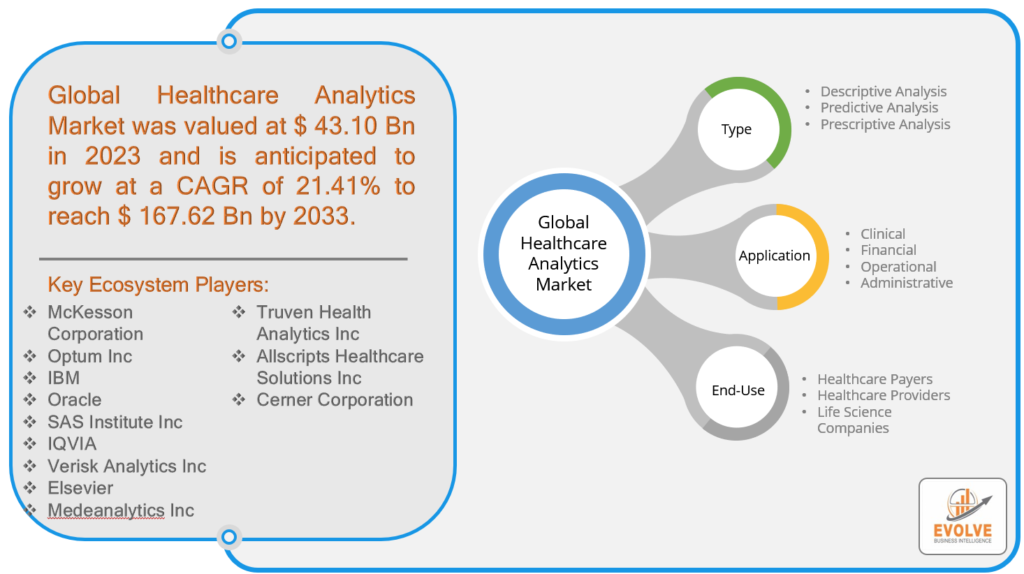

The global Healthcare Analytics Market Size is expected to reach USD 167.62 Billion by 2033. The global Healthcare Analytics industry size accounted for USD 43.10 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 21.41% from 2023 to 2033. Healthcare analytics is the use of advanced data analytics and statistical techniques to analyze and interpret large and complex healthcare data sets to improve patient care, operational efficiency, and decision-making in the healthcare industry. It involves the collection, integration, analysis, and interpretation of various types of healthcare data, such as electronic health records (EHRs), administrative data, clinical data, financial data, and patient outcomes data, to generate insights and inform evidence-based decision-making. Healthcare analytics utilizes various methods and tools, including descriptive analytics, predictive analytics, and prescriptive analytics, to analyze healthcare data and extract meaningful insights. Descriptive analytics focuses on analyzing historical data to understand what has happened in the past, while predictive analytics uses statistical models and algorithms to forecast future outcomes or trends. Prescriptive analytics goes beyond predicting future outcomes and provides recommendations or solutions to optimize decision-making in real time.

The COVID-19 pandemic has accelerated the adoption of telehealth and remote monitoring technologies, as healthcare organizations looked for ways to deliver care remotely and minimize in-person visits to reduce the risk of virus transmission. This has generated a significant amount of data related to virtual patient interactions, remote monitoring of vital signs, and patient-generated health data. Healthcare analytics solutions have played a crucial role in analyzing and interpreting this data to enable better remote care delivery, leading to increased demand for healthcare analytics tools.

Healthcare Analytics Market Dynamics

The major factors that have impacted the growth of Healthcare Analytics are as follows:

Drivers:

Rising need for data-driven decision-making and precision medicine

Healthcare organizations are increasingly recognizing the importance of data-driven decision-making in improving patient care and outcomes. Healthcare analytics solutions enable organizations to collect, analyze, and interpret vast amounts of data from various sources, including clinical data, genomic data, claims data, and social determinants of health, to support evidence-based decision-making and precision medicine. The growing need for personalized and data-driven care has driven the adoption of healthcare analytics solutions.

Restraint:

- Lack of skilled workforce and data literacy

The effective use of healthcare analytics requires a skilled workforce with expertise in data analysis, statistics, and domain-specific knowledge in healthcare. However, there is a shortage of skilled professionals in the field of healthcare analytics, including data scientists, data analysts, and healthcare domain experts. Additionally, there may be a lack of data literacy among healthcare professionals who need to interpret and use analytics insights to make informed decisions. The shortage of skilled workforce and data literacy can limit the adoption and utilization of healthcare analytics solutions.

