Cell Culture Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

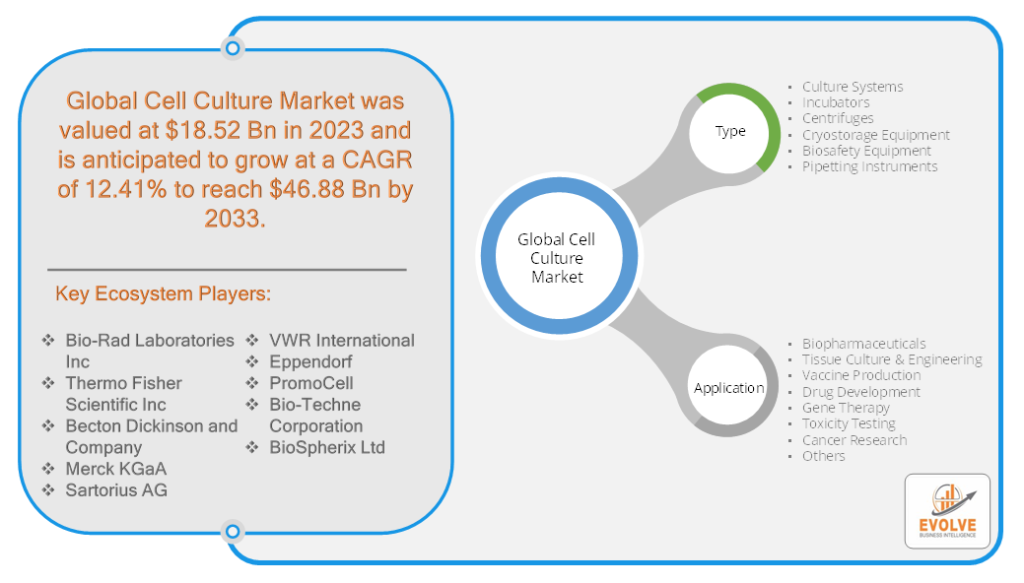

Cell Culture Market Research Report: Information By Product (Culture Systems, Incubators, Centrifuges, Cryostorage Equipment, Biosafety Equipment, Pipetting Instruments), By Application (Biopharmaceuticals, Tissue Culture & Engineering, Vaccine Production, Drug Development, Gene Therapy, Toxicity Testing, Cancer Research, Others), and by Region — Forecast till 2033

Cell Culture Market Overview

The Cell Culture Market Size is expected to reach USD 46.88 Billion by 2033. The Cell Culture industry size accounted for USD 18.52 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 12.41% from 2023 to 2033. Cell culture refers to the in vitro growth and maintenance of cells derived from multicellular organisms, typically done under controlled laboratory conditions. It involves the cultivation of cells in a suitable nutrient-rich medium, providing them with the necessary nutrients, growth factors, and environmental conditions to support their proliferation and survival. Cell culture techniques are employed to study cell behavior, physiological processes, drug discovery, and production of therapeutic proteins and vaccines. The process involves the isolation, subculturing, and propagation of cells in sterile conditions, often utilizing specialized equipment and culture vessels. Cell culture is an essential tool in biomedical research, biotechnology, and pharmaceutical industries for investigating cellular mechanisms, developing new therapies, and producing biological products on a large scale.

Global Cell Culture Market Synopsis

COVID-19 Impact Analysis

The Cell Culture market experienced a substantial impact from the COVID-19 pandemic. The pandemic led to disruptions in global supply chains, restrictions on research activities, and a shift in priorities toward COVID-19-related research and diagnostic testing. These factors affected the demand and availability of cell culture products and services. On one hand, there was an increased demand for cell culture-based products for vaccine development, drug screening, and studying the SARS-CoV-2 virus. On the other hand, many research activities unrelated to COVID-19 were temporarily halted or delayed, leading to a decline in demand for non-pandemic-related cell culture products. Furthermore, the stringent lockdown measures and restrictions on laboratory access hindered the regular workflow and impacted the production and distribution of cell culture reagents and consumables. However, with the gradual easing of restrictions and the resumption of research activities, the Cell Culture market is expected to recover and regain its growth trajectory in the post-pandemic period, driven by ongoing advancements in cell-based research, biopharmaceutical production, and regenerative medicine applications.

Cell Culture Market Dynamics

The major factors that have impacted the growth of Cell Culture are as follows:

Drivers:

Increasing Demand for Biopharmaceuticals

The growing demand for biopharmaceuticals, such as vaccines, monoclonal antibodies, and cell-based therapies, is a major driver for the cell culture market. Cell culture techniques are essential for the production of these biologics, as they allow for the large-scale cultivation of cells for protein expression and manufacturing. The expanding pipeline of biopharmaceutical products, along with the need for efficient and scalable production methods, fuels the demand for cell culture technologies and products.

Restraint:

- Cost and Complexity of Cell Culture Systems

The cost and complexity associated with setting up and maintaining cell culture systems can be a restraint for the market. Cell culture requires specialized equipment, dedicated facilities, and strict quality control measures to ensure sterility and optimal cell growth. These infrastructure and operational requirements can be expensive, especially for smaller research organizations or companies with limited resources. Additionally, the complex nature of cell culture processes, including media optimization, cell line development, and process scale-up, presents technical challenges that may hinder adoption or implementation.

Opportunity:

Advancements in 3D Cell Culture Technologies

The development and adoption of 3D cell culture technologies present significant opportunities in the market. Traditional 2D cell culture systems have limitations in mimicking the complex physiological and structural characteristics of tissues and organs. 3D cell culture models provide a more accurate representation of in vivo conditions, enabling better drug discovery, toxicity testing, and disease modeling. The integration of technologies like scaffolds, hydrogels, and bioprinting in 3D cell culture opens up new avenues for regenerative medicine, personalized medicine, and tissue engineering applications. The advancement and commercialization of 3D cell culture systems offer promising opportunities for growth and innovation in the cell culture market.

Cell Culture Segment Overview

By Product

Based on Product, the market is segmented based on Culture Systems, Incubators, Centrifuges, Cryostorage Equipment, Biosafety Equipment, and Pipetting Instruments. The Culture Systems segment is expected to witness significant growth during the forecast period. This growth can be attributed to several factors. Firstly, there is an increasing demand for advanced and automated culture systems that provide efficient and reproducible cell culture processes. These systems offer benefits such as higher throughput, improved scalability, and enhanced control over culture conditions, leading to higher productivity and reduced variability in cell culture workflows. Secondly, the rising adoption of 3D cell culture models and organoids has created a demand for specialized culture systems that can support the unique requirements of these complex culture techniques. The development of innovative culture systems that can mimic in vivo conditions and provide more physiologically relevant cell culture environments further drives the growth of this segment. Additionally, the integration of technologies such as microfluidics, bioreactors, and sensors into culture systems enhances process monitoring, optimization, and data collection, supporting the overall advancement and expansion of the Culture Systems segment in the cell culture market.

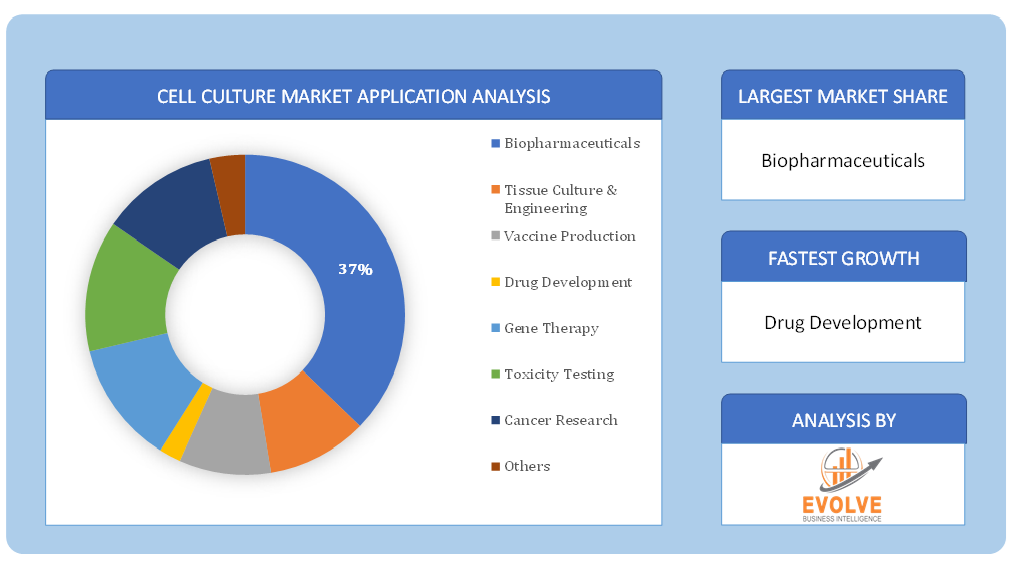

By Application

Based on Application, the market has been divided into Biopharmaceuticals, Tissue Culture & Engineering, Vaccine Production, Drug Development, Gene Therapy, Toxicity Testing, Cancer Research, and Others. Biopharmaceuticals dominate the Cell Culture Market. Biopharmaceuticals are therapeutic products derived from biological sources, such as proteins, antibodies, vaccines, and cell-based therapies. These products often require cell culture techniques for their production, as cells are used as factories to produce the desired therapeutic molecules. The high specificity and efficacy of biopharmaceuticals, along with their ability to target complex diseases, have led to their widespread adoption and significant market demand. Cell culture plays a crucial role in the production of biopharmaceuticals, allowing for large-scale cultivation of cells to generate the required proteins or cells for manufacturing. With the expanding pipeline of biologics and the continuous development of novel therapeutics, the dominance of biopharmaceuticals in the Cell Culture Market is expected to persist and drive its growth in the coming years.

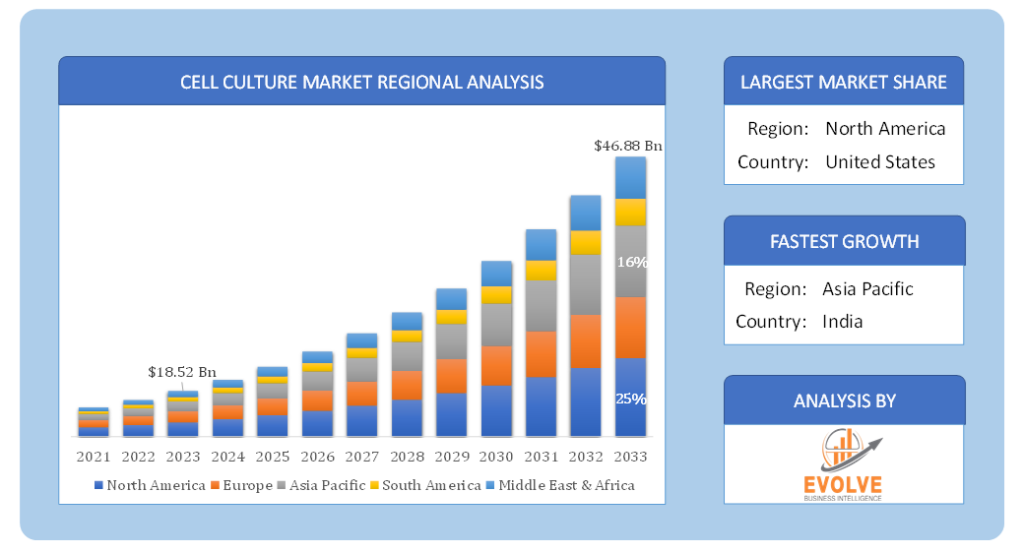

Global Cell Culture Market Regional Analysis

Based on region, the global Cell Culture market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Cell Culture market followed by the Asia-Pacific and Europe regions.

North America Market

North America has a strong presence of major pharmaceutical and biotechnology companies that extensively utilize cell culture techniques for drug discovery, development, and manufacturing. These companies have well-established research and development infrastructure and invest significantly in cell culture technologies and products. Secondly, North America has a robust regulatory framework that supports the development and commercialization of biopharmaceuticals, ensuring high standards of quality and safety. This regulatory environment attracts investments and fosters innovation in the cell culture market. Additionally, North America has a well-developed healthcare infrastructure, which includes advanced research institutions, academic centers, and clinical trial networks that actively engage in cell culture-based research. The availability of skilled professionals and a collaborative ecosystem further contribute to North America’s prominent position in the Cell Culture market.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Cell Culture market. Several factors contribute to this rapid growth. Firstly, the region has experienced significant economic growth, leading to increased investment in the healthcare and biotechnology sectors. This has resulted in the expansion of research and development activities, driving the demand for cell culture technologies and products. Secondly, countries in the Asia-Pacific region, such as China, Japan, South Korea, and India, have witnessed a surge in the establishment of biopharmaceutical manufacturing facilities and research institutions. These facilities require advanced cell culture systems for large-scale production, creating a significant market opportunity. Additionally, the region has a large population base and an increasing prevalence of chronic diseases, which fuels the demand for biopharmaceuticals and, consequently, cell culture technologies. Moreover, government initiatives supporting research and development, coupled with favorable regulatory policies, have further boosted the growth of the Cell Culture market in the Asia-Pacific region.

Competitive Landscape

The global Cell Culture market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Bio-Rad Laboratories Inc

- Thermo Fisher Scientific Inc

- Becton Dickinson and Company

- Merck KGaA

- Sartorius AG

- VWR International

- Eppendorf

- PromoCell

- Bio-Techne Corporation

- BioSpherix Ltd

Key Development

In June 2022, Evonik introduced the cQrex portfolio, a range of cell culture ingredients aimed at enhancing efficiency and productivity in bioprocesses. This portfolio is specifically designed to support the production of monoclonal antibodies, vaccines, viral vectors, and therapeutic cells. By leveraging these innovative cell culture ingredients, Evonik aims to improve the performance of bioprocesses and contribute to the development of advanced biologics.

In February 2022, CellulaREvolution secured GBP 1.75 million in funding to expedite the launch of its continuous cell culture technology. This funding will enable CellulaREvolution to further develop and commercialize its continuous cell culture technology, which offers a novel approach to cell culture processes.

Scope of the Report

Global Cell Culture Market, by Product

- Culture Systems

- Incubators

- Centrifuges

- Cryostorage Equipment

- Biosafety Equipment

- Pipetting Instruments

Global Cell Culture Market, by Application

- Biopharmaceuticals

- Tissue Culture & Engineering

- Vaccine Production

- Drug Development

- Gene Therapy

- Toxicity Testing

- Cancer Research

- Others

Global Cell Culture Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $46.88 Billion |

| CAGR | 12.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Bio-Rad Laboratories Inc, Thermo Fisher Scientific Inc, Becton Dickinson and Company, Merck, Sartorius, VWR International, Eppendorf, PromoCell, Bio-Techne Corporation, BioSpherix Ltd |

| Key Market Opportunities | • Expansion of personalized medicine and regenerative medicine applications • Adoption of 3D cell culture models and organoids • Integration of automation and robotics in cell culture Workflows |

| Key Market Drivers | • Increasing demand for biopharmaceuticals • Advancements in cell culture techniques and technologies • Growing prevalence of chronic diseases |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Cell Culture market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Cell Culture market historical market size for the year 2021, and forecast from 2023 to 2033

- Cell Culture market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Cell Culture market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Cell Culture market is 2021- 2033

What is the growth rate of the global Cell Culture market?

The global Cell Culture market is growing at a CAGR of 12.41% over the next 10 years

Which region has the highest growth rate in the market of Cell Culture?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Cell Culture market?

North America holds the largest share in 2022

Who are the key players in the global Cell Culture market?

Bio-Rad Laboratories Inc, Thermo Fisher Scientific Inc, Becton Dickinson and Company, Merck, Sartorius, VWR International, Eppendorf, PromoCell, Bio-Techne Corporation, BioSpherix Ltd are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Cell Culture Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Cell Culture Market 4.8. Import Analysis of the Cell Culture Market 4.9. Export Analysis of the Cell Culture Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Cell Culture Market, By Product 6.1. Introduction 6.2. Culture Systems 6.3. Incubators 6.4. Centrifuges 6.5. Cryostorage Equipment 6.6. Biosafety Equipment 6.7. Pipetting Instruments Chapter 7. Global Cell Culture Market, By Application 7.1. Introduction 7.2. Biopharmaceuticals 7.3. Tissue Culture & Engineering 7.4. Vaccine Production 7.5. Drug Development 7.6. Gene Therapy 7.7. Toxicity Testing 7.8. Cancer Research 7.9. Others Chapter 8. Global Cell Culture Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product, 2023-2033 8.2.5. Market Size and Forecast, By Application, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product, 2023-2033 8.2.6.4. Market Size and Forecast, By Application, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product, 2023-2033 8.2.7.5. Market Size and Forecast, By Application, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product, 2023-2033 8.3.5. Market Size and Forecast, By Application, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product, 2023-2033 8.3.6.4. Market Size and Forecast, By Application, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product, 2023-2033 8.3.7.4. Market Size and Forecast, By Application, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product, 2023-2033 8.3.8.4. Market Size and Forecast, By Application, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product, 2023-2033 8.3.9.4. Market Size and Forecast, By Application, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product, 2023-2033 8.3.11.4. Market Size and Forecast, By Application, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product, 2023-2033 8.12.28. Market Size and Forecast, By Application, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product, 2023-2033 8.4.6.4. Market Size and Forecast, By Application, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product, 2023-2033 8.4.7.4. Market Size and Forecast, By Application, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product, 2023-2033 8.4.8.4. Market Size and Forecast, By Application, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product, 2023-2033 8.4.9.4. Market Size and Forecast, By Application, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product, 2023-2033 8.4.10.4. Market Size and Forecast, By Application, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product, 2023-2033 8.5.4. Market Size and Forecast, By Application, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Bio-Rad Laboratories Inc 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Thermo Fisher Scientific Inc 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Becton Dickinson and Company 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Merck KGaA 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Sartorius AG 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. VWR International 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Eppendorf 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 PromoCell 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Bio-Techne Corporation 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. BioSpherix Ltd 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology