E Pharmacy Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

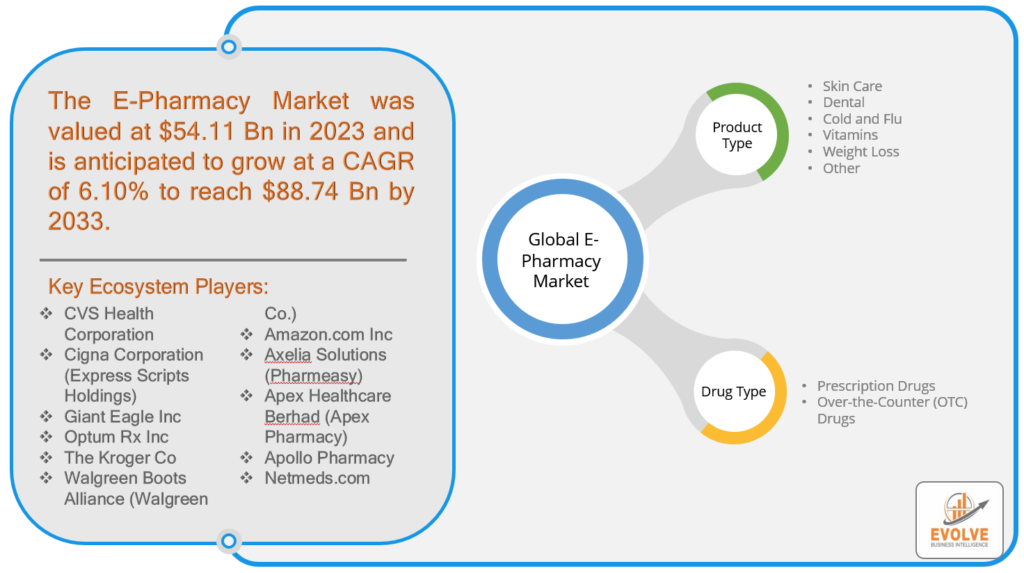

E-Pharmacy Market Research Report: Information By Product Type (Skin Care, Dental, Cold and Flu, Vitamins, Weight Loss, Other),By Drug Type (Prescription Drugs, Over-the-Counter (OTC) Drugs), and by Region — Forecast till 2033

PRESS RELEASE :https://evolvebi.com/global-e-pharmacy-market-is-estimated-to-record-a-cagr-of-around-6-10-during-the-forecast-period/