Opportunity:

Advancements in technology

Rapid advancements in technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and cloud computing are revolutionizing the field of healthcare analytics. These technologies enable more accurate and efficient analysis of large and complex healthcare data sets, leading to better insights, predictions, and recommendations for improving patient care, operational efficiency, and outcomes. The integration of these technologies into healthcare analytics solutions presents significant opportunities for innovation and growth in the market.

Healthcare Analytics Segment Overview

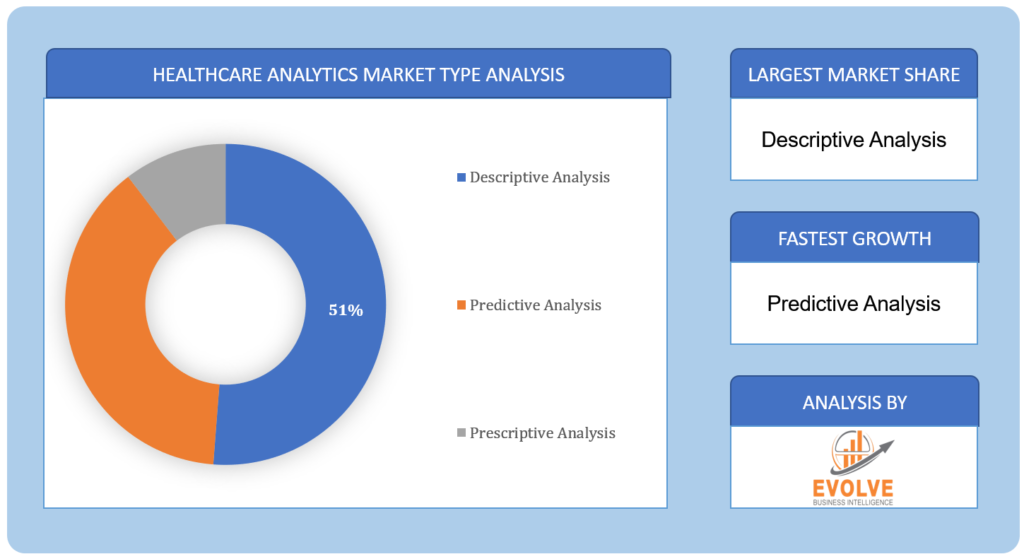

Based on the Type, the market is segmented based on Descriptive Analysis, Predictive Analysis, and Prescriptive Analysis. The Descriptive Analysis segment is expected to hold the largest market share. Descriptive analysis, which involves the use of historical data to describe and understand past events and trends, is one of the fundamental components of healthcare analytics. It helps healthcare organizations gain insights into their operations, patient populations, and performance metrics.

By Application

Based on Application, the market has been divided into Clinical, Financial, Operational, and Administrative. The Clinical segment is expected to hold the largest market share. Clinical analytics involves the use of data and analytics to gain insights into clinical processes, patient outcomes, and treatment effectiveness. It includes analyzing electronic health records (EHRs), laboratory data, imaging data, and other clinical data to support clinical decision-making, optimize patient care, and improve clinical outcomes.

By End-Use

Based on End-Use, the market has been divided into Healthcare Payers, Healthcare Providers, and Life Science Companies. The Healthcare Providers segment is expected to hold the largest market share. Healthcare providers, which include hospitals, clinics, and other healthcare facilities, are a significant end-user segment in the healthcare analytics market. They use healthcare analytics solutions to analyze and derive insights from their data, including electronic health records (EHRs), patient data, financial data, and operational data, to optimize patient care, improve outcomes, enhance operational efficiency, and drive better decision-making.

