Industrial Refrigeration System Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

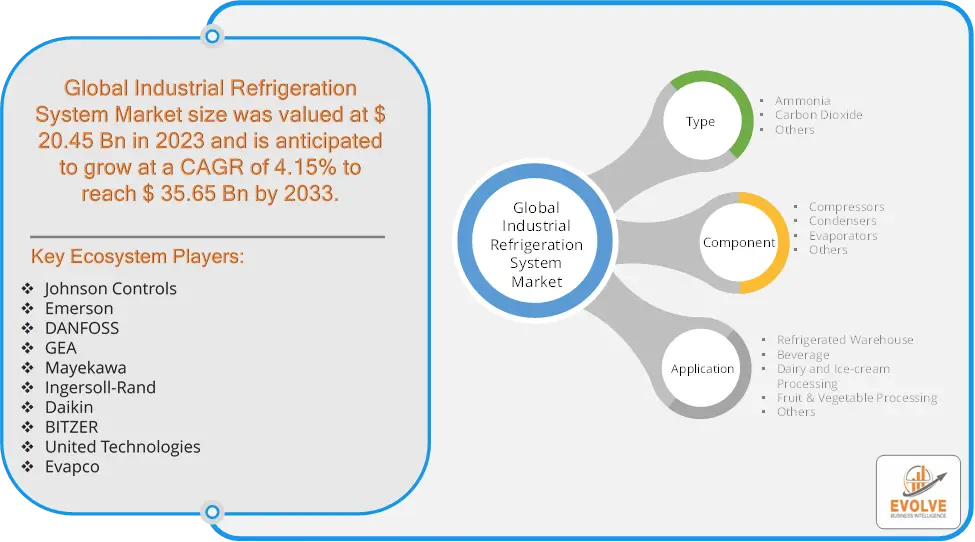

Industrial Refrigeration System Market Research Report: By Type (Ammonia, Carbon Dioxide, Others), By Component (Compressors, Condensers, Evaporators, Others), By Application (Refrigerated Warehouse, Beverage, Dairy and Ice-cream Processing, Fruit & Vegetable Processing, Others), and by Region — Forecast till 2033

Page: 167

Industrial Refrigeration System Market Overview

The Industrial Refrigeration System Market Size is expected to reach USD 35.65 Billion by 2033. The Industrial Refrigeration System industry size accounted for USD 20.45 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.15% from 2023 to 2033. The Industrial Refrigeration System Market encompasses equipment and technologies used for cooling and preserving products in various industrial sectors, such as food and beverage, pharmaceuticals, and chemical processing. It includes components like compressors, condensers, evaporators, and control systems. Key drivers of the market include rising demand for perishable goods, advancements in refrigerant technologies, and stringent regulations on energy efficiency. The market is segmented based on system type (e.g., ammonia, carbon dioxide, and hybrid systems), application, and geography. Growth is fueled by increasing industrialization and the need for efficient temperature management in production and storage processes.

Global Industrial Refrigeration System Market Synopsis

Global Industrial Refrigeration System Market Dynamics

Global Industrial Refrigeration System Market Dynamics

The major factors that have impacted the growth of Industrial Refrigeration System are as follows:

Drivers:

⮚ Advancements in Refrigeration Technologies

Technological innovations in refrigeration systems, such as improved refrigerants, energy-efficient compressors, and advanced control systems, are driving market growth. New technologies offer enhanced performance, reduced environmental impact, and lower operating costs, making them attractive options for industrial applications.

Restraint:

- Technological Complexity

The rapid advancement of refrigeration technologies can lead to complexity in system integration and operation. Businesses may face challenges in adapting to new technologies, requiring skilled personnel and specialized training. The complexity can also result in higher maintenance and repair costs.

Opportunity:

⮚ Expansion of the Cold Chain Industry

The expansion of the cold chain industry, driven by the rise in e-commerce and the need for efficient storage and transportation of perishable goods, provides a substantial opportunity. Investments in modern refrigeration systems that enhance cold chain logistics and ensure product safety and quality can lead to significant market growth. This is particularly relevant for food safety, pharmaceuticals, and temperature-sensitive products.