E-Pharmacy Market Overview

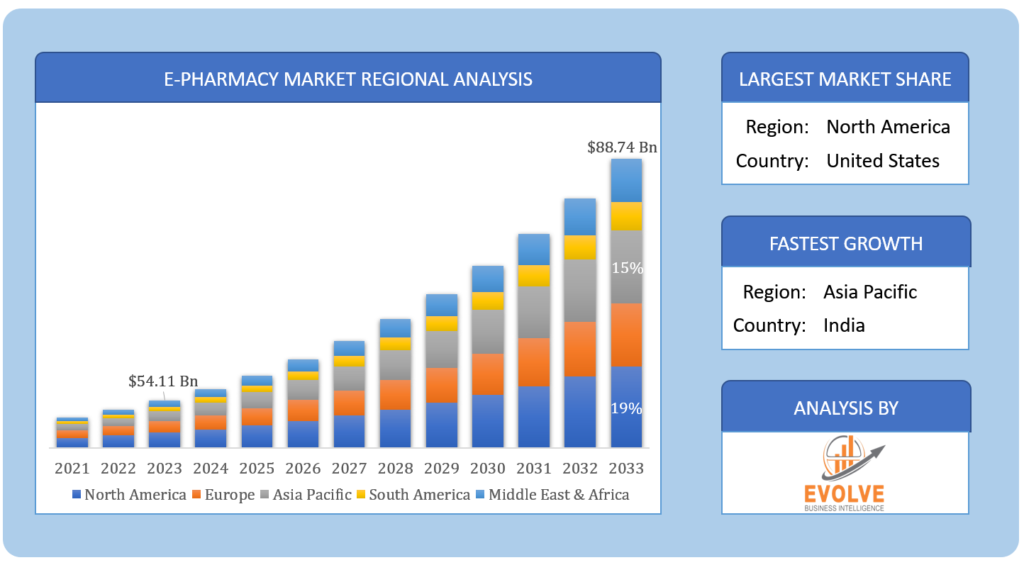

E Pharmacy Market Size is expected to reach USD 88.74 Billion by 2033. The E Pharmacy industry size accounted for USD 54.11 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.10% from 2023 to 2033. E Pharmacy, also known as an online pharmacy, refers to the sale of pharmaceutical products and medicines over the Internet. This method of purchasing allows consumers to order prescription drugs, over-the-counter medications, and other health-related products from the convenience of their homes, using their computers or mobile devices. EPharmacies operate similarly to traditional brick-and-mortar pharmacies, with licensed pharmacists who dispense medications and provide consultations to customers. The online format of EPharmacies provides greater convenience and accessibility, particularly for those who live in remote areas, have mobility issues, or prefer the privacy and anonymity of ordering medications online.

COVID-19 Impact Analysis and Post-COVID Scenario

The COVID-19 pandemic had a significant positive impact on the EPharmacy market. The pandemic has led to restrictions on movement, and people are encouraged to avoid unnecessary trips to physical stores, including pharmacies. As a result, there has been an increase in demand for EPharmacies, as more people opt for online platforms to order their medications and healthcare products. Additionally, the pandemic has highlighted the importance of social distancing and minimizing contact with others, which has further accelerated the growth of EPharmacies. Many consumers are now more comfortable with ordering their medications online and having them delivered to their doorstep, rather than going to a physical pharmacy.

Global E-Pharmacy Market Growth Factors

The increasing demand for convenience is a major driver of the growth of the E-Pharmacy market. With the rise of technology and the internet, consumers have become accustomed to the convenience of online shopping, and this trend has extended to the healthcare industry. EPharmacies provide a convenient solution for consumers who may have difficulty visiting a physical pharmacy due to their location, mobility issues, or busy schedules. The COVID-19 pandemic has further highlighted the importance of convenience, as consumers seek to minimize their contact with others and avoid unnecessary trips outside of their homes.

Global E-Pharmacy Market Restraining Factors

- Limited access to technology

Limited access to technology can be a limiting factor for the growth of the EPharmacy market. In rural and remote areas, internet connectivity and access to computers or mobile devices may be limited, which can hinder consumers from using E-Pharmacies. This can result in a lack of access to medications and healthcare products, particularly for those who are unable to travel to physical pharmacies. However, the increasing availability of affordable smartphones and internet connectivity in these areas presents an opportunity for EPharmacies to expand its reach and provide access to healthcare products and services to a wider range of consumers.

Global E-Pharmacy Market Opportunity Analysis

- Integration with healthcare providers

Partnering with healthcare providers could provide an opportunity for EPharmacies to offer a more comprehensive healthcare service to their customers. Telemedicine consultations can allow healthcare providers to remotely diagnose and treat certain medical conditions, while also providing a convenient and accessible option for patients. Additionally, integrating E-Pharmacy services into the healthcare provider’s office can streamline the medication ordering process, making it more efficient for both healthcare providers and patients. This type of collaboration could also help to build trust and credibility for EPharmacies among healthcare professionals and consumers.

Global E-Pharmacy Market Segment Analysis

The Vitamins segment is expected to hold the largest market share in 2023

The Vitamins segment is expected to hold the largest market share in 2023

Based on the Product Type, the E-Pharmacy market is segmented based on Skin Care, Dental, Cold and Flu, Vitamins, Weight Loss, and Other. The Vitamins segment is anticipated to hold the largest market share in the E-Pharmacy market. The demand for vitamins and dietary supplements is growing rapidly, and this trend is expected to continue in the coming years. This growth is driven by several factors, including increasing health consciousness among consumers, rising demand for natural and organic products, and growing awareness of the health benefits of vitamins and supplements.

The Over-the-Counter (OTC) Drugs segment is expected to hold the largest market share in 2023

Based on Drug Type, the global E-Pharmacy market has been divided into Prescription Drugs, Over-the-Counter (OTC) Drugs.The Over-the-Counter (OTC) Drugs segment is expected to dominate the E-Pharmacy market. OTC drugs are non-prescription medications that are widely available to consumers and are often used to treat common health conditions such as headaches, colds, and allergies. These medications are typically less expensive than prescription drugs, making them more affordable for consumers, and this affordability has contributed to their popularity.

