Biostimulants Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Biostimulants Market Research Report: Information By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Turfs & Ornamentals), By Application (Foliar Treatment, Soil Treatment, Seed Treatment), By Form (Liquid, Dry), and by Region — Forecast till 2033

Biostimulants Market Overview

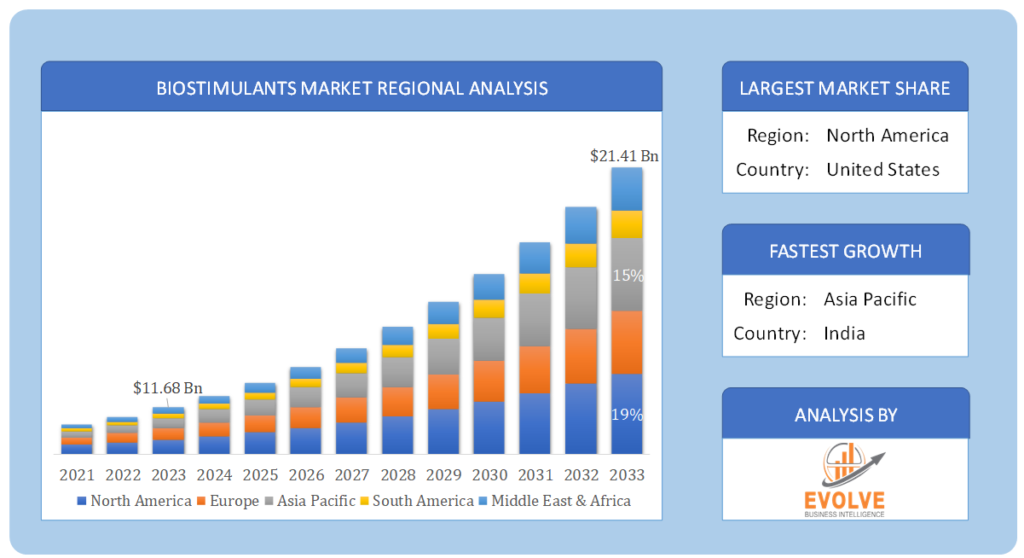

The Biostimulants Market Size is expected to reach USD 21.41 Billion by 2033. The Biostimulants Market industry size accounted for USD 11.68 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.85% from 2023 to 2033. Biostimulants are agricultural products or substances that enhance plant growth and development by stimulating natural processes. These products are used to improve the efficiency of nutrient uptake, enhance tolerance to abiotic stresses (such as drought, salinity, and extreme temperatures), and promote overall plant health and vigor. The Biostimulants Market refers to the commercial landscape and trade surrounding these products. It encompasses the production, distribution, and sale of biostimulant products to farmers, growers, and agricultural professionals. The market has been witnessing significant growth in recent years due to factors such as the increasing demand for sustainable agriculture practices, growing awareness about the environmental impact of synthetic chemicals, and the need for higher agricultural productivity to meet global food demand.

Global Biostimulants Market Synopsis

COVID-19 pandemic led to disruptions in transportation and logistics, which affected the supply of raw materials and finished biostimulant products. Restrictions on movement and trade barriers hindered the smooth flow of goods across borders. The pandemic highlighted the importance of food security and the resilience of agricultural systems. As a result, there was a growing emphasis on sustainable agriculture practices, including the use of biostimulants, to improve crop yields and optimize resource utilization. The pandemic also affected the regulatory environment for biostimulants, as authorities adapted their focus to address the immediate health crisis. Some regulatory processes for biostimulant registration and approval might have been delayed or affected.

Biostimulants Market Dynamics

The major factors that have impacted the growth of Biostimulants are as follows:

Drivers:

Ø Increasing demand for sustainable agriculture

With growing concerns about environmental sustainability and the need to reduce the environmental impact of agricultural practices, there has been a rising demand for biostimulants as a more sustainable alternative to chemical fertilizers and pesticides. The reduction in arable land and the scarcity of water resources have put pressure on farmers to increase crop productivity. Biostimulants offer a way to optimize nutrient uptake, improve crop resilience, and enhance overall plant health, thereby increasing yields without expanding agricultural land. Ongoing research and development efforts have led to the discovery of new biostimulant formulations and technologies, making them more effective and efficient in enhancing plant growth and stress tolerance.The increasing popularity of organic farming practices has driven the demand for biostimulants, as they align with the principles of organic agriculture and can be used as part of organic farming inputs.

Restraint:

- Limited awareness and understanding

Lack of standardized regulations: The biostimulant industry faced challenges due to the absence of globally harmonized regulations and definitions. Different countries and regions had varying regulatory frameworks, leading to uncertainties and complexities for market players seeking to navigate international trade. Despite the growing interest in biostimulants, there was still a lack of awareness and understanding among some farmers and growers about the benefits and proper use of these products. Educating potential customers about biostimulants’ effectiveness and value remained a challenge. Ensuring consistent and reliable performance of biostimulant products across different crops, regions, and growing conditions was a concern. The efficacy of biostimulants could vary depending on various factors, leading to skepticism among some potential users. The biostimulants market witnessed increasing competition as more companies entered the space. Established players and new entrants vied for market share, potentially leading to price pressures and reduced profit margins.

Opportunity

:

⮚ Growing demand for sustainable agriculture

With a growing global population, there is a rising demand for sustainable agricultural practices that minimize the environmental impact while ensuring food security. Biostimulants offer an eco-friendly and sustainable solution to enhance crop productivity and resilience. Ongoing research and development efforts have been leading to the discovery of innovative biostimulant formulations and technologies. These advancements present opportunities to develop more effective and efficient products, expanding the range of crops and growing conditions where biostimulants can be applied. The organic agriculture industry has been experiencing steady growth due to increasing consumer awareness of health and environmental benefits. Biostimulants align with organic farming principles and provide an opportunity for manufacturers to cater to the organic farming market. Governments and private investors have been recognizing the importance of agriculture in ensuring food security and sustainability. Increased investment in agriculture, research, and development can drive innovation and market expansion for biostimulants.

Biostimulants Market Segment Overview

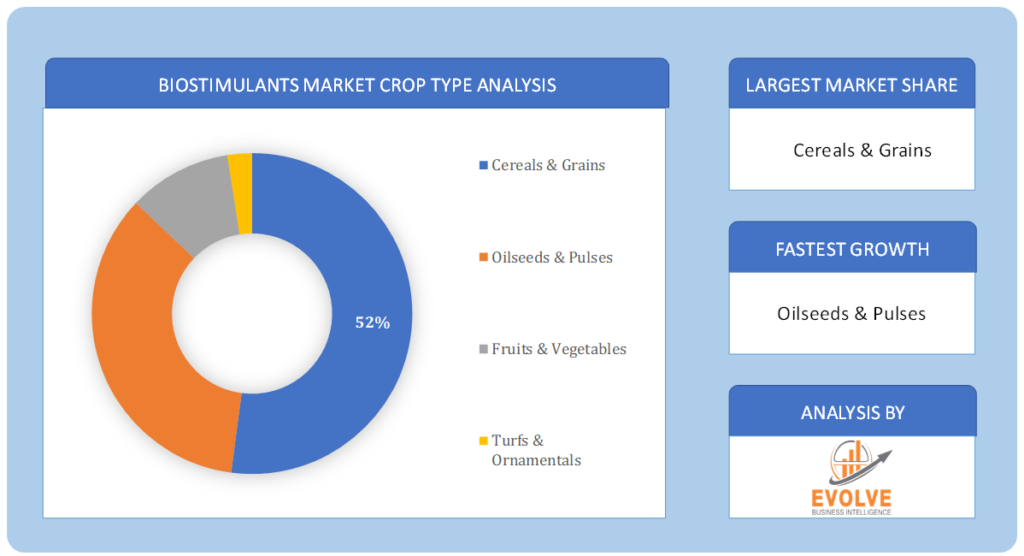

By Crop Type

Based on Crop Type, the market is segmented based on Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables and Turfs & Ornamentals. The cereals and grains segment represents a significant share of the Biostimulants Market. Biostimulants are applied to crops like wheat, corn, and rice to boost their resilience against environmental stressors and improve yields. Biostimulants play a crucial role in improving the quality and yield of fruits and vegetables, making them popular in horticultural applications. They are used to enhance fruit setting, improve fruit size and color, and extend shelf life. Biostimulants are used in the maintenance of lawns, golf courses, and ornamental gardens to promote healthy growth, stress tolerance, and aesthetic appeal.

Based on Crop Type, the market is segmented based on Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables and Turfs & Ornamentals. The cereals and grains segment represents a significant share of the Biostimulants Market. Biostimulants are applied to crops like wheat, corn, and rice to boost their resilience against environmental stressors and improve yields. Biostimulants play a crucial role in improving the quality and yield of fruits and vegetables, making them popular in horticultural applications. They are used to enhance fruit setting, improve fruit size and color, and extend shelf life. Biostimulants are used in the maintenance of lawns, golf courses, and ornamental gardens to promote healthy growth, stress tolerance, and aesthetic appeal.

By Application

Based on Application, the market has been divided into Foliar Treatment, Soil Treatment and Seed Treatment. Foliar application involves spraying biostimulant solutions directly onto plant leaves. This method allows for rapid nutrient absorption and is often used to address specific nutrient deficiencies or stress conditions. Soil treatment involves applying biostimulants to the soil before planting or during crop growth. This method enhances soil fertility, nutrient availability, and microbial activity, benefiting the entire plant’s development. Biostimulants can be applied directly to seeds before planting, promoting early root development and improving seedling vigor.

By Form

Based on Form, the market has been divided into liquid and dry. Liquid biostimulants are the most common form and are easy to apply through various irrigation systems or as foliar sprays. Dry biostimulants are available in powdered or granulated forms, and they can be mixed with soil or applied as seed treatments.

Global Biostimulants Market Regional Analysis

Based on region, the global Biostimulants Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Biostimulants Market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America has indeed emerged as the fastest-growing market for the Biostimulants Market. The North American Biostimulants Market, including the United States and Canada, was one of the leading markets for biostimulants. The region’s market growth was driven by the increasing adoption of sustainable agriculture practices, a focus on reducing chemical inputs, and the need to improve crop resilience and productivity. Strong research and development efforts and favorable government policies supporting biostimulants’ use also contributed to the market’s expansion in this region.

Asia-Pacific Market

The Asia-Pacific region holds a dominant position in the Biostimulants Market. The Asia-Pacific region witnessed substantial growth in the Biostimulants Market, driven by countries like China, Japan, India, and Australia. Rising population, increasing food demand and the need for sustainable agricultural practices supported the market’s expansion in this region. The adoption of advanced agricultural technologies, including biostimulant applications, helped improve crop yields and enhance food security.

Competitive Landscape

The global Biostimulants Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- BASF SE

- Isagro Group

- Sapec Agro S.A.

- Tradecorp

- Biolchim SpA

- Novozymes A/S

- Platform Specialty Products Corp.

- Mosiac Company

- Valagro SpA

- Koppert B.V.Italpollina SAP

Key Development

In February 2022, The Mosaic Company, a fertilizer manufacturer, acquired Plant Response Inc., leading to an enhanced presence and the ability to develop sustainable products and solutions for customers, thereby strengthening their position in the market.

In September 2021, Tradecorp introduced Biimore ly, a biostimulant derived from plant fermentation. Biimore comprises a distinctive blend of primary and secondary compounds, L-α amino acids, vitamins, sugars, and trace amounts of other natural compounds, providing a unique composition for enhanced agricultural performance.

Scope of the Report

Global Biostimulants Market, by Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turfs & Ornamentals

Global Biostimulants Market, by Application

- Foliar Treatment

- Soil Treatment

- Seed Treatment

Global Biostimulants Market, by Form

- Liquid

- Dry

Global Biostimulants Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $21.41 Billion |

| CAGR | 7.85% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Crop Type, Application, Form |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF SE, Isagro Group, Sapec Agro S.A., Tradecorp, Biolchim SpA, Novozymes A/S, Platform Specialty Products Corp., Mosiac Company, Valagro SpA, Koppert B.V.Italpollina SAP |

| Key Market Opportunities | • The growing demand for sustainable agriculture • Increasing investment in agriculture |

| Key Market Drivers | • Increasing demand for sustainable agriculture • Decline in arable land and water resources |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Biostimulants Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Biostimulants Market historical market size for the year 2021, and forecast from 2023 to 2033

- Biostimulants Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Biostimulants Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Biostimulants Market is 2021- 2033

What is the growth rate of the global Biostimulants Market?

The global Biostimulants Market is growing at a CAGR of 7.85% over the next 10 years

Which region has the highest growth rate in the market of Frozen Food?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Biostimulants Market?

Asia pacific holds the largest share in 2022

Who are the key players in the global Biostimulants Market?

BASF SE, Isagro Group, Sapec Agro S.A., Tradecorp, Biolchim SpA, Novozymes A/S, Platform Specialty Products Corp., Mosiac Company, Valagro SpA, Koppert B.V.Italpollina SAP are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Biostimulants Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7.Demand Supply Gap Analysis of the Biostimulants Market 4.8.Import Analysis of the Biostimulants Market 4.9.Export Analysis of the Biostimulants Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Biostimulants Market, By Crop Type 6.1. Introduction 6.2. Cereals & Grains 6.3. Oilseeds & Pulses 6.4. Turfs & Ornamentals Chapter 7. Global Biostimulants Market, By Application 7.1. Introduction 7.2. Foliar Treatment 7.3. Soil Treatment 7.4 Seed Treatment Chapter 8. Global Biostimulants Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. BASF SE 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Isagro Group 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Sapec Agro S.A. 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Tradecorp 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Biolchim SpA 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Novozymes A/S 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Platform Specialty Products Corp. 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Mosiac Company 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Valagro SpA 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Koppert B.V.Italpollina SAP 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology