Medical Supplies Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

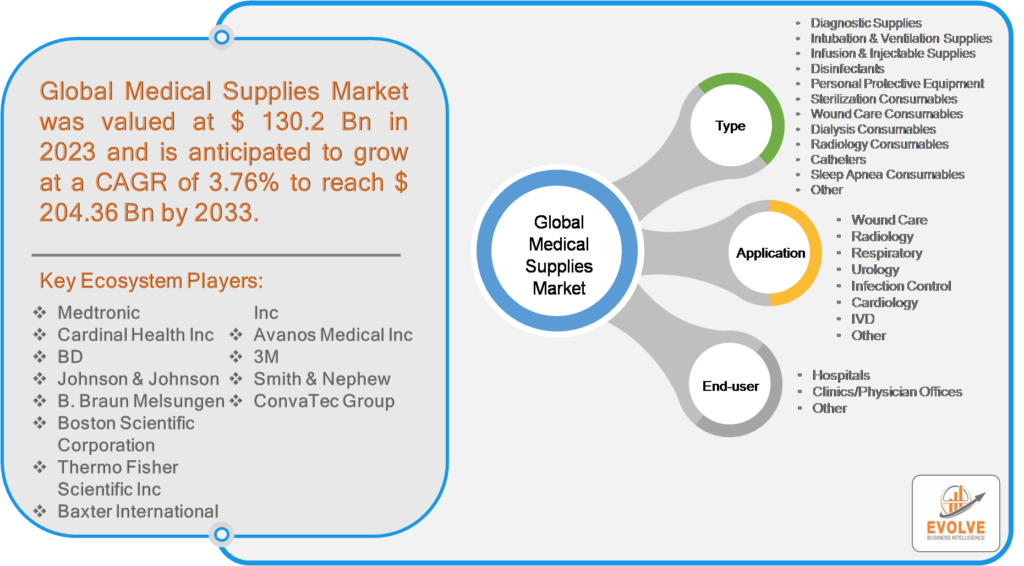

Medical Supplies Market Research Report: By Type(Diagnostic Supplies, Intubation & Ventilation Supplies, Infusion & Injectable Supplies, Disinfectants, Personal Protective Equipment, Sterilization Consumables, Wound Care Consumables, Dialysis Consumables, Radiology Consumables, Catheters, Sleep Apnea Consumables, Other), By Application(Wound Care, Radiology, Respiratory, Urology, Infection Control, Cardiology, IVD, and Others), By End-user(Hospitals, Clinics/Physician Offices, Other), and Region — Forecast till 2033.

PRESS RELEASE:https://evolvebi.com/the-medical-supplies-market-is-estimated-to-record-a-cagr-of-around-3-76-during-the-forecast-period/

Medical Supplies Market Overview

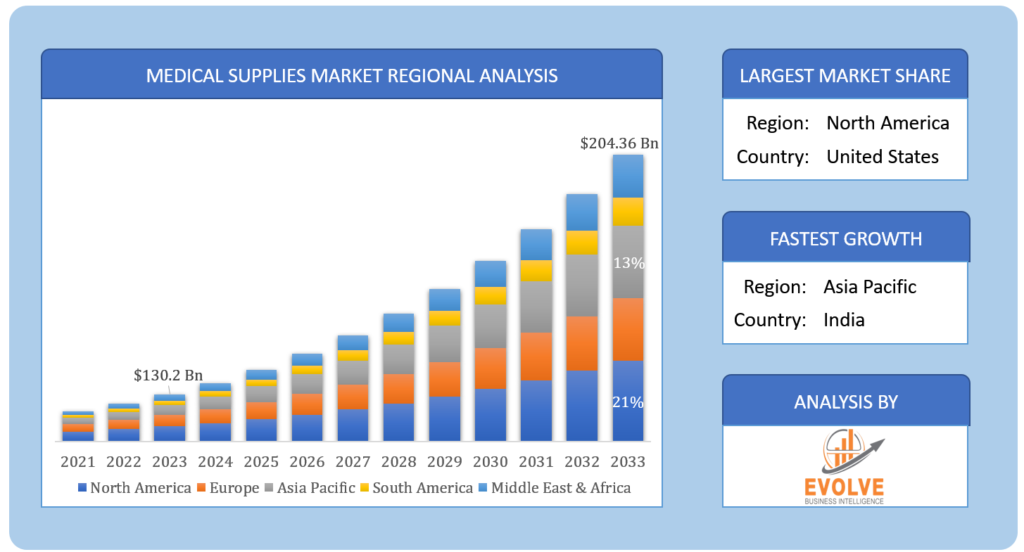

Medical Supplies Market Size is expected to reach USD 204.36 Billion by 2033. The Medical Supplies industry size accounted for USD 130.2 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.76% from 2023 to 2033.Medical supplies are a broad range of products and equipment utilized for diagnostic, treatment, and preventive purposes related to illnesses, injuries, and diseases. These supplies have a varying degree of complexity, ranging from simple items such as bandages and syringes to advanced equipment such as ventilators and MRI machines. Medical supplies find their use in diverse settings such as hospitals, clinics, doctors’ offices, laboratories, and even in-home care settings. Medical supplies include surgical instruments, diagnostic tests, medical gloves, catheters, and respiratory equipment. The quality and reliability of medical supplies are critical to ensure patient safety and achieving successful medical outcomes.

COVID-19 Impact and Post-COVID Scenario

The COVID-19 pandemic has certainly had a positive impact on the pharmaceutical industry, including the Medical Supplies market. The COVID-19 pandemic has led to a surge in demand for PPE, including masks, gloves, gowns, and face shields, as healthcare workers and other essential personnel require adequate protection to prevent the spread of the virus. This increased demand has led to a significant increase in the production and sales of PPE, resulting in revenue growth for many companies that manufacture and distribute these products.Similarly, the pandemic has also led to a surge in demand for medical devices, such as ventilators and oxygen concentrators, which are critical for treating severe COVID-19 cases. This increased demand has led to an increase in the production and sales of these devices, resulting in revenue growth for many medical device companies.

Global Medical Supplies Market Growth Factors

Increasing prevalence of chronic diseases

The rise in chronic diseases has led to an increased demand for medical supplies such as diagnostic equipment, therapeutic devices, and surgical instruments. For instance, cancer diagnosis and treatment often involve the use of imaging equipment such as computed tomography (CT) scanners, magnetic resonance imaging (MRI) machines, and X-ray machines, as well as surgical instruments such as scalpels, forceps, and retractors. Similarly, the management of diabetes may require the use of insulin pumps, blood glucose monitors, and lancets.Furthermore, cardiovascular diseases such as heart disease and stroke are a leading cause of death globally. These conditions often require the use of medical devices such as stents, pacemakers, and defibrillators, as surgical instruments such as catheters and guidewires.

Global Medical Supplies Market Restraining Factors

Limited healthcare infrastructure can result in a lack of healthcare facilities, healthcare providers, and medical supply distribution networks. This can make it difficult for people living in rural areas to access the medical supplies they need. For instance, medical devices and equipment such as X-ray machines, MRI scanners, and dialysis machines may not be available in remote areas, which means that patients may need to travel long distances to receive treatment.In addition, the limited availability of medical supplies can also lead to disparities in access to healthcare between urban and rural areas. In urban areas, medical supplies are often more readily available, and healthcare infrastructure is generally better developed. This means that people living in urban areas may have better access to medical supplies than those living in rural areas.

Global Medical Supplies Market Opportunity Analysis

The increasing use of digital technologies in healthcare

The increasing use of digital technologies in healthcare presents a significant opportunity for the medical supplies market. Digital health technologies such as telemedicine and mobile health (mHealth) are transforming the way healthcare is delivered and accessed, and medical supplies such as wearables, remote patient monitoring devices, and mobile health apps are playing an increasingly important role in improving patient outcomes and reducing healthcare costs.Telemedicine allows patients to receive medical consultations and treatment remotely, which can be particularly beneficial for patients living in rural or remote areas, as well as for patients with mobility or transportation issues. Medical supplies such as telemedicine equipment and software are critical to enabling telemedicine services.

Global Medical Supplies Market Segment Analysis

The Infusion & Injectable Supplies segment is expected to hold the largest market share in 2023

The Infusion & Injectable Supplies segment is expected to hold the largest market share in 2023

Based on the Type, the market is segmented based on Diagnostic Supplies, Intubation & Ventilation Supplies, Infusion & Injectable Supplies, Disinfectants, Personal Protective Equipment, Sterilization Consumables, Wound Care Consumables, Dialysis Consumables, Radiology Consumables, Catheters, Sleep Apnea Consumables, Other. The largest market share is anticipated to go to the Infusion & Injectable Supplies segment.The growth of this segment is being driven by factors such as the increasing prevalence of chronic diseases, the rising demand for home healthcare services, and the increasing use of infusion therapy in hospitals and other healthcare facilities.

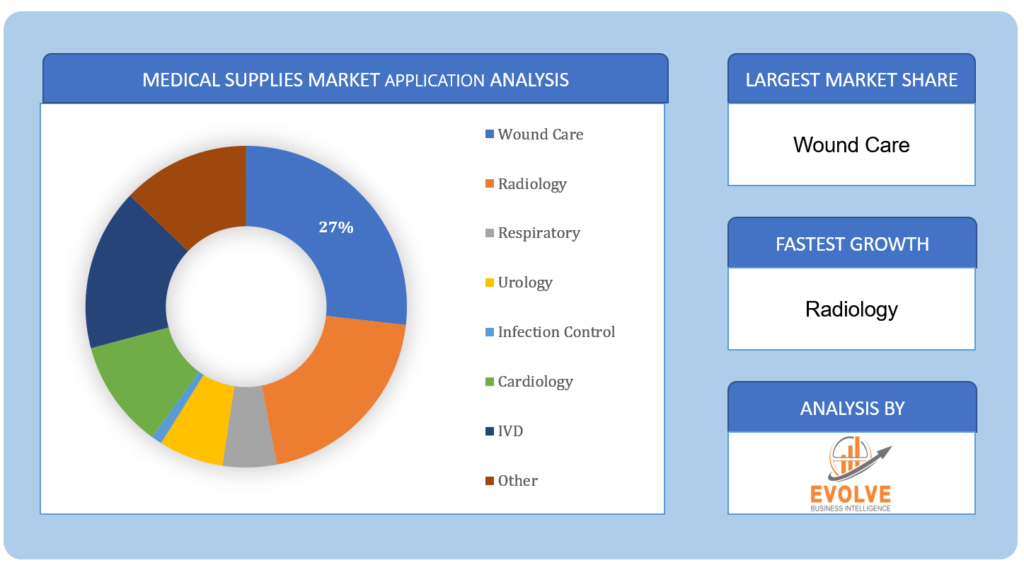

The Wound Care segment is expected to hold the largest market share in 2023

Based on Application, the market has been divided intoWound Care, Radiology, Respiratory, Urology, Infection Control, Cardiology, IVD, and Others.The Wound Care segment is expected to hold the largest market share in the Market, due tothe increasing prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, the rising incidence of surgical procedures, and the growing demand for advanced wound care products that can promote faster healing and reduce the risk of infection.

The Hospitals segment is expected to hold the largest market share in 2023

Based on End-user, the market has been divided into Hospitals, Clinics/Physician Offices, Other.The market is projected to see significant growth in the Hospitals segment due to the increasing demand for healthcare services, advancements in medical technology, government initiatives, and increasing healthcare expenditure.

Global Medical Supplies Market, Segmental Chart

Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, theMiddle East & Africa, and Latin America. The area of Europe is anticipated to dominate the market for the usage of Medical Supplies, followed by those in Asia-Pacific and North America.

Regional Coverage:

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- Thailand

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

Europe Market

The Europe region is the leading market for Medical Supplies. Numerous elements, including the rising incidence of chronic illnesses, an aging population, and developments in medical technology, are responsible for the expansion of the medical supply business in Europe. Additionally, Europe has a highly developed healthcare system, good reimbursement practices, and a robust regulatory environment, all of which contribute to the market expansion for medical supplies.Furthermore, there are several significant market participants, such as Medtronic, Becton, Dickinson and Company, and Siemens Healthineers, among others, making the European medical supply industry extremely competitive. These businesses make significant R&D investments to create cutting-edge products, which fuels the market’s expansion.

Asia Pacific Market

The Asia-Pacific region is expected to have the fastest CAGRfor the medical supplies market globally.This growth is attributed to several factors, such as the increasing prevalence of chronic diseases, a growing aging population, rising healthcare spending, and increasing demand for quality healthcare. Additionally, the increasing awareness of healthcare and the growing middle class in countries such as China and India are contributing to the growth of the medical supplies market in the Asia-Pacific region.Moreover, the Asia-Pacific region is witnessing significant investments in healthcare infrastructure, which is expected to boost the demand for medical supplies in the region. Additionally, several initiatives by governments and private organizations to improve healthcare access, affordability, and quality are further driving the growth of the medical supplies market in the region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Johnson & Johnson, B. Braun Melsungen, Boston Scientific Corporation, and Thermo Fisher Scientific Incare some of the leading players in the global Medical SuppliesIndustry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Medtronic

- Cardinal Health Inc

- Datasea Inc

- Johnson & Johnson

- Braun Melsungen

- Boston Scientific Corporation

- Thermo Fisher Scientific Inc

- Baxter International Inc

- Avanos Medical Inc

- 3M

- Smith & Nephew

- ConvaTec Group

Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

On March2022, Datasea Inc. introduced Ultrasonic Sound Sterilisation and Antivirus Equipment aimed at various application situations, with plans to penetrate the US market with acoustic intelligence solutions. The Ultrasonic Sound Sterilisation and Antivirus Equipment employ cutting-edge acoustic intelligence-powered disinfection that has been shown to cleanse the air while also reducing germs and viruses.

On March 2021, AESCULAP Inc announced the release of the AESCULAP Aicon Sterile Container System. The new container incorporates characteristics that aid in the streamlining of procedures and the reduction of the danger of wet sets.

Report Scope:

Global Medical Supplies Market, by Type

- Diagnostic Supplies

- Intubation & Ventilation Supplies

- Infusion & Injectable Supplies

- Disinfectants

- Personal Protective Equipment

- Sterilization Consumables

- Wound Care Consumables

- Dialysis Consumables

- Radiology Consumables

- Catheters

- Sleep Apnea Consumables

- Other

Global Medical Supplies Market, by Application

- Wound Care

- Radiology

- Respiratory

- Urology

- Infection Control

- Cardiology

- IVD

- Other

Global Medical Supplies Market, by End-user

- Hospitals

- Clinics/Physician Offices

- Other

Medical Supplies Market Synopsis:

| PARAMETER | VALUE |

Market Size | · 2023: USD 130.2 Billion· 2033: USD 204.36 Billion |

Growth Rate | · First 5 Years CAGR (2023–2028): XX%· Last 5 Years CAGR (2028–2033): XX%· 10 Years CAGR (2023–2033): 3.76% |

Key Market Drivers | · A growing number of older people people require medical care· Increasing prevalence of chronic diseases |

Key Market Restraints | · Stringent regulatory requirements· Limited healthcare access |

Market Opportunities | · Increasing demand for home healthcare· Growing healthcare infrastructure in developing countries |

Key Market Players | · Medtronic· Cardinal Health Inc· BD· Johnson & Johnson· B. Braun Melsungen· Boston Scientific Corporation· Thermo Fisher Scientific Inc· Baxter International Inc· Avanos Medical Inc· 3M· Smith & Nephew· ConvaTec Group |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Medical SuppliesIndustry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Medical Supplies market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Medical Supplies market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Medical Supplies Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Medical Supplies (PQC) market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Medical Supplies market?

The global Medical Supplies market is growing at a CAGR of ~76% over the next 10 years

Which region has the highest growth rate in the market of Medical Supplies?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Medical Supplies?

Europe holds the largest share in 2022

Major Key Players in the Market of Medical Supplies?

Medtronic, Cardinal Health Inc, BD, Johnson & Johnson, B. Braun Melsungen, Boston Scientific Corporation, Thermo Fisher Scientific Inc, Baxter International Inc, Avanos Medical Inc, 3M, Smith & Nephew, ConvaTec Groupare the major companies operating in the Medical Supplies

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. TypeSegement – Market Opportunity Score

4.1.2. Application Segment – Market Opportunity Score

4.1.3. End-userSegment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Medical Supplies Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. MArket Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Global Medical Supplies Market, By Type

7.1. Introduction

7.1.1. Diagnostic Supplies

7.1.2. Infusion & Injectable Supplies

7.1.3. Disinfectants

7.1.4. Personal Protective Equipment

7.1.5. Sterilization Consumables

7.1.6. Wound Care Consumables

7.1.7. Dialysis Consumables

7.1.8. Radiology Consumables

7.1.9. Catheters

7.1.10. Sleep Apnea Consumables

7.1.11. Other

CHAPTER 8. Global Medical Supplies Market, By Application

8.1. Introduction

8.1.1. Wound Care

8.1.2. Radiology

8.1.3. Respiratory

8.1.4. Urology

8.1.5. Infection Control

8.1.6. Cardiology

8.1.7. IVD

8.1.8. Other

CHAPTER 9. Global Medical Supplies Market, By End-user

9.1. Introduction

9.1.1. Hospitals

9.1.2. Clinics/Physician Offices

9.1.3. Other

CHAPTER 10. Global Medical Supplies Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.2.3. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.2.4. North America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.2.5.2. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.2.5.3. US: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.2.6.3. Canada: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.3. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.4. Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.6.3. Germany: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.7.2. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.7.3. France: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.8.3. Italy: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.9.3. Spain: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.11.3. Russia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.5.2. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.5.3. China: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.6.3. Japan: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.7.2. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.7.3. India: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.12.3. Australia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.5.3. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.5.4. South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.6.3. UAE: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Medtronic

13.1.1. Business Overview

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Cardinal Health Inc

13.3. BD

13.4. Johnson & Johnson

13.5. Merck Kgaa

13.6. B. Braun Melsungen

13.7. Boston Scientific Corporation

13.8. Thermo Fisher Scientific Inc

13.9. Baxter International Inc

13.10. Avanos Medical Inc

13.11. 3M

13.12. Smith & Nephew

13.13. ConvaTec Group

Connect to Analyst

Research Methodology