Global E-Pharmacy Market, Segmental Chart

E-Pharmacy Market Regional Analysis

E-Pharmacy Market Regional Analysis

Based on region, the global E-Pharmacy market has been divided into North America, Europe, Asia-Pacific, theMiddle East & Africa, and Latin America. North America is expected to dominate the use of the E-Pharmacy market followed by the Asia Pacific and Europe regions.

Regional Coverage:

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- Thailand

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

North America Market

North America is the dominant market for E-Pharmacy. This can be attributed to its advanced healthcare infrastructure and high levels of internet penetration, which have facilitated the growth of the EPharmacy market. Furthermore, North America has a considerable demand for prescription medications, and a significant portion of the population comprises aging adults who require regular medication, further driving the growth of the E-Pharmacy market. The COVID-19 pandemic has further accelerated the adoption of EPharmacies in North America, with an increasing number of consumers opting to avoid physical stores and minimize their exposure to the virus. The convenience and accessibility of EPharmacies have also contributed to their popularity, particularly among individuals residing in rural and remote areas with limited access to physical pharmacies.

Asia Pacific Market

The Asia Pacific region has exhibited the highest compound annual growth rate (CAGR) in the E-Pharmacy market. The region’s growth can be attributed to several factors, including increasing internet penetration, a growing population, and rising demand for healthcare products and services. Additionally, the presence of numerous emerging economies in the region, such as China and India, has created a significant opportunity for E-Pharmacies to expand their operations and reach a vast customer base. Moreover, the COVID-19 pandemic has accelerated the growth of the E-Pharmacy market in the Asia Pacific region, as consumers increasingly rely on online platforms to purchase their medications and healthcare products. The increasing awareness of the benefits of E-Pharmacies, including convenience, affordability, and accessibility, has further fueled the growth of the market in the region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globeCompanies such as Apollo Pharmacy, Netmeds.com, Amazon.com Inc, and Axelia Solutions (Pharmeasy) are some of the leading players in the global E-Pharmacy market. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- CVS Health Corporation

- Cigna Corporation (Express Scripts Holdings)

- Giant Eagle Inc

- Optum Rx Inc

- The Kroger Co

- Walgreen Boots Alliance (Walgreen Co.)

- Amazon

- Axelia Solutions (Pharmeasy)

- Apex Healthcare Berhad (Apex Pharmacy)

- Apollo Pharmacy

- Netmeds

Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

On December 2022, The Kroger Family of Pharmacies will continue to be in-network, according to a direct agreement between Kroger Health, its Family of Pharmacies, and Prime Therapeutics LLC (Prime), a diversified pharmacy benefit manager owned jointly by Blue Cross and Blue Shield Plans and providing services to more than 33 million people.

On September 2022, Amazon announced that it intended to provide prescription drugs for sale online in Japan. It seeks to work with small and medium-sized pharmacies to provide a platform where patients may access online directions on how to take drugs. Customers might have their medications delivered to their homes without going to a drugstore.

Report Scope:

Global E- Pharmacy Market, by Product Type

- Skin Care

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

- Dental

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

- Cold and Flu

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

- Vitamins

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

- Weight Loss

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

- Other

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

Global E-Pharmacy Market, by Drug Type

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

Global E-Pharmacy Market Synopsis:

| PARAMETER | VALUE |

Market Size | · 2023: USD 54.11Billion· 2033: USD 88.74Billion |

Growth Rate | · First 5 Years CAGR (2023–2028): XX%· Last 5 Years CAGR (2028–2033): XX%· 10 Years CAGR (2023–2033): 6.10% |

Key Market Drivers | · Increasing demand for convenience· Increasing prevalence of chronic diseases |

Key Market Restraints | · Limited access to technology· Security concerns |

Market Opportunities | · Development of personalized medicine· Integration with healthcare providers |

Key Market Players | · CVS Health Corporation· Cigna Corporation (Express Scripts Holdings)· Giant Eagle Inc· Optum Rx Inc· The Kroger Co· Walgreen Boots Alliance (Walgreen Co.)· Amazon· Axelia Solutions (Pharmeasy)· Apex Healthcare Berhad (Apex Pharmacy)· Apollo Pharmacy· Netmeds |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future E-Pharmacy market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2022, and forecast from 2023 to 2033

- E-Pharmacy market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global E-Pharmacy market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparisons from 2021 to 2033.

