Price range: $ 1,390.00 through $ 5,520.00

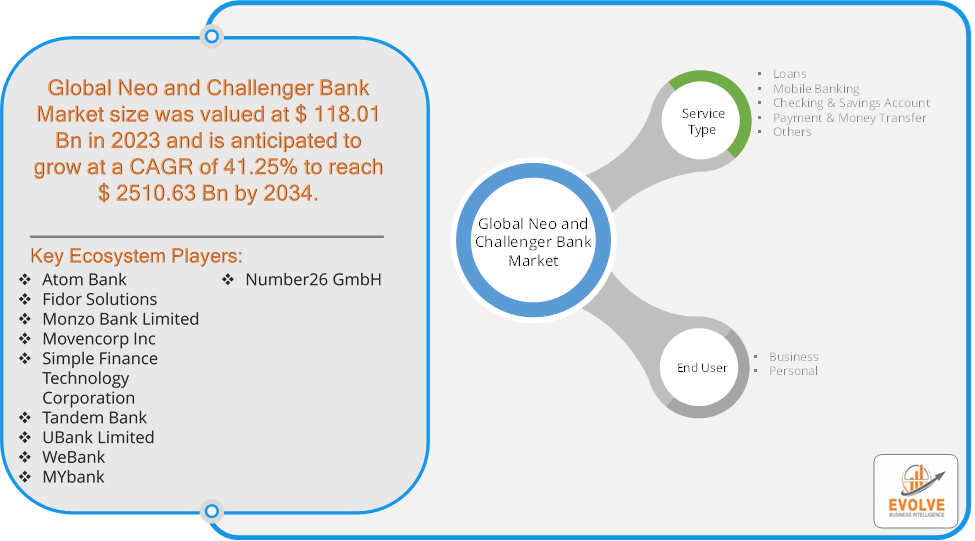

Global Neo and Challenger Bank Market Research Report: Information By Service Type (Loans, Mobile Banking, Checking & Savings Account, Payment & Money Transfer, Others), By End User (Business, Personal), and by Region — Forecast till 2034

Page: 170

Description

Global Neo and Challenger Bank Market Overview

The Global Neo and Challenger Bank Market size accounted for USD 118.01 Billion in 2023 and is estimated to account for 120.65 Billion in 2024. The Market is expected to reach USD 2510.63 Billion by 2034 growing at a compound annual growth rate (CAGR) of 41.25% from 2024 to 2034. The Global Neo and Challenger Bank Market refers to the sector composed of digital-first financial institutions that aim to disrupt traditional banking systems by offering modern, technology-driven services. Neo banks and challenger banks primarily operate online or via mobile platforms, providing banking services without the need for physical branches.

This market has experienced significant growth in recent years, driven by factors such as increased adoption of digital technologies, rising consumer expectations for convenience and personalized services, and the desire for more transparent and affordable financial solutions.

Global Neo and Challenger Bank Market Synopsis

Global Neo and Challenger Bank Market Dynamics

Global Neo and Challenger Bank Market Dynamics

The major factors that have impacted the growth of Global Neo and Challenger Bank Market are as follows:

Drivers:

Ø Technological Advancements

Advancements in artificial intelligence (AI), blockchain, big data, and cloud computing are enabling neo and challenger banks to provide faster, more personalized services, such as instant loan approvals, smart budgeting tools, and seamless peer-to-peer transfers. Many neo and challenger banks leverage open banking and APIs (Application Programming Interfaces) to integrate with third-party services, enhancing customer experiences by offering more personalized and diversified financial products. The widespread availability of smartphones and affordable internet access have enabled more people to access digital banking services. This is particularly significant in emerging markets where traditional banking infrastructure is less developed.

Restraint:

- Perception of Cybersecurity and Fraud Risks

Operating in a fully digital environment makes neo and challenger banks highly vulnerable to cyberattacks, data breaches, and fraud. Ensuring robust cybersecurity measures is critical but costly, especially for smaller or emerging banks. Handling sensitive customer information online can raise concerns about data privacy and security, deterring potential customers from trusting these digital platforms with their financial information.

