Ship Building Market Overview

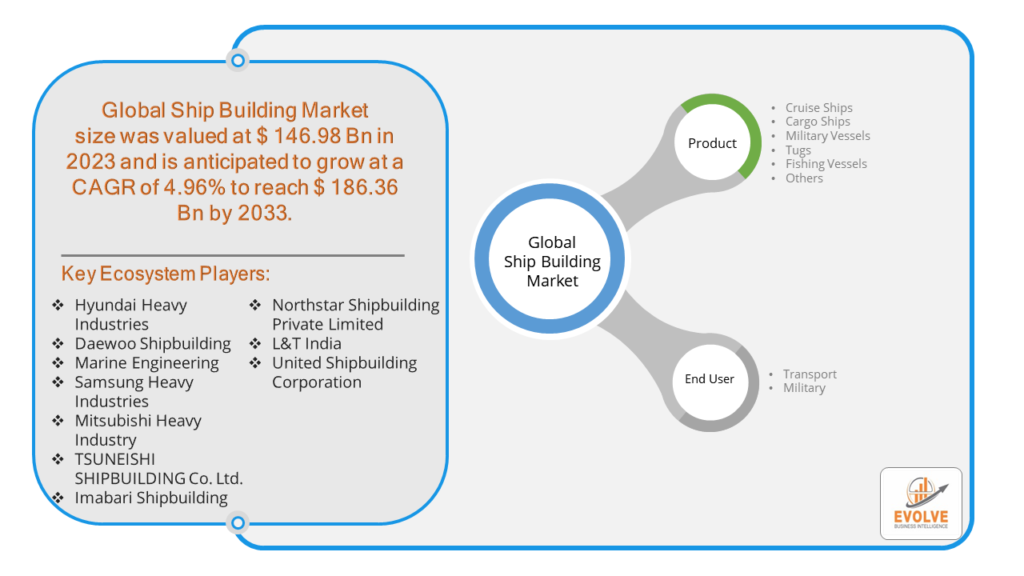

The Ship Building Market Size is expected to reach USD 186.36 Billion by 2033. The Ship Building Market industry size accounted for USD 146.98 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.96% from 2023 to 2033. The Ship Building Market refers to the industry involved in constructing and assembling ships and other large seagoing vessels. This market encompasses various stages of shipbuilding, including design, fabrication of hulls and superstructures, installation of propulsion systems, outfitting with navigational and safety equipment, and final testing and delivery.

It involves a range of specialized skills and technologies to meet diverse demands such as commercial shipping, naval vessels, offshore structures, and leisure boats. The market is influenced by factors like global trade trends, technological advancements, environmental regulations, and military requirements.

Global Ship Building Market Synopsis

The COVID-19 pandemic had a significant impact on the Ship Building Market. Lockdowns and restrictions disrupted global supply chains, affecting the availability of raw materials, components, and equipment necessary for shipbuilding. Social distancing requirements and health concerns led to reduced workforce capacity and productivity at shipyards, slowing down construction schedules. Reduced demand for new vessels, particularly in sectors like cruise ships and offshore oil and gas, due to travel restrictions and lower energy demand. The pandemic accelerated digital transformation in shipbuilding processes, including increased use of remote work tools, virtual inspections, and digital twins.

Ship Building Market Dynamics

The major factors that have impacted the growth of Ship Building Market are as follows:

Drivers:

Ø Global Trade and Maritime Transport

The demand for ships is closely tied to global trade volumes. As international trade expands, there is a need for more vessels to transport goods across oceans. Aging fleets require replacement, and technological advancements drive the need for more efficient and environmentally friendly vessels. Shipowners often invest in new ships to replace older, less efficient ones. Innovations in materials, propulsion systems, automation, and digitalization enhance efficiency, reduce operating costs, and improve safety in shipbuilding and operation. Rapid economic growth in emerging markets leads to increased demand for cargo and passenger vessels to support infrastructure development and rising consumer demands.

Restraint:

- Perception of Cost and Financing Challenges

Building ships is capital-intensive, and financing large projects can be challenging, especially during economic downturns or when shipbuilding projects face delays or cost overruns. Periods of overcapacity in certain vessel segments can lead to pricing pressures and reduced profit margins for shipbuilders, particularly in sectors like container ships and bulk carriers. The shipbuilding industry requires skilled labor, including welders, engineers, and naval architects. Shortages of skilled workers can lead to delays in project execution and higher labor costs.

Opportunity:

⮚ Growing demand for Green Shipping Initiatives

Increasing regulations and environmental awareness are driving demand for eco-friendly vessels. Opportunities exist for shipbuilders to innovate and develop ships powered by alternative fuels such as LNG, hydrogen, or hybrid propulsion systems. Many countries are modernizing their naval fleets, presenting opportunities for shipbuilders to secure contracts for new warships, submarines, and other naval vessels. Rapid economic growth in emerging markets, particularly in Asia-Pacific and Latin America, presents opportunities for shipbuilders to meet increasing demand for cargo and passenger vessels.

Ship Building Market Segment Overview

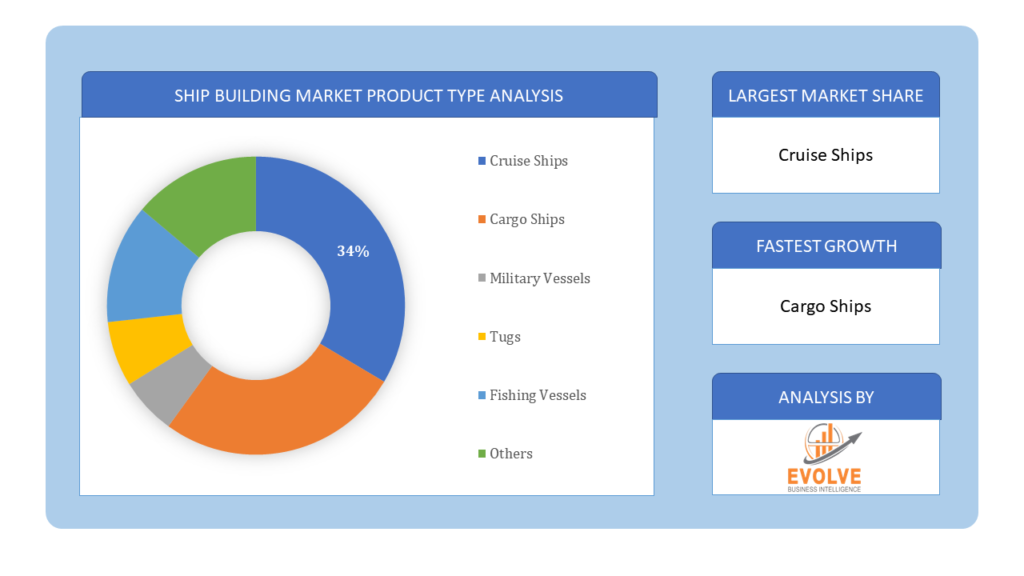

By Product Type

Based on Product Type, the market is segmented based on Cruise Ships, Cargo Ships, Military Vessels, Tugs, Fishing Vessels and Others. The Cargo Ships segment dominant the market. They focusing on vessels designed to transport goods and commodities across the world. Specialized for transporting liquids such as crude oil, petroleum products, chemicals, and liquefied natural gas (LNG). Subtypes include oil tankers, chemical tankers, and LNG carriers.

Based on Product Type, the market is segmented based on Cruise Ships, Cargo Ships, Military Vessels, Tugs, Fishing Vessels and Others. The Cargo Ships segment dominant the market. They focusing on vessels designed to transport goods and commodities across the world. Specialized for transporting liquids such as crude oil, petroleum products, chemicals, and liquefied natural gas (LNG). Subtypes include oil tankers, chemical tankers, and LNG carriers.

By End User

Based on End User, the market segment has been divided into the Transport and Military. The transport segment has dominated the shipbuilding market. Ships are widely used for transportation of various commodities from large machines to even oil, and passengers also. This mode of transportation is widely being used since the last couple of years. Transportation through water is cheaper as compared to that of air, exempting the changing exchange rates and the currency adjustment factor which means the fee imposed on the carrier companies.

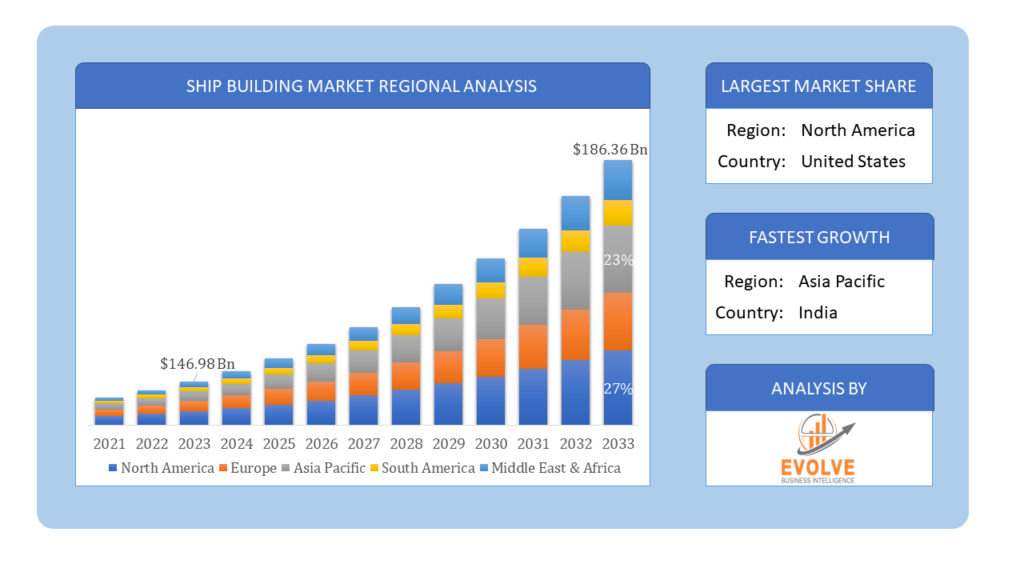

Global Ship Building Market Regional Analysis

Based on region, the global Ship Building Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Ship Building Market followed by the Asia-Pacific and Europe regions.

Ship Building North America Market

Ship Building North America Market

North America holds a dominant position in the Ship Building Market. United States focuses on military and defense vessels, including aircraft carriers, submarines, and surface combatants. Also involved in commercial shipbuilding, particularly in the Gulf Coast region. Also Canada is specializes in smaller vessels, icebreakers, and ferries. Growing focus on sustainable shipbuilding practices.

Ship Building Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Ship Building Market industry. China dominates global shipbuilding, particularly in commercial vessels like bulk carriers and container ships. Government support and large-scale infrastructure projects drive the industry.

Competitive Landscape

The global Ship Building Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Hyundai Heavy Industries

- Daewoo Shipbuilding

- Marine Engineering

- Samsung Heavy Industries

- Mitsubishi Heavy Industry

- TSUNEISHI SHIPBUILDING Co. Ltd.

- Imabari Shipbuilding

- Northstar Shipbuilding Private Limited

- L&T India

- United Shipbuilding Corporation

Scope of the Report

Global Ship Building Market, by Product Type

- Cruise Ships

- Cargo Ships

- Military Vessels

- Tugs

- Fishing Vessels

- Others

Global Ship Building Market, by End User

- Transport

- Military

Global Ship Building Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $186.36 Billion |

| CAGR | 4.96% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Hyundai Heavy Industries, Daewoo Shipbuilding, Marine Engineering, Samsung Heavy Industries, Mitsubishi Heavy Industry, TSUNEISHI SHIPBUILDING Co. Ltd., Imabari Shipbuilding, Northstar Shipbuilding Private Limited, L&T India and United Shipbuilding Corporation |

| Key Market Opportunities | • The growing demand for Green Shipping Initiatives • Naval Modernization Programs |

| Key Market Drivers | • Global Trade and Maritime Transport • Technological Advancements |

REPORT CONTENT BRIEF

- High-level analysis of the current and future Ship Building Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Ship Building Market historical market size for the year 2021, and forecast from 2023 to 2033

- Ship Building Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Ship Building Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.