AI Chipset Market Overview

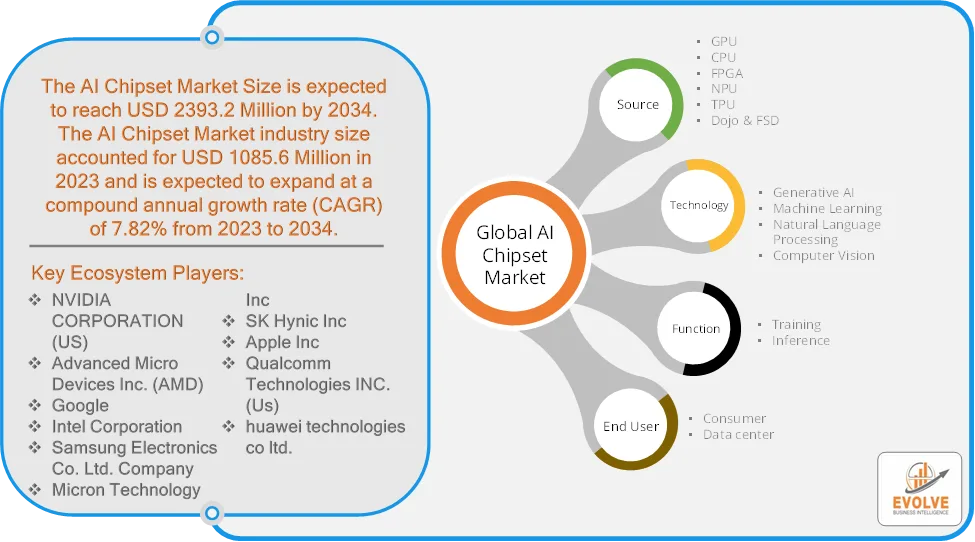

The AI Chipset Market Size is expected to reach USD 2393.2 Million by 2034. The AI Chipset Market industry size accounted for USD 1085.6 Million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.82% from 2023 to 2034. The AI Chipset Market refers to the sector of semiconductor technology focused on the development and manufacturing of specialized chips designed to accelerate and optimize artificial intelligence (AI) processes. These chipsets are crucial for powering AI-driven devices and systems across various applications, from machine learning (ML) to deep learning (DL), computer vision, natural language processing (NLP), and more.

The AI Chipset Market is expected to grow at a rapid pace in the coming years, driven by the continued advancements in AI technology and the increasing demand for AI-powered solutions.

Global AI Chipset Market Synopsis

AI Chipset Market Dynamics

AI Chipset Market Dynamics

The major factors that have impacted the growth of AI Chipset Market are as follows:

Drivers:

Ø Adoption of AI Across Industries

AI is increasingly being integrated into industries such as healthcare, automotive, retail, manufacturing, finance, and telecommunications to improve efficiency, reduce costs, and enhance decision-making. Applications like predictive maintenance, AI-based diagnostics, autonomous vehicles, and personalized recommendations drive demand for specialized AI chipsets. Energy consumption is a major concern, particularly in data centers and portable devices and Modern AI chipsets are being designed with better energy efficiency and optimized architectures to reduce power consumption.

Restraint:

- Perception of Data Security and Privacy Concerns

AI chipsets process vast amounts of sensitive data, raising concerns about data breaches, unauthorized access, and misuse of AI systems. AI workloads, especially in data centers and edge devices, demand high computational power, leading to increased energy consumption and heat dissipation. The development and deployment of AI chipsets require highly skilled professionals proficient in semiconductor design, AI algorithms, and hardware-software integration.

Opportunity:

⮚ Growing Adoption in Industrial Automation and Smart Manufacturing

Industries are increasingly adopting AI-powered automation systems to enhance productivity and minimize errors. AI chipsets power predictive maintenance, process optimization, and intelligent robotics in smart factories. AI chipsets are essential for real-time object detection, path planning, and vehicle-to-everything (V2X) communication and Rising investments in self-driving technologies create demand for AI processors.

