Global Private Health Insurance Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

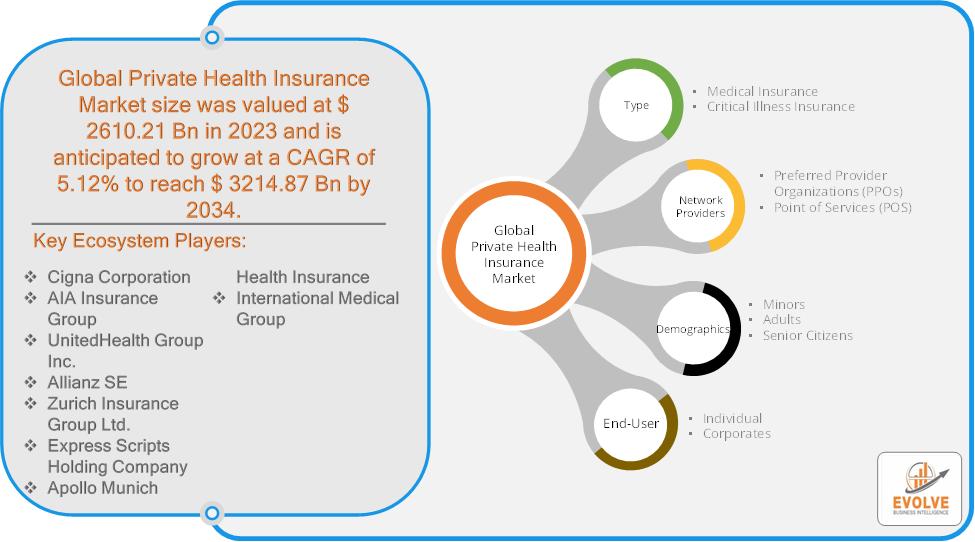

Global Private Health Insurance Market Research Report: By Type (Medical Insurance, Critical Illness Insurance), By Network Providers (Preferred Provider Organizations (PPOs), Point of Services (POS)), By Demographics (Minors, Adults, Senior Citizens), By End-Use (Individual, Corporates), and by Region — Forecast till 2034

Page: 170

Global Private Health Insurance Market Overview

The Global Private Health Insurance Market size accounted for USD 2610.21 Billion in 2023 and is estimated to account for 2785.65 Billion in 2024. The Market is expected to reach USD 3214.87 Billion by 2034 growing at a compound annual growth rate (CAGR) of 5.12% from 2024 to 2034. Employing health insurance will help protect one against the potential financial burdens that can come with a medical emergency. Coverage includes expenses such as ambulance fees and doctor consultations. It also covers hospitalization, medicines, and daycare proceedings. Generally, the reimbursement is calculated using the original medical bills or the estimated cost to diagnose a disease. Health insurance helps with financial protection, allows easy access to treatment at network hospitals, and provides a cashless option. Apart from this, health insurance also provides many tax benefits for a wide variety of medical conditions. Many health insurance providers are now providing coverage for at-home disease diagnosis and treatment. With follow-up care handled by a doctor in one of their offices, this method of service is cost-effective.

Global Private Health Insurance Market Synopsis

Global Private Health Insurance Market Dynamics

Global Private Health Insurance Market Dynamics

The major factors that have impacted the growth of Global Private Health Insurance are as follows:

Drivers:

⮚ Rising Geriatric Population in Developed and Developing Countries

The rise of the Geriatric population in developing countries and their aging profile is one of these very important factors which are influencing industry growth of Healthcare insurance. The elderly population is faced with many challenges; they have a high chance of developing chronic conditions and other diseases which often lead to death. In addition, people in the age group of 65 and above require continuous monitoring and medical attention. The elderly segment of the population is often struggling with finances and some cannot afford expensive medical treatments due to their age. They fall under the category of usually being considered unproductive. As a result, medical insurance with several policies could cause an increase in industry growth.