Global Healthcare Analytics Market Share, by Segmentation

Global Healthcare Analytics Market Regional Analysis

Global Healthcare Analytics Market Regional Analysis

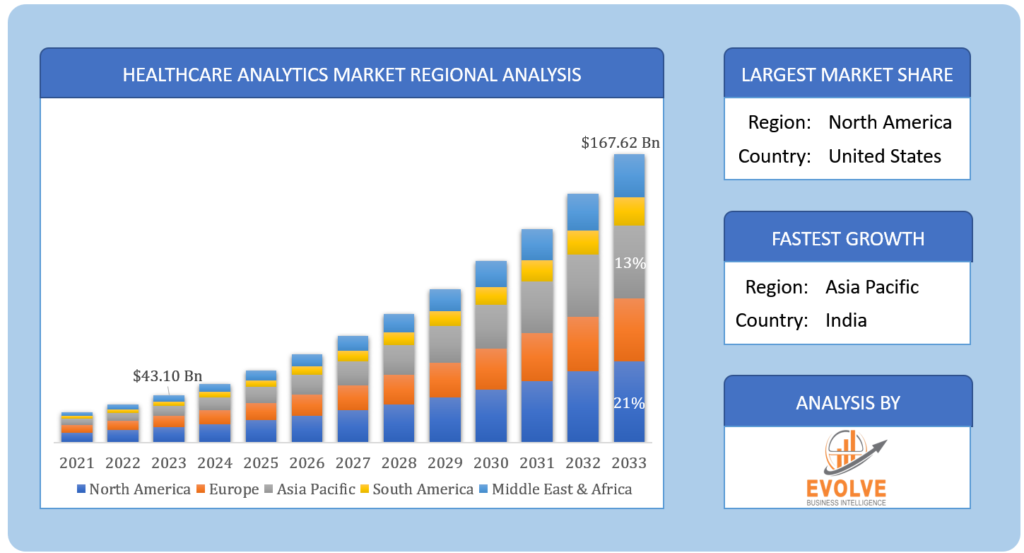

Based on region, the global Healthcare Analytics market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. North America is projected to dominate the use of the market followed by the Asia-Pacific and Europe regions.

North America Market

North America has been a dominant market for healthcare analytics. The region has a well-established healthcare infrastructure, advanced technologies, and a high adoption rate of healthcare analytics solutions. Additionally, North America has a strong focus on quality improvement, cost reduction, and population health management, which has driven the demand for healthcare analytics solutions. The healthcare analytics market in North America is driven by factors such as the need to improve patient outcomes, optimize healthcare operations, enhance patient safety, and reduce healthcare costs. The region also has a high prevalence of chronic diseases, an aging population, and increasing healthcare expenditure, which further fuels the demand for healthcare analytics to better manage patient populations, predict disease outcomes, and optimize healthcare resource allocation.

Asia-Pacific Market

The Asia-Pacific region is projected to be a significant growth market for the healthcare analytics market due to increasing demand for quality healthcare, rising prevalence of chronic diseases, growing adoption of digital health technologies, government initiatives, and investments in healthcare analytics, and emerging markets with high growth potential.

Competitive Landscape

The market comprises tier-1, tier-2, and local players. With their wide product portfolios, tier-1 and tier-2 players have a global reach. Since their strategic innovations and broad regional presence, companies such as McKesson Corporation, Optum Inc, IBM, Oracle, and SAS Institute Inc lead the global Healthcare Analytics business. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as growth, product releases, and alliances.

Prominent Players:

- McKesson Corporation

- Optum Inc

- IBM

- Oracle

- SAS Institute Inc

- IQVIA

- Verisk Analytics Inc

- Elsevier

- Medeanalytics Inc

- Truven Health Analytics Inc

- Allscripts Healthcare Solutions Inc

- Cerner Corporation

Key Development:

June 2022: Oracle Corporation’s acquisition of Cerner Corporation was to integrate Oracle’s enterprise platform analytics and automation skills with Cerner’s clinical capabilities.

January 2022: IBM and Francisco Partners agreed on a formal deal in which Francisco Partners will purchase healthcare data and analytics assets now part of IBM’s Watson Health division.

Scope of the Report

Global Healthcare Analytics Market, by Type

- Descriptive Analysis

- Predictive Analysis

- Prescriptive Analysis

Global Healthcare Analytics Market, by Application

- Clinical

- Financial

- Operational

- Administrative

Global Healthcare Analytics Market, by End-Use

- Healthcare Payers

- Healthcare Providers

- Life Science Companies

Global Healthcare Analytics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $167.62 Billion |

| CAGR | 21.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application, End-Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | McKesson Corporation, Optum Inc, IBM, Oracle, SAS Institute Inc, IQVIA, Verisk Analytics Inc, Elsevier, Medeanalytics Inc, Truven Health Analytics Inc, Allscripts Healthcare Solutions Inc, Cerner Corporation |

| Key Market Opportunities | Advancements in technology |

| Key Market Drivers | Rising need for data-driven decision-making and precision medicine |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Healthcare Analytics market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Healthcare Analytics market historical market size for the year 2021, and forecast from 2023 to 2033

- Healthcare Analytics market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Healthcare Analytics market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.