Digital Diabetes Management Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Digital Diabetes Management Market Research Report: By Type (Handheld Devices, Wearable Devices), By Product (Continuous blood glucose monitoring systems, Smart glucose meter, Smart insulin pumps, Smart insulin pens, Apps), By End User (Hospitals, Home settings, Diagnostic Centers), and by Region — Forecast till 2033

Digital Diabetes Management Market Size is expected to reach USD 24.60 Billion by 2033. The Digital Diabetes Management industry size accounted for USD 12.41 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.21% from 2023 to 2033. Digital diabetes management entails leveraging technological advancements, including mobile applications, wearable devices, and web-based platforms, to enhance the monitoring and management of diabetes in individuals. It encompasses functionalities such as continuous glucose monitoring, insulin delivery systems, mobile applications for comprehensive data tracking, analysis, and reporting, remote monitoring, and telemedicine capabilities, and provision of educational resources. The primary objective is to empower individuals with diabetes, enabling their active engagement in self-care, fostering improved self-management practices, and ultimately leading to enhanced health outcomes.

Global Digital Diabetes Management Market Synopsis

The Digital Diabetes Management market experienced a favorable impact from the COVID-19 pandemic. The implementation of social distancing measures and limitations on in-person healthcare visits prompted a significant shift towards remote and digital healthcare solutions. Consequently, there was an increased adoption and utilization of digital tools and services for diabetes management. The pandemic expedited the recognition of the significance of remote monitoring and self-management for individuals with diabetes. Digital solutions, including mobile apps, wearable devices, and telemedicine platforms, played a vital role in monitoring blood glucose levels, tracking medications, and providing educational resources. These digital tools empowered individuals with diabetes to effectively manage their condition from the safety and convenience of their homes. Moreover, the pandemic underscored the value of real-time data analysis and remote communication between patients and healthcare professionals. Digital diabetes management platforms facilitated remote monitoring, data sharing, and virtual consultations, ensuring uninterrupted care and support when in-person visits were limited. This highlighted the importance of leveraging digital solutions to bridge the gap in healthcare delivery during challenging circumstances.

Global Digital Diabetes Management Market Dynamics

The major factors that have impacted the growth of Digital Diabetes Management are as follows:

Drivers:

Increasing prevalence of diabetes

The rising incidence of diabetes globally is a key driver for the digital diabetes management market. Diabetes has become a significant global health concern, with millions of people affected by the condition. The increasing prevalence of diabetes creates a greater demand for effective tools and technologies to monitor and manage the condition. Digital diabetes management solutions offer the potential to improve the management of diabetes by providing individuals with real-time data, personalized insights, and tools for self-management. As the number of individuals with diabetes continues to grow, the market for digital diabetes management is expected to expand.

Restraint:

- Limited awareness and access

One of the restraints for the digital diabetes management market is the limited awareness and access to these technologies, particularly in low-income regions or areas with limited healthcare infrastructure. Lack of awareness among individuals with diabetes and healthcare providers can hinder the adoption and utilization of digital solutions. In many cases, individuals may not be aware of the availability or benefits of digital diabetes management tools, and healthcare providers may not have sufficient knowledge or training to effectively recommend or implement these technologies. Additionally, limited access to smartphones, internet connectivity, or healthcare facilities can further restrict the adoption of digital solutions in certain populations. Addressing these limitations through education and infrastructure development is essential to realize the full potential of digital diabetes management.

Opportunity:

Technological advancements

The continuous advancements in technology play a crucial role in driving opportunities for the digital diabetes management market. Improved sensors, wearable devices, and data analytics have the potential to revolutionize diabetes management. Advanced glucose monitoring devices provide more accurate and convenient ways to measure blood glucose levels, reducing the need for traditional fingerstick testing. Wearable devices, such as continuous glucose monitors (CGMs), insulin pumps, and smartwatches, enable individuals to monitor their glucose levels and manage insulin delivery in real-time. Data analytics capabilities allow for the analysis of extensive data collected by these devices, providing valuable insights and personalized treatment recommendations. Furthermore, advancements in user interfaces, mobile apps, and software platforms enhance user experiences, making digital diabetes management tools more intuitive and user-friendly. These technological advancements offer significant opportunities for the digital diabetes management market to provide more effective and user-centric solutions for individuals with diabetes.

Digital Diabetes Management Market Segment Overview

By Type

Based on the Type, the market is segmented based on Handheld Devices, Wearable Devices. The largest market share is anticipated to go to the Wearable Devices segment. The integration of wearable devices with mobile applications and cloud platforms has allowed for more comprehensive and convenient diabetes management. These devices can track glucose levels, provide alerts for high or low blood sugar levels, track physical activity and nutrition, and even offer personalized insights and recommendations.

By Product

Based on Product, the market has been divided into Continuous blood glucose monitoring systems, Smart glucose meters, Smart insulin pumps, Smart insulin pens, and Apps. The Smart glucose meter segment is expected to hold the largest market share in the Market, Smart glucose meters come with features such as wireless connectivity, data storage, and mobile app integration. These devices allow users to sync their glucose readings with mobile apps, which can provide real-time data analysis, tracking, and trend monitoring. Some smart glucose meters also offer advanced features like insulin dose recommendations, personalized insights, and reminders for medication and glucose monitoring.

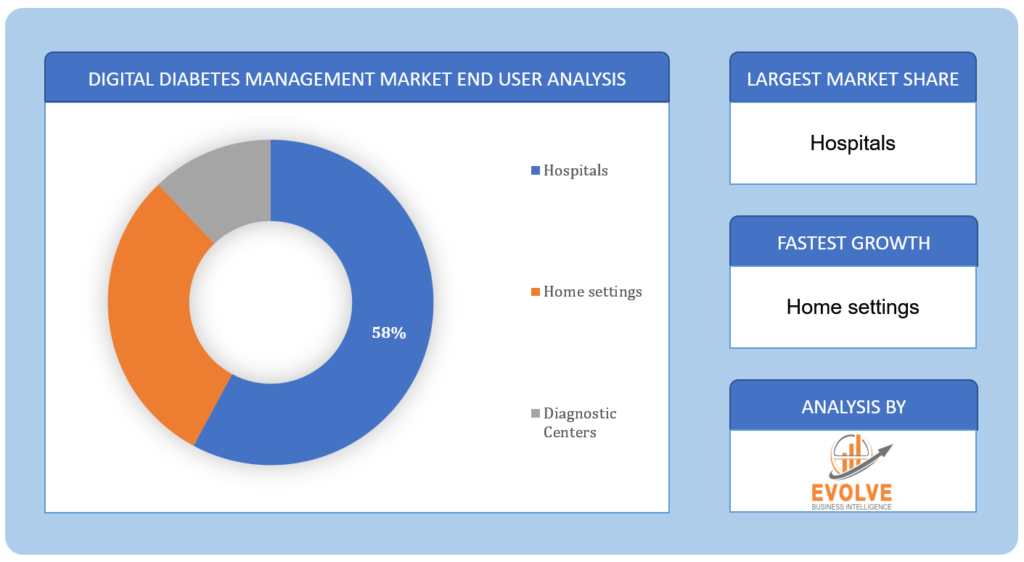

By End User

Based on End Users, the market has been divided into Hospitals, Home settings, and Diagnostic Centers. The market is projected to see significant growth in the Hospitals segment. Technological advancements in the field of diabetes management have improved the capabilities of hospitals in providing better care. Hospitals are equipped with advanced medical devices, diagnostic tools, and treatment options for diabetes patients. This growth in medical technology may attract more patients to hospitals for comprehensive and specialized diabetes management.

Based on End Users, the market has been divided into Hospitals, Home settings, and Diagnostic Centers. The market is projected to see significant growth in the Hospitals segment. Technological advancements in the field of diabetes management have improved the capabilities of hospitals in providing better care. Hospitals are equipped with advanced medical devices, diagnostic tools, and treatment options for diabetes patients. This growth in medical technology may attract more patients to hospitals for comprehensive and specialized diabetes management.

Global Digital Diabetes Management Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Digital Diabetes Management, followed by those in Asia-Pacific and Europe.

North America Market

North America Market

The North American region, particularly the United States, has held a dominant position in the digital diabetes management market. This is due to factors such as the advanced healthcare infrastructure, high prevalence of diabetes, technological advancements and innovation, and a favorable regulatory environment. However, it’s important to consider that market dynamics may have evolved since my knowledge cut off, and other regions may have experienced significant growth in the digital diabetes management market.

Asia Pacific Market

The Asia-Pacific region had been witnessing a growing CAGR in the digital diabetes management industry. There has been an increasing awareness of the benefits of digital diabetes management solutions in the Asia-Pacific region. Patients and healthcare providers are recognizing the value of technology-driven tools for better diabetes management and are adopting them at a growing rate.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Abbott Laboratories, Medtronic, F. Hoffmann-La Roche Ltd, and Bayer AG are some of the leading players in the global Digital Diabetes Management Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Abbott Laboratories

- Medtronic

- Hoffmann-La Roche Ltd

- Bayer AG

- Lifescan Inc

- Dexcom Inc

- Sanofi

- Insulet Corporation

- Ascensia Diabetes Care Holdings

- B Braun Melsungen

Key Development:

On April 2022, Abbott, CamDiab, and Ypsomed forged a partnership aimed at developing and bringing to market an integrated automated insulin delivery (AID) system across European countries. This collaborative effort aims to introduce a connected and intelligent wearable solution that continuously monitors an individual’s glucose levels. The system will automatically adjust and administer the appropriate amount of insulin at the necessary times, thereby eliminating the uncertainty associated with insulin dosing.

On April 2022, Medtronic unveiled the Medtronic Extended infusion set, a groundbreaking product available in selected European countries. This infusion set distinguishes itself as the first and only one capable of being worn for up to 7 days. Typically, an infusion set is tubing that delivers insulin from the pump to the body and necessitates replacement every few days. However, this innovative solution from Medtronic offers an extended wear time, providing greater convenience and reduced maintenance for individuals using insulin pumps.

Scope of the Report

Global Digital Diabetes Management Market, by Type

- Handheld Devices

- Wearable Devices

Global Digital Diabetes Management Market, by Product

- Continuous blood glucose monitoring systems

- Smart glucose meter

- Smart insulin pumps

- Smart insulin pens

- Apps

Global Digital Diabetes Management Market, by End User

- Hospitals

- Home settings

- Diagnostic Centers

Global Digital Diabetes Management Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $41.70 Billion |

| CAGR | 4.94% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Raw Material, Type, Production Technique, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Amcor, WestRock Company, Sonoco Products Company, Berry Global Inc, Tekni-Plex, Constantia Flexibles Group GmbH, Huhtamaki Oyj, Winpak Ltd, Uflex Ltd, Prent Corporation |

| Key Market Opportunities | Shift Towards Sustainable Packaging Growing E-commerce Industry |

| Key Market Drivers | Increasing Consumer Demand Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Digital Diabetes Management Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Digital Diabetes Management market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Digital Diabetes Management market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Digital Diabetes Management Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Digital Diabetes Management market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Digital Diabetes Management market?

The global Digital Diabetes Management market is growing at a CAGR of ~21% over the next 10 years

Which region has the highest growth rate in the market of Digital Diabetes Management?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Digital Diabetes Management?

North America holds the largest share in 2022

Major Key Players in the Market of Digital Diabetes Management?

Abbott Laboratories, Medtronic, F. Hoffmann-La Roche Ltd, Bayer AG, Lifescan Inc, Dexcom Inc, Sanofi, Insulet Corporation, Ascensia Diabetes Care Holdings, and B Braun Melsungen are the major companies operating in the Digital Diabetes Management

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Product Segment – Market Opportunity Score 4.1.3. End User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Digital Diabetes Management Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Digital Diabetes Management Market, By Type 7.1. Introduction 7.1.1. Handheld Devices 7.1.2. Wearable Devices CHAPTER 8. Global Digital Diabetes Management Market, By Product 8.1. Introduction 8.1.1. Continuous blood glucose monitoring systems 8.1.2. Smart glucose meter 8.1.3. Smart insulin pumps 8.1.4. Smart insulin pens 8.1.5. Apps CHAPTER 9. Global Digital Diabetes Management Market, By End User 9.1. Introduction 9.1.1. Hospitals 9.1.2. Home settings 9.1.3. Diagnostic Centers CHAPTER 10. Global Digital Diabetes Management Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Abbott Laboratories 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Medtronic 13.3. F. Hoffmann-La Roche Ltd 13.4. Bayer AG 13.5. Lifescan Inc 13.6. Dexcom Inc 13.7. Sanofi 13.8. Insulet Corporation 13.9. Ascensia Diabetes Care Holdings 13.10. B Braun Melsungen

|

Connect to Analyst

Research Methodology