Restraint:

- Fraud Insurance Claims Coupled with High Health Insurance Premiums

Facilitated government regulations due to fraudulent insurance claims are restricting the growth of the Private Health Insurance Market. If accidents are falsely reported such as faking an injury, fake death claims, or lack of understanding of the importance of insurance, it might hurt the market. In addition, increases in healthcare costs, such as drug costs, hospital fees, and other treatments have led to an increase in premiums for businesses.

Opportunity:

⮚ Increasing Awareness about Health Insurance policies in Rural Areas

The market for health insurance is growing in rural areas at a faster rate. This has opened up the doors to many benefits such as reimbursing the insured person’s illness treatment cost and paying a lump sum amount in prolonged cases. Customers in rural areas are becoming much better at understanding insurance benefits. Health care expenses like in-patient hospitalization, pre-hospitalization, and post-hospitalization expenses are widely covered by health insurance plans. In addition, doctors and teachers have increased the awareness of healthcare insurance policies, which is driving the growth of the healthcare insurance market.

Global Private Health Insurance Market Segment Overview

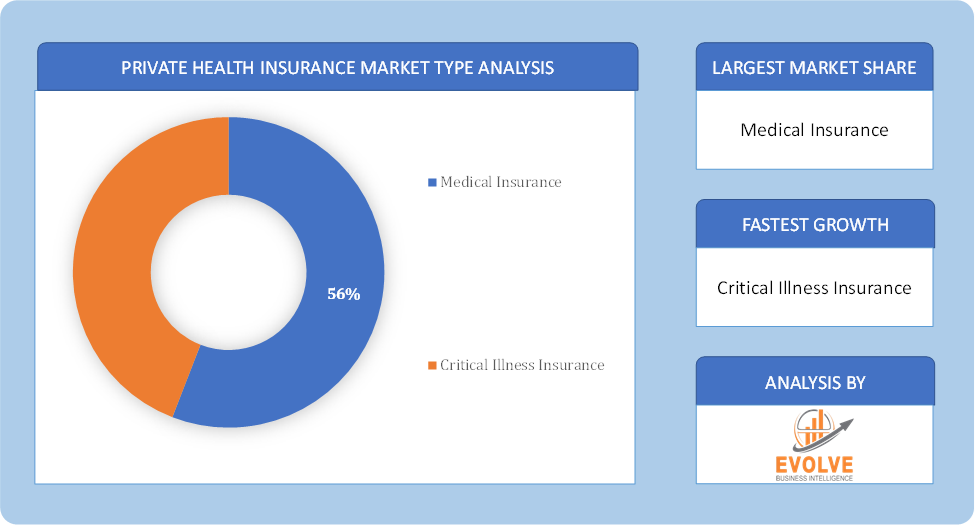

Based on the Type, the Private Health Insurance market is segmented based on Medical Insurance and Critical Illness Insurance. The Medical Insurance segment is anticipated to account for the large market share owing to the increasing adoption of a sedentary lifestyle, the surging obese population with multiple health issues, and rising accidental care expenses both in developed markets and emerging economies. The increasing prevalence of chronic diseases such as cancer, cardiac diseases, diabetes, and others would support greater growth in this niche market.

By Network Providers

Based on the Network Provider, the Private Health Insurance market is segmented based on Preferred Provider Organizations (PPOs), and Point of Services (POS). The PPOs segment is anticipated to account for the large market share. PPOs are the most common health insurance plans as it’s possible to access a large network of providers with just one plan. They’re also marketed as providing “flexibility” when it comes to choosing your healthcare provider, so the policyholders don’t have to worry about choice paralysis. The POS segment held the second position owing to the low premiums compared to PPOs.

