Distributed Transformer Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

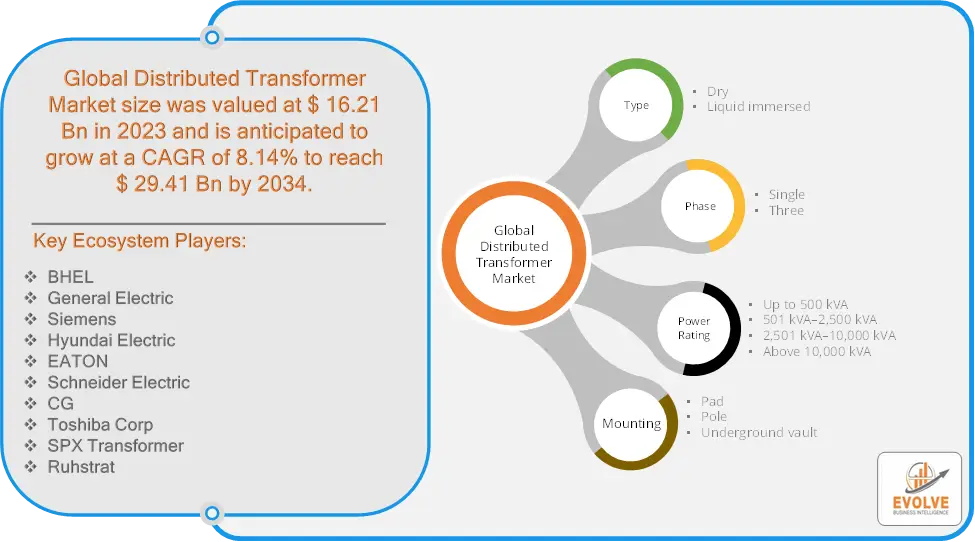

Distributed Transformer Market Research Report: By Type (Dry, Liquid immersed), By Phase (Single, Three), By Power Rating (Up to 500 kVA, 501 kVA–2,500 kVA, 2,501 kVA–10,000 kVA, Above 10,000 kVA,) , By Mounting (Pad, Pole, Underground vault), and by Region — Forecast till 2034

Page: 115

Distributed Transformer Market Overview

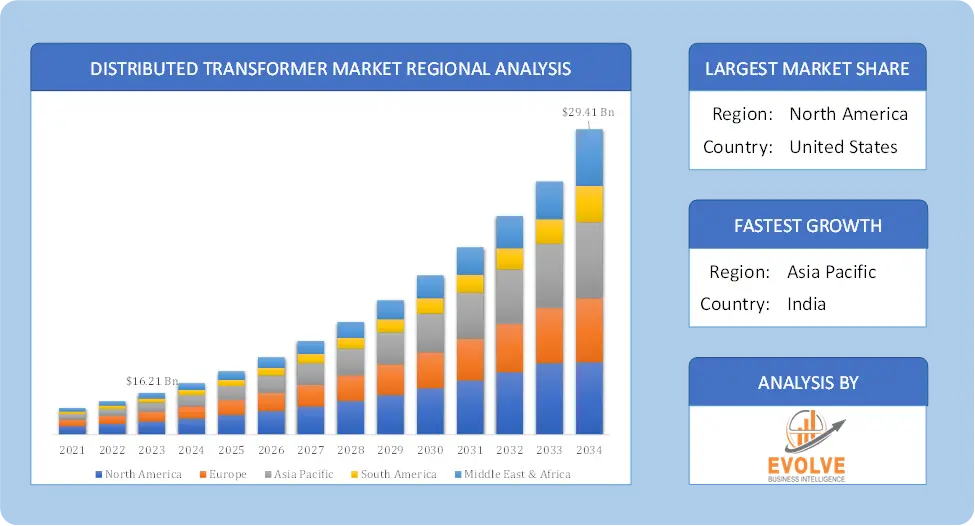

The Distributed Transformer Market size accounted for USD 16.21 Billion in 2023 and is estimated to account for 18.33 Billion in 2024. The Market is expected to reach USD 29.41 Billion by 2034 growing at a compound annual growth rate (CAGR) of 8.14% from 2024 to 2034. In distributed transformer markets, transformers are placed closer to the demand they service, usually in microgrids or renewable energy systems. Through the improvement of power quality and reduction of transmission losses, these transformers aid in the effective distribution of electricity. Distributed transformers are becoming increasingly necessary as the need for decentralized energy solutions grows, especially with the advent of solar and wind energy. The industry is being driven primarily by developments in smart grid technology, regulatory assistance for the integration of renewable energy sources, and the increasing focus on energy efficiency. Different varieties of transformers, such as pole-mounted, pad-mounted, and underground transformers, are available on the market to meet the needs of different applications in the residential, commercial, and industrial sectors.

