Feed plant-based protein market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

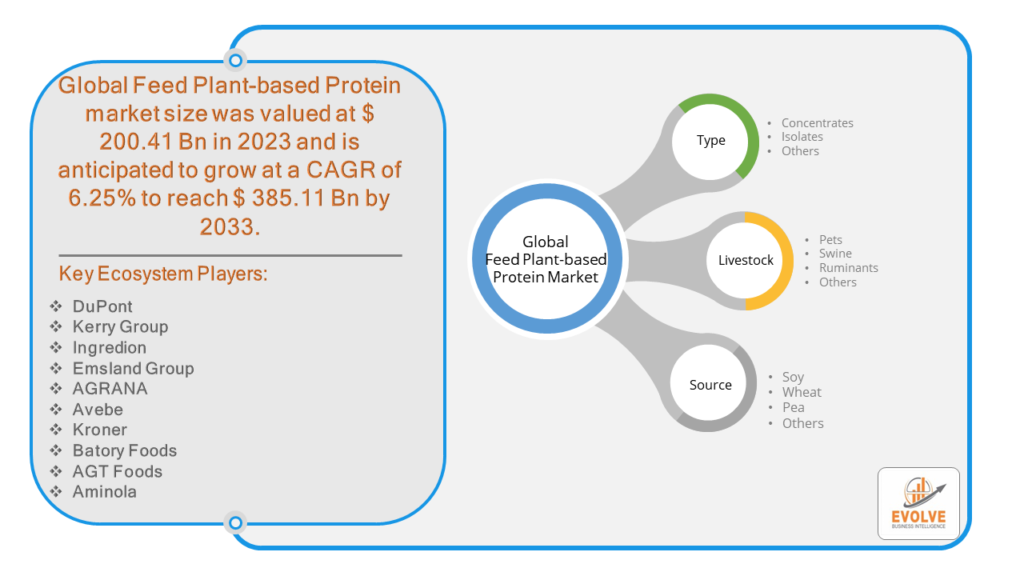

Feed plant-based protein market Research Report: Information By Type (Concentrates, Isolates, Others), By Livestock (Pets, Swine, Ruminants, Others), By Source (Soy, Wheat, Pea, Others), and by Region — Forecast till 2033

Page: 141

Feed plant-based protein market Overview

The Feed plant-based protein market Size is expected to reach USD 23.88 Billion by 2033. The Feed plant-based protein market industry size accounted for USD 16.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.87% from 2023 to 2033. The plant-based protein market refers to the segment of the food industry focused on producing, marketing, and selling protein-rich products derived from plants. These products are alternatives to traditional animal-based protein sources such as meat, dairy, and eggs. Plant-based protein sources include soy, peas, lentils, chickpeas, quinoa, hemp, chia seeds, and various grains and legumes.

The feed plant-based protein market specifically caters to providing plant-based protein sources for livestock feed. This segment focuses on producing protein-rich feeds derived from plants to meet the dietary needs of livestock, including poultry, pigs, and cattle, without relying on animal-derived protein sources. This market segment is also influenced by similar trends driving the human consumption of plant-based proteins, such as sustainability, animal welfare concerns, and health considerations.

Global Feed plant-based protein market Synopsis

The COVID-19 pandemic had various impacts on the feed plant-based protein market. The pandemic has heightened awareness of health and wellness, leading to a surge in demand for plant-based foods and ingredients, including plant-based protein. As consumers became more health-conscious and concerned about the origin of their food, they have shown increased interest in plant-based alternatives for both themselves and their livestock. Changes in consumer behavior during the pandemic, such as reduced meat consumption due to concerns about meat processing facilities’ safety and disruptions in the meat supply chain, have driven some livestock producers to explore alternative protein sources for animal feed. This has created opportunities for the feed plant-based protein market to expand its customer base. The economic downturn resulting from the pandemic has affected purchasing power and spending patterns globally. While some consumers may prioritize cost-effective plant-based protein options for livestock feed, others may perceive them as more expensive compared to conventional feed ingredients.

Feed plant-based protein market Dynamics

The major factors that have impacted the growth of Feed plant-based protein market are as follows:

Drivers:

Ø Health and Wellness Trends

Increasing awareness of the health benefits associated with plant-based diets has led to growing demand for plant-based protein products. Plant-based proteins are often perceived as healthier alternatives to animal-based proteins due to their lower levels of saturated fat and cholesterol and higher fiber content. This trend extends to livestock production, as consumers seek meat and dairy products from animals fed with plant-based diets. Advances in food science, biotechnology, and agricultural practices have enabled the production of high-quality plant-based protein ingredients for animal feed. Innovations such as fermentation, enzyme engineering, and precision agriculture contribute to the efficiency and scalability of plant-based protein production, making it more competitive with conventional feed ingredients. Changing consumer preferences and dietary trends, including the rise of vegetarianism, veganism, and flexitarianism, are driving demand for plant-based protein products across various market segments. As consumer awareness and acceptance of plant-based alternatives continue to grow, so does the demand for plant-based feed ingredients to support sustainable livestock production.

Restraint:

- Perception of Cost and Price Competitiveness

Plant-based protein ingredients may be more expensive to produce or purchase compared to conventional animal-derived feed ingredients such as soybean meal or fishmeal. Higher production costs, limited economies of scale, and the need for specialized equipment and processing facilities can make plant-based proteins less competitive in terms of price, potentially limiting their adoption by livestock producers, particularly in price-sensitive markets. The feed plant-based protein market relies on a complex global supply chain for sourcing, processing, and distributing raw materials and finished products. Disruptions such as extreme weather events, crop failures, trade disputes, and transportation bottlenecks can impact the availability and affordability of plant-based protein ingredients, leading to supply shortages and price volatility.

Opportunity:

⮚ Rising Demand for Sustainable Protein Sources

Increasing awareness of the environmental impact of conventional animal agriculture is driving demand for sustainable protein alternatives. Plant-based proteins offer a more environmentally friendly option, with lower greenhouse gas emissions, reduced land and water usage, and decreased reliance on intensive livestock farming practices. This presents an opportunity for feed manufacturers to capitalize on the growing demand for sustainable protein sources among livestock producers and consumers. The plant-based protein market is experiencing rapid expansion, driven by changing consumer preferences, dietary trends, and advancements in food technology. As the market continues to grow, there is an opportunity for feed manufacturers to diversify their product offerings and cater to a broader range of customers, including livestock producers seeking alternative protein sources for their animals. By innovating and introducing new plant-based feed ingredients tailored to the specific nutritional requirements of different animal species, feed manufacturers can capture a larger share of this expanding market.

