Breakfast Cereal Market Analysis and Global Forecast 2024-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

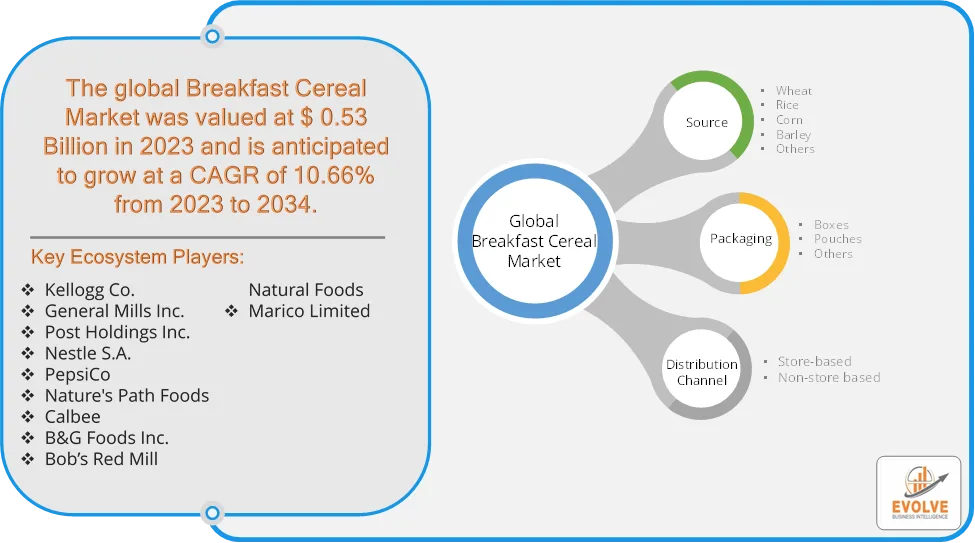

Breakfast Cereal Market Research Report: Information By Source (Wheat, Rice, Corn, Barley And Others), By Packaging (Boxes, Pouches And Others), By Distribution Channel (Store-based And Non-store based), and by Region — Forecast till 2034

Page: 129

Breakfast Cereal Market Overview

The Breakfast Cereal Market size accounted for USD 0.53 Billion in 2023 and is estimated to account for 2.65 Billion in 2024. The Market is expected to reach USD 10.66 Billion by 2034 growing at a compound annual growth rate (CAGR) of 7.85% from 2024 to 2034. The breakfast cereal market is a growing segment within the food and beverage industry, driven by increasing consumer demand for convenient, healthy, and fortified food options. Breakfast cereals, including ready-to-eat (RTE) cereals and hot cereals, cater to diverse consumer preferences and dietary needs and rising disposable incomes, particularly in emerging markets, allowing for increased spending on premium and imported cereal brands.

The breakfast cereal market is evolving to meet the changing needs and preferences of consumers, with a strong emphasis on health, convenience, and sustainability.

Global Breakfast Cereal Market Synopsis

Breakfast Cereal Market Dynamics

Breakfast Cereal Market Dynamics

The major factors that have impacted the growth of Breakfast Cereal Market are as follows:

Drivers:

Ø Growing Demand for Convenience Foods

Busy lifestyles and on-the-go consumption habits are boosting demand for ready-to-eat (RTE) cereals. Instant and easy-to-prepare breakfast options are preferred, especially among working professionals and students. Growth of e-commerce and direct-to-consumer sales via platforms like Amazon, Walmart, and brand websites. Supermarkets and hypermarkets remain key distribution channels, but online shopping convenience is accelerating sales and increased availability of subscription-based cereal services offering personalized choices.

Restraint:

- High Sugar and Artificial Ingredient Concerns

Growing health awareness has led to consumer backlash against high-sugar cereals, particularly among parents. Many traditional cereals contain artificial flavors, preservatives, and high sodium levels, discouraging health-conscious buyers and government regulations and sugar tax policies in some regions further impact the sales of sugary cereals. Rising preference for protein bars, smoothies, yogurt, and fast-food breakfast items reduces cereal consumption and the growing trend of intermittent fasting and ketogenic diets discourages traditional breakfast habits.

Opportunity:

⮚ Growing Demand for Healthier and Functional Cereals

Consumers are shifting toward high-fiber, protein-rich, and fortified cereals with added nutrients like vitamins, minerals, and omega-3s. Increased interest in gut health is driving demand for cereals with probiotics, prebiotics, and whole grains and Sugar-free, gluten-free, and keto-friendly cereals are gaining traction among health-conscious consumers. The rise of veganism and plant-based diets creates demand for dairy-free, plant-based cereals. Organic and non-GMO cereals appeal to consumers looking for clean-label and minimally processed food and Expansion of certified organic farming practices supports sustainable and health-oriented cereal production.

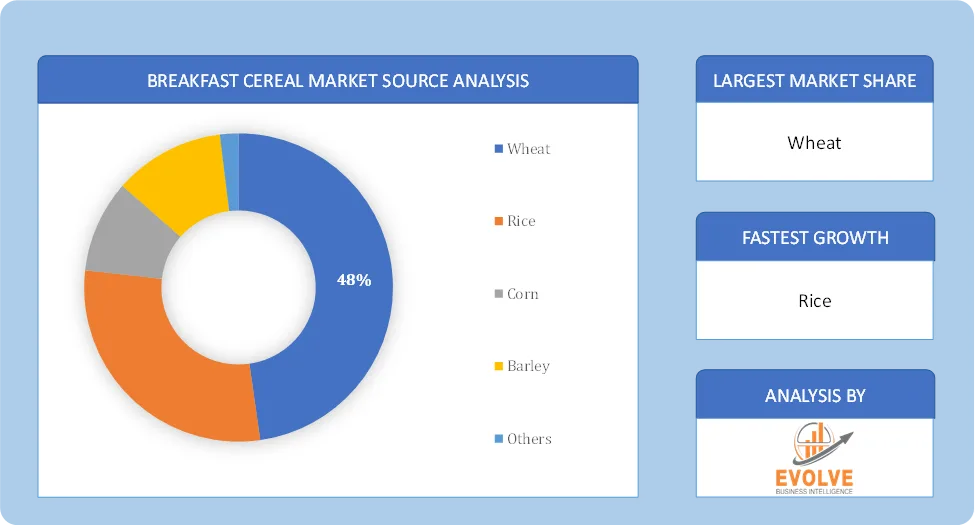

Breakfast Cereal Market Segment Overview

Based on Source, the market is segmented based on wheat, rice, corn, barley and others. Corn segments dominant the market. Corn flakes, often known as cornflakes, are a type of breakfast cereal prepared from toasted corn (maize) flakes. Maize flakes are a commercial cereal made of small, toasted flakes of maize that are often served cold with milk and occasionally sugar. The plain flakes have been flavoured with salt, sugar, and malt since their initial creation, and several subsequent versions with extra ingredients, such as sugar frosted flakes and honey & nut corn flakes, have been developed.

By Packaging

Based on Packaging, the market segment has been divided into Boxes, Pouches And Others. The boxes segment dominant the market. The box is constructed from a flat piece of cardboard that has been previously printed with the design you want to appear on the box’s outside. The box’s bottom and sides are joined by a potent glue. The plastic bag is made from moisture-proof material and placed inside the box.

By Distribution Channel

Based on Distribution Channel, the market segment has been divided into store-based and non-store based. Store-based segment dominant the market. Supermarkets and hypermarkets dominated the market, accounting for approximately 69% of total revenue. Supermarkets/hypermarkets are convenient places to buy everyday necessities. They are large and have stores that carry every high-quality brand.

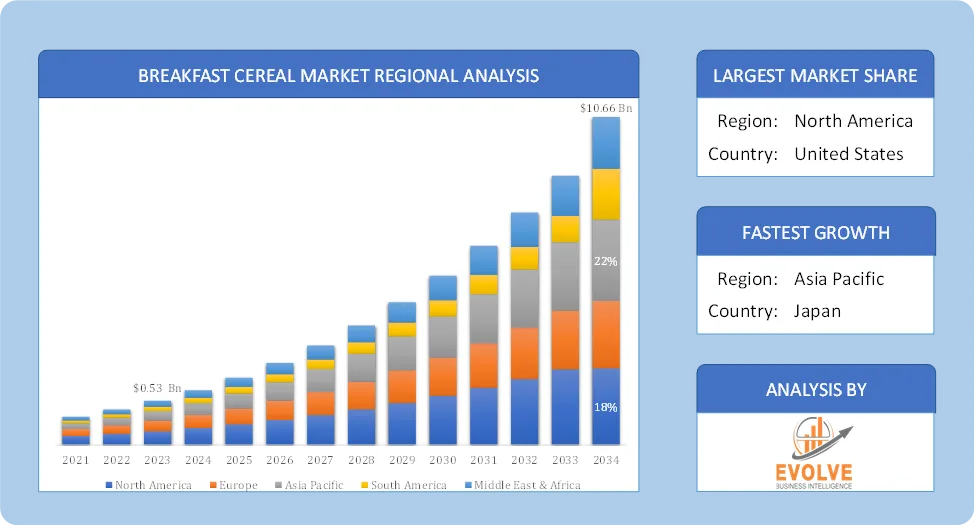

Global Breakfast Cereal Market Regional Analysis

Based on region, the global Breakfast Cereal Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Breakfast Cereal Market followed by the Asia-Pacific and Europe regions.

North America Breakfast Cereal Market

North America Breakfast Cereal Market

North America holds a dominant position in the Breakfast Cereal Market. North America holds the largest share of the global breakfast cereal market, led by the U.S. and Canada. The market is driven by busy lifestyles, demand for convenience foods, and high consumption of packaged cereals and rising demand for healthier options, including high-fiber, low-sugar, and protein-rich cereals and Growing popularity of organic, gluten-free, and plant-based cereals.

Asia-Pacific Breakfast Cereal Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Breakfast Cereal Market industry. Asia-Pacific region is fastest-growing region due to rising urbanization and Western dietary influences. China, India, and Japan are key players, with increasing breakfast cereal adoption among millennials. Traditional breakfast foods still dominate, but convenience and health trends are driving cereal demand and rapid shift toward instant and ready-to-eat cereals due to busy lifestyles. Increasing preference for health-focused cereals with superfoods like quinoa and chia

Competitive Landscape

The global Breakfast Cereal Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Kellogg Co.

- General Mills Inc.

- Post Holdings Inc.

- Nestle S.A.

- PepsiCo

- Nature’s Path Foods

- Calbee

- B&G Foods Inc.

- Bob’s Red Mill Natural Foods

- Marico Limited.

Scope of the Report

Global Breakfast Cereal Market, by Source

- Wheat

- Rice

- Corn

- Barley

- Others

Global Breakfast Cereal Market, by Packaging

- Boxes

- Pouches

- Others

Global Breakfast Cereal Market, by Distribution Channel

- Store-based

- Non-store based

Global Breakfast Cereal Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 10.66 Billion |

| CAGR (2024-2034) | 7.85% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Source, Packaging, Distribution Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Kellogg Co., General Mills Inc., Post Holdings Inc., Nestle S.A., PepsiCo, Nature’s Path Foods, Calbee, B&G Foods Inc., Bob’s Red Mill Natural Foods and Marico Limited. |

| Key Market Opportunities | · Growing Demand for Healthier and Functional Cereals · Plant-Based and Organic Cereal Growth |

| Key Market Drivers | · Growing Demand for Convenience Foods · Expansion of Online and Retail Distribution Channels |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Breakfast Cereal Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Breakfast Cereal Market historical market size for the year 2021, and forecast from 2023 to 2033

- Breakfast Cereal Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Breakfast Cereal Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Breakfast Cereal Market is 2021- 2033

What is the growth rate of the global Breakfast Cereal Market?

The global Breakfast Cereal Market is growing at a CAGR of 7.85% over the next 10 years

Which region has the highest growth rate in the market of Breakfast Cereal Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Breakfast Cereal Market?

North America holds the largest share in 2022

Who are the key players in the global Breakfast Cereal Market?

Kellogg Co., General Mills Inc., Post Holdings Inc., Nestle S.A., PepsiCo, Nature's Path Foods, Calbee, B&G Foods Inc., Bob’s Red Mill Natural Foods and Marico Limited. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Contents

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Source Segement – Market Opportunity Score

4.1.2. Packaging Segment – Market Opportunity Score

4.1.3. Distribution Channel Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Breakfast Cereal Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. Market Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Breakfast Cereal Market, By Source

7.1. Introduction

7.1.1. Wheat

7.1.2 Rice

7.1.3 Corn

7.1.4 Barley

7.1.5 Others

CHAPTER 8 Breakfast Cereal Market, By Packaging

8.1. Introduction

8.1.1. Boxes

8.1.2. Pouches

8.1.3. Others

CHAPTER 9. Breakfast Cereal Market, By Distribution Channel

9.1. Introduction

9.1.1. Store-based

9.1.2. Non-store based

CHAPTER 10. Breakfast Cereal Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.2.2. North America: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.2.3. North America: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.2.4. North America: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.2.5.2. US: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.2.5.3. US: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.2.6.3. Canada: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.3.2. Europe: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.3. Europe: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.3.4. Europe: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.3.6.3. Germany: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.7.2. France: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.3.7.3. France: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.3.8.3. Italy: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.3.9.3. Spain: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.3.11.3. Russia: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.5.2. China: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.5.3. China: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.6.3. Japan: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.7.2. India: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.7.3. India: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.12.3. Australia: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.5.2. South America: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.5.3. South America: Market Size and Forecast, By System, 2024 – 2034($ Million)

10.5.4. South America: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.6.6.3. UAE: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Packaging, 2024 – 2034($ Million)

10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By Distribution Channel, 2024 – 2034($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023-

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Kellogg Co.

13.1.1. Hanon Systems

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. General Mills Inc.

13.3. Post Holdings Inc.

13.4. Nestle S.A.

13.5. PepsiCo

13.6. Nature's Path Foods

13.7. Calbee

13.8. B&G Foods Inc.

13.9 Bob’s Red Mill Natural Foods

13.10 Marico Limited.

Connect To Analyst

Research Methodology