Industrial Robots & Automation Market Overview

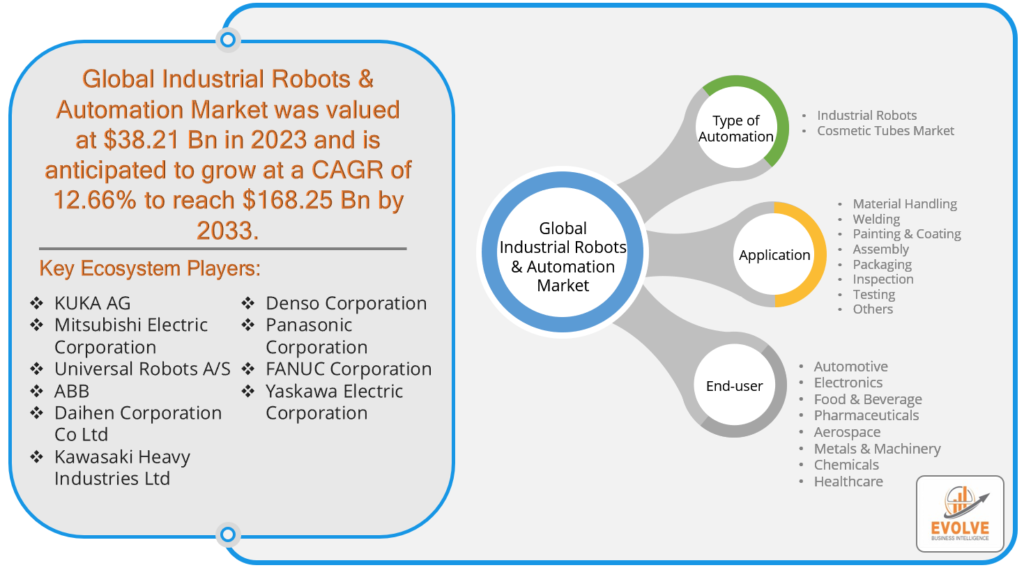

The Industrial Robots & Automation Market Size is expected to reach USD 168.25 Billion by 2033. The Industrial Robots and Automation Industry size accounted for USD 38.21 Billion in 2023 and is expected to expand at a CAGR of 12.66% from 2023 to 2033. Industrial robots are programmable mechanical devices designed to perform a variety of tasks in manufacturing and industrial settings, such as assembly, welding, painting, and material handling, with a high degree of precision and efficiency. Automation refers to the use of various technologies, including robots, computer systems, and control systems, to replace or enhance human labor in the production and operation of machinery and processes. Together, industrial robots and automation technologies aim to streamline production, improve quality, reduce costs, and increase overall productivity in industrial and manufacturing environments.

Global Industrial Robots & Automation Market Synopsis

The Industrial Robots & Automation market experienced a moderate impact from the COVID-19 pandemic. While the initial outbreak disrupted supply chains and temporarily slowed down production in some sectors, the crisis also highlighted the value of automation and robotics in maintaining business continuity and ensuring worker safety. Consequently, many industries accelerated their adoption of automation solutions to minimize human interaction, enhance operational resilience, and meet changing market demands. As a result, the sector witnessed increased interest and investment, particularly in industries like e-commerce, healthcare, and logistics, underscoring the adaptability and long-term growth potential of the industrial robotics and automation market in the face of global challenges.

Global Industrial Robots & Automation Market Dynamics

The major factors that have impacted the growth of Industrial Robots & Automation are as follows:

Drivers:

⮚ Increasing Labor Costs Drive Demand for Industrial Robots & Automation

The rising labor costs, coupled with the need for improved productivity and quality, are compelling industries to invest in industrial robots and automation. This driver is especially significant in sectors such as manufacturing, where the automation of repetitive and labor-intensive tasks can reduce operational expenses and enhance output, making it a cost-effective solution.

Restraint:

- Integration Challenges Pose a Restraint to Industrial Robots & Automation Adoption

The industrial robots and automation market is the complexity and cost of integrating automation systems into existing processes. Many industries face challenges in seamlessly transitioning to automated solutions, including the need for substantial capital investments, retrofitting existing infrastructure, and retraining the workforce. These integration hurdles can slow down the adoption of automation technologies.

Opportunity:

⮚ Industry 4.0 and IoT Unlock New Growth Opportunities for Industrial Robots & Automation

The advent of Industry 4.0 and the Internet of Things (IoT) presents a significant opportunity for the industrial robots and automation market. By leveraging connected devices, data analytics, and real-time monitoring, industries can achieve greater efficiency, predictive maintenance, and customization in their production processes. This not only enhances operational performance but also opens up new horizons for automation in various sectors, including smart factories, healthcare, and logistics.

Industrial Robots & Automation Market Segment Overview

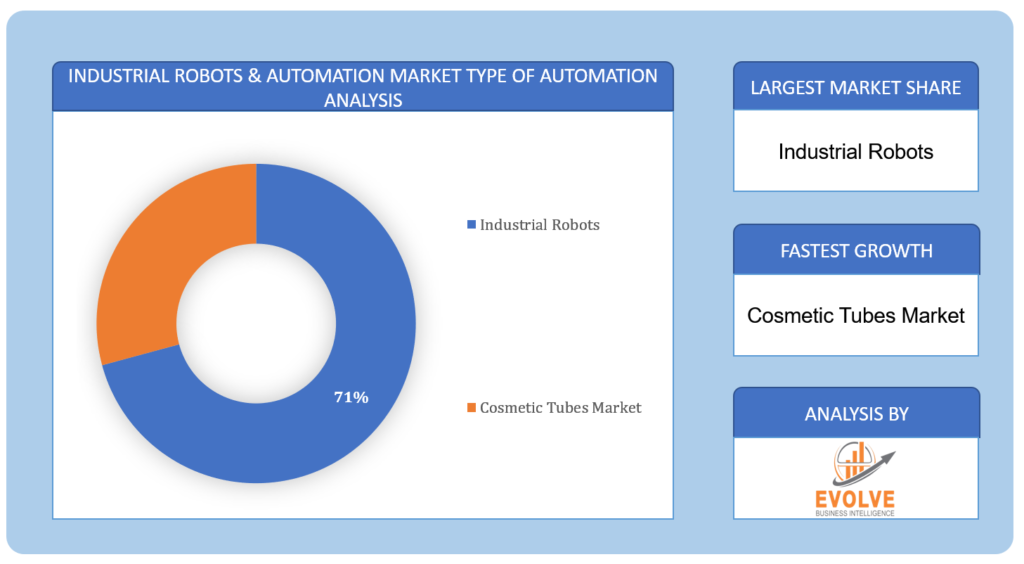

By Type of Automation

Based on the Type of Automation, the market is segmented based on Industrial Robots and Cosmetic Tubes Market. The Industrial Robots segment was projected to hold the largest market share in the Industrial Robots & Automation market due to its versatility and ability to cater to a wide range of manufacturing and industrial applications.

Based on the Type of Automation, the market is segmented based on Industrial Robots and Cosmetic Tubes Market. The Industrial Robots segment was projected to hold the largest market share in the Industrial Robots & Automation market due to its versatility and ability to cater to a wide range of manufacturing and industrial applications.

By Application

Based on the Application, the market has been divided into Material Handling, Welding, Painting & Coating, Assembly, Packaging, Inspection, Testing, and Others. The Material Handling segment is expected to hold the largest market share in the Elbow Sleeve market due to its broad utility in various industries, from logistics and e-commerce to manufacturing and healthcare, driving demand for protective and supportive solutions.

By End-user

Based on End-users, the market has been divided into Automotive, Electronics, Food & Beverage, Pharmaceuticals, Aerospace, Metals & Machinery, Chemicals, and Healthcare. The Automotive segment is expected to hold the largest market share in the Industrial Robots & Automation market due to its extensive adoption of robotics and automation for manufacturing and assembly processes, streamlining production and enhancing efficiency.

Global Industrial Robots & Automation Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Industrial Robots & Automation, followed by those in Asia-Pacific and Europe.