Global Distributed Transformer Market Synopsis

Global Distributed Transformer Market Dynamics

Global Distributed Transformer Market Dynamics

The major factors that have impacted the growth of Distributed Transformer are as follows:

Drivers:

⮚ Technological Advancements

Advancements in transformer technology consistently improve distributed transformers’ lifespan, performance, and dependability. These transformers are now more efficient and appropriate for a wider range of applications thanks to innovations like better cooling systems, smaller designs, and improved insulating materials. Such innovations not only boost operating efficiency but also cut maintenance expenses and downtime.

Restraint:

- Technological Complexity and Integration Challenges

The integration of dispersed transformers with the current grid infrastructure is a common implementation task that can provide technological challenges. The interoperability of new transformers with existing systems may present issues for utilities, necessitating major improvements or retrofitting. The rate at which distributed transformers can be implemented is constrained by this integration process, which can be expensive and time-consuming.

Opportunity:

⮚ Technological Innovations

Ongoing research and development in transformer technology present opportunities for manufacturers to enhance the performance and capabilities of distributed transformers. Innovations such as digital monitoring, advanced materials, and improved insulation systems can lead to more efficient, reliable, and compact transformer designs. These advancements can attract more customers seeking state-of-the-art solutions for their energy distribution needs.

Distributed Transformer Market Segment Overview

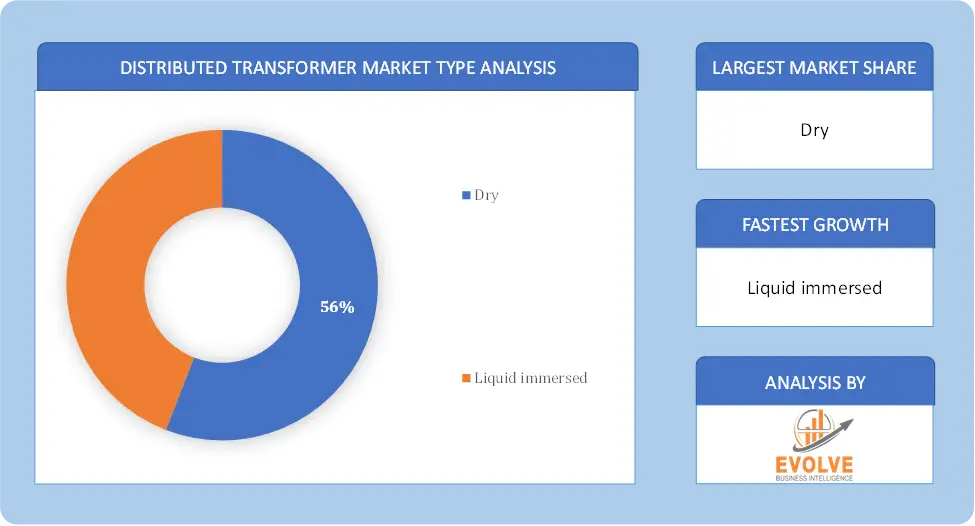

By Type

Based on the Type, the market is segmented based on Dry, Liquid immersed. liquid-immersed transformers dominate due to their higher efficiency, better cooling capabilities, and suitability for handling larger power loads, making them the preferred choice for utilities and heavy industrial applications.

Based on the Type, the market is segmented based on Dry, Liquid immersed. liquid-immersed transformers dominate due to their higher efficiency, better cooling capabilities, and suitability for handling larger power loads, making them the preferred choice for utilities and heavy industrial applications.

By Phase

Based on Phase , the market has been divided into Single, Three. three-phase transformers dominate, as they are more efficient for high-load applications, making them the preferred choice for industrial, commercial, and large-scale power distribution.

By Power Rating

Based on the Power Rating, the market has been divided into Up to 500 kVA, 501 kVA–2,500 kVA, 2,501 kVA–10,000 kVA, Above 10,000 kVA. Based on the Power Rating, the market has been divided into Up to 500 kVA, 501 kVA–2,500 kVA, 2,501 kVA–10,000 kVA, Above 10,000 kVA.

By Mounting

Based on Mounting, the market has been divided into Pad, Pole, Underground vault. pole-mounted transformers dominate due to their widespread use in rural and suburban areas for efficiently distributing electricity over long distances, particularly in less dense populations. Their ease of installation and lower costs make them a preferred choice over pad and underground vault-mounted transformers.

Global Distributed Transformer Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Distributed Transformer, followed by those in Asia-Pacific and Europe.

Distributed Transformer North America Market

Distributed Transformer North America Market

The North American region holds a dominant position in the Distributed Transformer market. The North American distribution transformer market is predicted to increase at a 9.1% annual rate between 2022 and 2032. Product demand will increase as more efforts are made to replace outdated electrical equipment with smart, energy-efficient systems. In February 2020, the US administration decided to increase import duties by 25% and 10%, respectively, on derivative steel and aluminum. Price increases result in higher operating costs, which inhibits market growth.