AI Chipset Market Segment Overview

Based on Source, the market is segmented based on GPU, CPU, FPGA, NPU, TPU, Dojo & FSD, Trainium & Inferentia, Athena ASIC, T-head, MTIA, LPU, Memory, NIC/Network Adapters, Interconnects and Network. CPU segment dominant the market. CPU offerings in AI chipsets refer to the integration of Central Processing Units (CPUs) within AI-focused hardware to manage and optimize general-purpose computations alongside specialized AI tasks. CPUs, known for their versatility and sequential processing capabilities, play a critical role in orchestrating AI workflows, including pre-processing data, managing memory, and executing control logic.

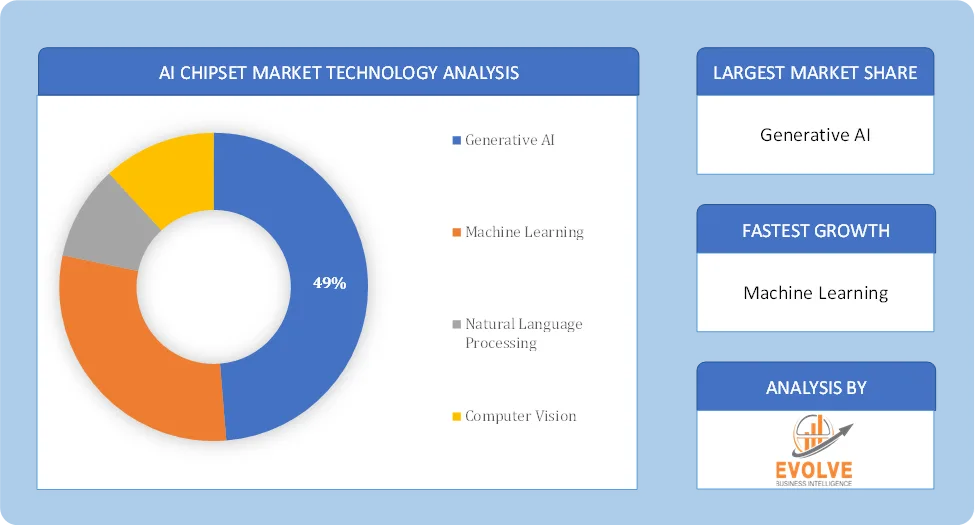

By Technology

Based on Technology, the market segment has been divided into the Generative AI, Machine Learning, Natural Language Processing and Computer Vision. Machine Learning segment dominant the market. Machine Learning refers to the application of artificial intelligence that enables systems to learn from data, identify patterns, and make predictions or decisions without being explicitly programmed. It involves training models on large datasets, allowing them to improve performance over time through experience. Machine learning leverages various algorithms, including supervised, unsupervised, and reinforcement learning, to solve complex tasks such as image recognition, natural language processing, and predictive analytics.

By Function

Based on Application, the market segment has been divided into the Training and Inference. Training segment dominant the market. Training in the context of artificial intelligence refers to the process of teaching machine learning models to recognize patterns, make predictions, and adapt to new data. This involves feeding large datasets into models and using algorithms to adjust the model’s parameters to minimize errors and improve performance. Training typically requires significant computational resources, including GPUs, TPUs, and specialized AI chipsets, to handle complex computations efficiently.

By End User

Based on End User, the market segment has been divided into the Consumer and Data center. Consumer segment dominant the market. A consumer interacts with artificial intelligence technologies in everyday applications such as voice assistants, smart home devices, recommendation systems, and personalized experiences. These AI-powered tools are optimized for usability, accuracy, and responsiveness, often leveraging specialized hardware like GPUs, NPUs, or custom AI chipsets to process large amounts of data efficiently.

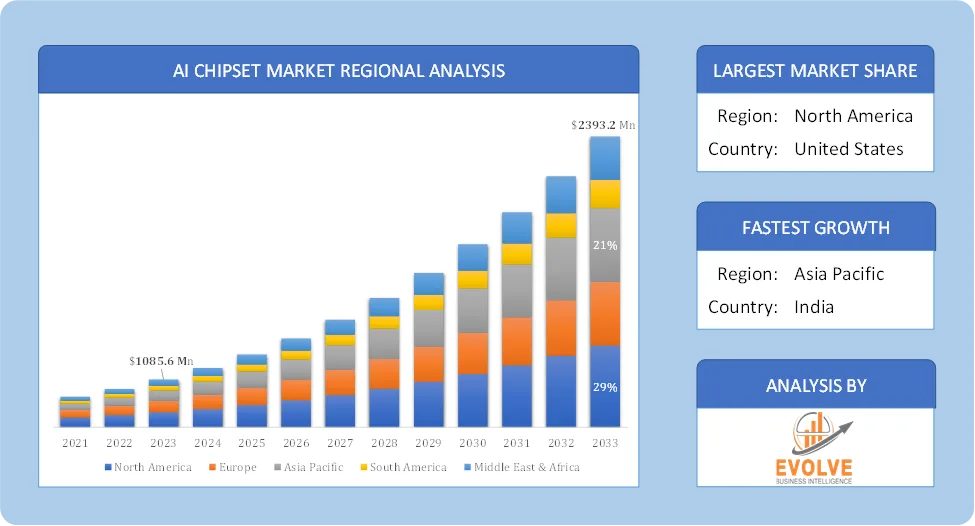

Global AI Chipset Market Regional Analysis

Based on region, the global AI Chipset Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the AI Chipset Market followed by the Asia-Pacific and Europe regions.

AI Chipset North America Market

AI Chipset North America Market

North America holds a dominant position in the AI Chipset Market. North America dominates the AI chipset market due to early adoption of AI technologies, robust R&D infrastructure, and significant investments in AI hardware. Heavy investments in AI research and innovation by both private and public sectors and adoption of AI in autonomous vehicles, smart healthcare, and defense sectors.

AI Chipset Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the AI Chipset Market industry. The Asia-Pacific region is the fastest-growing market for AI chipsets, with China, Japan, and South Korea at the forefront. China has emerged as a global leader in AI development, heavily supported by government initiatives like “Made in China 2025.” Rising adoption of AI technologies in consumer electronics, healthcare, and automotive sectors and Increasing investment in AI data centers and cloud infrastructure.

Competitive Landscape

The global AI Chipset Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- NVIDIA CORPORATION (US)

- Advanced Micro Devices Inc. (AMD)

- Intel Corporation

- Samsung Electronics Co. Ltd. Company

- Micron Technology Inc

- SK Hynic Inc

- Apple Inc

- Qualcomm Technologies INC. (Us)

- huawei technologies co ltd.

Scope of the Report

Global AI Chipset Market, by Source

- GPU

- CPU

- FPGA

- NPU

- TPU

- Dojo & FSD

- Trainium & Inferentia

- Athena ASIC

- T-head

- MTIA

- LPU

- Memory

- NIC/Network Adapters

- Interconnects

- Network

Global AI Chipset Market, by Technology

- Generative AI

- Machine Learning

- Natural Language Processing

- Computer Vision

Global AI Chipset Market, by Function

- Training

- Inference

Global AI Chipset Market, by End User

- Consumer

- Data center

Global AI Chipset Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD607.2Billion |

| CAGR (2023-2033) | 7.82% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Source, Technology, Function, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | NVIDIA CORPORATION (US), Advanced Micro Devices Inc. (AMD), Google, Intel Corporation, Samsung Electronics Co. Ltd. Company, Micron Technology Inc, SK Hynic Inc, Apple Inc, Qualcomm Technologies INC. (Us) and huawei technologies co ltd. |

| Key Market Opportunities | · Growing Adoption in Industrial Automation and Smart Manufacturing

· Expansion of AI in Autonomous Vehicles and ADAS |

| Key Market Drivers | · Growing Adoption of AI Across Industries

· Rising Demand for Energy-Efficient AI Chipsets |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future AI Chipset Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- AI Chipset Market historical market size for the year 2021, and forecast from 2023 to 2033

- AI Chipset Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global AI Chipset Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.