By Demographics

Based on Demographics, the global Private Health Insurance market has been divided into Minors, Adults, and Senior Citizens. The Adult segment is expected to hold the largest market share. Adults have a high risk of lifestyle diseases, which may make them more susceptible to health concerns in the future. Moreover, the population is becoming more prone to various diseases that require hospitalization. The Senior Citizen segment made the second-highest CAGR in the market for Private healthcare insurance. This is due to their increased vulnerability to chronic diseases which leads to an increased hospitalization rate.

By End-Use

Based on End-Use, the global Private Health Insurance market has been divided into Individual and Corporates. The Individuals segment is expected to hold the largest market share. The individual plans offer more benefits and thus provide much more value for the high premium. As a result, these plans are generally in higher demand and attract a lot of customers. Corporate insurance coverage is provided by the company but at a lower cost. This is because of its limited benefits while individual plans offer more comprehensive coverage. In addition, these types of insurance often become invalid once the employee leaves the job, making it difficult to guarantee the growth of this sector.

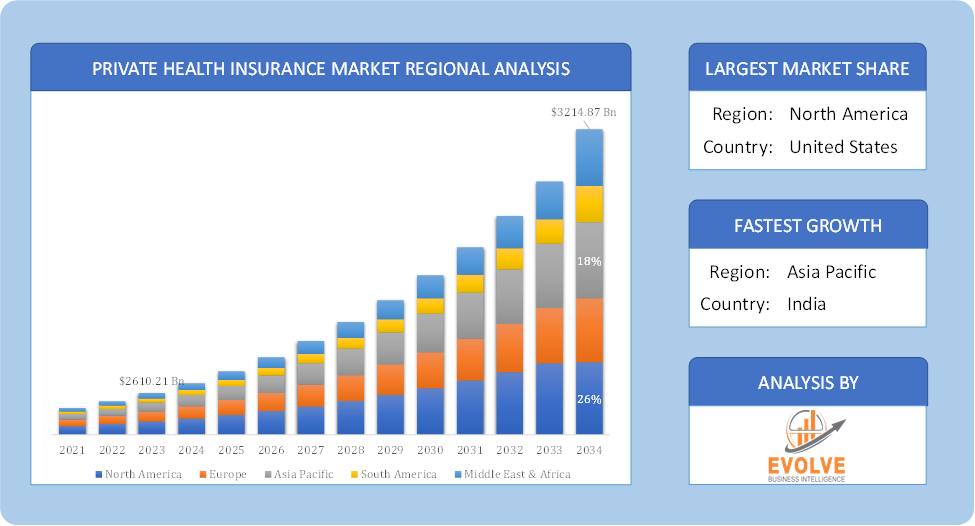

Global Private Health Insurance Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Global Private Health Insurance, followed by those in Asia-Pacific and Europe.

Global Private Health Insurance North America Market

Global Private Health Insurance North America Market

The North American region holds a dominant position in the Global Private Health Insurance market. The North American market is expected to be a dominant presence in the Private Health Insurance market. The presence of significant Insurance providers in the region accounts for the region’s largest market share. Also, in the United States, it is mandatory to have health care coverage under the Affordable Care Act. If a state did not comply, it would be penalized by the federal government

Global Private Health Insurance Asia Pacific Market

The Asia Pacific region is forecast to experience accelerated growth Private Health Insurance market growth over the next few years. This increase in health care spending would be largely due to an increase in public and private health expenditures, as well as the penetration of insurance services rendered to rural and urban centers, along with favorable government policies. Middle-class consumers in the developing countries in the region are increasing the demand for insurance. Insurance providers are focusing more on protection-based products with accident and health policies over fee-based products in the region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Amcor, WestRock Company, Sonoco Products Company, Berry Global Inc, and Tekni-Plex are some of the leading players in the global Global Private Health Insurance Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Cigna Corporation

- AIA Insurance Group

- UnitedHealth Group Inc.

- Allianz SE

- Zurich Insurance Group Ltd.

