metrology NV

- Mistras Group Inc.

- LynX Inspection

Scope of the Report

Global Non-Destructive Testing Equipment Market, by Testing Method

- Ultrasonic Testing

- Radiography Testing

- Visual Inspection Testing

- Magnetic Particle Testing & Electromagnetic Testing

- Eddy-Current Testing

- Others

Global Non-Destructive Testing Equipment Market, by Technique

- Volumetric Examination

- Surface Examination

- Others

Global Non-Destructive Testing Equipment Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 6.87 Billion |

| CAGR (2023-2033) | 8.24% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Testing Method, Technique |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Olympus Corporation, Intertek Group PLC, SGS SA, Ashtead Technology Inc., General Electric, Sonatest Ltd, Zetec Inc., Nikon Metrology NV, Mistras Group Inc. and LynX Inspection. |

| Key Market Opportunities | · Increased Focus on Sustainability and Green Energy |

| Key Market Drivers | · Technological Advancements

· Rising Awareness of Quality Assurance |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Non-Destructive Testing Equipment Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Non-Destructive Testing Equipment Market historical market size for the year 2021, and forecast from 2023 to 2033

- Non-Destructive Testing Equipment Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Non-Destructive Testing Equipment Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.