Biofungicides Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

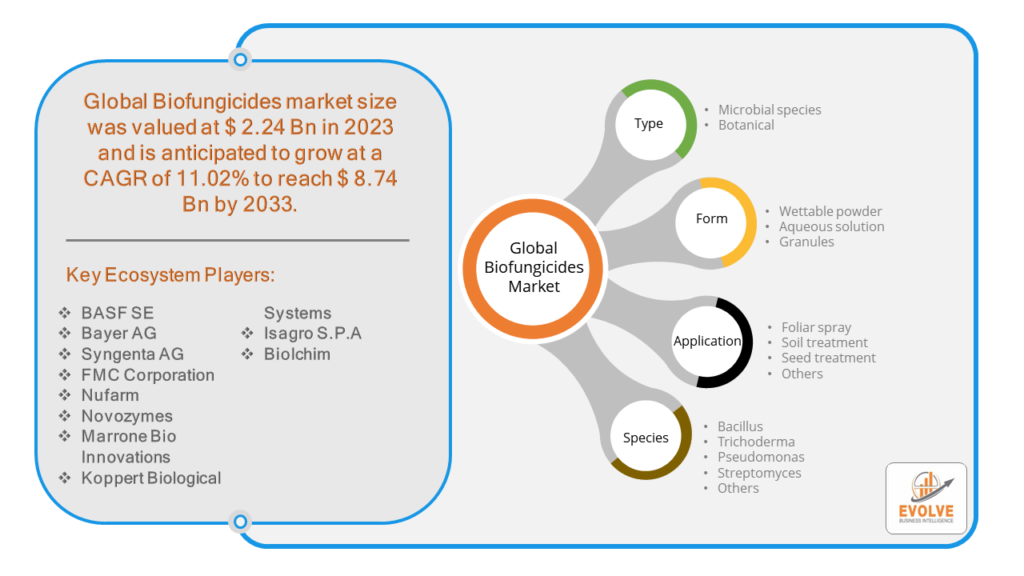

Biofungicides Market Research Report: By Type (Microbial species, Botanical), By Form (Wettable powder, Aqueous solution, Granules), By Application (Foliar spray, Soil treatment, Seed treatment, Others), By Species (Bacillus, Trichoderma, Pseudomonas, Streptomyces, Others), and by Region — Forecast till 2033.

Page: 149

Biofungicides Market Overview

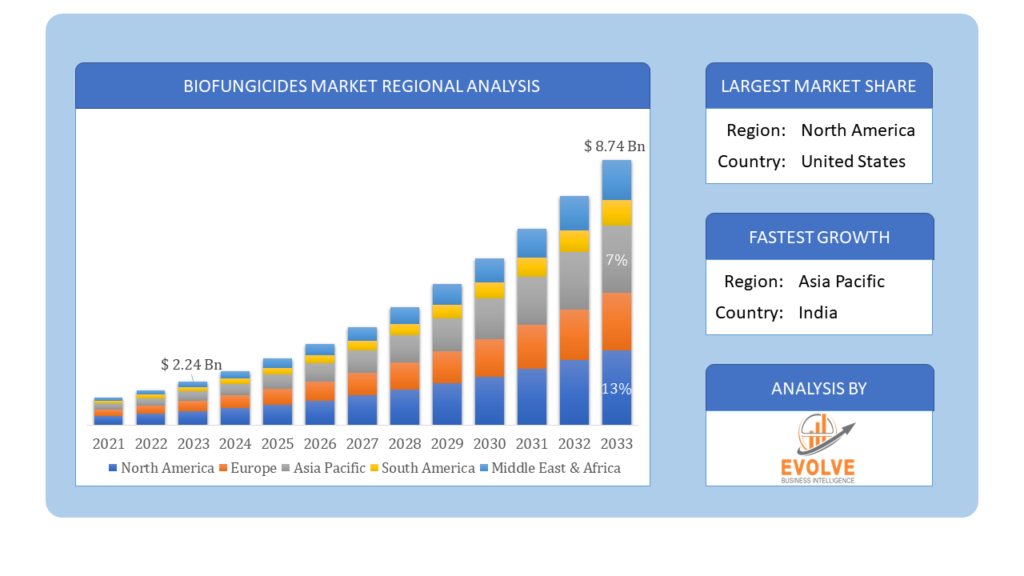

Biofungicides Market Size is expected to reach USD 8.74 Billion by 2033. The Biofungicides industry size accounted for USD 2.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 11.02% from 2023 to 2033. The biofungicides market is a growing sector focused on natural, biologically occurring compounds used to control agricultural pests. It is characterized by a high level of fragmentation with regional and local players dominating. The market size is estimated to reach USD 4.81 billion by 2029, with a CAGR of 10.80% from 2024 to 2029. Major players in the industry are expanding their product portfolios and focusing on new launches to meet registration standards. The market is influenced by factors like government efforts to increase awareness, partnerships with regional distributors, and a shift towards Integrated Pest Management (IPM) policies.

Global Biofungicides Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Biofungicides market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Global Biofungicides Market Dynamics

The major factors that have impacted the growth of Biofungicides are as follows:

Drivers:

⮚ Technological Advancements and Product Innovations

Continuous research and development efforts are leading to the development of new product Typeulations tailored to specific crop requirements. For example, the introduction of new biofungicide Typeulations like “Reegalia” by Marrone Bio Innovations is enhancing plant resistance to pathogens and boosting crop productivity

Restraint:

- High Risk of Infections

There is a concern about the high risk of infections, particularly related to skin and eyes, when handling biofungicides. This risk factor can deter farmers from using these products, impacting their adoption and effectiveness.

Opportunity:

⮚ Increasing Demand for Organic and Sustainable Farming Practices

The rising demand for organic food products and sustainable agricultural practices presents a significant opportunity for biofungicides. Consumers are becoming more conscious of synthetic chemical residues in food, driving the need for environmentally friendly crop protection products like biofungicides.

Biofungicides Market Segment Overview

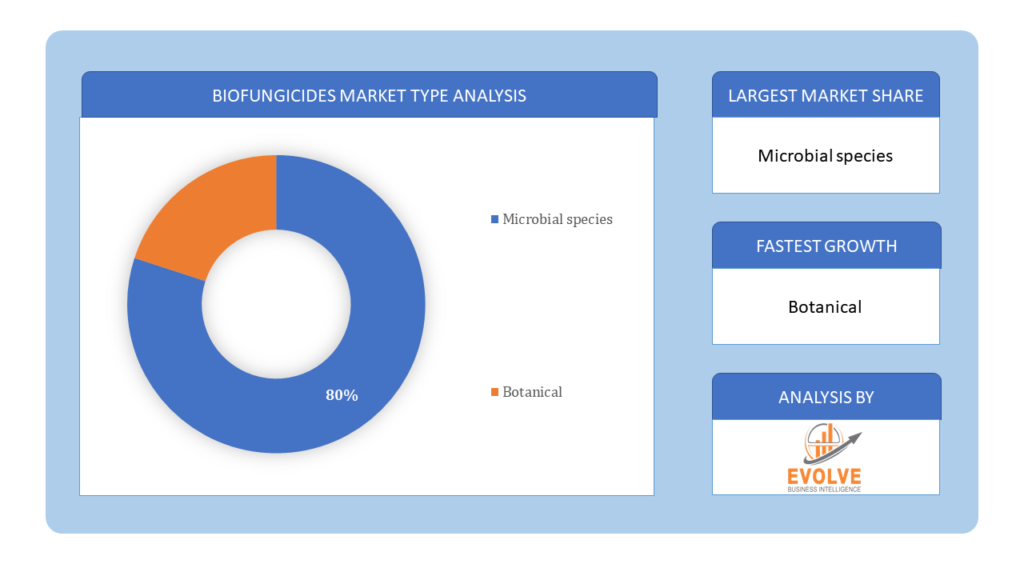

By Type

Based on the Type, the market is segmented based on Microbial species and Botanical. In 2022, microbial category dominated the market. Part of the adoption rate’s rise can be attributed to the ease of producing microbial biofungicides. Due to its vast environmental variation and remarkable tolerance for soil pH, Trichoderma accounted for the majority of microbial biofungicides in 2022.

Based on the Type, the market is segmented based on Microbial species and Botanical. In 2022, microbial category dominated the market. Part of the adoption rate’s rise can be attributed to the ease of producing microbial biofungicides. Due to its vast environmental variation and remarkable tolerance for soil pH, Trichoderma accounted for the majority of microbial biofungicides in 2022.

By form

Based on form, the market has been divided into Wettable powder, Aqueous solution and Granules. The powder category had the largest revenue share in 2022 and is predicted to grow at the highest rate during the forecast period due to its ease of manufacture and application. Powdered biofungicides can be mixed easily with any basic or acidic solution because to their powder shape.

By Application

Based on the Application, the market has been divided into Foliar spray, Soil treatment, Seed treatment and Others. Since soil application is the most common way to administer biofungicides, it held the largest revenue share of the global biofungicides market in 2022. Trichoderma and other biofungicides are frequently used to fight off the fungi that infiltrate the root zone and soil.

By Species

Based on Species, the market has been divided into Bacillus, Trichoderma, Pseudomonas, Streptomyces and Others. In the Biofungicides Market, the species segment plays a crucial role in offering effective pest control solutions. This segment includes microbial species like Bacillus, Trichoderma, Pseudomonas, and Streptomyces. These microorganisms colonize and combat plant pathogens, preventing diseases and promoting plant health. The diverse range of species in biofungicides provides a natural and environmentally friendly alternative to chemical fungicides, contributing to the sustainable agriculture practices and the growing demand for organic food products in the market.

Global Biofungicides Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Biofungicides, followed by those in Asia-Pacific and Europe.

Biofungicides North America Market

Biofungicides North America Market

The North American region holds a dominant position in the Biofungicides market. Because of the transition from conventional to sustainable agriculture and the presence of major players in the North American market, the biofungicide market in that region will dominate this one. One of the biggest producers of organic fruits and vegetables is the continent of North America. Furthermore, it is anticipated that the growing use and use of integrated pest management (IPM) approaches will fuel growth in the region’s biofungicides market.

Biofungicides Europe Market

The Europe region is witnessing rapid growth and emerging as a significant market for the Biofungicides industry. From 2023 to 2032, the Europe Biofungicides Market is anticipated to develop at the quickest CAGR. Because integrated pest management (IPM) techniques are being more widely used and adopted, it is projected that the market for biofungicides in the region will continue to grow. Tight rules and regulations limiting the use of pesticides that protect plants from harmful environmental effects also drive the regional market. The strong demand for crop protection agents derived from biotechnology propels the sales of biofungicides in regional markets. Furthermore, the biofungicides market in Germany accounted for the highest part of the European market, while the biofungicides market in the UK grew at the fastest rate.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BASF SE, Bayer AG, Syngenta AG, FMC Corporation, and Nufarm are some of the leading players in the global Biofungicides Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BASF SE

- Bayer AG

- Syngenta AG

- FMC Corporation

- Nufarm

- Novozymes

- Marrone Bio Innovations

- Koppert Biological Systems

- Isagro S.P.A

- Biolchim

Key Development:

June 2021: Marrone Bio Innovations, Inc, an international leader in sustainable bioprotection and plant health solutions to support agricultural needs, has announced a collaboration with ATP Nutrition of Manitoba, Canada, to distribute Stargus Biofungicide on Canadian broad acre crops, primarily canola, dry beans, peas, soybeans, and sunflower. In Canada, where the biocontrol market is expected to increase, these products cover more than 30 million acres.

March 2020: Bayer Crop Science, the world’s top seed manufacturer and Life Science Company, has recently introduced Serenade, its first biofungicide, in neighboring China. According to reports, this substance could form a protective barrier around plants’ roots via symbiosis in the root periphery.

Scope of the Report

Global Biofungicides Market, by Type

- Microbial species

- Botanical

Global Biofungicides Market, by Form

- Wettable powder

- Aqueous solution

- Granules

Global Biofungicides Market, by Application

- Foliar spray

- Soil treatment

- Seed treatment

- Others

Global Biofungicides Market, by Species

- Bacillus

- Trichoderma

- Pseudomonas

- Streptomyces

- Others

Global Biofungicides Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.74 Billion |

| CAGR | 11.02% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Form, Application, Species |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF SE, Bayer AG, Syngenta AG, FMC Corporation, Nufarm, Novozymes, Marrone Bio Innovations, Koppert Biological Systems, Isagro S.P.A, Biolchim |

| Key Market Opportunities | Plant pathogens developing resistance to chemical fungicides |

| Key Market Drivers | Growing emphasis on integrated pest management solutions |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Biofungicides Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Biofungicides market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Biofungicides market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

Provide Total Addressable Market (TAM) for the Global Biofungicides Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period spans from historical data in 2021 to forecasts for the market trends from 2023 to 2033.

What is the growth rate of the Biofungicides market?

The Biofungicides market is expected to expand at a compound annual growth rate (CAGR) of 11.02% from 2023 to 2033.

Which region has the highest growth rate in the Biofungicides market?

The North American region is anticipated to dominate the Biofungicides market, followed by Asia-Pacific and Europe.

Which region has the largest share of the Biofungicides market?

North America holds a dominant position in the Biofungicides market due to its transition towards sustainable agriculture and the presence of major players.

Who are the key players in the Biofungicides market?

Key players in the Biofungicides market include BASF SE, Bayer AG, Syngenta AG, FMC Corporation, Nufarm, Novozymes, Marrone Bio Innovations, Koppert Biological Systems, Isagro S.P.A, and Biolchim.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Form Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.1.4. Species Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Type 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Biofungicides Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Biofungicides Market, By Type 7.1. Introduction 7.1.1. Microbial species 7.1.2. Botanical CHAPTER 8. Global Biofungicides Market, By Form 8.1. Introduction 8.1.1. Wettable powder 8.1.2. Aqueous solution 8.1.3. Granules CHAPTER 9. Global Biofungicides Market, By Application 9.1. Introduction 9.1.1. Foliar spray 9.1.2. Soil treatment 9.1.3. eed treatment 9.1.5. Others CHAPTER 10. Global Biofungicides Market, By Species 10.1. Introduction 10.1.1. Bacillus 10.1.2. Trichoderma 10.1.3. Pseudomonas 10.1.4. Streptomyces 10.1.5. Others CHAPTER 11. Global Biofungicides Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Species, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. BASF SE 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Bayer AG 13.3. Syngenta AG 13.4. FMC Corporation 13.5. Nufarm 13.6. Novozymes 13.7. Marrone Bio Innovations 13.8. Koppert Biological Systems 13.9. Isagro S.P.A 13.10. Biolchim

Connect to Analyst

Research Methodology