Lab Automation Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Lab Automation Market Research Report: By Equipment and Software (Automated Workstations, Off-the-shelf Automated Workcells, Robotic Systems, Automated Storage & Retrieval Systems (ASRS)), By Application (Drug Discovery, Clinical Diagnostics, Genomics Solutions, Proteomics Solutions), By End user (Biotechnology & Pharmaceutical Industries, Research Institutes, Others), and by Region — Forecast till 2033

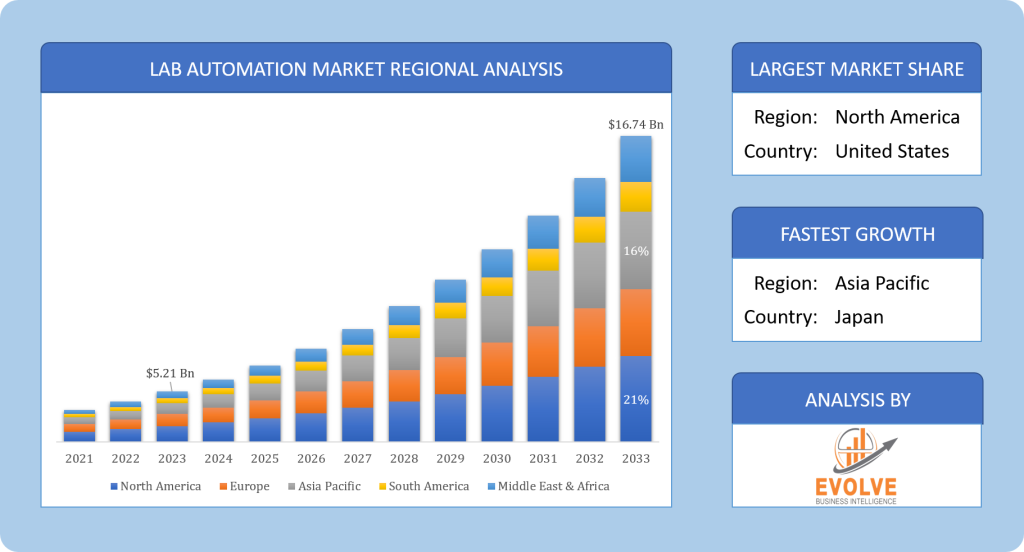

Lab Automation Market Size is expected to reach USD 16.74 Billion by 2033. The Lab Automation industry size accounted for USD 5.21 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.76% from 2023 to 2033. Lab automation refers to the application of advanced technologies and systems to automate laboratory processes and workflows, enabling increased efficiency, accuracy, and productivity in scientific research, experimentation, and analysis. It involves the integration of various instruments, robotics, software, and data management tools to streamline tasks such as sample handling, testing, data collection, analysis, and result interpretation. Lab automation aims to minimize manual intervention, reduce human errors, enhance reproducibility, and accelerate the overall scientific discovery and development processes. It finds extensive applications in various scientific disciplines, including pharmaceuticals, biotechnology, genomics, proteomics, clinical diagnostics, and academic research.

Global Lab Automation Market Synopsis

COVID-19 Impact Analysis

The Lab Automation market experienced a significant impact from the COVID-19 pandemic. The outbreak necessitated a rapid response from laboratories worldwide, leading to an increased demand for automation solutions to support diagnostic testing, research, and drug discovery efforts. The need for high-throughput testing, sample processing, and data analysis capabilities surged, pushing laboratories to adopt automated systems to meet the unprecedented testing volumes and turnaround time requirements. Furthermore, the pandemic highlighted the importance of remote operation and data accessibility, driving the adoption of cloud-based solutions and virtual collaborations in the Lab Automation market. While the pandemic posed challenges such as supply chain disruptions and resource constraints, it also acted as a catalyst for the advancement and wider adoption of automation technologies in laboratory settings.

Global Lab Automation Market Dynamics

The major factors that have impacted the growth of Lab Automation are as follows:

Drivers:

Increasing demand for efficient and accurate laboratory processes

The growing need for streamlined and error-free laboratory operations, driven by factors such as rising sample volumes, complex testing requirements, and the need for faster results, is a significant driver of the Lab Automation market. Automation technologies offer improved efficiency, precision, and scalability, meeting the increasing demands of modern laboratories.

Restraint:

- High implementation costs and complex integration processes

One of the key restraints in the Lab Automation market is the high initial investment required for implementing automation systems. The cost of acquiring and integrating sophisticated instruments, robotics, software, and infrastructure can be substantial. Additionally, integrating automation systems with existing laboratory workflows and technologies can pose challenges, requiring significant time and resources.

Opportunity:

Advancements in artificial intelligence (AI) and machine learning (ML) technologies

The integration of AI and ML capabilities in Lab Automation presents significant opportunities. These technologies enable the development of intelligent automation systems capable of learning from data, optimizing processes, and making data-driven decisions. AI and ML-powered automation can enhance efficiency, accuracy, and predictive capabilities, leading to improved experimental outcomes and faster research and development cycles. The integration of AI and ML in Lab Automation opens doors for innovative applications and improved decision-making capabilities within laboratory settings.

Lab Automation Market Segment Overview

By Equipment and Software

Based on the Equipment and Software, the market is segmented based on Automated Workstations, Off-the-shelf Automated Workcells, Robotic Systems, Automated Storage & Retrieval Systems (ASRS). The Automated Workstations segment was projected to hold the largest market share in the Lab Automation market. This segment includes automated workstations that are designed to perform specific laboratory tasks, such as sample preparation, liquid handling, and plate handling, with minimal human intervention. Automated workstations offer advantages such as improved accuracy, increased productivity, and reduced operational errors. The demand for automated workstations is driven by the need for streamlined laboratory workflows, higher throughput, and efficient handling of samples and reagents.

By Application

Based on the Application, the market has been divided into Drug Discovery, Clinical Diagnostics, Genomics Solutions, Proteomics Solutions. The Drug Discovery segment is expected to hold the largest market share in the Market. This segment focuses on the application of lab automation technologies and solutions in the process of discovering and developing new drugs. Lab automation plays a crucial role in accelerating the drug discovery process by automating tasks such as high-throughput screening, compound management, assay development, and data analysis. The increasing demand for innovative and effective drugs, coupled with the need to expedite the drug discovery timeline, drives the adoption of lab automation in this segment.

By End user

Based on End user, the market has been divided into Biotechnology & Pharmaceutical Industries, Research Institutes, Others. The Biotechnology & Pharmaceutical Industries segment is projected to experience significant growth in the Lab Automation market. This segment focuses on the application of lab automation technologies and solutions specifically tailored to meet the needs of the biotechnology and pharmaceutical sectors. Lab automation plays a crucial role in these industries by streamlining processes such as high-throughput screening, compound management, sample preparation, and data analysis. The increasing demand for innovative therapies, personalized medicine, and the need to accelerate drug discovery and development processes drive the adoption of lab automation in this segment.

Based on End user, the market has been divided into Biotechnology & Pharmaceutical Industries, Research Institutes, Others. The Biotechnology & Pharmaceutical Industries segment is projected to experience significant growth in the Lab Automation market. This segment focuses on the application of lab automation technologies and solutions specifically tailored to meet the needs of the biotechnology and pharmaceutical sectors. Lab automation plays a crucial role in these industries by streamlining processes such as high-throughput screening, compound management, sample preparation, and data analysis. The increasing demand for innovative therapies, personalized medicine, and the need to accelerate drug discovery and development processes drive the adoption of lab automation in this segment.

Global Lab Automation Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Lab Automation, followed by those in Asia-Pacific and Europe.

North America Market

North America has indeed consistently maintained the largest market share in the Lab Automation market. The region’s dominance can be attributed to several factors. Firstly, North America is home to a significant number of key players in the lab automation industry, including manufacturers, suppliers, and technology providers. These companies have a strong presence and extensive distribution networks, contributing to the region’s market leadership. Additionally, North America has a well-established research and development infrastructure, with leading academic institutions and pharmaceutical/biotechnology companies driving innovation in lab automation. The region’s robust healthcare system, high adoption of advanced technologies, and significant investments in research and development further contribute to its market share.

Asia Pacific Market

The Lab Automation industry in the Asia-Pacific region has indeed been witnessing a significant growth rate. Several factors contribute to this growth. Firstly, the region is experiencing rapid economic development, leading to increased investment in research and development activities across various industries, including pharmaceuticals, biotechnology, and academic research. This investment drives the demand for lab automation solutions to enhance efficiency and productivity in laboratory processes. Additionally, the Asia-Pacific region has a large population and a growing middle class, resulting in increased healthcare expenditure and demand for advanced healthcare services. This, in turn, fuels the adoption of lab automation technologies in clinical diagnostics and drug discovery. Furthermore, the region has a strong focus on technological advancements and digital transformation, with countries like China, Japan, and South Korea leading in areas such as robotics, artificial intelligence, and data analytics, which further supports the growth of the Lab Automation industry.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Thermo Fisher Scientific Inc, Agilent Technologies Inc, Danaher Corporation, PerkinElmer Inc, Siemens Healthineers are some of the leading players in the global Lab Automation Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Thermo Fisher Scientific Inc

- Agilent Technologies Inc

- Danaher Corporation

- PerkinElmer Inc

- Siemens Healthineers AG

- Tecan Group Ltd

- Roche Holding AG

- Hamilton Company

- Bio-Rad Laboratories Inc

- Beckman Coulter Inc

Key development:

In March 2022, Beckman Coulter Life Sciences unveiled an impactful solution for overcoming manual sample preparation and data management challenges in clinical flow cytometry. Introducing the CellMek SPS, a highly efficient and fully automated sample preparation system, laboratories can now address bottlenecks and enhance their capabilities through on-demand processing for various sample types. This advanced technology empowers laboratories with increased efficiency and expands their potential to handle a broader range of samples.

Scope of the Report

Global Lab Automation Market, by Equipment and Software

- Automated Workstations

- Off-the-shelf Automated Workcells

- Robotic Systems

- Automated Storage & Retrieval Systems (ASRS)

Global Lab Automation Market, by Application

- Drug Discovery

- Clinical Diagnostics

- Genomics Solutions

- Proteomics Solutions

Global Lab Automation Market, by End user

- Biotechnology & Pharmaceutical Industries

- Research Institutes

- Others

Global Lab Automation Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $16.74 Billion |

| CAGR | 6.76% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Equipment and Software, Application, End user |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Thermo Fisher Scientific Inc, Agilent Technologies Inc, Danaher Corporation, PerkinElmer Inc, Siemens Healthineers, Tecan Group Ltd, Roche Holding AG, Hamilton Company, Bio-Rad Laboratories Inc, Beckman Coulter Inc |

| Key Market Opportunities | • Increasing demand for efficient and accurate laboratory processes • Growing need for high-throughput testing and data analysis capabilities • Advancements in technology, including robotics, AI, and data management |

| Key Market Drivers | • Increasing demand for efficient and accurate laboratory processes • Growing need for high-throughput testing and data analysis capabilities • Advancements in technology, including robotics, AI, and data management |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Lab Automation Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Lab Automation market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Lab Automation market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Lab Automation Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Lab Automation market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Lab Automation market?

The global Lab Automation market is growing at a CAGR of ~76% over the next 10 years

Which region has the highest growth rate in the market of Lab Automation?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Lab Automation?

North America holds the largest share in 2022

Major Key Players in the Market of Stem Cell Manufacturers?

Thermo Fisher Scientific Inc, Agilent Technologies Inc, Danaher Corporation, PerkinElmer Inc, Siemens Healthineers, Tecan Group Ltd, Roche Holding AG, Hamilton Company, Bio-Rad Laboratories Inc, Beckman Coulter Inc are the major companies operating in the Lab Automation

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Equipment and Software Segement – Market Opportunity Score 4.1.2. Application Segment – Market Opportunity Score 4.1.3. End user Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Lab Automation Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Lab Automation Market, By Equipment and Software 7.1. Introduction 7.1.1. Automated Workstations 7.1.2. Off-the-shelf Automated Workcells 7.1.3. Robotic Systems 7.1.4. Automated Storage & Retrieval Systems (ASRS) CHAPTER 8. Global Lab Automation Market, By Application 8.1. Introduction 8.1.1. Drug Discovery 8.1.2. Clinical Diagnostics 8.1.3. Genomics Solutions 8.1.4. Proteomics Solutions CHAPTER 9. Global Lab Automation Market, By End user 9.1. Introduction 9.1.1. Biotechnology & Pharmaceutical Industries 9.1.2. Research Institutes 9.1.3. Others CHAPTER 10. Global Lab Automation Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Equipment and Software, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End user, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Thermo Fisher Scientific Inc 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Agilent Technologies Inc 13.3. Danaher Corporation 13.4. PerkinElmer Inc 13.5. Siemens Healthineers 13.6. Tecan Group Ltd 13.7. Roche Holding 13.8. Hamilton Company 13.9. Bio-Rad Laboratories Inc 13.10. Beckman Coulter Inc

Connect to Analyst

Research Methodology