GIS in the Telecommunications Market Analysis and Global Forecast 2022-2030

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

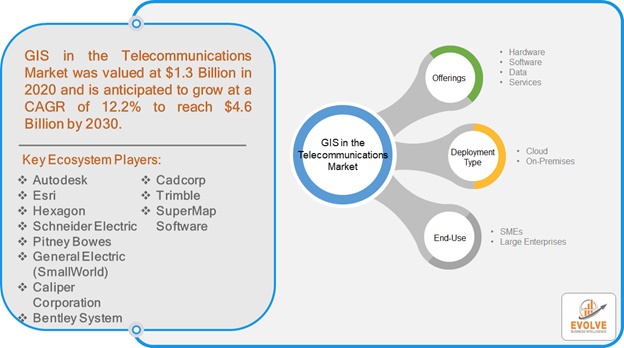

The global GIS in the Telecommunications market size is projected to reach approximately $4.6 Billion by 2030, at a CAGR of 12.2% from 2022 to 2030

Page: 160

The global GIS in the Telecommunications market size is projected to reach approximately $4.6 Billion by 2030, at a CAGR of 12.2% from 2022 to 2030. A Geographic information system (GIS) is a system designed primarily to provide the analysis, capture, record, and interpretation of geographical data such as location features, space and terrain features, time-related data (such as weather records), etc. for Telecommunication companies that need access to these types of data for effective performance. Data collected in this manner is useful for understanding and analyzing trends, like customer behavior and network coverage. It’s used to aid consumers as they make purchase decisions while also working on different business models. The Telecommunications market is utilizing GIS to help with the growth of the industry.

COVID-19 Impact Analysis

The Coronavirus pandemic has been maintaining its tight grip on the telecom industry. Although there have been challenges, many telecom companies around the world have adapted to them. Telecommunication firms are always evolving and innovating with new ways to change their industry, just as they do daily. Telecoms have seen a decrease in attendance at their storefronts in recent times. New business models and more affordable methods of communicating with customers made it difficult for these sites to maintain an average income. Many telecom businesses in major regions are suffering from a disconnect between the Point of Sales division and their subscribers. Regardless of the disruptions caused by this pandemic, telecoms have been able to benefit from industry growth and increased adoption of digital platforms. There is an increasing trend of digital connectivity as well as a global shift towards digitizing. Unbanked opportunities have been created for telecom operators by this new setup. Mobile and internet usage has increased and is more prevalent, leading to a spike in revenue for telecom companies.

GIS in the Telecommunications Market Dynamics

Virtual and augmented reality have been cutting-edge technologies in industries such as healthcare and production, driving the growth of services like GSI in the Telecommunication Market. However, a shortage of skilled professionals is the significant factor that is hindering the growth of companies that offer GSI in the telecom market. Mobile telecommunications technology is becoming increasingly advanced and the market, as a result, is expected to grow during the forecast period.

Drivers:

⮚ Adoption of the GIS Technology for the Broadband Services

With the rapid adoption of GIS for mobile and broadband services, telecom companies are using it to monitor their broadband infrastructure. Companies are also using GIS technology to figure out where the ideal location for an expansion would be. This technology has had a significant impact on data collection and analysis. It allows firms to get more accurate data from a single platform, which ultimately helps in resolving connectivity and broadband issues. Besides this, investment in the broadband speed, along with the expansion of the network is fueling the adoption of GIS technology in the global Telecommunications Market

Restraint:

- Lack of Skilled Professionals in the Market

Despite immense technological developments, the telecom sector is still struggling to gain market share. One of the major hurdles that telecom companies face is the lack of skilled professionals in this industry. It is estimated that there are only 8,000 GIS professionals across India. . This number is even less in some states, such as Punjab and Haryana. India Ratings (Ind-Ra) believes that blockchain can help to reduce the lack of skilled professionals in this industry. To achieve this goal, Ind-Ra will be launching a blockchain academy that will provide online education for GIS professionals. The academy will also provide certification courses.

Opportunity:

⮚ The Increasing Trend of Miniaturization of Devices

The GIS industry is currently undergoing significant changes that are driven by recent developments in the market. One of the major trends happening these days is the miniaturization of devices. Not only does AI help businesses reduce expenses, but IoT technology and artificial intelligence have created a new entrepreneurial space for innovation and competition that drives GIS forward. As a result, industry players are increasingly investing in sensors and connected devices to help telecom firms gather data specific to their needs. The use of miniature devices has increased quickly across the world in recent years due to their cost-effective and flexible properties that allow geospatial data collection. Additionally, these devices make it possible to collect real-time data that is necessary for various navigation/mapping applications

GIS in the Telecommunications Segment Overview

By Offerings

Based on the Offerings, the GIS in the Telecommunications market is segmented based on Hardware, Software, Data, and Services. The Data Segment is anticipated to account for the large market share. Geospatial (or geographical) data has been around for a while and is becoming increasingly popular in the field of telecom. Companies are now starting to use this data for capacity analysis, campaign management, and demand forecasting.

By Deployment Type

Based on Deployment Type, the global GIS in the Telecommunications market has been divided into Cloud and On-Premises. The Cloud segment is expected to hold the largest market share. The Cloud has been a huge leap forward in the world of technology. With the cloud, companies can share their data and back it up at all times, which means that they don’t have to worry about losing their business because of a power surge or computer crash.

By End-Use

Based on End-Use, the global GIS in the Telecommunications market has been divided into SMEs and Large Enterprises. The Large Enterprises segment is expected to hold the largest market share. Adoption of GIS by big telecommunication companies for improving their connectivity, installing towers, and expanding their reach in locations with severe problems is on the rise. This has been made possible by the use of GIS and AI technology.

Global GIS in the Telecommunications Market Share, by Segmentation

GIS in the Telecommunications Regional Analysis

GIS in the Telecommunications Regional Analysis

Based on region, the global GIS in the Telecommunications market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. North America is projected to dominate the use of the GIS in the Telecommunications market followed by the Asia-Pacific and Europe regions.

North America Market

North America is the largest GIS in the telecommunication market, due to the huge demand for 5G services. With telecommunications companies focusing heavily on rapid advancements in technology, the demand for geospatial services has also been increasing. In addition, people with a high disposable income are enabling the sale of various consumer electronic gadgets such as tablets, smartphones, and more. As a result, telecom companies are further demanding the quick adoption of GIS for a better customer experience.

Asia-Pacific Market

Asia-Pacific GIS providers are anticipated to have the highest CAGR in the telecom sector market. The government is investing hugely in building smart cities and the 5G internet market. This research growth has led to a significant increase in the use of geospatial technologies, which drives the GIS sector. As developing countries like China, India, and Japan invest heavily in digitalization, they offer lucrative opportunities for businesses to expand their market. Moreover, demand for GIS-based applications in Asia-Pacific is also one of the key drivers of this market.

Competitive Landscape

The market comprises tier-1, tier-2, and local players. With their wide product portfolios, tier-1 and tier-2 players have a global reach. Because of their strategic innovations and broad regional presence, companies such as BDP International, Agility, Montreal GIS in the Telecommunications, Autodesk, Hexagon, Schneider Electric, Pitney Bowes, General Electric (SmallWorld), Caliper Corporation, Bentley System, Cadcorp, Trimble, and SuperMap Software, lead the global GIS in the Telecommunications business. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as growth, product releases, and alliances.

Prominent Players:

- Autodesk

- Esri

- Hexagon

- Schneider Electric

- Pitney Bowes

- General Electric (SmallWorld)

- Caliper Corporation

- Bentley System

- Cadcorp

- Trimble

- SuperMap Software

In November 2019, IQGeo Group plc unveiled Network Manager, an advanced software system to manage network assets for telecommunications service providers. It would allow them to design, edit, and maintain networks and host network asset data. Providing support for on-premises infrastructure and the cloud, allows the service providers to save money and get a better experience.

Scope of the Report

Global GIS in the Telecommunications Market, by Offerings

- Hardware

- Software

- Data

- Services

Global GIS in the Telecommunications Market, by Deployment Type

- Cloud

- On-Premises

Global GIS in the Telecommunications Market, by End-Use

- SMEs

- Large Enterprises

Global GIS in the Telecommunications Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- Rest of the World

| Parameters | Indicators |

| Market Size | 2030: $ 4.6 Billion |

| CAGR | 12.2% CAGR (2022-2030) |

| Base year | 2021 |

| Forecast Period | 2022-2030 |

| Historical Data | 2020 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Offerings, Deployment Type, End-Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Autodesk, Hexagon, Schneider Electric, Pitney Bowes, General Electric (SmallWorld), Caliper Corporation, Bentley System, Cadcorp, Trimble, and SuperMap Software |

| Key Market Opportunities | The Increasing Trend of Miniaturization of Devices |

| Key Market Drivers | Adoption of the GIS Technology for the Broadband Services |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future GIS in the Telecommunications market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- GIS in the Telecommunications market historical market size for the year 2020, and forecast from 2021 to 2028

- GIS in the Telecommunications market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global GIS in the Telecommunications market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global GIS in the Telecommunications market is 2020 - 2030

What is the growth rate of the global GIS in the Telecommunications market?

The global GIS in the Telecommunications market is growing at a CAGR of ~ 12.2% over the next 7 years

Which region has the highest growth rate in the global GIS in the Telecommunications market?

Asia Pacific is expected to register the highest CAGR during 2022-2030

Which region has the largest share in the global GIS in the Telecommunications market?

North America holds the largest share in 2021

Who are the key players in the global GIS in the Telecommunications market?

Autodesk, Hexagon, Schneider Electric, Pitney Bowes, General Electric (SmallWorld), Caliper Corporation, Bentley System, Cadcorp, Trimble, and SuperMap Software are the major companies operating in the global GIS in the Telecommunications market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

Chapter 1. Executive Summary Chapter 2. Scope Of Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Application Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End Users 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on GIS in the Telecommunications 4.3.1. Impact on Market Size 4.3.2. End-User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of GIS in the Telecommunications 4.8. Import Analysis of GIS in the Telecommunications 4.9. Export Analysis of GIS in the Telecommunications Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global GIS in the Telecommunications, By Offerings 6.1. Introduction 6.2. Hardware 6.3. Software 6.4. Data 6.5. Services Chapter 7. Global GIS in the Telecommunications, By Deployment Type 7.1. Introduction 7.2. Cloud 7.3. On-Premises Chapter 8. Global GIS in the Telecommunications, By End-Use 8.1. Introduction 8.2. SMEs 8.3. Large Enterprises Chapter 9. Global GIS in the Telecommunications, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.5. Market Size and Forecast, By Application, 2020 – 2028 9.2.6. US 9.2.6.1. Introduction 9.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.2.7. Canada 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.6. Germany 9.3.6.1. Introduction 9.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.7. France 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.8. UK 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.9. Italy 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.10. Rest Of Europe 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.6. China 9.4.6.1. Introduction 9.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.7. India 9.4.7.1. Introduction 9.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.8. Japan 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.9. South Korea 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.10. Rest Of Asia-Pacific 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.4. Market Size and Forecast, By Application, 2020 - 2028 9.5.5. Market Size and Forecast, By Region, 2020 - 2028 9.5.6. South America 9.5.6.1. Introduction 9.5.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.5.7. Middle East and Africa 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 11. Company Profiles 11.1. Autodesk 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. Hexagon 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Schneider Electric 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Pitney Bowes 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. General Electric (SmallWorld) 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Caliper Corporation 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. Bentley System 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Cadcorp 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. Trimble 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology

GIS in the Telecommunications Regional Analysis

GIS in the Telecommunications Regional Analysis