Hybrid Train Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

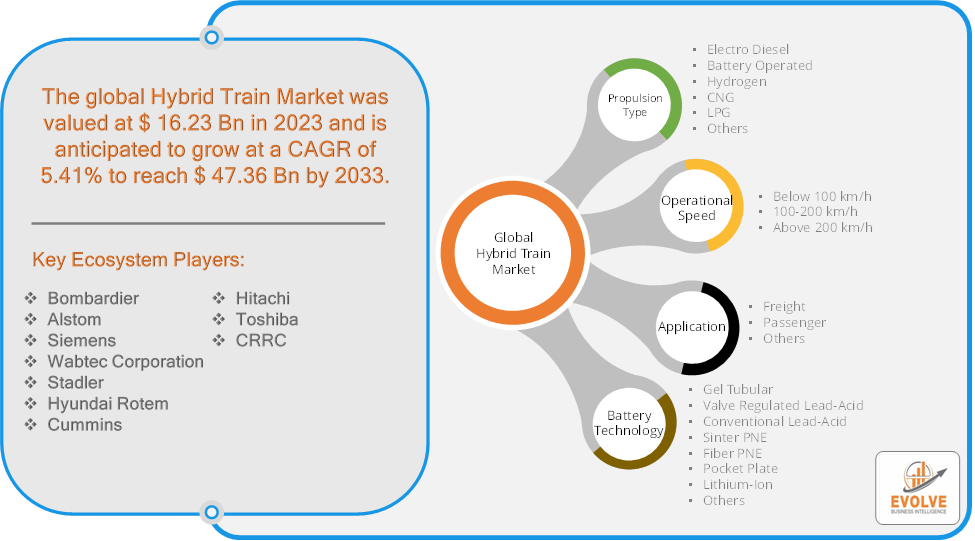

Hybrid Train Market Research Report: Information By Propulsion Type (Electro Diesel, Battery Operated, Hydrogen, CNG, LPG, Others), By Operational Speed (Below 100 km/h, 100-200 km/h, Above 200 km/h), By Application (Freight, Passenger, Others), By Battery Technology (Gel Tubular, Valve Regulated Lead-Acid, Conventional Lead-Acid, Sinter PNE, Fiber PNE, Pocket Plate, Lithium-Ion, Others), and by Region — Forecast till 2033

Page: 174

Hybrid Train Market Overview

The Hybrid Train Market Size is expected to reach USD 47.36 Billion by 2033. The Hybrid Train Market industry size accounted for USD 16.23 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.41% from 2023 to 2033. The Hybrid Train Market refers to the industry segment focused on the development, production, and sales of trains that use a combination of traditional energy sources (like diesel or electricity) and alternative power sources (such as batteries or hydrogen fuel cells) to operate. Hybrid trains aim to improve fuel efficiency, reduce emissions, and provide a more sustainable and cost-effective mode of transportation compared to conventional trains.

The Hybrid Train Market is an evolving sector with significant potential to transform the railway industry by offering more sustainable and efficient transportation solutions.

Global Hybrid Train Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the Hybrid Train Market. The pandemic caused widespread disruptions in the global supply chain, leading to delays in the manufacturing and delivery of hybrid train components. Restrictions and lockdowns affected the availability of raw materials, which slowed down production processes. With travel restrictions and a significant decrease in passenger numbers, rail operators experienced reduced demand, impacting revenue and delaying new train orders. While freight operations were less affected than passenger services, there was still some impact due to fluctuations in demand for goods. The pandemic has heightened awareness of environmental issues, potentially accelerating the demand for cleaner and more sustainable transportation options like hybrid trains in the long term. Companies are likely to invest in technological advancements to improve efficiency and reduce costs, making hybrid trains more attractive post-pandemic. The pandemic has accelerated digital transformation, leading to more emphasis on smart technologies and energy management systems in train operations. Rail operators and manufacturers may face financial constraints, impacting their ability to invest in new hybrid train projects. Enhanced focus on health and safety measures in public transport can influence the market, with a potential increase in public confidence in rail travel post-pandemic.

Hybrid Train Market Dynamics

The major factors that have impacted the growth of Hybrid Train Market are as follows:

Drivers:

Ø Technological Advancements

Improvements in battery technology, including increased energy density and reduced costs, make hybrid trains more efficient and viable. Advances in hydrogen fuel cell technology are making it a more feasible option for hybrid trains, offering a zero-emission alternative to diesel power. Sophisticated energy management systems enhance the efficiency and performance of hybrid trains by optimizing the use of multiple power sources. Rising urbanization and population growth drive demand for efficient and sustainable public transportation options, making hybrid trains an attractive solution. Urban areas facing congestion and pollution challenges are increasingly looking to hybrid trains as part of integrated transport solutions. Increasing public awareness of environmental issues leads to greater demand for eco-friendly transportation options, including hybrid trains.

Restraint:

- Perception of High Initial Costs and Infrastructure Constraints

Hybrid trains require significant investment in research and development, as well as higher manufacturing costs compared to conventional trains due to advanced technologies such as batteries and fuel cells. The establishment of necessary infrastructure, such as charging stations and hydrogen refueling facilities, involves substantial capital expenditure, which can be a barrier for many regions. In regions where rail electrification is limited or non-existent, the deployment of hybrid trains can be more challenging, as they may rely on existing infrastructure for charging or refueling. Integrating hybrid train systems with existing rail infrastructure and operations can be complex and require significant modifications.

Opportunity:

⮚ Expanding Rail Networks

The expansion of rail networks in emerging markets provides opportunities to integrate hybrid train technologies, particularly in regions where full electrification is not feasible. Efforts to modernize aging rail infrastructure in developed markets present opportunities to replace old diesel trains with hybrid models. Growing urban populations drive demand for efficient and sustainable public transportation solutions, providing opportunities for hybrid trains to become a preferred option. Hybrid trains powered by renewable energy sources, such as solar or wind, present opportunities for further reducing carbon footprints and enhancing sustainability. Opportunities exist to integrate hybrid trains with energy storage systems, improving energy efficiency and grid stability.

Hybrid Train Market Segment Overview

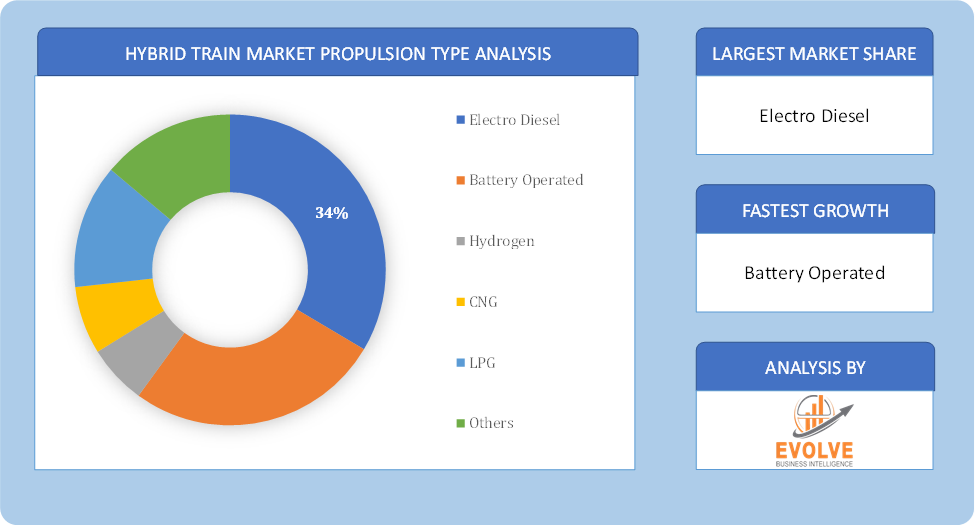

By Propulsion Type

By Propulsion Type

Based on Propulsion Type, the market is segmented based on Electro Diesel, Battery Operated, Hydrogen, CNG, LPG and Others. The Battery Operated segment dominant the market. The increasing utilization battery operated hybrid trains owing to primary advantages such as energy efficiency, zero carbon emissions, and is a cost-effective alternative is expected to drive the adoption of battery-operated segment faster than others. This, coupled with the ease in availability of electric train spares, keep the costs of battery-operated trains low, thereby promoting multiple market players investing in development of battery-operated trains.

By Operational Speed

Based on Operational Speed, the market segment has been divided into Below 100 km/h, 100-200 km/h and Above 200 km/h. Hybrid trains running at speeds of more 200 Km/hr segment are of increasing interest among the locomotive community. The growth of this segment is due to electric train manufacturers focusing on this segment due to its niche customer base. This is promoting emerging and established economies to invest in this segment of trains as the future of rail transportation.

By Application

Based on Application, the market segment has been divided into Freight, Passenger and Others. The Freight segment dominant the market. The increasing demand for freight transportation is expected to drive the demand for hybrid trains in the transportation market.

By Battery Technology

Based on Battery Technology, the market segment has been divided into Gel Tubular, Valve Regulated Lead-Acid, Conventional Lead-Acid, Sinter PNE, Fiber PNE, Pocket Plate, Lithium-Ion and Others. The Lithium-Ion segment dominant the market. Lead-acid batteries are the rechargeable batteries used in hybrid train systems for their low cost and high power density. Their primary advantage is their ability to deliver large currents quickly, making them ideal for starting engines or providing short-term backup power during power outages. Lithium-ion (Li-ion) batteries are used in hybrid trains owing to their high energy density, enhanced cycle life, and reduced maintenance requirements compared to their lead-acid counterparts.

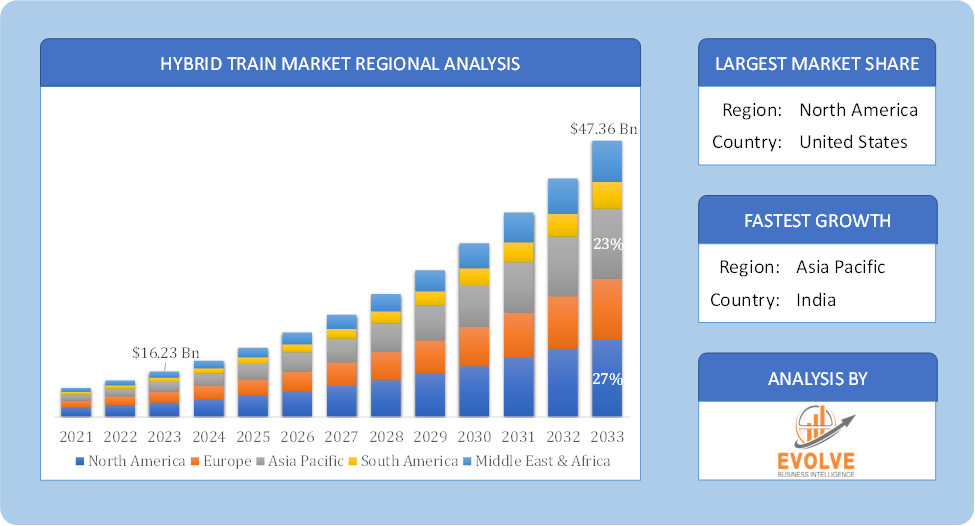

Global Hybrid Train Market Regional Analysis

Based on region, the global Hybrid Train Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Hybrid Train Market followed by the Asia-Pacific and Europe regions.

Hybrid Train North America Market

Hybrid Train North America Market

North America holds a dominant position in the Hybrid Train Market. The North American market is gradually embracing hybrid trains, driven by increasing awareness of environmental issues and government support for sustainable transport. The presence of many non-electrified tracks provides opportunities for hybrid trains, especially in areas where full electrification is not feasible. Projects in the United States and Canada aim to modernize rail infrastructure and reduce emissions, supporting the hybrid train market.

Hybrid Train Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Hybrid Train Market industry. The Asia-Pacific region is experiencing rapid growth in the hybrid train market, driven by urbanization, population growth, and government initiatives to improve public transport. Countries like China, Japan, and India are investing heavily in rail infrastructure, creating opportunities for hybrid train deployment. Japan is a leader in rail technology, including hybrid and alternative energy trains, influencing regional market trends.

Competitive Landscape

The global Hybrid Train Market is highly competitive, with numerous players offering a wide range of software Solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Bombardier

- Alstom

- Siemens

- Wabtec Corporation

- Stadler

- Hyundai Rotem

- Cummins

- Hitachi

- Toshiba

- CRRC

Key Development

In September 2022, Trenitalia, an Italian train operator, collaborated with Hitachi Rail in launch of “Blues Train” at the InnoTrans transport fair in Berlin. The collaboration is aimed at commercializing their first hybrid battery train in Europe. The train technology is sustainable, energy-efficient and reduces carbon emissions which are some key factors responsible in the early adoption of this train in Europe.

In February 2022, East Japan Railway announced the successful testing of its hydrogen fuel-based test train, HYBARI. The train is a “Hydrogen-Hybrid Advanced Rail Vehicle,” equipped robust fuel cell & battery system. Toyota Motor Corp., has collaboratively developed the train’s fuel cell system, which is supplied with high-pressure hydrogen to drive this train.

Scope of the Report

Global Hybrid Train Market, by Propulsion Type

- Electro Diesel

- Battery Operated

- Hydrogen

- CNG

- LPG

- Others

Global Hybrid Train Market, by Operational Speed

- Below 100 km/h

- 100-200 km/h

- Above 200 km/h

Global Hybrid Train Market, by Application

- Freight

- Passenger

- Others

Global Hybrid Train Market, by Battery Technology

- Gel Tubular

- Valve Regulated Lead-Acid

- Conventional Lead-Acid

- Sinter PNE

- Fiber PNE

- Pocket Plate

- Lithium-Ion

- Others

Global Hybrid Train Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 47.36 Billion |

| CAGR (2023-2033) | 5.41% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Propulsion Type, Operational Speed, Application, Battery Technology |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Bombardier, Alstom, Siemens, Wabtec Corporation, Stadler, Hyundai Rotem, Cummins, Hitachi, Toshiba and CRRC. |

| Key Market Opportunities | · Expanding Rail Networks · Integration with Renewable Energy |

| Key Market Drivers | · Technological Advancements · Urbanization and Population Growth |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Hybrid Train Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Hybrid Train Market historical market size for the year 2021, and forecast from 2023 to 2033

- Hybrid Train Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Hybrid Train Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Hybrid Train Market is 2021- 2033

What is the growth rate of the global Hybrid Train Market?

The global Hybrid Train Market is growing at a CAGR of 4.41% over the next 10 years

Which region has the highest growth rate in the market of Hybrid Train Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Hybrid Train Market?

North America holds the largest share in 2022

Who are the key players in the global Hybrid Train Market?

Bombardier, Alstom, Siemens, Wabtec Corporation, Stadler, Hyundai Rotem, Cummins, Hitachi, Toshiba and CRRC. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Propulsion Type Segement – Market Opportunity Score 4.1.2. Operational Speed Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.1.4. Battery Technology Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Hybrid Train Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Hybrid Train Market, By Propulsion Type 7.1. Introduction 7.1.1. Electro Diesel 7.1.2. Battery Operated 7.1.3 Hydrogen 7.1.4 CNG 7.1.5 LPG 7.1.6 Others CHAPTER 8. Hybrid Train Market, By Operational Speed 8.1. Introduction 8.1.1. Below 100 km/h 8.1.2. 100-200 km/h 8.1.3. Above 200 km/h CHAPTER 9. Hybrid Train Market, By Application 9.1. Introduction 9.1.1. Freight 9.1.2. Passenger 9.1.3. Others CHAPTER 10. Hybrid Train Market, By Battery Technology 10.1.Introduction 10.1.1. Gel Tubular 10.1.2. Valve Regulated Lead-Acid 10.1.3. Conventional Lead-Acid 10.1.4. Sinter PNE 10.1.5. Fiber PNE 10.1.6. Pocket Plate 10.1.7. Lithium-Ion 10.1.8. Others CHAPTER 11. Hybrid Train Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Propulsion Type, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Operational Speed, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Battery Technology, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Bombardier 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Alstom 13.3. Siemens 13.4. Wabtec Corporation 13.5. Stadler 13.6. Hyundai Rotem 13.7. Cummins 13.8. Hitachi 13.9. Toshiba 13.10. CRRC

Connect to Analyst

Research Methodology

Hybrid Train North America Market

Hybrid Train North America Market