Opportunity:

⮚ Growing Demand for Digital Banking Services

The ongoing shift toward digitalization in financial services is creating a massive opportunity for neo and challenger banks to capture a growing audience of consumers who prefer online banking solutions. This demand is expected to continue rising as more people adopt digital-first lifestyles, particularly in emerging markets. Neo and challenger banks can continue to innovate by offering new financial products such as instant credit, buy-now-pay-later (BNPL) services, cryptocurrency trading, automated savings, and personal finance management tools. These innovative solutions attract tech-savvy consumers looking for alternative financial services.

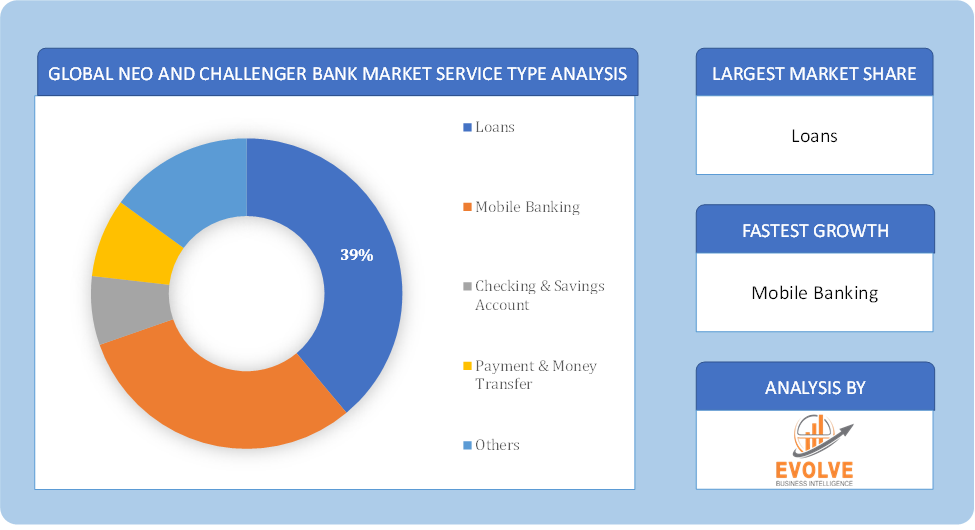

Global Neo and Challenger Bank Market Segment Overview

Based on Service Type, the market is segmented based on Loans, Mobile Banking, Checking & Savings Account, Payment & Money Transfer and Others. The Mobile Banking segment dominant the market. These services draw clients because they provide simplified, easy-to-use digital interfaces at affordable prices with excellent accessibility. Neo and challenger banks use technology to offer low-cost solutions, simple account administration, and real-time information. They target both tech-savvy consumers and those looking for more economical, efficient banking options. The emphasis on efficiency and simplicity drives significant interest and adoption in the digital banking industry.

By End User

Based on End User, the market segment has been divided into Business and Personal. The Business segment will be the most rapidly expanding market due to the rise of peer-to-peer lending platforms and the growing number of enterprises. Alternative financial services, such as cash and money orders, are frequently used by businesses that do not have a bank account. The necessity for a bank account, on the other hand, persists, and banks may capitalize on this by offering low fees and competitive interest rates.