Distributed Transformer Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Distributed Transformer industry. From 2023 to 2032, the Asia-Pacific Distribution Transformer Market is anticipated to develop at the quickest compound annual growth rate (CAGR). This is a result of the industrial and manufacturing facilities expanding quickly. Additionally, the distribution transformer market in China had the biggest market share, while the market in India had the highest rate of growth in the Asia-Pacific area.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BHEL, General Electric, Siemens, Hyundai Electric, and EATON are some of the leading players in the global Distributed Transformer Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BHEL

- General Electric

- Siemens

- Hyundai Electric

- EATON

- Schneider Electric

- CG

- Toshiba Corp

- SPX Transformer

- Ruhstrat

Key Development:

In September 2023, Hyundai Electric secured a significant contract valued at $86.3 million to provide 3,500 distribution transformers to American Electric Power (AEP), one of the largest electric utilities in the U.S. This deal underscores Hyundai Electric’s growing presence in the global transformer market, focusing on meeting the increasing demand for power distribution infrastructure

Scope of the Report

Global Distributed Transformer Market, by Type

- Dry

- Liquid immersed

Global Distributed Transformer Market, by Phase

- Single

- Three

Global Distributed Transformer Market, by Power Rating

- Up to 500 kVA

- 501 kVA–2,500 kVA

- 2,501 kVA–10,000 kVA

- Above 10,000 kVA

Global Distributed Transformer Market, by Mounting

- Pad

- Pole

- Underground vault

Global Distributed Transformer Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $29.41 Billion |

| CAGR | 8.14% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Phase , Power Rating, Mounting |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BHEL, General Electric, Siemens, Hyundai Electric, EATON, Schneider Electric, CG, Toshiba Corp, SPX Transformer, Ruhstrat. |

| Key Market Opportunities | Calibration of suitable equipment New product introductions. |

| Key Market Drivers | Power infrastructure already in place in underdeveloped nations. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Distributed Transformer market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Distributed Transformer market historical market size for the year 2022, and forecast from 2021 to 2034

- Distributed Transformer market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Distributed Transformer market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Distributed Transformer market is 2021- 2034

What are the 10 Years CAGR (2021 to 2034) of the global Distributed Transformer market?

The global Distributed Transformer market is growing at a CAGR of ~8.14% over the next 10 years

Which region has the highest growth rate in the market of Distributed Transformer?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Distributed Transformer?

North America holds the largest share in 2023

Major Key Players in the Market of Distributed Transformer?