Feed plant-based protein market Segment Overview

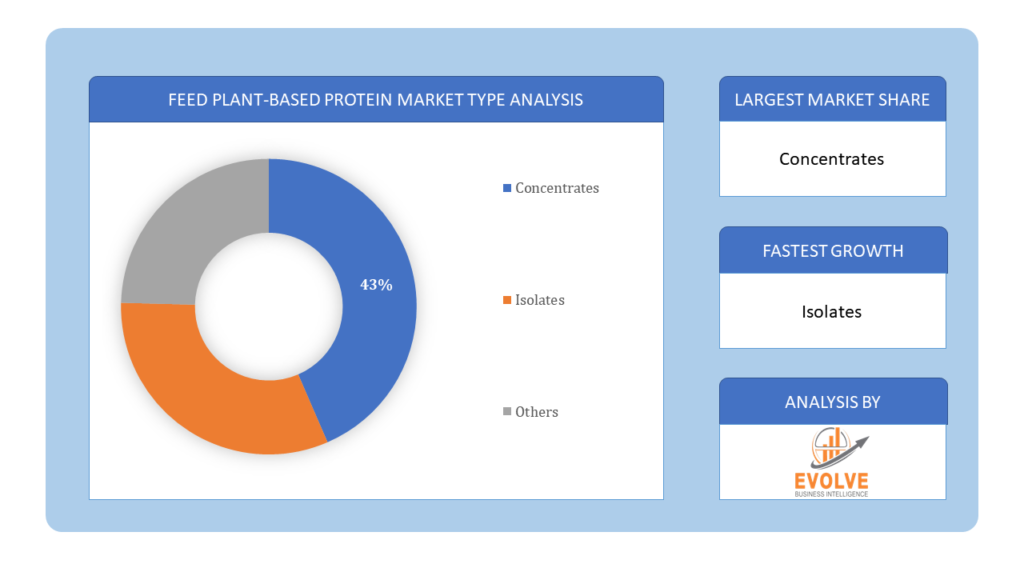

By Type

Based on Type, the market is segmented based on Concentrates, Isolates and Others. The isolate segment holds the largest share of plant-based protein market. Their functional properties that include high concentration of proteins and easily digestible nature boost the market growth. Isolates are produced through various extraction and purification methods designed to separate protein from other components of the plant material, such as carbohydrates, fats, fiber, and minerals.

Based on Type, the market is segmented based on Concentrates, Isolates and Others. The isolate segment holds the largest share of plant-based protein market. Their functional properties that include high concentration of proteins and easily digestible nature boost the market growth. Isolates are produced through various extraction and purification methods designed to separate protein from other components of the plant material, such as carbohydrates, fats, fiber, and minerals.

By Livestock

Based on Livestock, the market segment has been divided into Pets, Swine, Ruminants and Others. Swine diets traditionally rely on protein sources derived from animal products such as soybean meal and fishmeal. However, there is growing interest in incorporating plant-based protein ingredients to reduce reliance on animal-derived feed ingredients.

By Source

Based on Source, the market segment has been divided into Soy, Wheat, Pea and Others. Soy is the most dominating segment in plant-based protein market. Soy are highly rich in protein, fiber and are beneficial to digestive health. Soybean meal is a primary protein source in swine diets, providing essential amino acids and nutrients required for growth and production. It is rich in essential amino acids, particularly lysine, methionine, and threonine, which are crucial for animal growth, reproduction, and overall health.

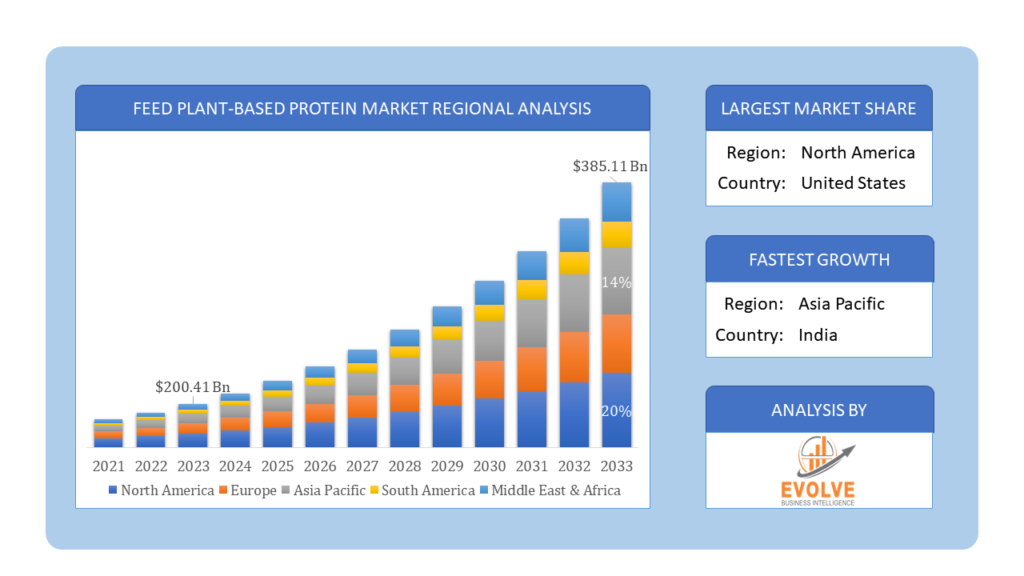

Global Feed plant-based protein market Regional Analysis

Based on region, the global Feed plant-based protein market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Feed plant-based protein market followed by the Asia-Pacific and Europe regions.

Feed plant based protein North America Market

Feed plant based protein North America Market

North America holds a dominant position in the Feed plant-based protein market. North America has been a significant driver of growth in the plant-based protein market, with the United States and Canada leading in terms of production and consumption. North America’s strong agricultural infrastructure and research capabilities have enabled the development and adoption of plant-based feed ingredients. Consumer demand for sustainable and ethically sourced food products is driving interest in plant-based feed ingredients, particularly among producers catering to niche markets and specialty diets.

Feed plant based protein Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Feed plant-based protein market industry. Asia-Pacific is a diverse region with varying levels of economic development, cultural preferences, and agricultural practices. In countries such as China and India, where meat consumption is rising rapidly, there is growing interest in plant-based protein as a sustainable and affordable alternative to conventional livestock feed. The region’s large population and expanding middle class present significant market opportunities for plant-based protein products, both for human consumption and livestock feed.

Competitive Landscape

The global Feed plant-based protein market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- DuPont

- Kerry Group

- Ingredion

- Emsland Group

- AGRANA

- Avebe

- Kroner

- Batory Foods

- AGT Foods

- Aminola

Key Development

In July 2021, Israel-based ChickP Ltd. Declared that its protein isolates can work as 1:1 plant-based substitutes for egg yolk in mayonnaise and salad dressings.

In February 2022, ADM, a global supplier of nutrition that powers many of the world’s top health and wellness and food & beverages brands, released its alternative protein outlook. Scope of the Report

Global Feed plant-based protein Market, by Type

- Concentrates

- Isolates

- Others

Global Feed plant-based protein market, by Livestock

- Pets

- Swine

- Ruminants

- Others

Global Feed plant-based protein market, by Source

- Soy

- Wheat

- Pea

- Others

Global Feed plant-based protein market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $23.88 Billion |

| CAGR | 6.87% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Livestock, Source |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | DuPont, Kerry Group, Ingredion, Emsland Group, AGRANA, Avebe, Kroner, Batory Foods, AGT Foods and Aminola. |

| Key Market Opportunities | • Rising Demand for Sustainable Protein Sources • Expanding Market for Alternative Proteins |

| Key Market Drivers | • Health and Wellness Trends • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Feed plant-based protein market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Feed plant-based protein market historical market size for the year 2021, and forecast from 2023 to 2033

- Feed plant-based protein market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Feed plant-based protein market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Feed plant-based protein market?

The study period spans from historical data in 2021 to forecasts for the years 2023 to 2033.

What is the growth rate of the Feed plant-based protein market?

The Feed plant-based protein market is projected to expand at a compound annual growth rate (CAGR) of 6.87% from 2023 to 2033.

Which region has the highest growth rate in the Feed plant-based protein market?

The Asia-Pacific region is anticipated to experience the highest growth rate in the Feed plant-based protein market due to rising interest in plant-based alternatives for livestock feed and increasing meat consumption.

Which region has the largest share of the Feed plant-based protein market?

Currently, North America dominates the Feed plant-based protein market, driven by factors such as strong agricultural infrastructure, research capabilities, and consumer demand for sustainable food products.

Who are the key players in the Feed plant-based protein market?

Key players in the Feed plant-based protein market include DuPont, Kerry Group, Ingredion, Emsland Group, AGRANA, Avebe, Kroner, Batory Foods, AGT Foods, and Aminola, among others.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Livestock Segment – Market Opportunity Score 4.1.3. Source Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Feed plant-based protein market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Feed plant-based protein market, By Type 7.1. Introduction 7.1.1. Concentrates 7.1.2. Isolates 7.1.3. Others CHAPTER 8. Global Feed plant-based protein market, By Livestock 8.1. Introduction 8.1.1. Pets 8.1.2. Swine 8.1.3. Ruminants 8.1.4. Others CHAPTER 9. Global Feed plant-based protein market, By Source 9.1. Introduction 9.1.1. Soy 9.1.2. Wheat 9.1.3. Pea 9.1.4 Others CHAPTER 10. Global Feed plant-based protein market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Livestock, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. DuPont 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Kerry Group. 13.3. Ingredion 13.4. Emsland Group 13.5. AGRANA 13.6. Avebe 13.7. Batory Foods 13.8. AGT Foods 13.9. Aminola 13.10 Kroner

Connect to Analyst

Research Methodology