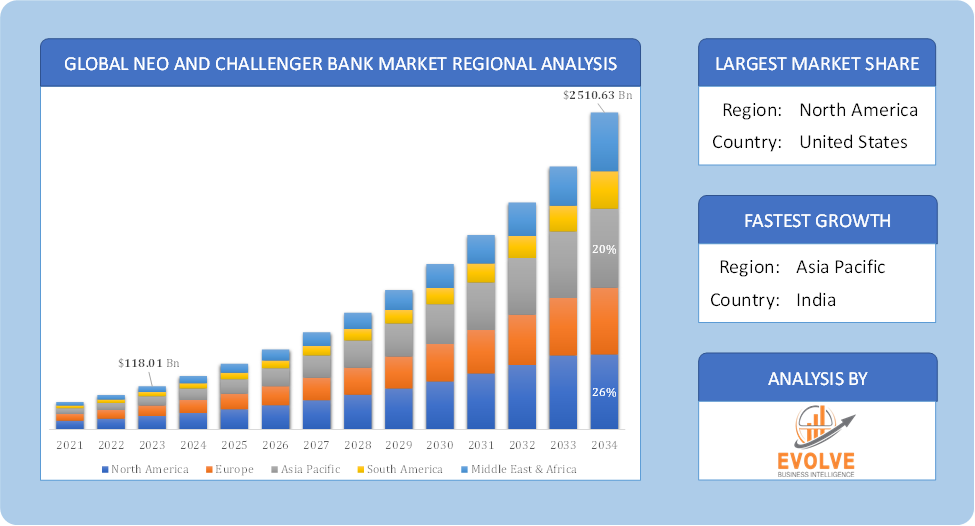

Global Neo and Challenger Bank Market Regional Analysis

Based on region, the Global Neo and Challenger Bank Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global Neo and Challenger Bank Market followed by the Asia-Pacific and Europe regions.

Global Neo and Challenger Bank North America Market

Global Neo and Challenger Bank North America Market

North America holds a dominant position in the Global Neo and Challenger Bank Market. North America, especially the U.S., has a well-developed financial system, but there is growing consumer demand for digital banking services. Neo and challenger banks are gaining traction, particularly among tech-savvy and younger demographics and the shift toward mobile banking, dissatisfaction with traditional banks, and the rise of fintech ecosystems are fueling growth in this region. U.S. consumers are increasingly turning to digital-first banks for features like no-fee accounts, higher interest rates on savings, and innovative financial tools.

Global Neo and Challenger Bank Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global Neo and Challenger Bank Market industry. The Asia-Pacific region, particularly countries like China, India, Singapore, and Australia, represents a significant growth area for neo and challenger banks. There is a large, tech-savvy population, with growing demand for mobile-first financial services and rapid digital transformation, the increasing use of smartphones, and government initiatives promoting financial inclusion are key drivers of growth. In emerging markets, many people are bypassing traditional banks in favor of mobile and digital banking.

Competitive Landscape

The Global Neo and Challenger Bank Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Atom Bank

- Fidor Solutions

- Monzo Bank Limited

- Movencorp Inc

- Simple Finance Technology Corporation

- Tandem Bank

- UBank Limited

- WeBank

- MYbank

- Number26 GmbH

Scope of the Report

Global Neo and Challenger Bank Market, by Service Type

- Loans

- Mobile Banking

- Checking & Savings Account

- Payment & Money Transfer

- Others

Global Neo and Challenger Bank Market, by End User

- Business

- Personal

Global Neo and Challenger Bank Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 2510.63 Billion |

| CAGR (2024-2034) | 41.25% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Service Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Atom Bank, Fidor Solutions, Monzo Bank Limited, Movencorp Inc, Simple Finance Technology Corporation, Tandem Bank, UBank Limited, WeBank, MYbank and Number26 GmbH. |

| Key Market Opportunities | · Growing Demand for Digital Banking Services

· Innovative Financial Products and Services |

| Key Market Drivers | · Technological Advancements

· Increasing Digital Adoption |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global Neo and Challenger Bank Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global Neo and Challenger Bank Market historical market size for the year 2021, and forecast from 2023 to 2033

- Global Neo and Challenger Bank Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the Global Neo and Challenger Bank Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the growth rate of the Global Neo and Challenger Bank Market?

The Global Neo and Challenger Bank Market is growing at a CAGR of 41.25% over the next 10 years

Which region has the highest growth rate in the market of Global Neo and Challenger Bank Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the Global Neo and Challenger Bank Market?

North America holds the largest share in 2022

Who are the key players in the Global Neo and Challenger Bank Market?

Atom Bank, Fidor Solutions, Monzo Bank Limited, Movencorp Inc, Simple Finance Technology Corporation, Tandem Bank, UBank Limited, WeBank, MYbank and Number26 GmbH. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Additional information

| Packages | Single User License, Enterprise License, Data Pack Excel |

|---|

Table of Contents

[html_block id="9039"]

Connect to Analyst

[html_block id="6813"]