Industrial Refrigeration System Market Segment Overview

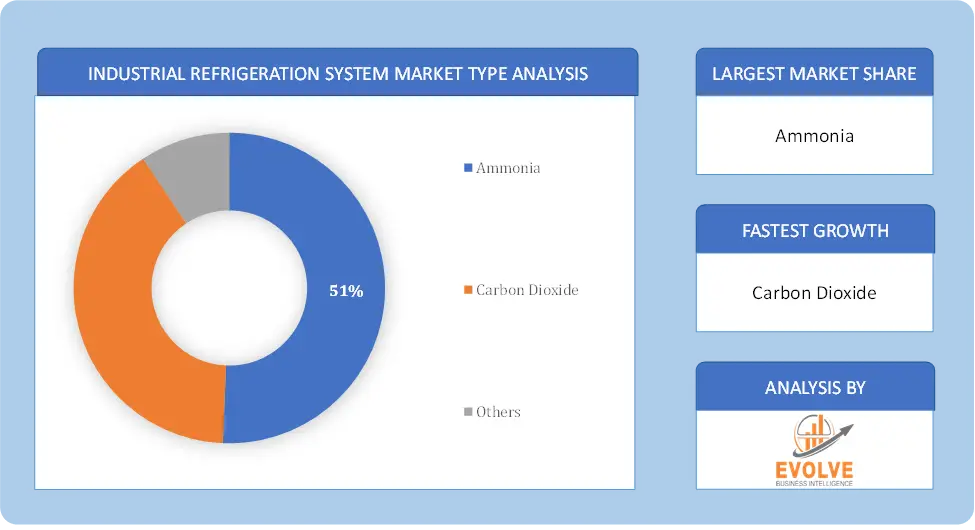

By Type

Based on the Type, the market is segmented based on Ammonia, Carbon Dioxide, Others. Ammonia dominates the segment based on type due to its high efficiency and effectiveness in large-scale industrial applications, despite its handling complexity.

Based on the Type, the market is segmented based on Ammonia, Carbon Dioxide, Others. Ammonia dominates the segment based on type due to its high efficiency and effectiveness in large-scale industrial applications, despite its handling complexity.

By Component

Based on the Component, the market has been divided into Compressors, Condensers, Evaporators, Others. Compressors dominate the segment based on components due to their critical role in the refrigeration cycle, affecting overall system efficiency and performance.

By Application

Based on Application, the market has been divided into Refrigerated Warehouse, Beverage, Dairy and Ice-cream Processing, Fruit & Vegetable Processing, Others. the Refrigerated Warehouse segment dominates due to the extensive need for large-scale temperature-controlled storage facilities across various industries, including food and pharmaceuticals.

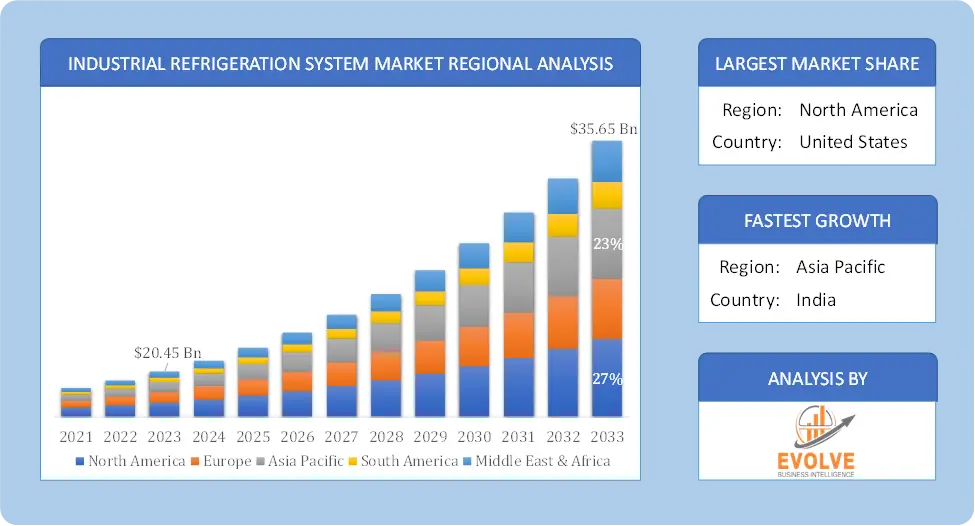

Global Industrial Refrigeration System Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Industrial Refrigeration System, followed by those in Asia-Pacific and Europe.

Industrial Refrigeration System North America Market

Industrial Refrigeration System North America Market

North America dominates the Industrial Refrigeration System market due to several factors. With a revenue share of over 30.0% in 2022, North America held the biggest market share and is predicted to increase steadily through the projection period. One of the elements influencing the growth of the local market is the e-commerce sector’s rise. Consumer purchasing habits have been influenced by the growth of e-commerce in the United States and Canada, as online grocery shopping has become a necessity.

Industrial Refrigeration System Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. In the Asia-Pacific region, the Industrial Refrigeration System Market is experiencing robust growth driven by rapid industrialization, urbanization, and increasing demand for perishable goods. Emerging economies like China, India, and Southeast Asian countries are expanding their industrial and cold chain infrastructure to support food safety, pharmaceuticals, and chemical processing. Government initiatives to enhance energy efficiency and sustainability are further boosting market development.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Johnson Controls, Emerson, DANFOSS, GEA, and Mayekawa are some of the leading players in the global Industrial Refrigeration System Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Johnson Controls

- Emerson

- DANFOSS

- GEA

- Mayekawa

- Ingersoll-Rand

- Daikin

- BITZER

- United Technologies

- Evapco

Key development:

In November 2023, DAIKIN Industries Ltd. introduced a fully electric and plug-in hybrid transport refrigeration product range aimed at reducing emissions from internal combustion engines.