BHEL, General Electric, Siemens, Hyundai Electric, EATON, Schneider Electric, CG, Toshiba Corp, SPX Transformer, and Ruhstrat are the major companies operating in the Distributed Transformer Industry.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope of The Study 2.1. Market Definition 2.2. Scope of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat of New Entrants 4.2.2. Bargaining Power of Buyers 4.2.3. Bargaining Power of Suppliers 4.2.4. Threat of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Distributed Transformer Market 4.3.1. Impact on Market Size 4.3.2. Mounting Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Distributed Transformer Market, By Type 6.1. Introduction 6.2. Dry 6.3. Liquid immersed Chapter 7. Global Distributed Transformer Market, By Phase 7.1. Introduction 7.2. Single 7.3. Three Chapter 8. Global Distributed Transformer Market, By Power Rating 8.1. Introduction 8.2. Up to 500 kVA 8.3. 501 kVA–2,500 kVA 8.4. 2,501 kVA–10,000 kVA 8.5. Above 10,000 kVA Chapter 9. Global Distributed Transformer Market, By Mounting 9.1. Introduction 9.2. Pad 9.3. Pole 9.4. Underground vault Chapter 10. Global Distributed Transformer Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By Type, 2020 - 2028 10.2.5. Market Size and Forecast, By Phase, 2020 - 2028 10.2.6. Market Size and Forecast, By Power Rating, 2020 – 2028 10.2.7. Market Size and Forecast, By Mounting, 2020 – 2028 10.2.8. US 10.2.8.1. Introduction 10.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.2.8.4. Market Size and Forecast, By Phase, 2020 - 2028 10.2.8.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.2.8.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.2.9. Canada 10.2.9.1. Introduction 10.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.2.9.4. Market Size and Forecast, By Phase, 2020 - 2028 10.2.9.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.2.9.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.3. Europe 10.3.1. Introduction 10.3.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By Type, 2020 - 2028 10.3.5. Market Size and Forecast, By Phase, 2020 - 2028 10.3.6. Market Size and Forecast, By Power Rating, 2020 – 2028 10.3.7. Market Size and Forecast, By Mounting, 2020 – 2028 10.3.8. Germany 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.8.4. Market Size and Forecast, By Phase, 2020 - 2028 10.3.8.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.3.8.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.3.9. France 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.9.4. Market Size and Forecast, By Phase, 2020 - 2028 10.3.9.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.3.9.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.3.10. UK 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.10.4. Market Size and Forecast, By Phase, 2020 - 2028 10.3.10.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.3.10.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.3.11. Italy 10.3.11.1. Introduction 10.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.11.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.11.4. Market Size and Forecast, By Phase, 2020 - 2028 10.3.11.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.3.11.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.3.12. Rest of Europe 10.3.12.1. Introduction 10.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.12.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.12.4. Market Size and Forecast, By Phase, 2020 - 2028 10.3.12.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.3.12.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.4. Asia-Pacific 10.4.1. Introduction 10.4.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.3. Market Size and Forecast, By Country, 2020 - 2028 10.4.4. Market Size and Forecast, By Type, 2020 - 2028 10.4.5. Market Size and Forecast, By Phase, 2020 - 2028 10.4.6. Market Size and Forecast, By Power Rating, 2020 – 2028 10.4.7. Market Size and Forecast, By Mounting, 2020 - 2028 10.4.8. China 10.4.8.1. Introduction 10.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.8.4. Market Size and Forecast, By Phase, 2020 - 2028 10.4.8.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.4.8.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.4.9. India 10.4.9.1. Introduction 10.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.9.4. Market Size and Forecast, By Phase, 2020 - 2028 10.4.9.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.4.9.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.4.10. Japan 10.4.10.1. Introduction 10.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.10.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.10.4. Market Size and Forecast, By Phase, 2020 - 2028 10.4.10.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.4.10.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.4.11. South Korea 10.4.11.1. Introduction 10.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.11.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.11.4. Market Size and Forecast, By Phase, 2020 - 2028 10.4.11.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.4.11.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.4.12. Rest of Asia-Pacific 10.4.12.1. Introduction 10.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.12.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.12.4. Market Size and Forecast, By Phase, 2020 - 2028 10.4.12.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.4.12.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.5. Rest of The World (RoW) 10.5.1. Introduction 10.5.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.3. Market Size and Forecast, By Type, 2020 - 2028 10.5.4. Market Size and Forecast, By Phase, 2020 - 2028 10.5.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.5.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.5.7. Market Size and Forecast, By Region, 2020 - 2028 10.5.8. South America 10.5.8.1. Introduction 10.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.5.8.4. Market Size and Forecast, By Phase, 2020 - 2028 10.5.8.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.5.8.6. Market Size and Forecast, By Mounting, 2020 - 2028 10.5.9. Middle East & Africa 10.5.9.1. Introduction 10.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.5.9.4. Market Size and Forecast, By Phase, 2020 - 2028 10.5.9.5. Market Size and Forecast, By Power Rating, 2020 – 2028 10.5.9.6. Market Size and Forecast, By Mounting, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 12.1. BHEL 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. General Electric 12.2.1. Business Overview 12.2.2. Financial Analysis 12.2.3. Product Portfolio 12.2.4. Recent Development and Strategies Adopted 12.2.5. SWOT Analysis 12.3. Siemens 12.3.1. Business Overview 12.3.2. Financial Analysis 12.3.3. Product Portfolio 12.3.4. Recent Development and Strategies Adopted 12.3.5. SWOT Analysis 12.4. Hyundai Electric 12.4.1. Business Overview 12.4.2. Financial Analysis 12.4.3. Product Portfolio 12.4.4. Recent Development and Strategies Adopted 12.4.5. SWOT Analysis 12.5. EATON 12.5.1. Business Overview 12.5.2. Financial Analysis 12.5.3. Product Portfolio 12.5.4. Recent Development and Strategies Adopted 12.5.5. SWOT Analysis 12.6. Schneider Electric 12.6.1. Business Overview 12.6.2. Financial Analysis 12.6.3. Product Portfolio 12.6.4. Recent Development and Strategies Adopted 12.6.5. SWOT Analysis 12.7. CG 12.7.1. Business Overview 12.7.2. Financial Analysis 12.7.3. Product Portfolio 12.7.4. Recent Development and Strategies Adopted 12.7.5. SWOT Analysis 12.8. Toshiba Corp 12.8.1. Business Overview 12.8.2. Financial Analysis 12.8.3. Product Portfolio 12.8.4. Recent Development and Strategies Adopted 12.8.5. SWOT Analysis 12.9. SPX Transformer 12.9.1. Business Overview 12.9.2. Financial Analysis 12.9.3. Product Portfolio 12.9.4. Recent Development and Strategies Adopted 12.9.5. SWOT Analysis 12.10. Ruhstrat 12.10.1. Business Overview 12.10.2. Financial Analysis 12.10.3. Product Portfolio 12.10.4. Recent Development and Strategies Adopted 12.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology