Global In-Game Advertising Market Analysis and Global Forecast 2024-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

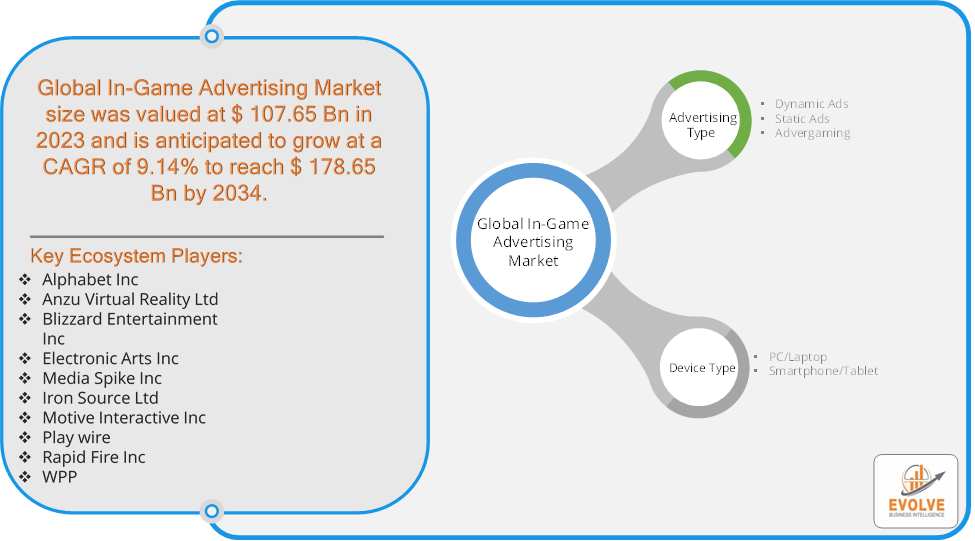

Global In-Game Advertising Market Research Report: Information By Advertising Type (Dynamic Ads, Static Ads, Advergaming), By Device Type (PC/Laptop, Smartphone/Tablet), and by Region — Forecast till 2034

Page: 155

Global In-Game Advertising Market Overview

The Global In-Game Advertising Market size accounted for USD 107.65 Billion in 2023 and is estimated to account for 109.66 Billion in 2024. The Market is expected to reach USD 178.65 Billion by 2034 growing at a compound annual growth rate (CAGR) of 9.14% from 2024 to 2034. The global in-game advertising market refers to the entire industry involved in creating, selling, and delivering advertisements within video games. This market has been growing rapidly in recent years due to the increasing popularity of video games, the effectiveness of in-game advertising, and the development of new technologies that enable more immersive and targeted ad experiences.

The key drivers for this market include the growing popularity of mobile gaming, increasing player engagement in online multiplayer games, and advancements in advertising technology, such as programmatic advertising and AI-driven personalized ads.

Global In-Game Advertising Market Synopsis

Global In-Game Advertising Market Dynamics

Global In-Game Advertising Market Dynamics

The major factors that have impacted the growth of Global In-Game Advertising Market are as follows:

Drivers:

Ø Advancements in Programmatic Advertising

Programmatic advertising technology allows brands to deliver highly targeted and dynamic ads based on real-time data. This improves the effectiveness and relevance of in-game ads, making them more appealing to advertisers. Free-to-play games, which generate revenue through in-game advertisements instead of direct purchases, have gained significant traction. Advertisers capitalize on the large user base of these games to display ads while allowing gamers to play for free. Technological advancements have led to more seamless and non-intrusive ad placements. This includes native advertising formats that blend into the game’s environment, enhancing user experience while delivering brand messages.

Restraint:

- Perception of Ad Blockers and Privacy Concerns

The rising use of ad-blocking software on mobile devices and gaming platforms can reduce the visibility of in-game ads, limiting their effectiveness and reach. This trend poses a challenge for advertisers seeking to maximize their exposure in gaming environments. As in-game advertising becomes more data-driven, concerns around data privacy and the use of personal information for targeted ads are growing. Players may be wary of how their data is collected and used, which can lead to pushback against in-game ads that are perceived as invasive.

Opportunity:

⮚ Monetization of Free-to-Play and Freemium Games

As the popularity of free-to-play and freemium game models continues to grow, in-game advertising becomes a primary revenue source for game developers. Brands can capitalize on the large user base of these games to deliver ads without disrupting the user experience, providing value to both advertisers and developers. Offering in-game rewards, such as virtual currency or unlockable items, in exchange for watching ads or interacting with branded content, presents an effective way to engage players while delivering advertising messages. This creates a win-win scenario, where players receive benefits while brands gain exposure.

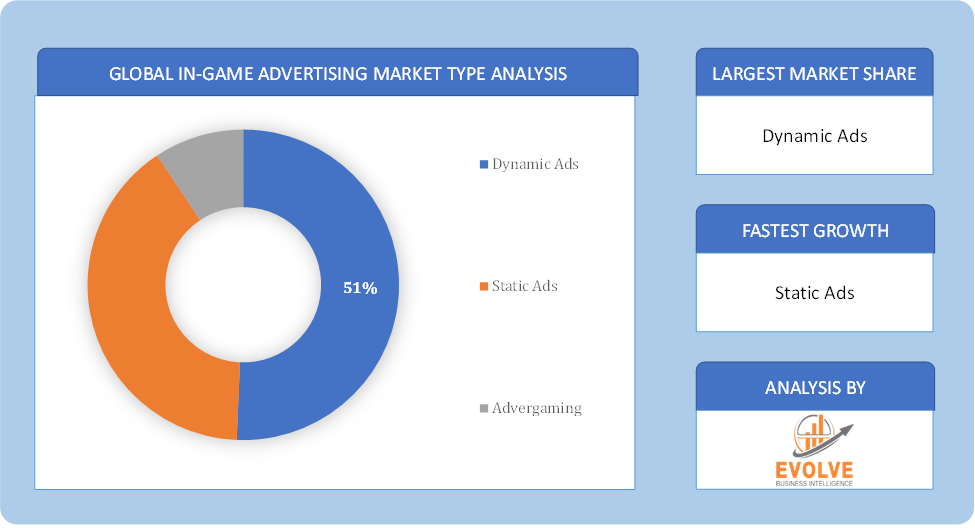

Global In-Game Advertising Market Segment Overview

Based on Advertising Type, the market is segmented based on Dynamic Ads, Static Ads and Advergaming. The Static Ads segment dominant the market. Static advertisements are stationary commercials that fit in well with the gaming environment and give advertisers a discrete means of promoting their goods and services. This type of advertising can be simply incorporated into a wide range of gaming platforms, including PC, console, and mobile games, without requiring major modifications to the game’s code or functionality.

By Device Type

Based on Device Type, the market segment has been divided into PC/Laptop and Smartphone/Tablet. The PC/laptop segment dominated the global in-game advertising industry. The PC gaming platform Steam has frequently announced breaking records for concurrent users worldwide. One of the reasons the PC/laptop sub-segment is prominent is because online games have high graphic resolutions and are accessible on PC/laptop, which leads to a huge number of PC/laptop games being played by people around the world with improved user experiences.

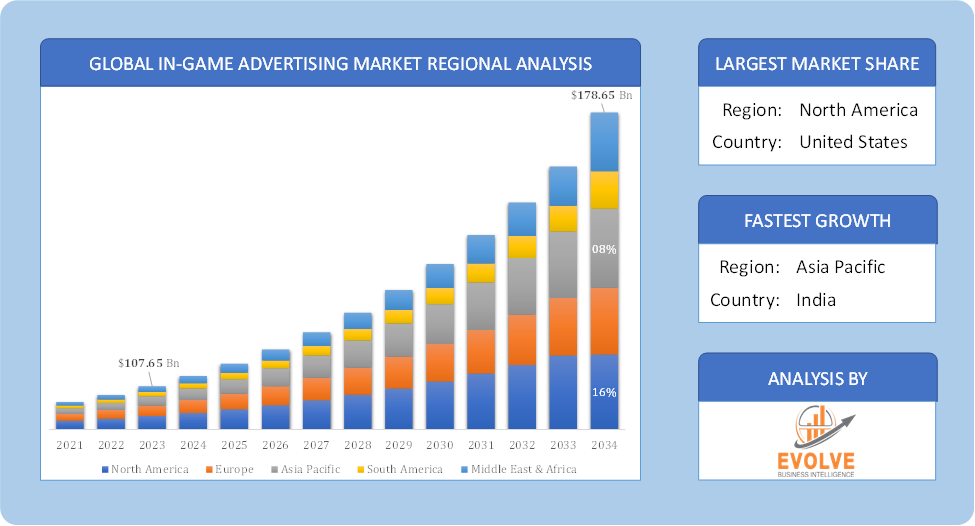

Global In-Game Advertising Market Regional Analysis

Based on region, the Global In-Game Advertising Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global In-Game Advertising Market followed by the Asia-Pacific and Europe regions.

Global In-Game Advertising North America Market

Global In-Game Advertising North America Market

North America holds a dominant position in the Global In-Game Advertising Market. North America is a dominant region in the global in-game advertising market due to its mature gaming industry, strong infrastructure, and widespread mobile and console gaming adoption and the presence of major game developers and advertisers, along with the rising popularity of esports and live-streaming platforms (e.g., Twitch), are key growth factors. The high disposable income of gamers and advanced digital marketing technologies also support the market.

Global In-Game Advertising Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global In-Game Advertising Market industry. APAC is the fastest-growing region in the global in-game advertising market, driven by the massive gaming population in countries like China, Japan, South Korea, and India. The region is home to both the largest gaming companies and a rapidly expanding mobile gaming market and Mobile gaming dominates in APAC, especially in China and Southeast Asia, where smartphone penetration is high. The rise of 5G technology, coupled with affordable internet, has also accelerated gaming adoption. In-game advertisements are a key revenue stream in free-to-play games, which are highly popular in the region.

Competitive Landscape

The Global In-Game Advertising Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Alphabet Inc

- Anzu Virtual Reality Ltd

- Blizzard Entertainment Inc

- Electronic Arts Inc

- Media Spike Inc

- Iron Source Ltd

- Motive Interactive Inc

- Play wire

- Rapid Fire Inc

- WPP

Key Development

In February 2023, Anzu and Livewire, the global game tech and gaming marketing company, have announced a partnership in Germany. The collaboration will support Anzu and Livewire’s footprint in Germany, permitting even more brands to reach gamers via non-intrusive in-game ad placements inside titles they love, where their attention is greatest.

Scope of the Report

Global In-Game Advertising Market, by Advertising Type

- Dynamic Ads

- Static Ads

- Advergaming

Global In-Game Advertising Market, by Device Type

- PC/Laptop

- Smartphone/Tablet

Global In-Game Advertising Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 178.65 Billion |

| CAGR (2024-2034) | 9.14% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Advertising Type, Device Type |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Alphabet Inc, Anzu Virtual Reality Ltd, Blizzard Entertainment Inc, Electronic Arts Inc, Media Spike Inc, Iron Source Ltd, Motive Interactive Inc, Play wire, Rapid Fire Inc and WPP. |

| Key Market Opportunities | · Monetization of Free-to-Play and Freemium Games · In-Game Rewards and Sponsored Content |

| Key Market Drivers | · Advancements in Programmatic Advertising · Improved In-Game Ad Formats |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global In-Game Advertising Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global In-Game Advertising Market historical market size for the year 2021, and forecast from 2023 to 2033

- Global In-Game Advertising Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the Global In-Game Advertising Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the Global In-Game Advertising Market is 2021- 2033

What is the growth rate of the Global In-Game Advertising Market?

The Global In-Game Advertising Market is growing at a CAGR of 9.14% over the next 10 years

Which region has the highest growth rate in the market of Global In-Game Advertising Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the Global In-Game Advertising Market?

North America holds the largest share in 2022

Who are the key players in the Global In-Game Advertising Market?

Alphabet Inc, Anzu Virtual Reality Ltd, Blizzard Entertainment Inc, Electronic Arts Inc, Media Spike Inc, Iron Source Ltd, Motive Interactive Inc, Play wire, Rapid Fire Inc and WPP. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Global In-Game Advertising Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Global In-Game Advertising Market 4.8. Import Analysis of the Global In-Game Advertising Market 4.9. Export Analysis of the Global In-Game Advertising Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global In-Game Advertising Market, By Advertising Type 6.1. Introduction 6.2. Dynamic Ads 6.3. Static Ads 6.4. Advergaming Chapter 7. Global In-Game Advertising Market, By Device Type 7.1. Introduction 7.2. PC/Laptop 7.3. Smartphone/Tablet Chapter 8. Global In-Game Advertising Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2024-2034 8.2.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.5. Market Size and Forecast, By End User, 2024-2034 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.2.6.4. Market Size and Forecast, By End User, 2024-2034 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.7.5. Market Size and Forecast, By End User, 2024-2034 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2024-2034 8.3.4. Market Size and Forecast, By Product Type, 2024-2034 8.3.5. Market Size and Forecast, By End User, 2024-2034 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.6.4. Market Size and Forecast, By End User, 2024-2034 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.7.4. Market Size and Forecast, By End User, 2024-2034 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.8.4. Market Size and Forecast, By End User, 2024-2034 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.9.4. Market Size and Forecast, By End User, 2024-2034 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.11.4. Market Size and Forecast, By End User, 2024-2034 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2024-2034 8.4.4. Market Size and Forecast, By Product Type, 2024-2034 8.12.28. Market Size and Forecast, By End User, 2024-2034 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.6.4. Market Size and Forecast, By End User, 2024-2034 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.7.4. Market Size and Forecast, By End User, 2024-2034 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.8.4. Market Size and Forecast, By End User, 2024-2034 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.9.4. Market Size and Forecast, By End User, 2024-2034 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.10.4. Market Size and Forecast, By End User, 2024-2034 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2024-2034 8.5.4. Market Size and Forecast, By End User, 2024-2034 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Alphabet Inc 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Anzu Virtual Reality Ltd 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Blizzard Entertainment Inc 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Electronic Arts Inc 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Media Spike Inc 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Iron Source Ltd 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Motive Interactive Inc 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Play wire 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Rapid Fire Inc 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. WPP 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology