Heavy construction equipment market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

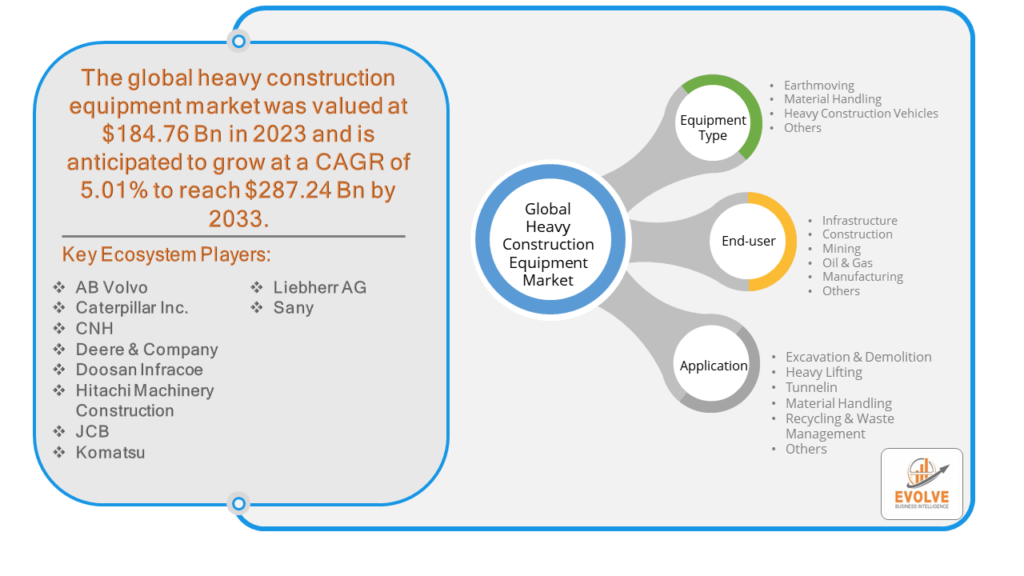

Heavy Construction Equipment Market by Equipment Type (Earthmoving , Material Handling, Heavy Construction Vehicles, Others, , ), By End-user (Infrastructure, Construction, Mining, Oil & Gas, Manufacturing, Others), By Application (Excavation & Demolition, Heavy Lifting, Tunnelin, Material Handling, Recycling & Waste Management, Others,) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2021 to 2028

Page: 112

Heavy construction equipment Market Overview

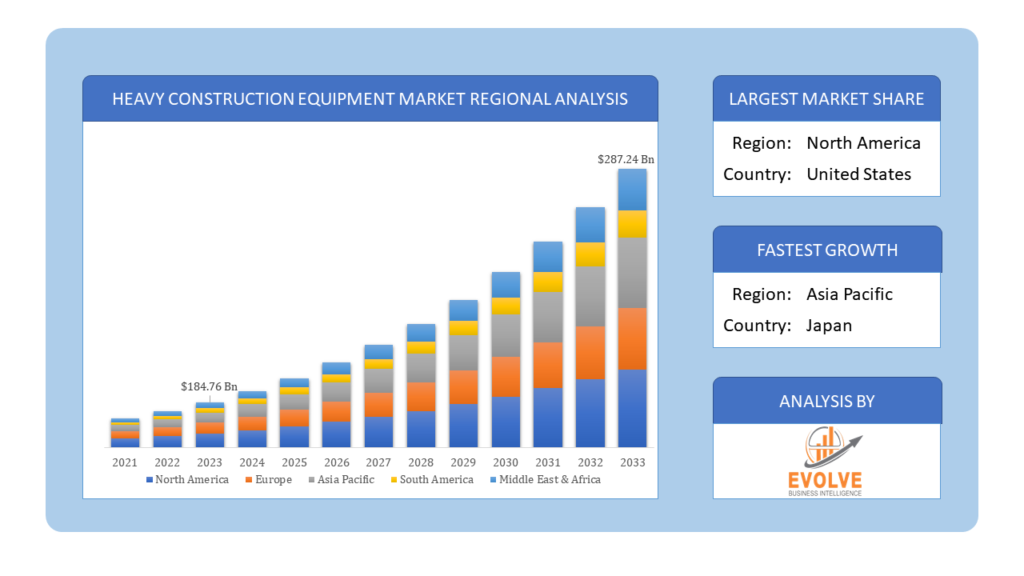

The Heavy construction equipment market Size is expected to reach USD 287.24 Billion by 2033. The Heavy construction equipment market industry size accounted for USD 184.76 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.01% from 2023 to 2033. The heavy construction equipment market refers to the industry segment involved in the manufacturing, distribution, and utilization of large machinery and equipment specifically designed for construction tasks requiring significant power and capabilities. This market encompasses a wide range of equipment such as excavators, bulldozers, cranes, loaders, dump trucks, and others, used in various construction projects including infrastructure development, residential and commercial building construction, mining, and other heavy-duty applications.

The market is influenced by factors such as economic conditions, infrastructure investment, technological advancements, regulatory policies, and environmental concerns. Key players in the heavy construction equipment market include manufacturers who design and produce these machines, as well as rental companies, dealerships, and service providers who facilitate their distribution, maintenance, and repair.

Global Heavy construction equipment market Synopsis

The COVID-19 pandemic had a significant impact on the heavy construction equipment market. Lockdowns, travel restrictions, and shutdowns of manufacturing facilities in various parts of the world disrupted the supply chain for heavy construction equipment. This led to delays in production, shortages of components, and logistical challenges in delivering equipment to customers. The rental market for heavy construction equipment was affected as construction activity slowed down. Rental companies experienced decreased demand and had to adjust their fleets and pricing strategies to adapt to changing market conditions. The pandemic accelerated the adoption of technology in the heavy construction equipment industry. Remote monitoring and telematics solutions became more important for equipment management and maintenance, as companies sought to minimize on-site personnel and optimize equipment utilization. The long-term impact of the pandemic on the heavy construction equipment market will depend on factors such as the pace of economic recovery, government infrastructure spending, and trends in construction activity. While the pandemic caused significant disruptions, it also highlighted the importance of resilient supply chains, digitalization, and innovation in the industry’s future resilience.

Heavy construction equipment Market Dynamics

The major factors that have impacted the growth of Heavy construction equipment market are as follows:

Drivers:

Ø Technological Advancements

Innovation in heavy construction equipment, including advancements in automation, electrification, and connectivity, improves efficiency, productivity, and safety on construction sites. Technologies such as GPS, telematics, and remote monitoring enable better fleet management and equipment utilization. Aging equipment fleets in many markets create opportunities for equipment replacement and upgrades. Construction companies and rental firms may invest in new machinery to improve efficiency, reliability, and safety or to comply with regulatory requirements. Overall economic growth and stability, as well as business confidence and investment sentiment, influence demand for construction equipment. Strong economic conditions, low interest rates, and favorable business environments encourage companies to invest in construction projects and equipment acquisition.

Restraint:

- Perception of High Initial Cost

Heavy construction equipment typically requires substantial upfront investment, which can be a barrier for small and medium-sized construction companies or those operating in regions with limited access to financing. The high initial cost can also deter companies from upgrading their fleets or investing in new technologies. The heavy construction equipment market is cyclical and susceptible to fluctuations in economic conditions, construction activity levels, and commodity prices. During economic downturns or periods of reduced construction activity, demand for equipment may decline, leading to excess capacity, pricing pressure, and decreased profitability for equipment manufacturers and rental companies.

Opportunity:

⮚ Technological Innovation

Advancements in technology such as automation, electrification, and digitalization offer opportunities to improve the efficiency, productivity, and safety of heavy construction equipment. Manufacturers can differentiate themselves by developing innovative solutions that enhance equipment performance, reduce operating costs, and minimize environmental impact. Digital technologies such as IoT, AI, and cloud computing are transforming the heavy construction equipment industry by enabling real-time monitoring, predictive maintenance, and remote equipment management. Manufacturers can leverage digitalization to improve equipment performance, optimize operations, and offer value-added services that enhance customer experience and loyalty.

Heavy construction equipment market Segment Overview

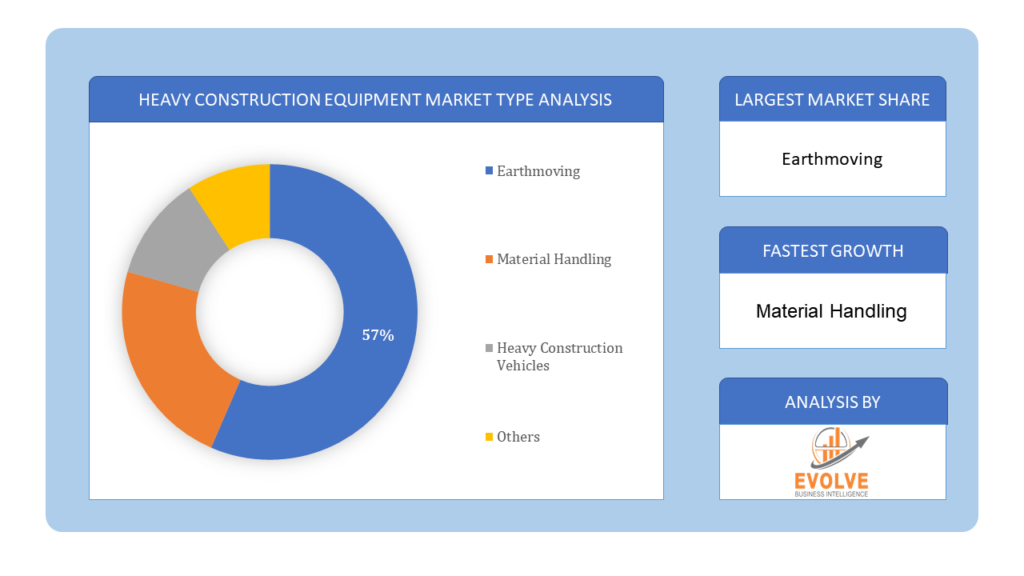

By Equipment Type

Based on Equipment Type, the market is segmented based on Earthmoving Equipment, Material Handling Equipment, Heavy Construction Vehicles and others. The earthmoving equipment segment is dominating the market. The reason is that the need for earthmoving machinery products is mostly met by developing nations like India, Malaysia, and Indonesia. To encourage economic growth, these nations have made investments in the construction of transportation infrastructure, which mostly makes use of earthmoving equipment.

Based on Equipment Type, the market is segmented based on Earthmoving Equipment, Material Handling Equipment, Heavy Construction Vehicles and others. The earthmoving equipment segment is dominating the market. The reason is that the need for earthmoving machinery products is mostly met by developing nations like India, Malaysia, and Indonesia. To encourage economic growth, these nations have made investments in the construction of transportation infrastructure, which mostly makes use of earthmoving equipment.

By Application

Based on Product Type, the market is segmented based on Excavation & Demolition, Material Handling, Heavy Lifting, Recycling & Waste Management and Tunneling. Excavation & demolition dominated the market. Excavation and demolition activities have emerged as major drivers, dominating the heavy construction equipment market. This trend is symptomatic of the dynamic terrain in the construction industry, where the need for efficient and robust excavation and demolition machinery has increased dramatically Heavy excavators, bulldozers and hydraulic fracturing is a must for reconstructing landscapes, cleaning areas, and preparing foundations for new structures Specialized equipment capable of handling complex construction projects and dominating the heavy construction equipment market.

By End User

Based on End Users, the market has been divided into Metals, Minerals, Coal, Real Estate, Oil & Gas and Others. Real Estate segment dominates the market. The real estate sector has emerged as a major driving force for the heavy construction equipment market. As urbanization and infrastructure boom across the globe, the demand for heavy machinery in the real estate industry has risen. Excavators, cranes, bulldozers and concrete mixers have become essential equipment in the residential, commercial and industrial sectors. These heavy-duty construction equipment not only speeds up the construction process but also ensures accuracy and safety during construction activities

Global Heavy construction equipment market Regional Analysis

Based on region, the global Heavy construction equipment market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Heavy construction equipment market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America holds a dominant position in the Heavy construction equipment market. North America particularly, the U.S. heavy construction equipment market is driven by infrastructure renewal projects, especially in transportation and energy sectors. Demand for equipment like excavators, loaders, and cranes remains strong. Technological advancements, including the adoption of telematics and autonomous machinery, are shaping the market.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Heavy construction equipment market industry. In Asia-Pacific, generally India’s heavy construction equipment market is growing rapidly due to urbanization, industrialization, and infrastructure development projects. The government’s focus on initiatives like “Make in India” and “Smart Cities Mission” boosts demand for machinery such as excavators, cranes, and concrete equipment.

Competitive Landscape

The global Heavy construction equipment market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Volvo Group

- Sany Heavy Industry Co. Ltd.

- CNH Industrial N.V

- Caterpillar Inc

- Terex Corporation

- Wacker Neuson SE

- Hitachi Construction Machinery Co. Ltd.

- Deere & Company

- Doosan Bobcat

- Komatsu Ltd

Key Development

In March 2023, In October 2022, JCB India launched three new excavators for the infrastructure and mining and quarrying applications at Udaipur in Rajasthan recently. These machines will be built at JCB India’s factory in Pune, Maharashtra, and will be sold not only in India but also in global markets.

In October 2022, John Deere expanded its line-up of large wheel loaders with the introduction of the all-new 744, 824 and 844 P-tier model under its Performance Tiering Strategy.

Scope of the Report

Global Heavy construction equipment Market, by Equipment

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Vehicles

- Others

Global Heavy construction equipment market, by Application

- Excavation & Demolition

- Material Handling

- Heavy Lifting

- Recycling & Waste Management

- Tunneling

Global Heavy construction equipment Market, by Equipment

- Metals

- Minerals

- Coal

- Real Estate

- Oil & Gas and Others

- Others

Global Heavy construction equipment market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $287.24 Billion |

| CAGR | 5.01% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Equipment Type, Application, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Volvo Group, Sany Heavy Industry Co. Ltd., CNH Industrial N.V, Caterpillar Inc, Terex Corporation, Wacker Neuson SE, Hitachi Construction Machinery Co. Ltd., Deere & Company, Doosan Bobcat and Komatsu Ltd.. |

| Key Market Opportunities | • Technological Innovation • Digital Transformation |

| Key Market Drivers | • Technological Advancements • Replacement Cycle |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Heavy construction equipment market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Heavy construction equipment market historical market size for the year 2021, and forecast from 2023 to 2033

- Heavy construction equipment market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Heavy construction equipment market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period for the Heavy construction equipment market analysis spans from 2023 to 2033.

What is the growth rate of the Heavy construction equipment market?

The Heavy construction equipment market is expected to expand at a compound annual growth rate (CAGR) of 5.01% from 2023 to 2033.

Which region has the highest growth rate in the Heavy construction equipment market?

The Asia-Pacific region exhibits the highest growth rate in the Heavy construction equipment market.

Which region has the largest share of the Heavy construction equipment market?

North America holds the largest share of the Heavy construction equipment market.

Who are the key players in the Heavy construction equipment market?

Key players in the Heavy construction equipment market include Volvo Group, Sany Heavy Industry Co. Ltd., CNH Industrial N.V, Caterpillar Inc, Terex Corporation, Wacker Neuson SE, Hitachi Construction Machinery Co. Ltd., Deere & Company, Doosan Bobcat, and Komatsu Ltd.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. TypeSegement – Market Opportunity Score

4.1.2. Application Segment – Market Opportunity Score

4.1.3. End-userSegment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Heavy construction equipment market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. MArket Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Global Heavy construction equipment market, By Equipment Type

7.1. Introduction

7.1.1. Earthmoving Equipment,

7.1.2. Material Handling Equipment

7.1.3. Heavy Construction Vehicles

7.1.4. Others

CHAPTER 8. Global Heavy construction equipment market, By Application

8.1. Introduction

8.1.1. Excavation & Demolition

8.1.2. Material Handling

8.1.3. Heavy Lifting

8.1.4. Recycling & Waste Management

8.1.5. Tunneling

CHAPTER 9. Global Heavy construction equipment market, By End-user

9.1. Introduction

9.1.1. Metals

9.1.2. Minerals

9.1.3. Coal

9.1.4 Real Estate

9.1.5. Oil & Gas

9.1.6 Others

CHAPTER 10. Global Heavy construction equipment market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.2.3. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.2.4. North America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.2.5.2. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.2.5.3. US: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.2.6.3. Canada: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.3. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.4. Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.6.3. Germany: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.7.2. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.7.3. France: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.8.3. Italy: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.9.3. Spain: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.11.3. Russia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.5.2. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.5.3. China: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.6.3. Japan: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.7.2. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.7.3. India: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.12.3. Australia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.5.3. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.5.4. South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.6.3. UAE: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million)

10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Volvo Group

13.1.1. Business Overview

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Sany Heavy Industry Co. Ltd.

13.3. CNH Industrial N.V

13.4. Caterpillar Inc

13.5. Terex Corporation

13.6. Wacker Neuson SE

13.7. Hitachi Construction Machinery Co. Ltd.

13.8. Deere & Company

13.9. Doosan Bobcat

13.10. Komatsu Ltd

Connect to Analyst

Research Methodology