IoT in Banking and Financial Services Market Overview

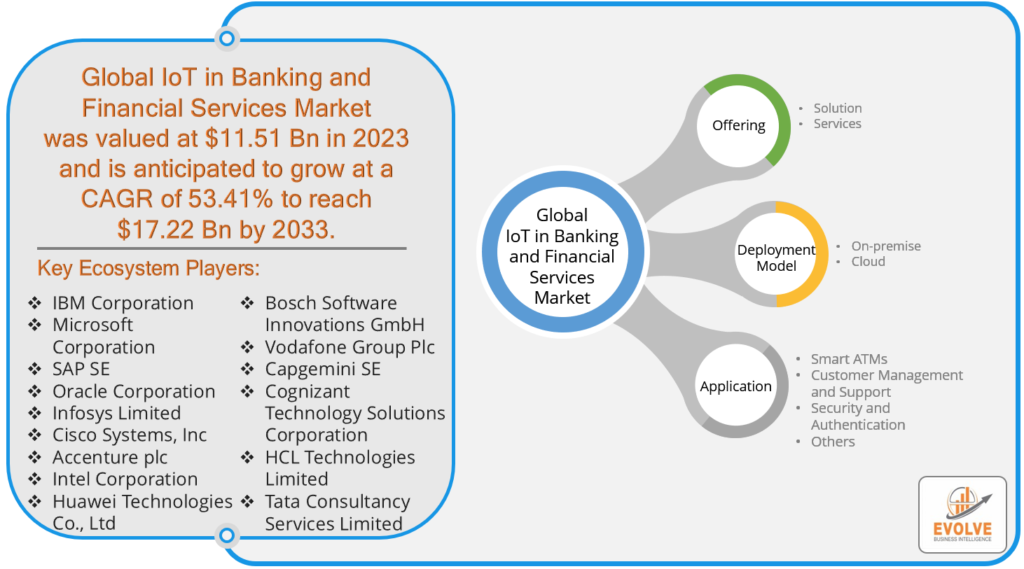

The IoT in Banking and Financial Services Market Size is expected to reach USD 17.22 Billion by 2033. The IoT in Banking and Financial Services industry size accounted for USD 11.51 Billion in 2023 and is expected to expand at a CAGR of 53.41% from 2023 to 2033. IoT in Banking and Financial Services is the application of Internet of Things technology to enhance and streamline various aspects of the financial industry. It involves the deployment of IoT devices and sensors in physical assets, such as ATMs, bank branches, vehicles, and even wearable devices, to gather real-time data and enable seamless communication and data exchange. These interconnected devices and systems aim to improve operational efficiency, enhance customer experiences, and enable data-driven decision-making in the banking and financial sectors.

Global IoT in Banking and Financial Services Market Synopsis

The IoT market in banking and financial services experienced both challenges and opportunities as a result of the COVID-19 pandemic. On the one hand, the pandemic accelerated the adoption of digital banking and contactless payment methods, driving increased interest in IoT devices like wearable payment devices and mobile banking apps. Banks and financial institutions also turned to IoT for monitoring and maintaining critical assets remotely, reducing the need for physical presence during lockdowns. However, the economic uncertainties and budget constraints triggered by the pandemic led some organizations to delay or scale back their IoT initiatives temporarily. Overall, the pandemic underscored the importance of IoT in ensuring business continuity and enhancing customer experiences, and it is likely to continue shaping the IoT landscape in the financial sector in the post-pandemic era.

Global IoT in Banking and Financial Services Market Dynamics

The major factors that have impacted the growth of IoT in Banking and Financial Services are as follows:

Drivers:

⮚ Enhanced Customer Experiences

IoT adoption in the banking and financial services market is the opportunity to provide enhanced customer experiences. IoT technology allows banks to gather real-time data on customer behavior and preferences, enabling them to offer personalized services and recommendations. For example, wearable devices and smart banking applications can provide customers with real-time financial insights and transaction alerts, improving overall satisfaction and engagement.

Restraint:

- Security and Privacy Concerns

Security and privacy concerns represent a significant restraint in the adoption of IoT in banking and financial services. The vast amount of sensitive financial data collected and transmitted by IoT devices makes them attractive targets for cyberattacks. Ensuring the security of these devices and the data they generate is a constant challenge, and any breaches can have severe financial and reputational consequences for financial institutions. Additionally, privacy regulations such as GDPR and CCPA impose strict requirements on data handling, adding complexity to IoT implementations.

Opportunity:

⮚ Operational Efficiency and Cost Reduction

IoT offers financial institutions the opportunity to improve operational efficiency and reduce costs. IoT sensors and devices can be deployed in branches, ATMs, and back-office operations to monitor equipment performance, predict maintenance needs, and automate routine tasks. This not only reduces operational downtime but also lowers maintenance expenses. Moreover, IoT-driven analytics can help banks optimize their physical footprint by identifying underutilized branches or ATMs, further reducing costs while maintaining service quality.

IoT in Banking and Financial Services Market Segment Overview

By Offering

Based on the Offering, the market is segmented based on Solutions and services. The Solution segment was projected to hold the largest market share in the IoT in Banking and Financial Services market due to the comprehensive offerings, including software platforms and consulting services, required to implement and manage IoT solutions effectively in the financial sector.

Based on the Offering, the market is segmented based on Solutions and services. The Solution segment was projected to hold the largest market share in the IoT in Banking and Financial Services market due to the comprehensive offerings, including software platforms and consulting services, required to implement and manage IoT solutions effectively in the financial sector.

By Deployment Model

Based on the Deployment Model, the market has been divided into On-premise and cloud. The Cloud segment is expected to hold the largest market share in the IoT in Banking and Financial Services market due to its scalability, cost-effectiveness, and ability to facilitate real-time data processing and analytics for financial institutions.

By Application

Based on Application, the market has been divided into Smart ATMs, Customer Management and Support, Security and Authentication, and Others. The Smart ATMs segment is expected to hold the largest market share in the IoT in Banking and Financial Services market due to its role in enhancing operational efficiency, reducing downtime, and providing secure and convenient banking services.

Global IoT in Banking and Financial Services Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of IoT in Banking and Financial services, followed by those in Asia-Pacific and Europe.

North America Market

North America Market

North America asserts dominance in the IoT in Banking and Financial Services market primarily due to its advanced technological infrastructure, early adoption of IoT solutions, and a highly developed financial services sector. The region’s well-established banking and financial institutions have been at the forefront of IoT adoption, leveraging the technology to improve customer experiences, enhance operational efficiency, and strengthen security measures. Furthermore, North America benefits from a robust ecosystem of IoT solution providers and technology vendors, fostering innovation and driving market growth. Regulatory support and a strong focus on data privacy and security compliance have also contributed to North America’s leadership position in the IoT-driven transformation of the banking and financial services industry.

Asia Pacific Market

The Asia-Pacific region has been experiencing remarkable growth in the IoT in Banking and Financial Services market, fueled by several key factors. First, the region’s rapidly expanding middle class and increasing smartphone penetration have created a substantial customer base for digital banking and IoT-enabled financial services. Second, financial institutions in Asia-Pacific are increasingly investing in technology to stay competitive and meet evolving customer expectations, driving the adoption of IoT solutions for better customer engagement and operational efficiency. Moreover, the diverse and dynamic financial services landscape in the region, encompassing both mature markets like Japan and emerging markets like India and Southeast Asia, has created a fertile ground for IoT innovation and tailored solutions. As regulatory frameworks adapt to technological advancements, Asia-Pacific is positioned for continued growth and innovation in the IoT-driven banking and financial services sector.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, and Infosys Limited are some of the leading players in the global IoT in Banking and Financial Services Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Infosys Limited

- Cisco Systems, Inc

- Accenture plc

- Intel Corporation

- Huawei Technologies Co Ltd

- Bosch Software Innovations GmbH

- Vodafone Group Plc

- Capgemini SE

- Cognizant Technology Solutions Corporation

- HCL Technologies Limited

- Tata Consultancy Services Limited

Key development:

In February 2023, T-Systems, a subsidiary of Deutsche Telekom, and Commerzbank unveiled their partnership to jointly create a blockchain and IoT-based solution aimed at automating supply chain processes and associated financial transactions.

Scope of the Report

Global IoT in Banking and Financial Services Market, by Offering

- Solution

- Services

Global IoT in Banking and Financial Services Market, by Deployment Model

- On-premise

- Cloud

Global IoT in Banking and Financial Services Market, by Application

- Smart ATMs

- Customer Management and Support

- Security and Authentication

- Others

Global IoT in Banking and Financial Services Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $17.22 Billion |

| CAGR | 53.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Offering, Deployment Model, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, Infosys Limited, Cisco Systems, Inc., Accenture plc, Intel Corporation, Huawei Technologies Co Ltd., Bosch Software Innovations GmbH, Vodafone Group Plc, Capgemini SE, Cognizant Technology Solutions Corporation, HCL Technologies Limited, Tata Consultancy Services Limited |

| Key Market Opportunities | • Improved Security Measures • Personalized Financial Services |

| Key Market Drivers | • Enhanced Customer Experiences • Operational Efficiency |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future IoT in Banking and Financial Services Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- IoT in Banking and Financial Services market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global IoT in Banking and Financial Services market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global IoT in Banking and Financial Services Market.