Flip Chip Market Overview

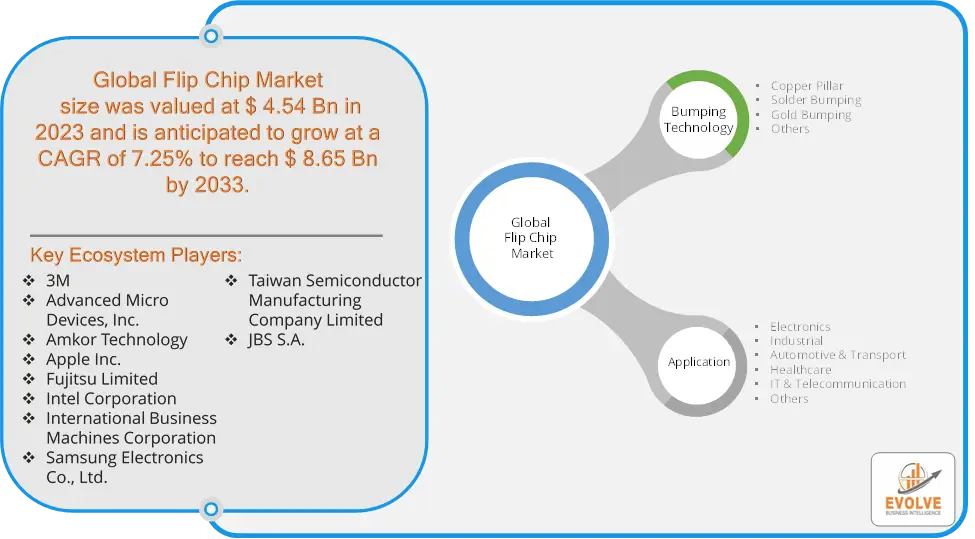

The Flip Chip Market Size is expected to reach USD 8.65 Billion by 2033. The Flip Chip industry size accounted for USD 4.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.25% from 2023 to 2033. The flip chip market involves the use of a semiconductor packaging technology where the chip is flipped over and directly mounted onto a substrate, such as a printed circuit board (PCB). This technology allows for higher performance and miniaturization by reducing the size and length of interconnects. Key drivers of the market include the increasing demand for high-performance electronics, advancements in mobile devices, and the growth of consumer electronics. The market is characterized by its application in various sectors such as automotive, consumer electronics, and telecommunications. Leading players in the market focus on innovations in materials and processes to enhance chip performance and integration.

Global Flip Chip Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Flip Chip market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Flip Chip Market Dynamics

The major factors that have impacted the growth of Flip Chip are as follows:

Drivers:

Ø Advancements in Mobile Devices

The proliferation of smartphones and tablets, which demand high processing power and energy efficiency, has accelerated the adoption of flip chip technology. These devices require advanced packaging solutions to accommodate their compact designs while ensuring high performance and reliability.

Restraint:

- High Manufacturing Costs

Flip chip technology involves complex manufacturing processes, including wafer bumping, underfill encapsulation, and advanced substrate materials. These processes are costly and can increase the overall production expenses of flip chip packages. High manufacturing costs may limit the adoption of flip chip technology in price-sensitive markets.

Opportunity:

⮚ Advancements in Electronics Technology

The rapid evolution of electronics, including higher processing speeds, increased functionality, and greater miniaturization, creates significant opportunities for flip chip technology. As electronic devices become more sophisticated, the need for advanced packaging solutions like flip chips that can handle high performance and density requirements grows.

Flip Chip Segment Overview

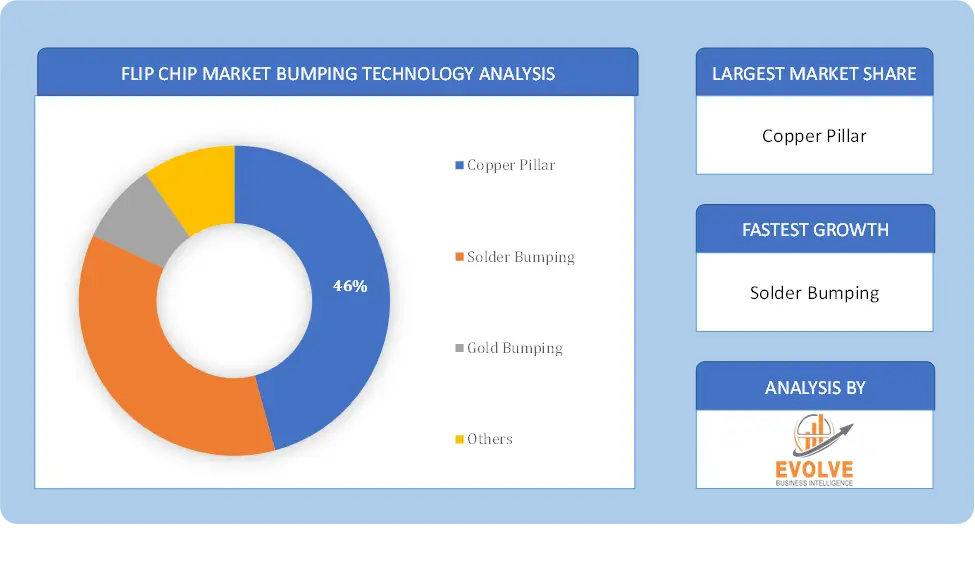

By Bumping Technology

Based on Bumping Technology, the market is segmented based on Copper Pillar, Solder Bumping, Gold Bumping, Others. Solder Bumping technology dominates due to its established use in high-volume production and its cost-effectiveness for a wide range of applications.

Based on Bumping Technology, the market is segmented based on Copper Pillar, Solder Bumping, Gold Bumping, Others. Solder Bumping technology dominates due to its established use in high-volume production and its cost-effectiveness for a wide range of applications.

By Industry

Based on Industrys, the market has been divided into the Electronics, Industrial, Automotive & Transport, Healthcare, IT & Telecommunication, Others. the Electronics segment dominates due to its extensive application in consumer electronics, including smartphones, tablets, and wearables, which drive high demand for advanced packaging solutions.

Global Flip Chip Market Regional Analysis

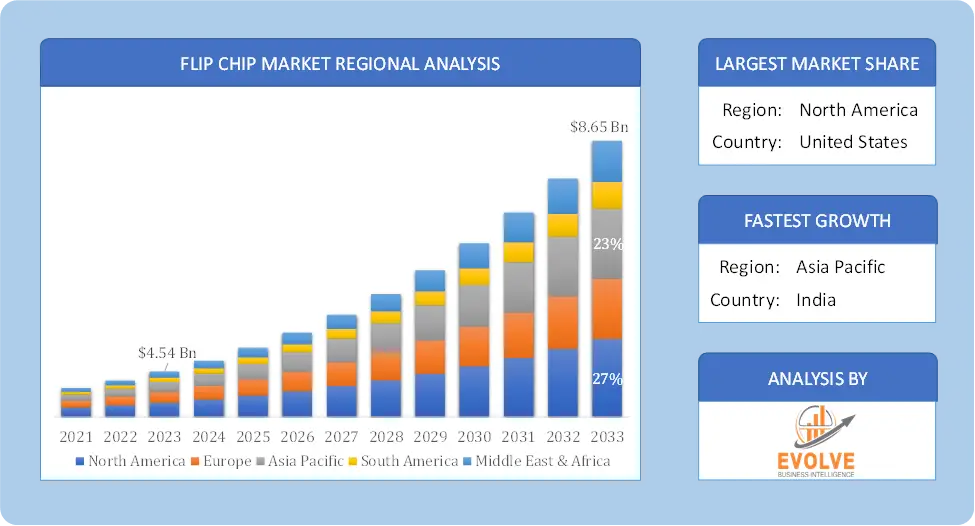

Based on region, the global Flip Chip market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Flip Chip market followed by the Asia-Pacific and Europe regions.

Flip Chip North America Market

Flip Chip North America Market

North America holds a dominant position in the Flip Chip Market. Because flip-chip technology is used so widely, the North American flip-chip technology market will dominate. In the semiconductor business, it has a long history of being a trailblazer in R&D, electronic design automation (EDA), chip design, core intellectual property (IP), and advanced facilities manufacturing equipment.

Flip Chip Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Flip Chip industry. Rising disposable income and an increase of input/output connections are projected to propel the Asia-Pacific flip-chip technology market to the fastest compound annual growth rate (CAGR) from 2023 to 2032. With the aid of supportive government initiatives, flip chip technology offers benefits in a growing range of sectors, reduced production costs, enhanced efficiency, and smaller packaging.

Competitive Landscape

The global Flip Chip market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Bumping Technology launches, and strategic alliances.

Prominent Players:

- 3M

- Advanced Micro Devices, Inc.

- Amkor Technology

- Apple Inc.

- Fujitsu Limited

- Intel Corporation

- International Business Machines Corporation

- Samsung Electronics Co., Ltd.

- Taiwan Semiconductor Manufacturing Company Limited

- JBS S.A.

Key Development

In September 2022, Samsung Electronics Co., Ltd. announced advancements in flip chip packaging technology, focusing on enhancing performance and miniaturization for its semiconductor products, including improvements in 3D packaging and interconnect density.

Scope of the Report

Global Flip Chip Market, by Bumping Technology

- Copper Pillar

- Solder Bumping

- Gold Bumping

- Others

Global Flip Chip Market, by Application

- Electronics

- Industrial

- Automotive & Transport

- Healthcare

- IT & Telecommunication

- Others

Global Flip Chip Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.65 Billion |

| CAGR | 7.25% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Bumping Technology, Industry |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | 3M, Advanced Micro Devices, Inc., Amkor Technology, Apple Inc., Fujitsu Limited, Intel Corporation, International Business Machines Corporation, Samsung Electronics Co., Ltd., Taiwan Semiconductor Manufacturing Company Limited, JBS S.A. |

| Key Market Opportunities | • The meteoric rise of play in the physical world Developments in technology |

| Key Market Drivers | • Rising levels of discretionary income Increased demand for small electronic items |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Flip Chip market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Flip Chip market historical market size for the year 2021, and forecast from 2023 to 2033

- Flip Chip market share analysis at each Bumping Technology level

- Competitor analysis with detailed insight into its Bumping Technology segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Bumping Technology launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Flip Chip market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Bumping Technology offering, recent developments, SWOT analysis, and key strategies.