Compound Semiconductor Market Overview

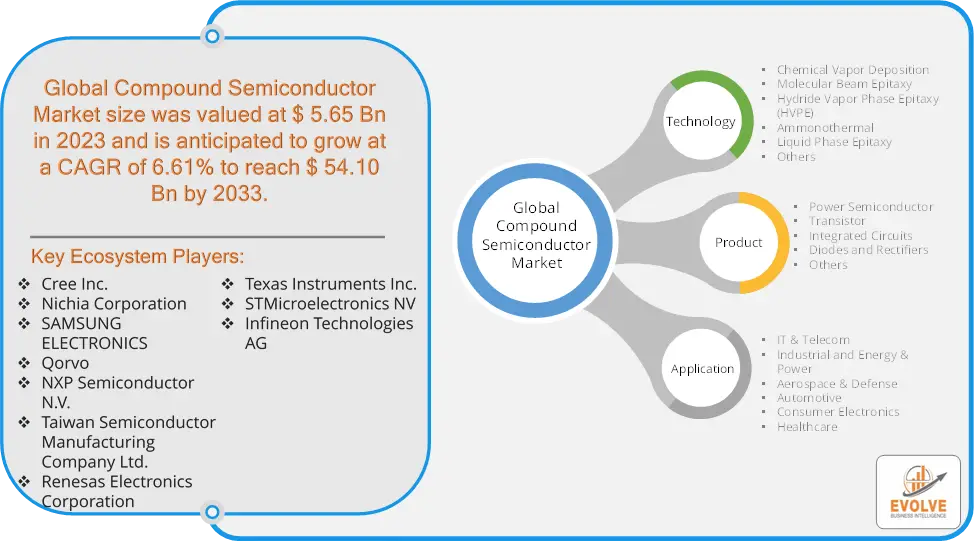

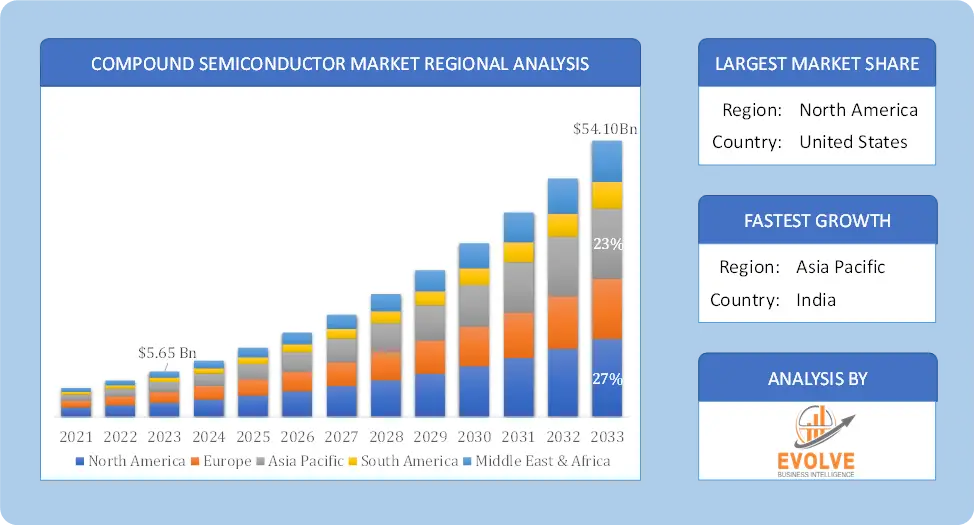

The Compound Semiconductor Market Size is expected to reach USD 54.10 Billion by 2033. The Compound Semiconductor industry size accounted for USD 5.65 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.61% from 2023 to 2033. The compound semiconductor market involves the production and use of semiconductors made from compound materials rather than silicon. These materials, such as gallium nitride (GaN), gallium arsenide (GaAs), and indium phosphide (InP), are used for their superior electronic and optical properties. Compound semiconductors are essential for high-performance applications like RF (radio frequency) and microwave technologies, optoelectronics, and power electronics. The market is driven by the growing demand for advanced electronics, telecommunications, and energy-efficient devices. Key sectors include automotive, aerospace, telecommunications, and consumer electronics. Technological advancements and increasing adoption of compound semiconductors in various industries contribute to market growth.

Global Compound Semiconductor Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Compound Semiconductor market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Global Compound Semiconductor Market Dynamics

The major factors that have impacted the growth of Compound Semiconductor are as follows:

Drivers:

⮚ Increased Demand for High-Performance Electronics

The rise of consumer electronics, including smartphones, tablets, and wearables, requires high-performance components. Compound semiconductors offer superior performance for RF and microwave applications, essential for communication systems, data processing, and signal amplification.

Restraint:

- Limited Supply Chain and Raw Materials

The availability and cost of raw materials used in compound semiconductors, such as gallium, indium, and arsenic, can be volatile. These materials are often sourced from a few key suppliers, leading to supply chain constraints and potential shortages. Any disruption in the supply of these critical materials can impact production and lead to price fluctuations.

Opportunity:

⮚ Innovations in Optoelectronics

Compound semiconductors are essential for optoelectronic devices such as LEDs, laser diodes, and photodetectors. The demand for high-performance lighting solutions, advanced display technologies, and optical communication systems provides opportunities for innovation and growth in the optoelectronics sector. Emerging applications in augmented reality (AR) and virtual reality (VR) also drive the need for advanced optoelectronic components.

Compound Semiconductor Market Segment Overview

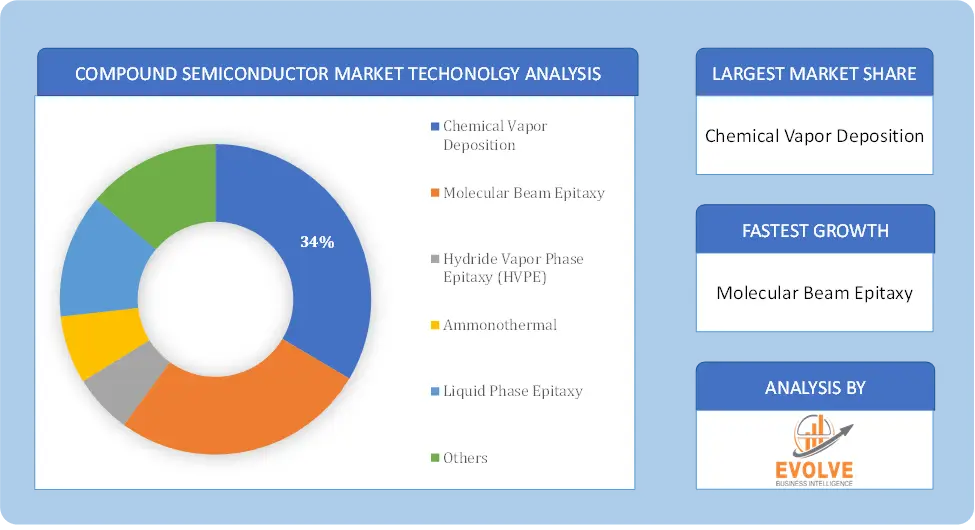

By Technology

Based on the Technology, the market is segmented based on Chemical Vapor Deposition, Molecular Beam Epitaxy, Hydride Vapor Phase Epitaxy (HVPE), Ammonothermal, Liquid Phase Epitaxy, Others. Chemical Vapor Deposition (CVD) dominates due to its widespread use and versatility in producing high-quality thin films and layers essential for various semiconductor devices.

Based on the Technology, the market is segmented based on Chemical Vapor Deposition, Molecular Beam Epitaxy, Hydride Vapor Phase Epitaxy (HVPE), Ammonothermal, Liquid Phase Epitaxy, Others. Chemical Vapor Deposition (CVD) dominates due to its widespread use and versatility in producing high-quality thin films and layers essential for various semiconductor devices.

By Product

Based on the Product, the market has been divided into Power Semiconductor, Transistor, Integrated Circuits, Diodes and Rectifiers, Others. the Power Semiconductor segment leads due to its critical role in high-efficiency power conversion and management applications, especially in industries like automotive and renewable energy.

By Application

Based on Application, the market has been divided into IT & Telecom, Industrial and Energy & Power, Aerospace & Defense, Automotive, Consumer Electronics, Healthcare. the IT & Telecom segment currently dominates due to the high demand for advanced RF and microwave components essential for 5G networks and communication infrastructure.

Global Compound Semiconductor Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia Pacific is anticipated to dominate the market for the usage of Compound Semiconductor, followed by those in North America and Europe.

Compound Semiconductor Asia Pacific Market

Compound Semiconductor Asia Pacific Market

Asia Pacific dominates the Compound Semiconductor market due to several factors. In terms of revenue, Asia Pacific led the way in 2021. elevated product adoption rates and a sharp increase in demand for consumer electronics manufactured goods. The area’s growing urbanization and rising disposable income are expected to fuel a continued expansion in consumer electronics.

Compound Semiconductor North America Market

The North America region has been witnessing remarkable growth in recent years. Throughout the projection period, the region of North America will have the fastest CAGR. demand from the end-user industries in Mexico, Canada, and the United States. Foreign manufacturers are compelled to broaden their target markets as a result of their relocation, which is promoting capacity expansion and acquisitions.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Cree Inc., Nichia Corporation, SAMSUNG ELECTRONICS, Qorvo, and NXP Semiconductor N.V. are some of the leading players in the global Compound Semiconductor Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Cree Inc.

- Nichia Corporation

- SAMSUNG ELECTRONICS

- Qorvo

- NXP Semiconductor N.V.

- Taiwan Semiconductor Manufacturing Company Ltd.

- Renesas Electronics Corporation

- Texas Instruments Inc.

- STMicroelectronics NV

- Infineon Technologies AG

Key development:

In September 2022, Texas Instruments Inc. introduced new high-performance compound semiconductor-based products, including advanced analog and mixed-signal ICs, to enhance performance in automotive and industrial applications.

Scope of the Report

Global Compound Semiconductor Market, by Technology

- Chemical Vapor Deposition

- Molecular Beam Epitaxy

- Hydride Vapor Phase Epitaxy (HVPE)

- Ammonothermal

- Liquid Phase Epitaxy

- Others

Global Compound Semiconductor Market, by Product

- Power Semiconductor

- Transistor

- Integrated Circuits

- Diodes and Rectifiers

- Others

Global Compound Semiconductor Market, by Application

- IT & Telecom

- Industrial and Energy & Power

- Aerospace & Defense

- Automotive

- Consumer Electronics

- Healthcare

Global Compound Semiconductor Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $54.10 Billion |

| CAGR | 6.61% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Product, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Cree Inc., Nichia Corporation, SAMSUNG ELECTRONICS, Qorvo, NXP Semiconductor N.V., Taiwan Semiconductor Manufacturing Company Ltd., Renesas Electronics Corporation, Texas Instruments Inc., STMicroelectronics NV, Infineon Technologies AG |

| Key Market Opportunities | • Commercialization of 5G services. |

| Key Market Drivers | • Rising investments in the development of electric vehicles. Increasing government initiatives for adoption of 5G. Increasing demand for high-speed transceivers in the data center. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Compound Semiconductor Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Compound Semiconductor market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Compound Semiconductor market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Compound Semiconductor Market.