Low Voltage Circuit Breaker Market Overview

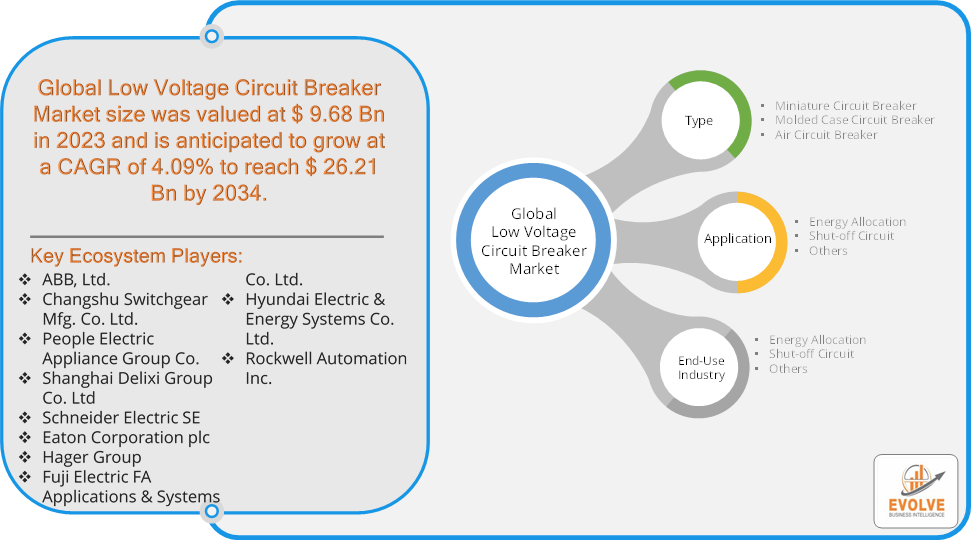

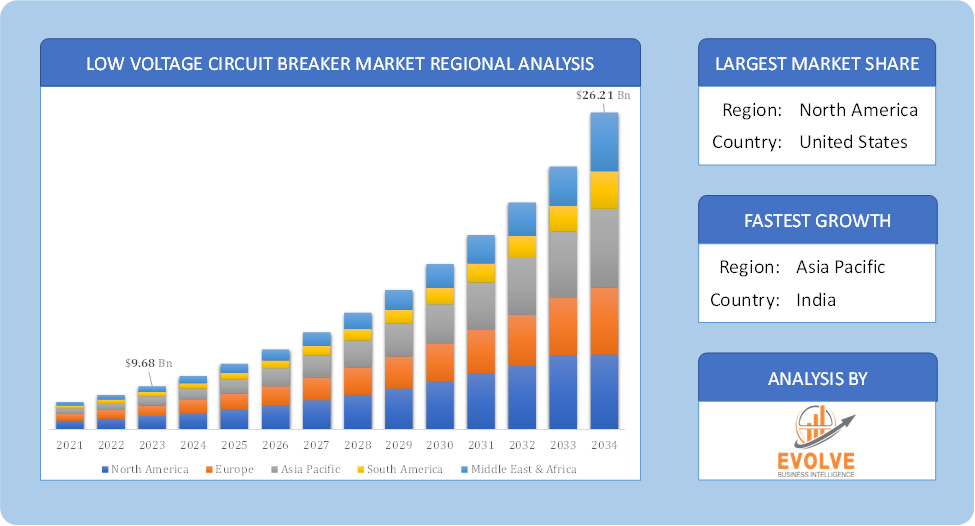

The Low Voltage Circuit Breaker Market size accounted for USD 9.68 Billion in 2023 and is estimated to account for 11.03 Billion in 2024. The Market is expected to reach USD 26.21 Billion by 2034 growing at a compound annual growth rate (CAGR) of 4.09% from 2024 to 2034. The Low Voltage Circuit Breaker (LVCB) Market refers to the market for electrical devices designed to protect electrical circuits from damage caused by overloads, short circuits, and other faults. These devices are essential in residential, commercial, and industrial applications to ensure safety and reliability in electrical systems. These breakers are designed to automatically interrupt the electrical circuit when the current exceeds a predetermined threshold, preventing potential hazards.

The Low Voltage Circuit Breaker Market plays a crucial role in electrical safety and efficiency, and it continues to evolve with technological advancements and changing regulatory landscapes.

Global Low Voltage Circuit Breaker Market Synopsis

Low Voltage Circuit Breaker Market Dynamics

Low Voltage Circuit Breaker Market Dynamics

The major factors that have impacted the growth of Low Voltage Circuit Breaker Marketare as follows:

Drivers:

Ø Technological Advancements

Innovations in circuit breaker technology, including smart circuit breakers with IoT integration, enhanced monitoring, and automation features, make them more appealing to consumers and businesses. Increased awareness regarding electrical safety standards and regulations promotes the adoption of LVCBs to prevent electrical faults, thereby reducing risks of electrical fires and shocks. The rapid growth of data centers, driven by the increasing demand for cloud computing and data storage, requires robust electrical systems and protection solutions, boosting LVCB demand.

Restraint:

- Perception of High Competition and Complexity of Installation

The market is characterized by intense competition among numerous manufacturers, which can lead to price wars and reduced profit margins. Installing advanced circuit breakers, especially smart models, can require specialized knowledge and training, which may deter some users from adopting these technologies. Economic downturns can lead to reduced investments in construction and infrastructure development, negatively affecting the demand for LVCBs.

Opportunity:

⮚ Renewable Energy Adoption

The global shift toward renewable energy sources, such as solar and wind, creates opportunities for LVCBs to facilitate the integration of these energy systems into the existing grid while ensuring safety and reliability. The rise in automation across various industries increases the need for reliable electrical protection solutions, providing a growing market for LVCBs in industrial applications. The proliferation of data centers driven by cloud computing and big data analytics necessitates robust electrical protection solutions, creating a significant demand for LVCBs.

Low Voltage Circuit Breaker Market Segment Overview

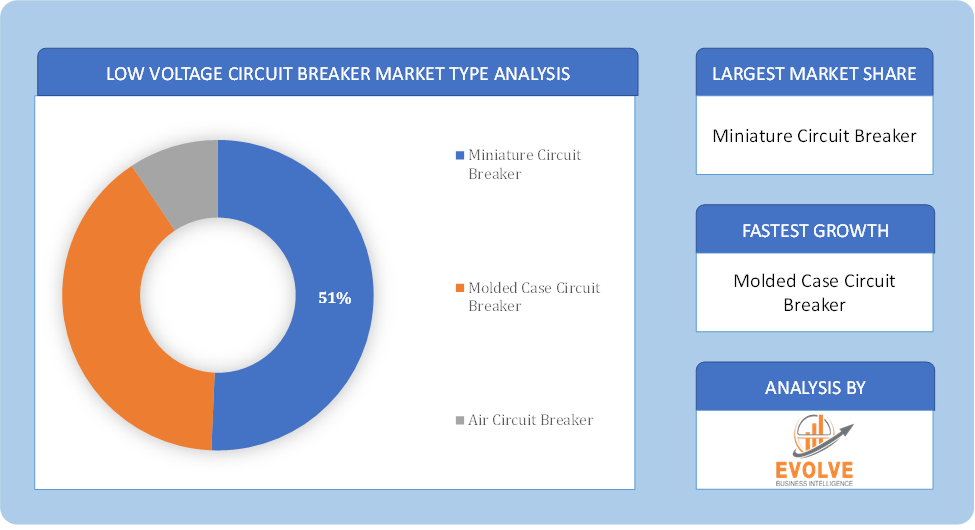

Based on Type, the market is segmented based on Miniature Circuit Breaker, Molded Case Circuit Breaker and Air Circuit Breaker. The Molded-case Circuit Breaker (MCCB) segment dominant the market. Because of its simple design and longevity, the Moulded Case Circuit Breaker (MCCCB) is more dependable and affordable than its competitors. With the expansion of power generating and transmission networks, moulded case circuit breakers are becoming more popular.

By Application

Based on Application, the market segment has been divided into Energy Allocation, Shut-off Circuit and Others. The shut-off circuit segment will lead the market share due to an increase in defective electrical circuit operations such as overloading, short circuit issues, motor-powered system failures, and others in residential, commercial, and manufacturing uses.

By End-Use Industry

Based on End Use Industry, the market segment has been divided into Residential, Commercial and Others. The Residential segment dominant the market. The residential segment primarily includes Miniature Circuit Breakers (MCBs) and Residual-Current Circuit Breakers (RCCBs). MCBs protect against overloads and short circuits, while RCCBs prevent electric shocks by detecting earth faults and increasing urbanization, rising disposable incomes, and growing awareness of electrical safety contribute to the demand for LVCBs in residential settings.

Global Low Voltage Circuit Breaker Market Regional Analysis

Based on region, the global Low Voltage Circuit Breaker Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Low Voltage Circuit Breaker Market followed by the Asia-Pacific and Europe regions.

Low Voltage Circuit Breaker North America Market

Low Voltage Circuit Breaker North America Market

North America holds a dominant position in the Low Voltage Circuit Breaker Market. The increasing adoption of solar and wind power in North America is driving demand for LVCBs in these applications and aging electrical infrastructure in the region requires regular upgrades and replacements. Governments and businesses are focusing on energy efficiency, leading to the adoption of smart LVCBs with energy management capabilities.

Low Voltage Circuit Breaker Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Low Voltage Circuit Breaker Market industry. The Asia-Pacific region is currently the largest and fastest-growing market for low voltage circuit breakers. The region is witnessing significant urbanization, leading to increased demand for electrical infrastructure and countries like China and India are experiencing rapid economic growth, driving industrialization and infrastructure development.

Competitive Landscape

The global Low Voltage Circuit Breaker Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- ABB, Ltd.

- Changshu Switchgear Mfg. Co. Ltd.

- People Electric Appliance Group Co.

- Shanghai Delixi Group Co. Ltd

- Schneider Electric SE

- Eaton Corporation plc

- Hager Group

- Fuji Electric FA Applications & Systems Co. Ltd.

- Hyundai Electric & Energy Systems Co. Ltd.

- Rockwell Automation Inc.

Scope of the Report

Global Low Voltage Circuit Breaker Market, by Type

- Miniature Circuit Breaker

- Molded Case Circuit Breaker

- Air Circuit Breaker

Global Low Voltage Circuit Breaker Market, by Application

- Energy Allocation

- Shut-off Circuit

- Others

Global Low Voltage Circuit Breaker Market, by End-Use Industry

- Residential

- Commercial

- Others

Global Low Voltage Circuit Breaker Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 26.21 Billion |

| CAGR (2024-2034) | 4.09% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application, End Use Industry |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | ABB Ltd., Changshu Switchgear Mfg. Co., Ltd., People Electric Appliance Group Co., Shanghai Delixi Group Co. Ltd, Schneider Electric SE, Eaton Corporation plc, Hager Group, Fuji Electric FA Applications & Systems Co. Ltd., Hyundai Electric & Energy Systems Co. Ltd. and Rockwell Automation Inc. |

| Key Market Opportunities | · Renewable Energy Adoption

· Data Center Expansion |

| Key Market Drivers | · Technological Advancements

· Expansion of Data Centers |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Low Voltage Circuit Breaker Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Low Voltage Circuit Breaker Market historical market size for the year 2021, and forecast from 2023 to 2033

- Low Voltage Circuit Breaker Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Low Voltage Circuit Breaker Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.