- Provide Total Addressable Market (TAM) for the Global E-Pharmacy Market

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global E-Pharmacy market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global E-Pharmacy market?

The global E-Pharmacy market is growing at a CAGR of ~10% over the next 10 years

Which region has the highest growth rate in the global E-Pharmacy market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the global E-Pharmacy market?

North America holds the largest share in 2022

Major Key Players in the Global E-Pharmacy Market?

CVS Health Corporation, Cigna Corporation (Express Scripts Holdings), Giant Eagle Inc, Optum Rx Inc, The Kroger Co, Walgreen Boots Alliance (Walgreen Co.), Amazon.com Inc, Axelia Solutions (Pharmeasy), Apex Healthcare Berhad (Apex Pharmacy), Apollo Pharmacy, Netmeds.com are the major companies operating in the global E-Pharmacy

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver particular sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of content

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Product Type Segement – Market Opportunity Score

4.1.2. Drug Type Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on E-Pharmacy Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. MArket Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Global E-Pharmacy Market, By Product Type

7.1. Introduction

7.1.1. Skin Care

7.1.1.1.Prescription Drugs

7.1.1.2.Over-the-Counter (OTC) Drugs

7.1.2. Dental

7.1.2.1.Prescription Drugs

7.1.2.2.Over-the-Counter (OTC) Drugs

7.1.3. Cold and Flu

7.1.3.1.Prescription Drugs

7.1.3.2.Over-the-Counter (OTC) Drugs

7.1.4. Vitamins

7.1.4.1.Prescription Drugs

7.1.4.2.Over-the-Counter (OTC) Drugs

7.1.5. Weight Loss

7.1.5.1.Prescription Drugs

7.1.5.2.Over-the-Counter (OTC) Drugs

7.1.6. Other

7.1.6.1.Prescription Drugs

7.1.6.2.Over-the-Counter (OTC) Drugs

CHAPTER 8. Global E-Pharmacy Market, By Drug Type

8.1. Introduction

8.1.1. Prescription Drugs

8.1.2. Over-the-Counter (OTC) Drugs

CHAPTER 10. Global E-Pharmacy Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.2.2. North America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.2.2.1. North America E-Pharmacy forSkin Care Market By Drug Type

10.2.2.2. North America E-Pharmacy for Dental Market By Drug Type

10.2.2.3. North America E-Pharmacy forCold and Flu Market By Drug Type

10.2.2.4. North America E-Pharmacy for Vitamins Market By Drug Type

10.2.2.5. North America E-Pharmacy forWeight Loss Market By Drug Type

10.2.2.6. North America E-Pharmacy for Other Market By Drug Type

10.2.3. North America: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.2.4. US

10.2.4.1. US: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.2.4.2. US: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.2.5. CANADA

10.2.5.1. Canada: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.2.5.2. Canada: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.2.6. MEXICO

10.2.6.1. Mexico: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.2.6.2. Mexico: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.3.2. Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.2.1. Europe E-Pharmacy forSkin Care Market By Drug Type

10.3.2.2. Europe E-Pharmacy for Dental Market By Drug Type

10.3.2.3. Europe E-Pharmacy forCold and Flu Market By Drug Type

10.3.2.4. Europe E-Pharmacy for Vitamins Market By Drug Type

10.3.2.5. Europe E-Pharmacy forWeight Loss Market By Drug Type

10.3.2.6. Europe E-Pharmacy for Other Market By Drug Type

10.3.3. Europe: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.3.4. U.K.

10.3.4.1. U.K.: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.4.2. U.K.: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.3.5. GERMANY

10.3.5.1. Germany: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.5.2. Germany: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.3.6. FRANCE

10.3.6.1. France: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.6.2. France: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.3.7. ITALY

10.3.7.1. Italy: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.7.2. Italy: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.3.8. SPAIN

10.3.8.1. Spain: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.8.2. Spain: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.3.9. BENELUX

10.3.9.1. BeNeLux: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.9.2. BeNeLux: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.3.10. RUSSIA

10.3.10.1. Russia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.10.2. Russia: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.3.11. REST OF EUROPE

10.3.11.1. Rest of Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.11.2. Rest of Europe: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.2.1. Asia Pacific E-Pharmacy forSkin Care Market By Drug Type

10.4.2.2. Asia Pacific E-Pharmacy for Dental Market By Drug Type

10.4.2.3. Asia Pacific E-Pharmacy forCold and Flu Market By Drug Type

10.4.2.4. Asia Pacific E-Pharmacy for Vitamins Market By Drug Type

10.4.2.5. Asia Pacific E-Pharmacy forWeight Loss Market By Drug Type

10.4.2.6. Asia Pacific E-Pharmacy for Other Market By Drug Type

10.4.3. Asia Pacific: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4.54 CHINA

10.4.4.1. China: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.4.2. China: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4.5. JAPAN

10.4.5.1. Japan: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.5.2. Japan: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4.6. INDIA

10.4.6.1. India: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.6.2. India: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4.7. SOUTH KOREA

10.4.7.1. South Korea: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.7.2. South Korea: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4.8. THAILAND

10.4.8.1. Thailand: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.8.2. Thailand: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4.9. INDONESIA

10.4.9.1. Indonesia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.9.2. Indonesia: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4.10. MALAYSIA

10.4.10.1. Malaysia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.10.2. Malaysia: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4.11. AUSTRALIA

10.4.11.1. Australia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.11.2. Australia: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.4.12. REST FO ASIA PACIFIC

10.4.12.1. Rest fo Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.4.12.2. Rest fo Asia Pacific: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.5.2. South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.5.2.1. South America E-Pharmacy forSkin Care Market By Drug Type

10.5.2.2. South America E-Pharmacy for Dental Market By Drug Type

10.5.2.3. South America E-Pharmacy forCold and Flu Market By Drug Type

10.5.2.4. South America E-Pharmacy for Vitamins Market By Drug Type

10.5.2.5. South America E-Pharmacy forWeight Loss Market By Drug Type

10.5.2.6. South America E-Pharmacy for Other Market By Drug Type

10.5.3. South America: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.5.4. BRAZIL

10.5.4.1. Brazil: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.5.4.2. Brazil: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.5.5. ARGENTINA

10.5.5.1. Argentina: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.5.5.2. Argentina: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.5.6. REST OF SOUTH AMERICA

10.5.6.1. Rest of South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.5.6.2. Rest of South America: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.3.2.1. Middle East & Africa E-Pharmacy forSkin Care Market By Drug Type

10.3.2.2. Middle East & Africa E-Pharmacy for Dental Market By Drug Type

10.3.2.3. Middle East & Africa E-Pharmacy forCold and Flu Market By Drug Type

10.3.2.4. Middle East & Africa E-Pharmacy for Vitamins Market By Drug Type

10.3.2.5. Middle East & Africa E-Pharmacy forWeight Loss Market By Drug Type

10.3.2.6. Middle East & Africa E-Pharmacy for Other Market By Drug Type

10.6.3. Middle East & Africa: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.6.4. SAUDI ARABIA

10.6.4.1. Saudi Arabia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.6.4.2. Saudi Arabia: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.6.5. UAE

10.6.5.1. UAE: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.6.5.2. UAE: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.6.6. EGYPT

10.6.6.1. Egypt: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.6.6.2. Egypt: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.6.7. SOUTH AFRICA

10.6.7.1. South Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.6.7.2. South Africa: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

10.6.8. REST OF MIDDLE EAST & AFRICA

10.6.8.1. Rest of Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million)

10.6.8.2. Rest of Middle East & Africa: Market Size and Forecast, By Drug Type, 2023 – 2033 ($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. CVS Health Corporation

13.1.1. Business Overview

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Cigna Corporation (Express Scripts Holdings)

13.3. Giant Eagle Inc

13.4. Optum Rx Inc

13.5. The Kroger Co

13.6. Walgreen Boots Alliance (Walgreen Co.)

13.7. Amazon.com Inc

13.8. Axelia Solutions (Pharmeasy)

13.9. Apex Healthcare Berhad (Apex Pharmacy)

13.10. Apollo Pharmacy

13.11. Netmeds.com

Connect to Analyst

Research Methodology