Mobile Health Market Overview

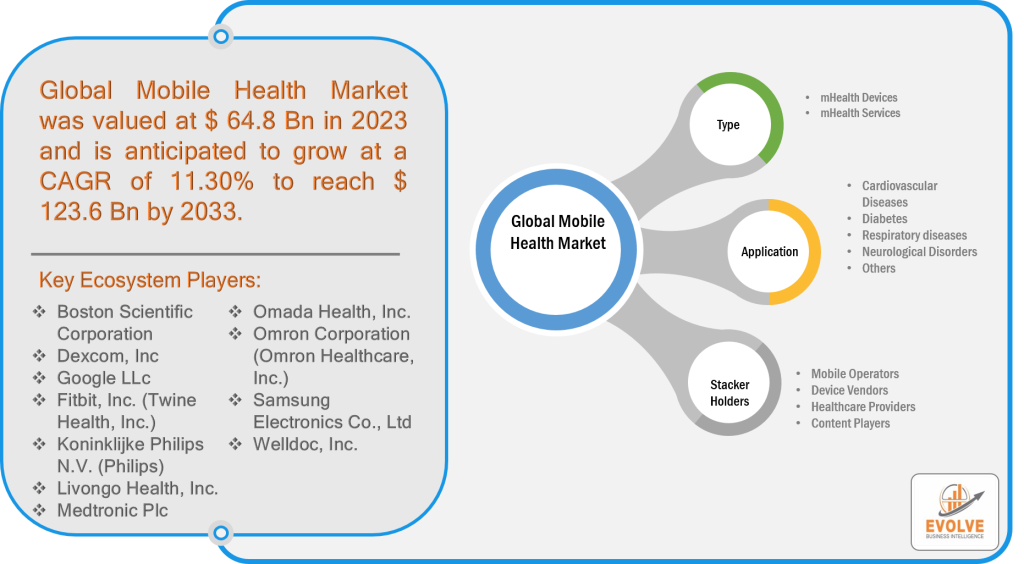

Mobile Health Market Size is expected to reach USD 181.16 Billion by 2033. The Mobile Health industry size accounted for USD 64.8 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 10.82% from 2023 to 2033. The Mobile Health Market, also known as mHealth, refers to the use of mobile devices such as smartphones, tablets, and wearables to support healthcare delivery. mHealth applications allow patients to monitor their health status, receive medical advice, and access healthcare services remotely. The rapid proliferation of mobile devices and the increase in healthcare costs have contributed to the growth of the mobile health market in recent years.

COVID-19 Impact and Post-COVID Scenario

The COVID-19 pandemic has had a significant impact on the mobile health market. The pandemic has highlighted the need for remote healthcare solutions that can enable healthcare providers to monitor patients remotely and provide care without physical contact. This has led to an increase in demand for mHealth applications and telemedicine services, which allow patients to access healthcare services from the comfort of their homes. The pandemic has also led to an increase in the adoption of digital health solutions such as remote patient monitoring and virtual consultations. This has been driven by the need to reduce the risk of infection for both patients and healthcare providers. The use of these technologies has helped to minimize the burden on healthcare systems and reduce the risk of transmission of the virus.

The post-COVID scenario is expected to lead to continued growth in the mobile health market. The pandemic has accelerated the adoption of mHealth applications, and this trend is expected to continue in the post-pandemic era. The market is expected to witness significant growth in the coming years, driven by factors such as the increasing prevalence of chronic diseases, the rise in healthcare costs, and the need for cost-effective healthcare solutions.

Global Mobile Health Market Growth Factors

-

The increasing demand for personalized healthcare

The increasing demand for personalized healthcare is one of the driving factors of the mobile health market. Personalized healthcare is an approach to healthcare that takes into account an individual’s unique genetic, environmental, and lifestyle factors to provide tailored treatment and prevention strategies. Mobile health technologies such as wearables, sensors, and mobile applications are enabling personalized healthcare by providing patients with access to real-time health data and insights into their health status. Patients can use mobile health apps to track their physical activity, monitor their nutrition, and manage their medication adherence. Personalized healthcare is particularly relevant in the management of chronic diseases such as diabetes, where individualized treatment plans can help to improve patient outcomes and reduce healthcare costs. By leveraging mobile health technologies, healthcare providers can monitor patients’ health in real-time and provide personalized recommendations for lifestyle modifications and medication adjustments.

Global Mobile Health Market Restraining Factors

-

The lack of interoperability between different healthcare technologies

The lack of interoperability between different healthcare technologies is a major restraining factor in the mobile health market. Interoperability refers to the ability of different healthcare technologies to communicate and share data seamlessly. In the mobile health market, there are a multitude of digital health solutions such as wearables, mobile applications, and sensors that collect and transmit patient data. However, the lack of interoperability between these technologies makes it difficult for healthcare providers to integrate patient data from different sources into a single platform. This lack of interoperability can result in fragmented patient data and can make it difficult for healthcare providers to make informed decisions about patient care.