North America Market

North America significantly dominates the Industrial Robots & Automation market. This leadership is attributed to several factors, including the region’s strong manufacturing base, technological innovation, and a robust focus on automation. The presence of major automotive, aerospace, and electronics industries, as well as increasing demand for automation in e-commerce and logistics, has fueled the growth of industrial robots in the region. Moreover, North America boasts a thriving ecosystem of robotics and automation companies, research institutions, and a skilled workforce, making it a global hub for technology development and adoption in this field. Additionally, government initiatives, such as tax incentives and funding for automation projects, have further accelerated the adoption of industrial robots and automation solutions across various industries, solidifying North America’s position as a dominant force in this market.

North America significantly dominates the Industrial Robots & Automation market. This leadership is attributed to several factors, including the region’s strong manufacturing base, technological innovation, and a robust focus on automation. The presence of major automotive, aerospace, and electronics industries, as well as increasing demand for automation in e-commerce and logistics, has fueled the growth of industrial robots in the region. Moreover, North America boasts a thriving ecosystem of robotics and automation companies, research institutions, and a skilled workforce, making it a global hub for technology development and adoption in this field. Additionally, government initiatives, such as tax incentives and funding for automation projects, have further accelerated the adoption of industrial robots and automation solutions across various industries, solidifying North America’s position as a dominant force in this market.

Asia Pacific Market

The Asia-Pacific region has been experiencing remarkable growth in the Industrial Robots & Automation market. This surge can be attributed to several factors, including the rapid industrialization of countries like China and India, coupled with the need to meet increasing consumer demand efficiently. The automotive and electronics industries, in particular, have been major drivers of automation adoption in the region, seeking to enhance production capacity and product quality. Additionally, government initiatives, such as “Made in China 2025” and “Made in India,” have further incentivized the use of industrial robots and automation technologies, promoting local manufacturing and innovation. The region’s well-established supply chain networks, expanding middle-class population, and a growing emphasis on smart manufacturing and Industry 4.0 practices have all contributed to the remarkable growth of the Industrial Robots & Automation market in the Asia-Pacific region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as KUKA AG, Mitsubishi Electric Corporation, Universal Robots A/S, ABB, and Daihen Corporation Co Ltd are some of the leading players in the global Industrial Robots & Automation Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- KUKA AG

- Mitsubishi Electric Corporation

- Universal Robots A/S

- ABB

- Daihen Corporation Co Ltd

- Kawasaki Heavy Industries Ltd

- Denso Corporation

- Panasonic Corporation

- FANUC Corporation

- Yaskawa Electric Corporation

Key development:

In June 2023, ABB Robotics revealed their plans for extending the GoFa cobot family, introducing the latest models, GoFa 10 and GoFa 12. These new cobots come with improved efficiency, increased payload capacity, and a host of other advanced features.

In October 2022, ABB Robotics introduced the IRB1010, their smallest industrial robot ever, in response to the growing demand for smart device production. Specifically tailored for the electronics manufacturing sector, including products like earphones, health trackers, smartwatches, and similar devices, the robot is designed to meet the needs of this industry.

Scope of the Report

Global Industrial Robots & Automation Market, by Type of Automation

- Industrial Robots

- Cosmetic Tubes Market

Global Industrial Robots & Automation Market, by Application

- Material Handling

- Welding

- Painting & Coating

- Assembly

- Packaging

- Inspection

- Testing

- Others

Global Industrial Robots & Automation Market, by End User

- Automotive

- Electronics

- Food & Beverage

- Pharmaceuticals

- Aerospace

- Metals & Machinery

- Chemicals

- Healthcare

Global Industrial Robots & Automation Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $168.25 Billion |

| CAGR | 12.66% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type of Automation, Application, End-user |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | KUKA AG, Mitsubishi Electric Corporation, Universal Robots A/S, ABB, Daihen Corporation Co Ltd, Kawasaki Heavy Industries Ltd, Denso Corporation, Panasonic Corporation, FANUC Corporation, Yaskawa Electric Corporation |

| Key Market Opportunities | • Industry 4.0 and IoT Integration • Expanding Applications in Various Sectors • Long-Term Growth Potential |

| Key Market Drivers | • Labor Cost Pressures • Enhanced Productivity and Quality • Resilience and Business Continuity |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Industrial Robots & Automation Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Industrial Robots & Automation market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Industrial Robots & Automation market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Industrial Robots & Automation Market.