- Express Scripts Holding Company

- Apollo Munich Health Insurance

- International Medical Group

Key Development:

In November 2021, Oscar Health and Emory Healthcare partnered to create an innovative new product that will allow patients to connect with their doctors in the US. They will also be able to access additional healthcare perks through technology-connected services at home and on the go.

Scope of the Report

Global Private Health Insurance Market, by Type

- Medical Insurance

- Critical Illness Insurance

Global Private Health Insurance Market, by Network Providers

- Preferred Provider Organizations (PPOs)

- Point of Services (POS)

Global Private Health Insurance Market, by Demographics

- Minors

- Adults

- Senior Citizens

Global Private Health Insurance Market, by End-Use

- Individual

- Corporates

Global Private Health Insurance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 3214.87 Billion |

| CAGR (2021-2034) | 5.12% |

| Base year | 2023 |

| Forecast Period | 2021-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Network Providers, Demographics, End-Use |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa. |

| Key Vendors | Cigna Corporation, AIA Insurance Group, UnitedHealth Group Inc., Allianz SE, Zurich Insurance Group Ltd., Express Scripts Holding Company, AXA, Aviva plc, Aetna, Inc., Apollo Munich Health Insurance, and International Medical Group |

| Key Market Opportunities | Increasing Awareness about Health Insurance policies in Rural Areas |

| Key Market Drivers | Rising Geriatric Population in Developed and Developing Countries |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global Private Health Insurance market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global Private Health Insurance market historical market size for the year 2022, and forecast from 2021 to 2034

- Global Private Health Insurance market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Global Private Health Insurance market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the Global Private Health Insurance market is 2021- 2034

What are the 10 Years CAGR (2021 to 2034) of the Global Private Health Insurance market?

The Global Private Health Insurance market is growing at a CAGR of ~5.12% over the next 10 years

Which region has the highest growth rate in the market of Global Private Health Insurance?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Global Private Health Insurance?

North America holds the largest share in 2023

Major Key Players in the Market of Global Private Health Insurance?

Cigna Corporation, AIA Insurance Group, UnitedHealth Group Inc., Allianz SE, Zurich Insurance Group Ltd., Express Scripts Holding Company, AXA, Aviva plc, Aetna, Inc., Apollo Munich Health Insurance, and International Medical Group are the major companies operating in the Global Private Health Insurance Industry.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Network Providers Segment – Market Opportunity Score 4.1.3. Demographics Segment – Market Opportunity Score 4.1.4. End-Use Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Type 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Global Private Health Insurance Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Private Health Insurance Market, By Type 7.1. Introduction 7.1.1. Medical Insurance 7.1.2. Critical Illness Insurance CHAPTER 8. Global Private Health Insurance Market, By Network Providers 8.1. Introduction 8.1.1. Preferred Provider Organizations (PPOs) 8.1.2. Point of Services (POS) CHAPTER 9. Global Private Health Insurance Market, By Demographics 9.1. Introduction 9.1.1. Minors 9.1.2. Adults 9.1.3. Senior Citizens CHAPTER 10. Global Private Health Insurance Market, By End-Use 10.1. Introduction 10.1.1. Individual 10.1.2. Corporates CHAPTER 11. Global Private Health Insurance Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 11.2.2. North America: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.2.3. North America: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.2.4. North America: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.2.5. North America: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.2.6.4. US: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.3.5. Europe: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.3.8.4. France: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.6.4. China: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.8.4. India: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 11.5.2. South America: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.5.3. South America: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.5.4. South America: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.5.5. South America: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2021 – 2034 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Network Providers, 2021 – 2034 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Demographics, 2021 – 2034 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By End-Use, 2021 – 2034 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2021 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Amcor 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. WestRock Company 13.3. Sonoco Products Company 13.4. Berry Global Inc 13.5. Tekni-Plex 13.6. Constantia Flexibles Group GmbH 13.7. Huhtamaki Oyj 13.8. Winpak Ltd 13.9. Uflex Ltd 13.10. Prent Corporation

Connect to Analyst

Research Methodology