For example, a patient may have data on their physical activity from a wearable device, data on their glucose levels from a glucose meter, and data on their medication adherence from a mobile app. However, if these data sources are not interoperable, healthcare providers may not be able to access all of the patient’s data in one place, making it difficult to develop a comprehensive treatment plan.

Global Mobile Health Market Opportunity Analysis

-

Companies operating in the healthcare sector

The global mobile health market presents a significant opportunity for companies operating in the healthcare sector. Mobile health refers to the use of mobile devices such as smartphones, tablets, and wearables to deliver healthcare services and information. The market is driven by several factors such as the increasing prevalence of chronic diseases, rising healthcare costs, and the need for remote patient monitoring solutions.

Global Mobile Health Market Segment Analysis

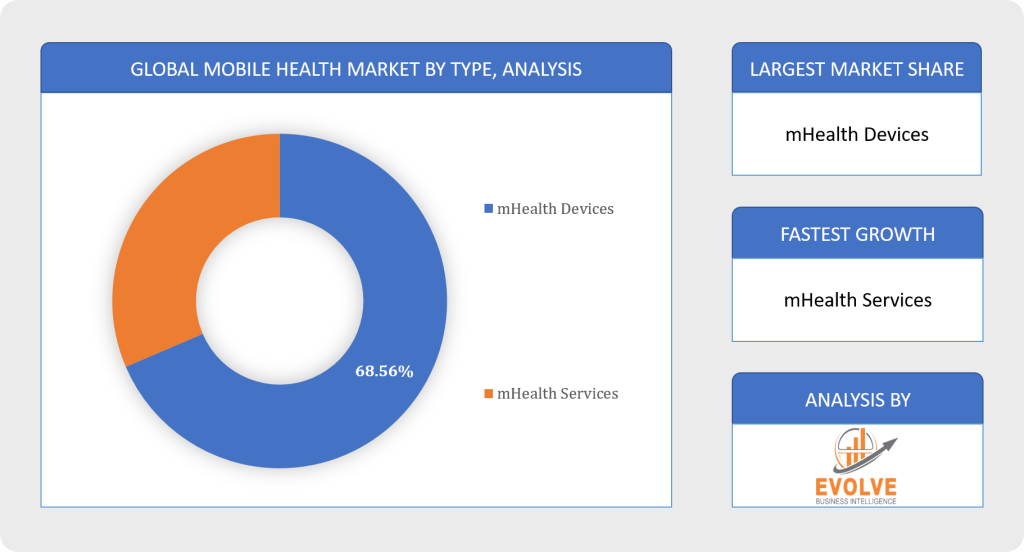

mHealth services are expected to hold the largest market share in 2023

Based on the Type, the market has been divided into mHealth Devices and mHealth Services. mHealth services hold the largest market share, driven by the increasing adoption of telemedicine and remote patient monitoring solutions. These services enable healthcare providers to remotely monitor patients’ health and provide personalized recommendations for medication adjustments and lifestyle modifications.

The Healthcare providers segment is expected to hold the largest market share in 2023

Based on Stakeholders, the market has been divided into Mobile Operators, Device Vendors, Healthcare Providers, and Content Players. Healthcare providers hold the largest market share, owing to the increasing adoption of mobile health technologies to improve patient outcomes and reduce healthcare costs. Mobile operators and device vendors are also significant stakeholders in the market, owing to their role in providing mobile connectivity and developing mHealth devices and apps.

The cardiovascular diseases segment is expected to hold the largest market share in 2023

Based on Application, the market has been divided into Cardiovascular Diseases, Diabetes, Respiratory diseases, Neurological Disorders, and Others. The cardiovascular diseases segment holds the largest market share, driven by the increasing prevalence of cardiovascular diseases and the growing demand for remote monitoring solutions. The diabetes segment is also a significant market, owing to the increasing prevalence of diabetes and the need for personalized diabetes management solutions.

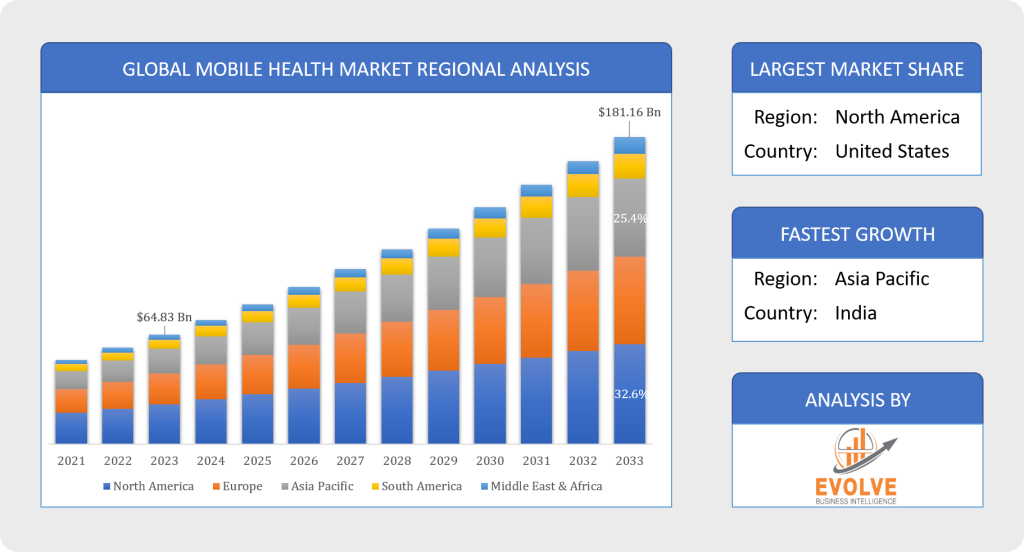

Global Mobile Health Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Mobile Health, followed by those in Asia-Pacific and Europe.

Regional Coverage:

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- Thailand

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

North America Market

North America is the largest market for mobile health (mHealth) solutions, driven by the high adoption of mobile devices and the presence of established players in the region. The region has a well-established healthcare infrastructure, favorable reimbursement policies, and high healthcare expenditures, which support the adoption of mHealth solutions

Asia Pacific Market

The mHealth market in Asia Pacific is driven by the increasing adoption of smartphones and mobile devices, which enable patients to access healthcare services remotely. The region also has a large population of elderly individuals who require long-term care and monitoring, creating a significant demand for mHealth solutions.

Moreover, governments in the region are increasingly investing in healthcare infrastructure and digital health initiatives, which is expected to further drive the adoption of mHealth solutions. For instance, the Indian government has launched the National Digital Health Mission to provide universal health coverage and increase the use of digital health solutions.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Apple Inc., Google LLC, and Samsung Electronics Co., Ltd. are some of the leading players in the global Mobile Health Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Boston Scientific Corporation

- Dexcom, Inc

- Google LLC

- Fitbit, Inc. (Twine Health, Inc.)

- Koninklijke Philips N.V. (Philips)

- Livongo Health, Inc.

- Medtronic Plc

- Omada Health, Inc.

- Omron Corporation (Omron Healthcare, Inc.)

- Samsung Electronics Co., Ltd

- Welldoc, Inc.

Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

On February 2021, Google Health announced that it is partnering with Hologic, a medical technology company, to develop a mobile screening tool for breast cancer. The tool will use AI to analyze mammograms and identify potential signs of breast cancer, to improve early detection and diagnosis rates.

On March 2021, The UK’s National Health Service (NHS) launched a new mHealth app called the NHS App Library, which provides a curated list of approved health apps for patients to download. The app library is designed to help patients find reliable and trustworthy health apps and encourage the adoption of digital health solutions.

Report Scope:

Global Mobile Health Market, by Type

- mHealth Devices

- mHealth Services

Global Mobile Health Market, by Stakeholders

- Mobile Operators

- Device Vendors

- Healthcare Providers

- Content Players

Global Mobile Health Market, by Application

- Cardiovascular Diseases

- Diabetes

- Respiratory diseases

- Neurological Disorders

- Others

Mobile Health Market Synopsis:

| Parameters | Values |

|---|---|

| Market Size | 2023: USD 64.8 Billion, 2033: USD 181.2 Billion |

| Growth Rate | First 5 Years CAGR (2023–2028): XX%, Last 5 Years CAGR (2028–2033): XX%, 10 Years CAGR (2023–2033): 10.82% |

| Key Market Drivers | The increasing demand for personalized healthcare, The rise in chronic diseases |

| Key Market Restraints | The lack of standardization in technology and concerns about data security., The integration of mHealth applications |

| Market Opportunities | Companies operating in the healthcare sector |

| Key Market Players | Boston Scientific Corporation, Dexcom, Inc, Google LLC, Fitbit, Inc. (Twine Health, Inc.), Koninklijke Philips N.V. (Philips), Livongo Health, Inc., Medtronic Plc, Omada Health, Inc., Omron Corporation (Omron Healthcare, Inc.), Samsung Electronics Co., Ltd, Welldoc, Inc. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Mobile Health Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Mobile Health market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Mobile Health market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Mobile Health Market.