Agricultural Adjuvants market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Agricultural Adjuvants market Research Report: Information By Type (Activator Adjuvants, Utility Adjuvants), By Application (Herbicides, Insecticides, Fungicides), By Crop Type (Grains & Cereals, Oil Seeds & Pulses, Fruits & Vegetables), and by Region — Forecast till 2033

Page: 169

Agricultural Adjuvants market Overview

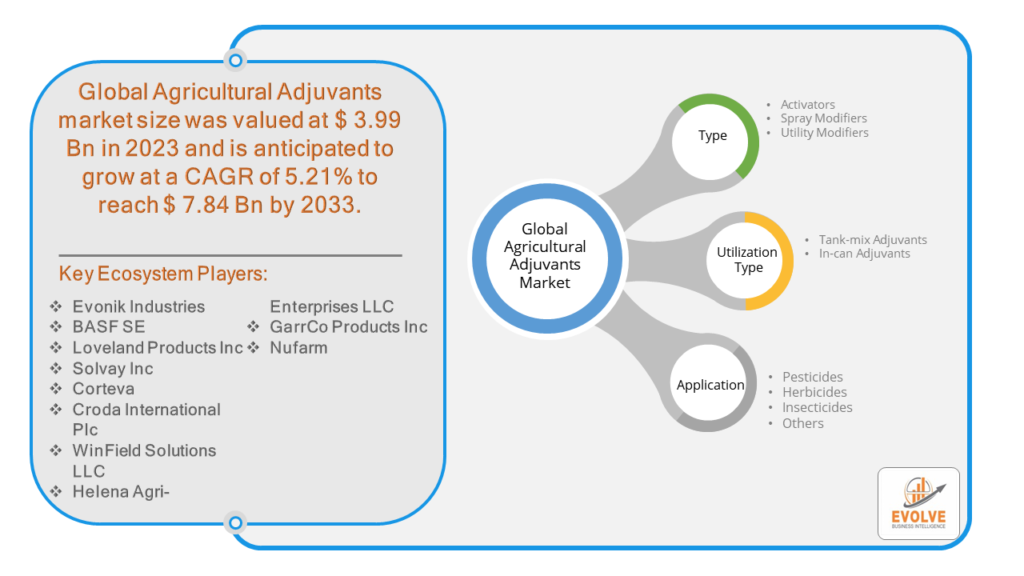

The Agricultural Adjuvants market Size is expected to reach USD 7.84 Billion by 2033. The Agricultural Adjuvants market industry size accounted for USD 3.99 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.21% from 2023 to 2033. The Agricultural Adjuvants market refers to the industry involved in the production, distribution, and sale of chemical agents or additives used in conjunction with pesticides, herbicides, fungicides, and other agricultural chemicals. These adjuvants are formulated to enhance the effectiveness and performance of agricultural chemicals by improving their application, spreading, sticking, absorption, and overall efficacy. Agricultural adjuvants can come in various forms such as surfactants, activators, spreaders, penetrants, buffers, and drift control agents. The market for agricultural adjuvants is influenced by factors such as advancements in farming techniques, increasing demand for crop protection products, regulatory changes, environmental concerns, and the adoption of precision agriculture practices.

The market for agricultural adjuvants is influenced by factors such as advancements in farming techniques, increasing demand for crop protection products, regulatory changes, environmental concerns, and the adoption of precision agriculture practices. Key players in the Agricultural Adjuvants market include manufacturers of adjuvants, agrochemical companies, distributors, and suppliers. The market encompasses both synthetic and bio-based adjuvants, catering to the diverse needs of farmers across different crops, regions, and farming systems.

Global Agricultural Adjuvants market Synopsis

The COVID-19 pandemic has had various impacts on the Agricultural Adjuvants market. The pandemic disrupted global supply chains, leading to delays in the production and distribution of agricultural adjuvants. Restrictions on transportation and movement of goods hindered the availability of raw materials and finished products, affecting the supply chain. The lockdowns and restrictions imposed to curb the spread of the virus led to shifts in consumer behavior and demand patterns. While demand for food and agricultural products remained relatively stable, the demand for certain types of adjuvants may have fluctuated due to changes in planting schedules, crop choices, and farmer budgets. The pandemic affected agricultural activities worldwide, including planting, harvesting, and farm operations. Farmers faced challenges such as labor shortages, reduced access to inputs, and disruptions in farm services. Consequently, the demand for agricultural adjuvants may have been impacted as farmers adjusted their cropping practices and input usage.

Agricultural Adjuvants market Dynamics

The major factors that have impacted the growth of Agricultural Adjuvants market are as follows:

Drivers:

Ø Growing Demand for Crop Protection Products

The increasing global population necessitates higher agricultural productivity to meet food demand. This drives the demand for crop protection products, including pesticides, herbicides, and fungicides, thereby boosting the market for adjuvants that enhance the effectiveness of these products. Modern farming practices, such as precision agriculture and integrated pest management, rely on the use of agricultural adjuvants to improve the efficiency and precision of chemical applications. As farmers adopt these advanced techniques to optimize yields and reduce input costs, the demand for adjuvants continues to rise. There’s a growing emphasis on sustainable agricultural practices aimed at minimizing environmental impact and maximizing resource efficiency. Agricultural adjuvants play a crucial role in sustainable agriculture by reducing the amount of chemical inputs needed, improving application efficiency, and minimizing off-target effects, thus driving their adoption.

Restraint:

- Perception of Environmental Concerns

Growing environmental awareness and concerns about the impact of agrochemicals on ecosystems can lead to resistance against the use of certain adjuvants perceived as harmful to the environment. Adjuvants that are associated with adverse environmental effects, such as water pollution or harm to non-target organisms, may face public scrutiny and regulatory restrictions, limiting their market potential. Agricultural adjuvants often rely on petroleum-derived or synthetic chemicals as key raw materials. Fluctuations in the prices of these raw materials, influenced by factors such as global oil prices and geopolitical tensions, can impact production costs and profit margins for adjuvant manufacturers, potentially leading to price volatility and supply chain disruptions.

Opportunity:

⮚ Growing Demand for Sustainable Solutions

Increasing awareness of environmental sustainability and regulatory pressure to reduce chemical usage in agriculture create opportunities for the development and adoption of environmentally friendly adjuvants. Manufacturers can capitalize on this trend by investing in research and development to formulate adjuvants with low environmental impact and improved safety profiles. The adoption of precision agriculture technologies, such as GPS-guided equipment and remote sensing, is increasing globally. Agricultural adjuvants play a crucial role in optimizing the performance of precision agriculture inputs, such as pesticides and fertilizers, by improving their efficacy and target specificity. There is a significant opportunity for adjuvant manufacturers to develop specialized formulations tailored to the needs of precision agriculture systems.

Agricultural Adjuvants market Segment Overview

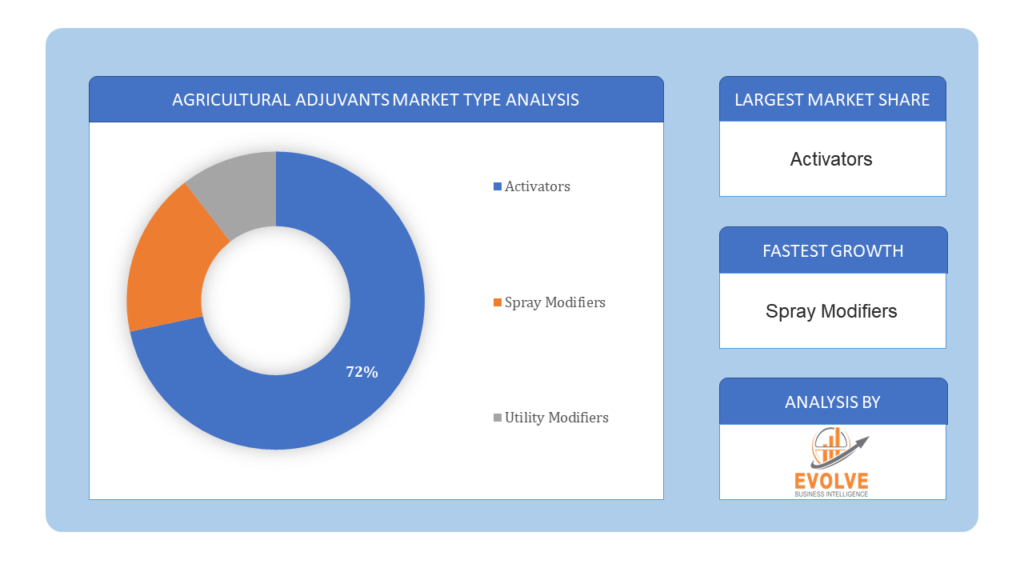

By Type

Based on Type, the market is segmented based on Activator Adjuvants and Utility Adjuvants. The Utility Adjuvants segment dominant the Agricultural Adjuvants Market. Due more pesticides are being used to control unwanted things in cropland. There are many different kinds of utility adjuvants, depending on the use. Compatibility agents, drift control agents, buffering agents, and water conditioning agents are essential utility adjuvants.

Based on Type, the market is segmented based on Activator Adjuvants and Utility Adjuvants. The Utility Adjuvants segment dominant the Agricultural Adjuvants Market. Due more pesticides are being used to control unwanted things in cropland. There are many different kinds of utility adjuvants, depending on the use. Compatibility agents, drift control agents, buffering agents, and water conditioning agents are essential utility adjuvants.

By Application

Based on Application, the market has been divided into Herbicides, Insecticides and Fungicides. The Insecticides segment dominated the market. Rising consumer demand for various crops, including cereals, grains, fruits, and vegetables. They successfully prevent pest attacks on various crops’ early germination implants entail considerably lower costs than polymers. Hence, rising applications of metal material implants for Agricultural Adjuvants positively impact market growth.

By Crop Type

Based on Crop Type, the market has been divided into Grains & Cereals, Oil Seeds & Pulses and Fruits & Vegetables. The Grains & Cereals segment dominated the market. The largest crop consumed worldwide is cereal and grain, primarily in Asia and the Pacific. The rising consumption of cereal and grains in various other regions, including rice, wheat, rye, corn, oats, sorghum, and barley, drives demand for agricultural adjuvants. For cereals and grains, non-ionic surfactants and agrochemicals are generally advised.

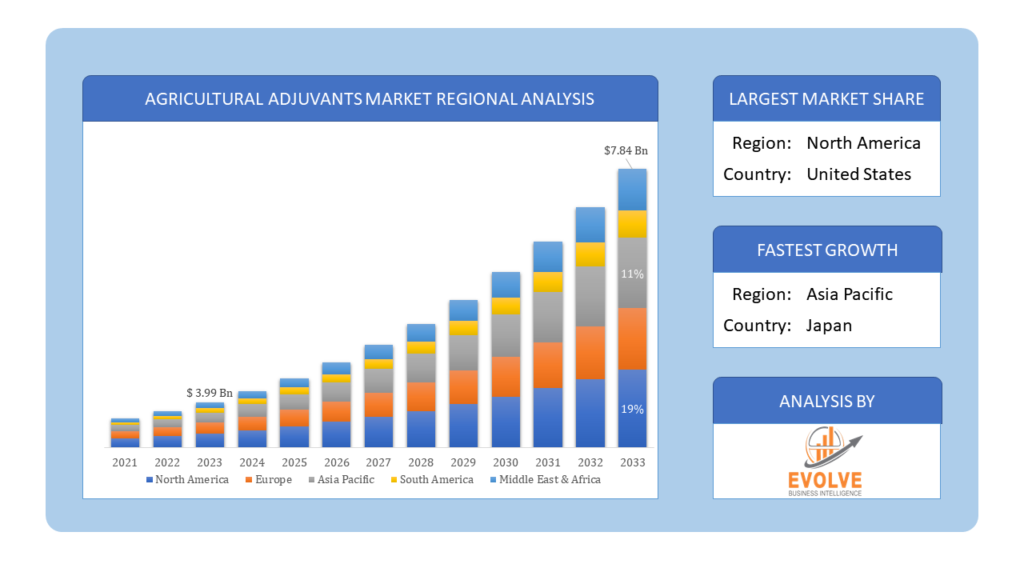

Global Agricultural Adjuvants market Regional Analysis

Based on region, the global Agricultural Adjuvants market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Agricultural Adjuvants market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America holds a dominant position in the Agricultural Adjuvants market. The United States and Canada are major markets for agricultural adjuvants, driven by large-scale commercial farming operations and extensive use of agrochemicals. Adoption of advanced farming techniques, such as precision agriculture, boosts the demand for adjuvants that enhance the performance of precision application systems. Stringent regulatory standards and environmental concerns drive innovation in environmentally friendly adjuvant formulations.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Agricultural Adjuvants market industry. The Asia-Pacific region represents a significant growth opportunity for the Agricultural Adjuvants market, fueled by population growth, rising food demand, and increasing adoption of modern agricultural practices. Countries like China and India are key markets, driven by large agricultural sectors and government initiatives to improve agricultural productivity. Rapid adoption of biotechnology and genetically modified crops in countries like China contributes to the demand for associated adjuvants.

Competitive Landscape

The global Agricultural Adjuvants market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Corteva Agriscience

- Evonik Industries

- Croda International

- Nufarm

- Solvay

- BASF

- Huntsman Corporation

- Clariant

- Brandt

- Stepan Company

Key Development

In November 2020, Turftech International, based in the UK, was purchased by Lamberti SPA. Turftech is a well-known business that creates and markets unique surfactants for use in horticulture and turf. The company is increasing its product line and market share in the area through this acquisition.

In September 2020, A new crop of products was added to the market, according to Attune Agriculture. Accomplice, an all-in-one adjuvant made for use on row crops, is being sold by the business in collaboration with Commodity Ag.

Scope of the Report

Global Agricultural Adjuvants Market, by Type

- Activator Adjuvants

- Utility Adjuvants

Global Agricultural Adjuvants market, by Application

- Herbicides

- Insecticides

- Fungicides

Global Agricultural Adjuvants market, by Crop Type

- Grains & Cereals

- Oil Seeds & Pulses

- Fruits & Vegetables

Global Agricultural Adjuvants market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $7.84 Billion |

| CAGR | 5.21% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application, Crop Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Corteva Agriscience, Evonik Industries, Croda International, Nufarm, Solvay, BASF, Huntsman Corporation, Clariant, Brandt and Stepan Company. |

| Key Market Opportunities | • Growing Demand for Sustainable Solutions • Expanding Precision Agriculture Practices |

| Key Market Drivers | • Growing Demand for Crop Protection Products • Advancements in Farming Techniques |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Agricultural Adjuvants market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Agricultural Adjuvants market historical market size for the year 2021, and forecast from 2023 to 2033

- Agricultural Adjuvants market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Agricultural Adjuvants market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Agricultural Adjuvants market is 2021- 2033

2.What is the growth rate of the global Agricultural Adjuvants market?

- The global Agricultural Adjuvants market is growing at a CAGR of 4.41% over the next 10 years

3.Which region has the highest growth rate in the market of Agricultural Adjuvants market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Agricultural Adjuvants market?

- North America holds the largest share in 2022

5.Who are the key players in the global Agricultural Adjuvants market?

- Corteva Agriscience, Evonik Industries, Croda International, Nufarm, Solvay, BASF, Huntsman Corporation, Clariant, Brandt and Stepan Company. are the major companies operating in the market.

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Application Segment – Market Opportunity Score 4.1.3. Crop Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Agricultural Adjuvants market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Agricultural Adjuvants market, By Type 7.1. Introduction 7.1.1. Activator Adjuvants 7.1.2. Utility Adjuvants CHAPTER 8. Global Agricultural Adjuvants market, By Application 8.1. Introduction 8.1.1. Herbicides 8.1.2. Insecticides 8.1.3. Fungicides CHAPTER 9. Global Agricultural Adjuvants market, By Crop Type 9.1. Introduction 9.1.1. Grains & Cereals 9.1.2. Oil Seeds & Pulses 9.1.3. Fruits & Vegetables CHAPTER 10. Global Agricultural Adjuvants market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Crop Type r, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Corteva Agriscience 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Evonik Industries 13.3. Croda International 13.4. Nufarm 13.5. Solvay 13.6. BASF 13.7. Huntsman Corporation 13.8. Clariant 13.9. Brandt 13.10. Stepan Company

Connect to Analyst

Research Methodology