In June 2023, Johnson Controls acquired M&M Carnot, a provider of natural refrigeration solutions with ultra-low global warming potential (GWP). This acquisition is projected to support Johnson Controls’ move to help customers meet sustainability goals. The acquisition also strengthened the portfolio of Johnson Controls, which meets environmental regulations.

Scope of the Report

Global Industrial Refrigeration System Market, by Type

- Ammonia

- Carbon Dioxide

- Others

Global Industrial Refrigeration System Market, by Component

- Compressors

- Condensers

- Evaporators

- Others

Global Industrial Refrigeration System Market, by Application

- Refrigerated Warehouse

- Beverage

- Dairy and Ice-cream Processing

- Fruit & Vegetable Processing

- Others

Global Industrial Refrigeration System Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $35.65 Billion |

| CAGR | 4.15% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Component, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Johnson Controls, Emerson, DANFOSS, GEA, Mayekawa, Ingersoll-Rand, Daikin, BITZER, United Technologies, Evapco. |

| Key Market Opportunities | • Creative Content Generation and Personalization • Expanding Components in industries like media & entertainment, gaming, healthcare, design |

| Key Market Drivers | • Advancements in AI research and technology • Growing demand for personalized and creative content |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Industrial Refrigeration System Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Industrial Refrigeration System market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Industrial Refrigeration System market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Industrial Refrigeration System Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Industrial Refrigeration System market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Industrial Refrigeration System market?

The global Industrial Refrigeration System market is growing at a CAGR of ~4.15% over the next 10 years

Which region has the highest growth rate in the market of Industrial Refrigeration System?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Industrial Refrigeration System?

North America holds the largest share in 2022

Major Key Players in the Market of Stem Cell Manufacturers?

Johnson Controls, Emerson, DANFOSS, GEA, Mayekawa, Ingersoll-Rand, Daikin, BITZER, United Technologies, Evapco

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Industrial Refrigeration System Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Industrial Refrigeration System Market, By Type 6.1. Introduction 6.2. Ammonia 6.3. Carbon Dioxide 6.4. Others Chapter 7. Global Industrial Refrigeration System Market, By Component 7.1. Introduction 7.2. Compressors 7.3. Condensers 7.4. Evaporators 7.5. Others Chapter 8. Global Industrial Refrigeration System Market, By Application 8.1. Introduction 8.2. Refrigerated Warehouse 8.3. Beverage 8.4. Dairy and Ice-cream Processing 8.5. Fruit & Vegetable Processing 8.6. Others Chapter 9. Global Industrial Refrigeration System Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Type, 2020 - 2028 9.2.5. Market Size and Forecast, By Component, 2020 – 2028 9.2.6. Market Size and Forecast, By Application, 2020 – 2028 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.7.3. Market Size and Forecast, By Type, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Component, 2020 – 2028 9.2.7.5. Market Size and Forecast, By Application, 2020 - 2028 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.8.4. Market Size and Forecast, By Type, 2020 - 2028 9.2.8.5. Market Size and Forecast, By Component, 2020 – 2028 9.2.8.6. Market Size and Forecast, By Application, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Type, 2020 - 2028 9.3.5. Market Size and Forecast, By Component, 2020 – 2028 9.3.6. Market Size and Forecast, By Application, 2020 – 2028 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.7.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.7.5. Market Size and Forecast, By Application, 2020 - 2028 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.8.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.8.5. Market Size and Forecast, By Application, 2020 - 2028 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.9.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.9.5. Market Size and Forecast, By Application, 2020 - 2028 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.10.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.10.5. Market Size and Forecast, By Application, 2020 - 2028 9.3.11. Rest Of Europe 9.3.11.1. Introduction 9.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.11.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.11.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.11.5. Market Size and Forecast, By Application, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Type, 2020 - 2028 9.4.5. Market Size and Forecast, By Component, 2020 – 2028 9.4.7. Market Size and Forecast, By Application, 2020 - 2028 9.4.8. China 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.8.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.8.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.9. India 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.9.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.9.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.10. Japan 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.10.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.10.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.11. South Korea 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.11.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.11.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.11.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.12. Rest Of Asia-Pacific 9.4.11.1. Introduction 9.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.12.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.12.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.12.5. Market Size and Forecast, By Application, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.3. Market Size and Forecast, By Type, 2020 - 2028 9.5.4. Market Size and Forecast, By Component, 2020 – 2028 9.5.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.6. Market Size and Forecast, By Region, 2020 - 2028 9.5.7. South America 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.7.3. Market Size and Forecast, By Type, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Component, 2020 – 2028 9.5.7.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.8. Middle East & Africa 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.8.3. Market Size and Forecast, By Type, 2020 - 2028 9.5.8.4. Market Size and Forecast, By Component, 2020 – 2028 9.5.8.5. Market Size and Forecast, By Application, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning 2020 Chapter 11. Company Profiles 11.1. Johnson Controls 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. Emerson 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Danfoss 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. GEA 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. Mayekawa 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Ingersoll-Rand 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. Daikin 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. BITZER 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. United Technologies 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. Evapco 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology